- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Social Safety Nets : Issues and Recent Experience

About this book

NONE

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

1998eBook ISBN

9781557756800III Country Studies

6 Bangladesh: Economic Reform Measures and the Poor

With a per capita income of about $200 in 1991, Bangladesh is one of the poorest countries in the world. More than half of its population—50 million people—live in poverty. The most vulnerable groups include small farmers, landless rural laborers, and workers in the urban informal sector. Health care, nutrition, and education standards are low, especially among women and children. The earning potential of most poor people is limited by their lack of skills, assets, and access to credit. Given its limited natural resources, high population density, and frequent natural disasters, Bangladesh faces an enormous challenge in its efforts to reduce poverty.

The only lasting way to reduce poverty is to ensure sustainable economic growth, by implementing policies to promote financial stability and the efficient use of resources. With this strategy in mind, the government launched a medium-term structural adjustment program in the mid-1980s, supported by the IMF under the Structural Adjustment Facility (SAF) and the Enhanced Structural Adjustment Facility (ESAF). The government’s efforts have also been supported by the World Bank, other donors, and nongovernmental organizations (NGOs).

Adjustment efforts are likely, however, to have some adverse effects on the poor in the short run, arising primarily from increases in public pricing, lower subsidies, public enterprise reform, and deregulation of private sector activity. The government has put in place compensatory and targeted programs to mitigate these negative effects, although the massive numbers of poor people, on the one hand, and the shortage of budgetary resources, on the other, constrain the scope of these efforts. Although improved food availability remains the focus of targeted action under the SAF and ESAF programs, efforts are being made to reduce the constraints that impeded the development of a comprehensive social safety net in the past.

This paper evaluates the impact of the adjustment programs on the poor. It sets out the objectives of the government’s economic reforms and the main elements of the SAF and ESAF programs. It then analyzes the impact on the poor of program-induced changes in relative prices as well as induced changes in production, employment, and income.

Economic Reforms and Structural Adjustment Programs

The programs under the SAF (1986/87, 1988/89) and ESAF (1990/91, 1992/93) reflect the government’s emphasis on addressing poverty reduction mainly by promoting sustained economic growth. The government has adopted a policy program to (1) spur private investment through financial reform, exchange and trade liberalization, and industrial deregulation; (2) facilitate public investment by raising domestic revenues, curtailing government consumption, and improving project implementation; (3) protect the purchasing power of the poor by reducing inflation; and (4) improve human resource development by strengthening social programs and reorienting public expenditures. These policies aim at promoting labor-intensive agricultural, industrial, and export production, and economic diversification. At the same time, since the benefits of growth may not reach the poor in the short run, this policy framework has been supplemented by targeted programs that provide special assistance to the poor. The details of each policy measure are discussed in the next two sections.

During the SAF arrangement, growth and investment objectives were not realized because of the disruptions caused by severe floods, as well as slippages in the implementation of structural reform. Real GDP growth averaged only 3 percent, inflation remained at 10 percent, and per capita income did not increase in real terms. The SAF program, however, was successful in expanding the tradable goods sector, which created employment, and in reforming the agriculture sector, which laid the basis for the subsequent recovery of production and the improved availability of food. The ESAF program maintains the objectives of raising investment and reducing inflation with a view to achieving 5 percent real GDP growth. Higher incomes and profits resulting from higher investment are expected to improve per capita consumption while generating increased private savings. A more open and competitive economy, resulting from agricultural, financial, and exchange and trade liberalization, is expected to strengthen production incentives and create employment opportunities.

Program-Induced Changes in Relative Prices and Their Impact on the Poor

Although it is generally observed that the poor are hardest hit by changes in relative prices during adjustment, this is not so in Bangladesh because price distortions have not been severe. As a result, not only was the need for sizable adjustment reduced, but it was possible for the pace of adjustment to be gradual. The government recognizes, however, that, as adjustment efforts are intensified, there could be more pronounced short-term adverse effects on the poor, which would require compensatory measures.

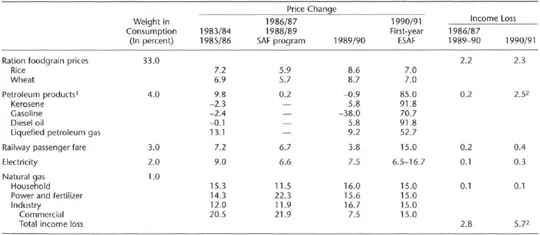

The main changes in relative prices resulting from the adjustment programs are those stemming from increases in ration prices for food-grains, prices of administered goods and services (e.g., energy and transportation), and excise taxes. The direct impact of these changes on the poor has varied, depending on the relative importance of the affected items in their consumption and the magnitude of the changes. The poor spend a high proportion (about 60 percent) of their income on food compared with the rest of the population, with more than half of such expenditure devoted to foodgrains. Given this consumption pattern, the changes in relative prices resulting from the program are estimated to have reduced the incomes of the poor by not more than 3–6 percent during 1986–91 (see Table 6.1).1

Table 6.1. Bangladesh: Impact of Program-Induced Changes on the Poor

(Annual average percentage change)

Sources: Bangladesh authorities; and IMF staff estimates.

1 Weighted average.

2 In response to the 92 percent increase in kerosene prices, the poor are expected to substitute less expensive firewood for kerosene, as a result of which the net income loss would be 1.5 percent and the corresponding total income loss would be 47 percent.

Increases in Foodgrain Prices

An important objective of the government’s food policy under the structural adjustment programs has been to reduce food subsidies and the budgetary cost of food management operations, partly through an increase in ration food prices. Although the availability and cost of food have a major influence on the standard of living of the poor, the impact of change in ration food prices alone on their income has been limited and is likely to remain so in the future. This limited impact is explained by the fact that the poor receive only 20 percent of their foodgrain consumption from the public food distribution system. Out of the 8 million tons of foodgrains consumed by the poor, only 1.5 million tons are obtained through the public system. The major share, 4.5 million tons, of their consumption is obtained from their own farm production, while the remaining 2 million tons are purchased from the private market. The urban poor receive a larger share of the food distributed by the public system and also depend more on the private market than the rural poor.

Within the poor groups, the ultrapoor receive the bulk of the 1.5 million tons distributed by the public system, which represents about half of their total consumption of foodgrains. About 60 percent of the 1.5 million tons is made available to them under the nonmonetized channels of the system as food wages paid for work rendered under the Food for Work and Vulnerable Group Development programs. Thus, the increase in ration prices undertaken in the adjustment programs applies to only 0.6 million tons or 20 percent of the food consumed by the ultrapoor.

Average ration prices for rice and wheat were both raised by only 6 percent annually during the SAF program, well below the rate of inflation. Assuming that these increases affect a third of the total income of the poor, their impact on the income of poor households would be to reduce it by about 2 percent annually. Under the first-year ESAF program, ration prices were raised by an average of 7 percent in July 1990. To improve the targeting of subsidies, prices were increased by 5 percent for distribution channels available to poorer groups and by 16 percent for channels available to the relatively well-off groups. The 5 percent increase in ration prices would reduce the income of poor households by less than 2 percent.

Although the ration price increases of recent years sought to reduce budgetary food subsidies, the latter increased considerably in 1988/89 and 1989/90 as higher international prices were not passed through to consumers. While the poor benefited to this extent, they would have been better off had the ration prices on those channels available to the nonpoor been raised in step with world price increases and the resulting budgetary savings applied toward programs for the poor. The differentiated ration price increase in 1990/91, coupled with a cutback in commercial food imports, will permit a substantial reduction in budgetary food subsidies, from 0.8 percent of GDP in 1989/90 to 0.6 percent in 1990/91.

Increases in Administered Prices

The rationalization of public enterprises under the adjustment programs has led to increases in prices of several public goods and services, some of which imply higher consumption costs for the poor. This impact was limited during the SAF program because some planned price increases had not been implemented, and those that had been carried out accounted for only a small share of the consumption of the poor. During the SAF program, administered prices were increased for electricity (20 percent), natural gas (35 percent for household consumers), and transportation (10 percent). Gas and electricity prices were further increased by 16 percent and 8 percent, respectively, in 1989/90. The impact of the changes in transport fares and energy prices on the income of the poor during this four-year period, however, is estimated at only 0.4 percent annually.

The government is raising prices more aggressively during the ESAF period to strengthen public enterprise finances. Increases that have already been implemented include prices of natural gas (15 percent), electricity (6–17 percent), railway fares (15 percent), and petroleum products (85 percent). However, even price increases of this magnitude for energy products, except for kerosene, have limited impact on the rural poor, although the urban poor are somewhat more affected by increases in transportation costs. In the case of kerosene, prices have been raised by 92 percent, largely reversing its previous cross-subsidization against other petroleum products, which the authorities believed had encouraged smuggling across land borders. This price increase will cause a reduction of 2½ percent in the real income of the poor. However, this effect is likely to be smaller to the extent that the poor would substitute less expensive firewood for kerosene.

Increases in Excise Taxes

The SAF and ESAF programs include, as part of the revenue mobilization effort, increases in excise taxes for sugar, tobacco, natural gas, and certain services, which result in higher prices. Such effects are not substantial for the poor since these goods together account for less than 10 percent of their consumption. During the SAF program, price increases on these items are estimated to have reduced the income of the poor by less than 1 percent annually. Further, the government usually attempts to levy excises mainly on goods and services largely consumed by the better-off groups, including bank transactions, telephone services, and luxury consumer goods. To assist the poor, proposals in the original 1990/91 budget for higher excise duties on kerosene, which represent an estimated 4 percent of the total consumption expenditure of the poor, were subsequently withdrawn.

Program-Induced Changes in Production, Income, Employment and Their Impact on the Poor

The reform measures that induce changes in production, employment, and income consist of (1) agricultural policies; (2) tax reform; (3) public expenditure policies; (4) financial reform, exchange rate, and trade liberalization policies; and (5) public enterprise reform. In contrast to the limited adverse effects of relative price changes, program-induced changes in production, income, and employment are substantially benefiting the poor. Under t...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Foreword

- Acknowledgments

- I. Overview

- II. Issues in the Design of Social Safety Nets

- III. Country Studies

- Additional Papers on Social Safety Nets Prepared by IMF Staff

- Footnotes