eBook - ePub

Spain : Converging with the European Community

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Spain : Converging with the European Community

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Spain : Converging with the European Community by Gonzalo Pastor, Thierry Pujol, and Michel Galy in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

1993eBook ISBN

9781557753199VI Fiscal Decentralization in Spain

Fiscal decentralization is rather a new phenomenon in Spain. In contrast to recent developments in other countries of the Organization of Economic Cooperation and Development (OECD) where governments have embarked on a process of growing fiscal centralization, in Spain, the weight of regional governments in general government total expenditure has increased from less than 2 percent in 1981 to 7.5 percent in 1986 and to around 12 percent in 1988.1 At the same time, regional governments have become an important source of public employment. For example, in 1986, they employed 340,000 people, twice as many as in 1984. The rapid growth in the size of regional government employment represented an increase in its share in total public sector employment from around 10 percent in 1983 to 23 percent in 1988. Employment by regional governments is now more than half the size of the state civil service.

The process of decentralization has proceeded very rapidly with regional governments obtaining responsibility for a vast array of public services in less than ten years, a transformation that in other countries took decades. Moreover, this trend toward decentralization promises to continue, as the Socialist Party, in its campaign for the 1991 regional elections, proposed to transform Spain into a full-fledged federal state.

Since 1978, a complete array of fiscal instruments has been developed to finance regional governments’ new responsibilities. A key criterion in developing these instruments was to ensure that the regions had sufficient resources to cover the cost of their new activities. At the same time, the system was designed to provide incentives for improving tax collections by the regions. Another important consideration was to establish a system that would work to reduce regional disparities. To this end, a system of capital transfers was developed to redistribute public investment across the Spanish territory. The method, however, by which the central government allocates grants to regional authorities has reduced the regions’ financial autonomy and has led to growing regional governments’ fiscal imbalances. As a result, regional governments have increased their recourse to debt financing, which, if not addressed, could have important implications for the economy in the near future.

The Size and Scope of Regional Governments

The 1978 Constitution divided the Spanish state in 17 regional governments (Comunidades Autónomas) invested with administrative and legislative powers. Rather than specifying a definite state of affairs, the Constitution sketched an open process of fiscal decentralization. The decisions on the speed at which fiscal responsibilities were to be transferred from the central administration to the regions remained in the hands of the regional authorities. In principle, all regional authorities were made responsible for the structure of their institutions, their financial relationships with local governments in their territory, and investment decisions on infrastructure development, such as public works, housing, transportation (roads, railways, harbors). Other responsibilities included the provision of education, health, and welfare services, as well as environmental policy implementation, cultural development, tourism, and police.2 Consequently, the scope of the decentralization process has varied substantially across regional governments depending mainly on two elements: (1) the intensity of each region’s political movement for independence and autonomy and (2) the degree of sophistication of each region’s institutions and tax administrative capacity.

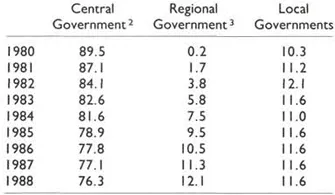

As a result of this changing nature of the Spanish state, regional governments have become an important sector in the Spanish economy in the last ten years. From a base of 0.6 percent of GDP in 1981 regional governments’ total expenditure increased to 3.2 percent of GDP in 1984, and to 5.2 percent in 1988.3 The increase in regional authorities’ operations did not translate into higher total public sector expenditure, but rather represented a substitution of regional authority’s expenditure for central government’s expenditure.4 This was particularly true for the period 1984–90, when total government expenditure leveled off at an average of around 41 percent of GDP, notwithstanding the rapid increase in regional government expenditure. During this period, the weight of central government operations in total public sector’s total expenditure declined from around 82 percent in 1984 to 76.3 percent in 1988 (Table 16).

Table 16. Participation of Different levels of Government in Total Public Sector Expendiure

(In Percent of total public sector expenditure) 1

Source: International Monetary Fund, Government Finance Statistics Yearbook, various issues.

1 Refers to unconsolidated public sector expenditure.

2 Includes the operations of the state, the administrative autonomous agencies, and the social security system.

3 Excludes expenditures associated with the transfer of health (INSALUD) services from the social security system to the regional governments.

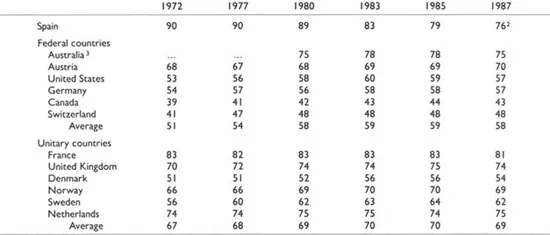

The decline in the weight of central government operations in total public sector expenditure in Spain contrasts with recent trends in the main OECD countries (Table 17). Between 1977 and 1987, both federal and unitary states in the OECD show a tendency toward a more centralized public sector. In the case of federal countries, the average weight of central government expenditure in total public expenditure rose from around 57 percent in 1972 to around 59 percent in 1985–87. Similarly, in the case of unitary countries, this centralization ratio went from 67 percent in 1972 to some 70 percent in 1987. Interestingly, in the United States a sharp increase in the degree of centralization occurred during 1972–87 despite calls for a policy of “New Federalism.” Although the U.S. Congress delegated to the states new responsibilities, there were no provisions to allow for a parallel increase in state revenues.

Table 17. Particiption of Central central Government Expenditure in Total Public Sector Expenditure in Selected Countries

(In percent of total public expenditure) 1

Sources: International Monetary Fund, Government Finance Statistics Yearbook; and IMF staff estimates.

1 Except for Australia, figures are with respect to unconsolidated public sector expenditure.

2 Refers to 1988.

3 In 1980, Government Finance Statistics data for Australia contain a break in the time series starting 1980

Notwithstanding the progress to date, much remains to be done to reduce the weight of central government operations in total public sector expenditure in Spain to levels comparable to other OECD countries. The weight of central government operations in total public sector expenditure in Spain remains 18 percent higher than the average for federal states and 8 percent higher than the average for unitary states (Table 17).

Instruments of Regional Authority Finance

Regional authorities in Spain are classified in two broad categories: regional governments under the regular financing scheme (Comunidades Autónomas de Regimen Común) and regional governments under the forum system (Comunidades Autónomas de Regimen Foral). The Basque Provinces and Navarra are the only two regional governments under the latter system, which has evolved from these two regions’ unique historical relationship with the central authorities. Within their territory, these two regional authorities are fully responsible for the legislation and administration of a large number of state taxes (Impuestos Concertados), which are negotiated annually between the state and the regional authorities. These regional authorities are then obligated to transfer back to the central government a specific amount of resources (Cupo) in lieu of those public services that are still being provided by the state. In 1986, revenue from Impuestos Concertados, net of Cupo, represented 93 percent and 78 percent of total revenues of Cataluña and Navarra, respectively.

The other 15 regional governments are all included under the regular financing scheme (Comunidades Autónomas de Regimen Común) and represent the core of the process of fiscal decentralization in Spain. In terms of their responsibilities, they can be classified in two groups: regional authorities with limited responsibilities and regional authorities with a broad mandate, including the provision of education and health services. The first group is usually referred to in Spain as regional authorities under Article 143 of the Constitution. It includes ten regional governments: Aragón, Asturias, Baleares, Cantabria, Castilla-La Mancha, Castilla-León, Extremadura, Madrid, Murcia, and La Rioja. The second group is known as the regional authorities under Article 151 of the Constitution. This group includes five regional governments: Andalucía, Canarias, Cataluña, Galicia, and ...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Preface

- I. Introduction

- II. Opening Up of the Spanish Economy in the Context of EC Integration

- III. Financial Liberalization in Spain

- IV. External Constraints on Monetary Management

- V. Personal Income Tax Reform

- VI. Fiscal Decentralization in Spain

- Bibliography

- Tables

- Footnotes