- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The ASEAN Way : Sustaining Growth and Stability

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The ASEAN Way : Sustaining Growth and Stability by Ana Corbacho, and Shanaka Peiris in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2018eBook ISBN

9781513558905Chapter 1 Overview

This chapter was prepared by Ana Corbacho and Shanaka J. Peiris.

A bumpy normalization of monetary policies in advanced economies, capital flow volatility, global policy missteps: these are just a few of the possible risks shaping the global outlook in the years ahead. They represent important challenges for emerging market and developing economies across the globe.

The Association of Southeast Asian Nations–5 (ASEAN-5: the five founding members, comprising Indonesia, Malaysia, the Philippines, Singapore, and Thailand) stand strong in the face of these challenges. The dramatic transformation of their policy frameworks since the Asian financial crisis delivered macro-financial stability during significant domestic and regional transformation as well as global macroeconomic and financial turmoil. Over the past few decades, the ASEAN-5 have strengthened resilience, built up buffers, and adapted their policies to respond to global spillovers.

However, global risks will continue to test ASEAN-5 economies. Against this backdrop, this book proposes a policy agenda to sustain growth and stability in the coming decades. Part I offers a retrospective of the evolution of monetary policy and financial stability frameworks in the ASEAN-5, with special focus on changes since the Asian financial crisis and the more recent period of unconventional monetary policies in advanced economies. Part II looks into the channels of transmission of global spillovers and the monetary, exchange rate, and ASEAN-5 macroprudential policy responses. Part III concludes with forthcoming challenges and maps out ways to further upgrade policy frameworks, exploit synergies, and enhance resilience.

The successful experience of the ASEAN-5 provides valuable lessons for other emerging market and developing economies. The authors’ rigorous and novel analysis leaves no stone unturned as they gather evidence of what has worked and what could work better to meet the challenges ahead.

The analysis put forth in the book supports three broad conclusions:

1. The ambitious reforms of monetary policy and financial stability frameworks since the Asian financial crisis paid off.

Since the Asian financial crisis, the ASEAN-5 countries have adjusted their policy frameworks to address financial booms and busts more systematically, embarking on an ambitious and broad-ranging program of economic and financial sector reforms.

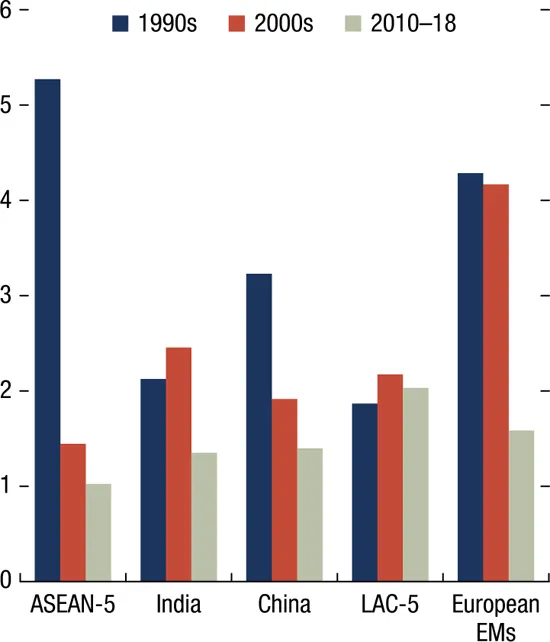

With respect to monetary policy frameworks, a flexible inflation-targeting framework in Indonesia, the Philippines, and Thailand, alongside slightly different frameworks in Malaysia and Singapore, have served the ASEAN-5 economies well in terms of low inflation and output volatility (Figures 1.1 and 1.2). Chapter 2, by Hoe Ee Khor and others, examines the evolution of monetary policy regimes since the Asian crisis, showing how ASEAN-5 countries accommodated the constraints imposed by the “impossible trinity” of a fixed exchange rate, an open capital market, and independent monetary policy. The clarification of price stability objectives, including the adoption of explicit inflation targets in some countries, and the strengthening of central bank operations and transparency, have been major milestones in the evolution of monetary policy frameworks. The transition to more consistent forward-looking frameworks allowed ASEAN-5 economies to withstand the global financial crisis well, as well as the commodity price cycle and the recent low-inflation environment. Moreover, the ASEAN-5 gradually moved toward flexible exchange rate regimes, which strengthened monetary independence and facilitated adjustment to external shocks. Finally, active and independent liquidity management to align market conditions with the announced policy stance and improved central bank communications were key ingredients to their success.

Figure 1.1. GDP Growth: ASEAN-5 and Peers

(Standard deviation of year-over-year growth)

Sources: IMF, World Economic Outlook database; and IMF staff calculations.

Note: ASEAN-5 = Indonesia, Malaysia, Philippines, Singapore, Thailand; LAC-5 = Brazil, Chile, Colombia, Mexico, Peru; European EMs = Bulgaria, Hungary, Poland, Romania, Russia, Turkey, Ukraine.

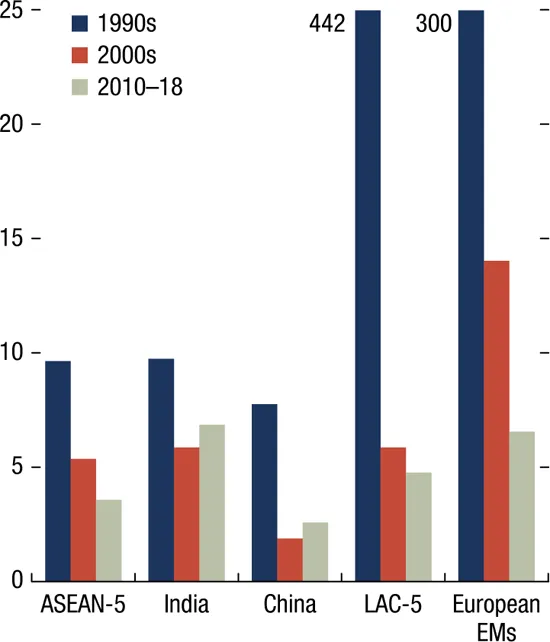

Figure 1.2. Inflation: ASEAN-5 and Peers

(Year-over-year percent change, average)

Sources: IMF, World Economic Outlook database; and IMF staff calculations.

Note: LAC-5 = Brazil, Chile, Colombia, Mexico, Peru; European EMs = Bulgaria, Hungary, Poland, Romania, Russia, Turkey, Ukraine.

Major reforms of micro- and macroprudential policy frameworks allowed ASEAN-5 financial systems to build significant resilience. Chapter 3, by Pablo Lopez Murphy, takes stock of these major initiatives. ASEAN-5 countries overhauled financial regulation and supervision; bank supervisors embraced Basel core principles, strengthened supervisory policies, required banks to hold more capital, and aligned regulations with best practice. The ASEAN-5 also worked to restructure nonfinancial corporations, including by establishing centralized asset-management companies and relying on out-of-court debt workouts as a speedy, cost-effective, and market-friendly alternative to court-supervised workouts. To cap it off, ASEAN-5 countries developed bond markets in local currencies to reduce foreign exchange mismatches, lower credit and maturity risks in banks, and store away a spare tire should the banking system be impaired.

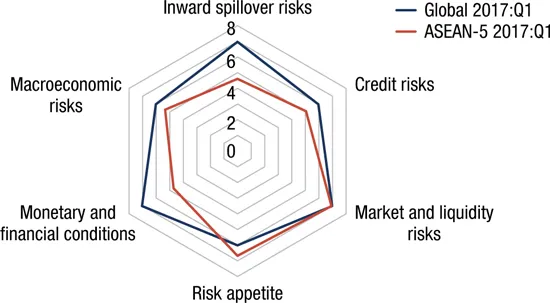

All these efforts helped ASEAN-5 countries navigate the global financial crisis well and preserve financial stability. Following the global crisis, ASEAN-5 financial systems were in much better shape than those of many advanced economies because ASEAN policymakers routinely responded to emerging systemic risks. Nowadays, ASEAN-5 financial systems differ in size, access, efficiency, and financial supervision structure, partly reflecting varying stages of economic development. But they also have important similarities, including the increasing importance of shadow banks and financial markets, the large presence of financial conglomerates, and the high participation of the government. A bird’s-eye view suggests that macro-financial risks are contained and generally lower in ASEAN-5 countries than in the global financial system (Figure 1.3), a testament to the benefits of decades of strong reform efforts.

Figure 1.3. ASEAN-5 Financial Stability Map 2017 versus Global, 20171

Source: IMF staff estimates.

1 Lower values indicate lower risks.

2. Global spillovers will continue to test policy frameworks in ASEAN-5 countries.

In the wake of the global financial crisis, ASEAN-5 policymakers were compelled to adapt their frameworks to strengthen policy autonomy and mitigate risks from global spillovers. Chapter 4, by Shanaka J. Peiris and others, considers the channels through which global financial factors have impacted domestic financial markets and monetary conditions in the ASEAN-5. Principal component analysis of domestic financial conditions identifies two key macro-financial channels of transmission of global financial shocks: one is related to the Chicago Board Options Volatility Index (VIX) and affects largely capital flows and asset prices; the other is linked to US interest rates and affects mainly monetary and credit conditions. The chapter also assesses empirically the transmission of reserve currency monetary policy to domestic short- and long-term market interest rates, as well as to retail bank rates, given their importance in domestic monetary policy transmission (Figure 1.4). Macro-financial spillovers to the real economy are also investigated through Bayesian vector autoregression models. Results suggest that global financial cycles emanate from changes in US monetary policy and that global risk aversion drives domestic financial and macroeconomic conditions in the ASEAN-5.

Figure 1.4. Global Bond Yields

Change since January 2010 (basis points)

Sources: Bloomberg L.P.; and Haver Analytics.

Note: AEs = advanced economies; EMs = emerging markets; LCY = local currency.

Looking ahead, several global scenarios could shape the outlook and spillover to emerging markets against the backdrop of elevated uncertainty. Illustrative model-based simulations show that faster-than-anticipated monetary policy normalization in the United States or an abrupt growth slowdown in China would hit the ASEAN-5 economies hard through weaker external demand and higher financing costs, warranting a policy response.

Chapter 5, by Hoe Ee Khor and others, explores how monetary and exchange rate policies responded to spillovers during and after the global financial crisis. The chapter presents results from country-specific Taylor rule reaction functions, which show that central banks responded predominantly to domestic inflation developments, although external considerations also played a role. Policy rates are found to be susceptible to global monetary shocks, controlling for the interdependence of economic cycles, while the degree of monetary policy autonomy varies across the ASEAN-5, with monetary transmission influenced by global financial and commodity price shocks.

The move to more flexible exchange rate regimes in the region was instrumental in facilitating adjustment to external shocks and discouraging a buildup of short-term foreign exchange debt. This was a big departure from the pre–Asian financial crisis period, and allowed the exchange rate to act as an effective shock absorber during the global financial crisis. Alongside this policy shift, international reserves in these economies also rose significantly, strengthening external positions and allowing the use of reserve buffers to avoid disorderly market conditions. Calibrated model simulations also suggest that foreign exchange market intervention, in some circumstances, could help reduce business cycle fluctuations in response to capital flow shocks. A key aspect of the policy responses to the global financial crisis and other capital outflow episodes was the timely use of different policy levers, taking into account macro-financial linkages.

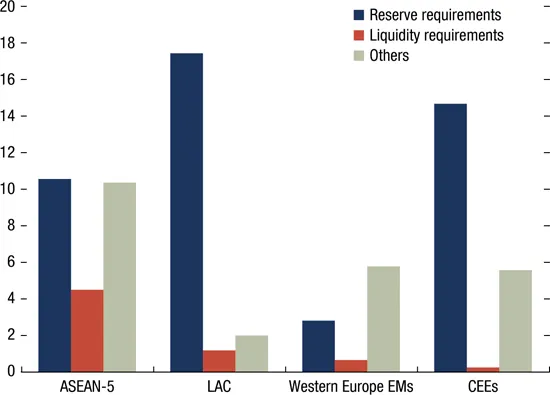

The ASEAN-5 economies have been well ahead of other regions in realizing the value of macroprudential policies for financial stability. Chapter 6, by Sohrab Rafiq, documents the increasing use of macroprudential policies in the ASEAN-5 and analyzes the effectiveness of such policies in maintaining financial stability. The past 30 years witnessed a shift in the types of macroprudential tools used by ASEAN-5 countries, with greater focus on the real estate sector and credit-specific domestic prudential tools (Figure 1.5). This responded to the need to address financial stability risks marked by rising household debt and asset price cycles.

Figure 1.5. Use of Macroprudential Policies

(Number of policy changes, 1990–latest)

Sources: Bank for International Settlements database; and IMF staff calculations.

Note: CEEs = central and eastern European economies; EMs = emerging markets; LAC = Latin America and Caribbean.

The use and effectiveness of macroprudential policies is a frontier area in macroeconomic policymaking globally and one in which we are still very much in learning mode. Event studies and panel data estimations for the ASEAN-5 show that macroprudential tools have been effective in containing systemic vulnerabilities and procyclical dynamics between asset prices and credit over the past two decades. In particular, the use of loan-to-value ratios and real-estate-related taxes have effectively mitigated property price appreciation and housing sector credit growth. Macroprudential policies have also complemented monetary policy and enhanced the monetary policy transmission mechanism via the bank lending channel. Moreover, the increased use of macroprudential tools has mirrored shifts in the management of bank capital across the region, coincided with lower risk taking and less reliance on noncore funding by banks, and led to more prudent bank balance sheet management. The ASEAN-5’s successful experience with macroprudential policies thus holds lessons for other advanced and emerging market economies.

The more active...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Foreword

- Acknowledgments

- Contributors

- 1 Overview

- Part I From the Asian Financial Crisis to the Present

- Part II Policy Responses to Global Spillovers

- Part III Challenges Ahead

- Footnotes