eBook - ePub

Global Financial Stability Report, October 2015 : Vulnerabilities, Legacies, and Policy Challenges - Risks Rotating to Emerging Markets

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Global Financial Stability Report, October 2015 : Vulnerabilities, Legacies, and Policy Challenges - Risks Rotating to Emerging Markets

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Global Financial Stability Report, October 2015 : Vulnerabilities, Legacies, and Policy Challenges - Risks Rotating to Emerging Markets by International Monetary Fund. Monetary and Capital Markets Department in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2015eBook ISBN

9781513582047Chapter 1. Three Scenarios for Financial Stability

Prepared by Matthew Jones (Division Chief), Martin Čihák (Advisor), Ali Al-Eyd (Deputy Division Chief), Jennifer Elliott (Deputy Division Chief), Serkan Arslanalp, Magally Bernal, Antoine Bouveret, Peter Breuer, John Caparusso, Yingyuan Chen, Fabio Cortes, Reinout De Bock, Martin Edmonds, Michaela Erbenova, Tryggvi Gudmundsson, Sanjay Hazarika, Geoffrey Heenan, Eija Holttinen, Mustafa Jamal, Bradley Jones, David Jones, William Kerry, Sheheryar Malik, Evan Papageorgiou, Vladimir Pillonca, Jean Portier, Juan Rigat, Shaun Roache, Luigi Ruggerone, Luca Sanfilippo, Kate Seal, Nobuyasu Sugimoto, Narayan Suryakumar, Shamir Tanna, Constant Verkoren, Francis Vitek, and Jeffrey Williams.

Financial Stability Overview

During the past six months financial stability has improved in advanced economies, but risks continue to rotate toward emerging markets amid a lower risk appetite and higher market and liquidity risks. In advanced economies, growth is gaining traction, and monetary policy normalization is approaching in the United States. Despite these improvements in advanced economies, emerging market vulnerabilities remain elevated. Several key emerging market economies face substantial domestic imbalances, and growth projections have been downgraded, leaving financial stability risks tilted to the downside. The possibility of a global asset market disruption, whereby market risk premiums would decompress in a disorderly way and spread financial contagion, remains heightened. Such a scenario could derail the recovery and delay or stall monetary policy exits. In contrast, “successful normalization”—featuring gradually rising risk premiums, orderly balance sheet adjustments, and renewed financial and corporate health—will require concerted policy action.

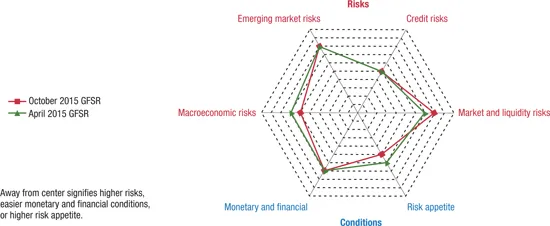

Financial stability has improved modestly in advanced economies since the April 2015 Global Financial Stability Report (GFSR), as shown in the Global Financial Stability Map (Figure 1.1) and its components (Figure 1.2). Risks continue to rotate from advanced economies to emerging markets and from banking to nonbanking sectors, keeping emerging market risks elevated, while market and liquidity risks continue to increase, in an environment of lower risk appetite.

Figure 1.1. Global Financial Stability Map: Risks and Conditions

Source: IMF staff estimates.

Note: GFSR = Global Financial Stability Report.

Figure 1.2. Global Financial Stability Map: Components of Risks and Conditions

(Notch changes since the April 2015 Global Financial Stability Report)

Source: IMF staff estimates.

Note: Changes in risks and conditions are based on a range of indicators, complemented by IMF staff judgment (see Annex 1.1 in the April 2010 Global Financial Stability Report and Dattels and others [2010] for a description of the methodology underlying the Global Financial Stability Map). Overall notch changes are the simple average of notch changes in individual indicators. The number below each label indicates the number of individual indicators within each subcategory of risks and conditions. For lending conditions, positive values represent slower pace of tightening or faster easing. CB = central bank; QE = quantitative easing.

Financial stability has improved in advanced economies

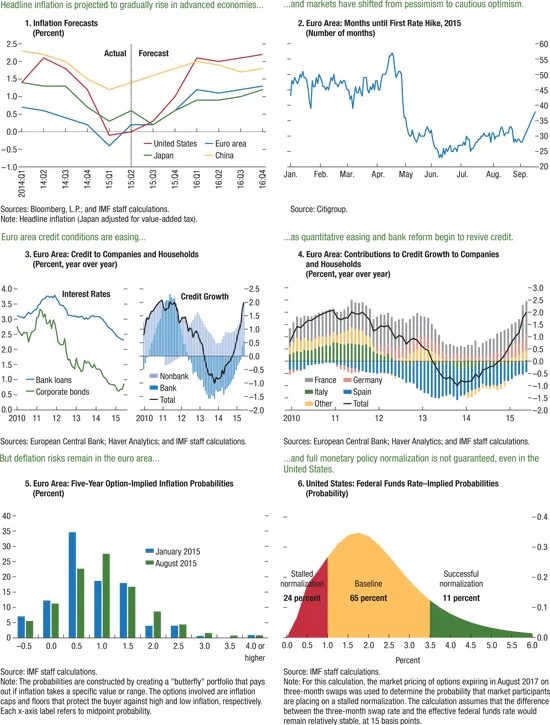

Macroeconomic risks have declined as the economic recovery in advanced economies has broadened. Deflation fears peaked in early 2015 and confidence in monetary policies has since increased (Figure 1.3, panels 1 and 2), as reflected in improved cyclical economic data in advanced economies. The following developments allow for cautious optimism about near-term stability and growth:

- The U.S. recovery has resumed, and wage and price inflation pressures remain subdued. Improving labor market performance is boosting hopes of sustainable consumer and household support for the recovery, as noted in the October 2015 World Economic Outlook (WEO). With the output gap closing, the Federal Reserve is nearer to raising its monetary policy rate above the zero bound. This action will mark the beginning of a move away from the long period of extraordinary monetary accommodation and the first step toward normalizing monetary and financial conditions. It will also help reduce the pockets of both excess financial risk taking and corporate leverage—as flagged in previous issues of the GFSR—that have arisen as a result of the highly accommodative monetary policies of recent years.

- The policies of the European Central Bank (ECB) are taking hold and euro area credit conditions are easing. Signs are growing that the ECB’s unconventional monetary policy is starting to work. For example, the portfolio rebalancing channel sent asset prices higher, narrowed spreads, and boosted the nonbank supply of credit. Policies aimed at strengthening the banking system have bolstered confidence as well as safety, and credit supply and demand have risen. The market’s expected time remaining before the commencement of ECB policy normalization has halved to 2½ years, but has recently edged up amid increased turmoil in global markets (Figure 1.3, panel 2). Market reactions to developments in Greece have been muted so far, reflecting the strength of European firewalls, the ECB’s commitment and actions, and the declining importance of systemic linkages associated with Greece.

- The Japanese economy is expected to continue to recover, despite a setback in the second quarter. Tentative signs are emerging that corporate investment plans are firming, helping improve the outlook for wage and price inflation. The Bank of Japan’s quantitative and qualitative monetary easing has improved financial conditions, increasing equity prices and leading to a modest increase in bank lending. However, market-based inflation expectations remain below the Bank of Japan’s inflation target.

Figure 1.3. Inflation, Monetary Policy, and Policy Rate Normalization

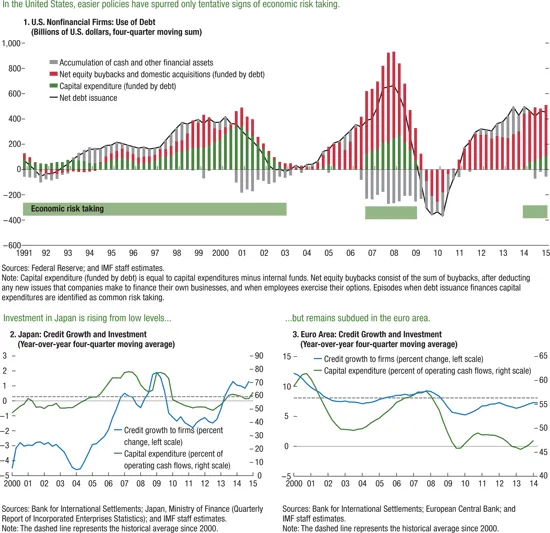

Easy monetary and financial conditions and improvements in private balance sheets in advanced economies have spurred the cyclical recovery, but the transition to self-sustaining growth is incomplete. The financial stability outlook is characterized by continuing cyclical recovery, but prospects for medium-term growth are weak, as noted in the October 2015 WEO. In the United States, earlier measures to repair bank balance sheets have helped boost credit growth, and economic risk taking is rising, but from low levels (Figure 1.4). In Japan, investment is slowly recovering from very low levels as the availability of credit has increased with the improvement in banking system health. The level of euro area real investment still remains below that of 2008, and the outlook for medium-term growth is decidedly weak.

Figure 1.4. Economic Risk Taking Remains Weak in Advanced Economies

Risks continue to rotate from advanced economies to emerging markets

Emerging market risks remain elevated. Several key emerging market economies face substantial domestic imbalances, and growth projections have been downgraded. Although the quality of bank assets appears robust, many emerging market economies are at late stages in their credit cycles, leaving them more vulnerable to an economic downturn and a likely tightening of external financial conditions as the Federal Reserve prepares to raise policy rates for the first time since 2006 (see also Chapter 3).

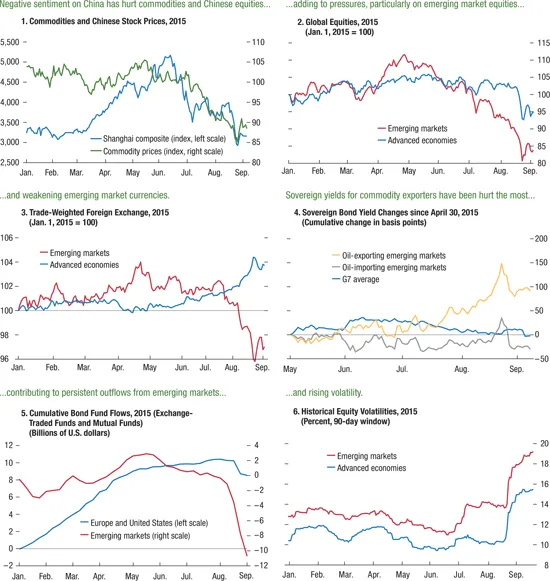

China faces a delicate balance of transitioning to more consumption-driven growth without activity slowing too much, addressing rising financial and corporate sector vulnerabilities, and making the transition toward a more market-based financial system that discourages the buildup of imbalances. Recent market developments underscore the complexity of these challenges, as well as potentially stronger spillovers from China. A gradual growth slowdown is inevitable in the process of reining in vulnerabilities, but the recent weaker-than-expected economic indicators and exchange rate depreciation raised concerns about corporate indebtedness (particularly in foreign currency), while banks are reporting higher credit costs and rising nonperforming loans, albeit from low levels. Although China has substantial buffers to deal with shocks—including official foreign reserves well exceeding private sector external debt—what has been perceived as unconventional official policy interventions to stem volatility in Chinese equities and the exchange rate have weakened market confidence in a smooth resolution of these challenges. The consequences for emerging market economies of weaker economic performance and increased policy uncertainty in China could be significant. Further softening of Chinese demand for commodities and investment goods would undermine growth in emerging market economies, while a weaker Chinese exchange rate would affect external competitiveness. These concerns have started to manifest in market prices, crystallizing the rotation of financial market risks toward emerging market economies, as discussed in this and previous GFSRs (Figure 1.5).

Figure 1.5. Locus of Risks Shifting toward Emerging Markets

Sources: Bloomberg, L.P; EPFR Global; Morgan Stanley; Morgan Stanley Capital International; and IMF staff calculations.

Note: G7 = Group of Seven.

The risks of tipping into the downside are driven by disruptions in global asset markets

Potential near-term adverse shocks in the presence of system vulnerabilities could prematurely halt the rise in U.S. interest rates, degrade financial stability, and stall the economic recovery. Shocks could originate in advanced economies—possibly owing to greater spillovers from Greece to the euro area and international markets—or emerging markets, for example, from greater-than-expected spillovers from China. These shocks could further exacerbate the negative influence of the medium-term forces at play, including ongoing low productivity growth, crisis legacies in advanced economies (high public and private debt and low investment), and ongoing adjustment in emerging market economies after the postcrisis boom in credit and growth and the turn of the commodity cycle (see the October 2015 WEO).

Disruptions in global asset markets would erode public confidence in policy, eliminate market optimism, and generate an abrupt rise in market risk ...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Assumptions and Conventions

- Further Information and Data

- Preface

- Executive Summary

- IMF Executive Board Discussion Summary

- Chapter 1 Three Scenarios for Financial Stability

- Chapter 2 Market Liquidity—Resilient or Fleeting?

- Chapter 3 Corporate Leverage in Emerging Markets—A Concern?

- Tables

- Footnotes