- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Coordinated Portfolio Investment Survey Guide

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Coordinated Portfolio Investment Survey Guide by International Monetary Fund in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

1996eBook ISBN

9781557756060IV. Survey Notes of Individual Countries

Argentina

Institutions Responsible for Data Collection and Compilation

CPIS data were compiled and estimated by the National Directorate of International Accounts of the Argentine Ministry of Economy and Public Works and Services. The directorate is also responsible for compiling balance of payments statistics.

Legal Authority to Collect CPIS Data (Compulsory/Voluntary Reporting)

Some data were obtained from the records of domestic supervisory agencies having legal authority to collect information from supervised entities.

Survey Approach

The Argentine National Directorate of International Accounts conducted an aggregate survey of end-investors and supplemented survey data with estimates. The information consisted of data reported by selected categories of end-investors (banks, insurance companies, pension funds, and investment funds) to relevant supervisory agencies. (These investors generally submit supplementary data on investments in nonresident securities by means of appendices to balance sheet reports provided to supervisory agencies.) The information also included data—which were reported by other directorates—for the general government sector and estimates of the portfolio investment assets of the private nonfinancial sector. (Most of these assets were thought to be directly owned by entities located abroad and entrusted to nonresident custodians. The CPIS was the first instance in which such data were compiled for statistical purposes, and some types of data were collected for the first time. IMF-designed survey forms were not used. Records of supervisory agencies proved effective as existing sources of data.) The estimates were based mainly on the results of a survey of international financial experts, but BIS and partner country data were also used. The estimated component amounted to nearly US$24 billion and could not be allocated geographically. (Estimation methodologies are described in the Metodología de Estimación del Balance de Pagos of the Ministry of Economy and Public Works and Services.)

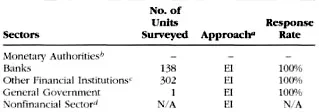

Coverage of Institutional Units by Sector

a EI (end-investor), CU (custodian), or BO (both end-investor and custodian)

b Securities held as reserve assets were not included in CPIS data.

c Pension funds, investment funds, and insurance companies

d The nonfinancial sector was not surveyed directly. Sector holdings of nonresident securities were estimated.

Exemption/Simplification Thresholds

No threshold was established for survey coverage.

Exclusion of Direct Investment

Data on direct investment were reported and collected separately; an attempt was made to ensure that data for the CPIS did not include direct investment positions.

Market Price Valuation

Respondents reported portfolio investments at market prices.

Treatment of Accrued Interest

Most respondents included accrued interest in market values.

Views of National Compilers on Accuracy of Reported Data

A major effort was made to cover portfolio investment assets of resident households. The prevalence of high risk during past decades encouraged the development of long-term positions in financial assets issued abroad and held through nonresident intermediaries. The mix of survey data and sectoral estimates of portfolio investment was thought to result in more reliable data. However, estimated components could not be geographically disaggregated, and this lack of detail diminished the quality of the data.

Australia

Institutions Responsible for Data Collection and Compilation

CPIS data were collected and compiled by the Australian Bureau of Statistics (ABS), which is also responsible for the compilation of balance of payments and IIP statistics.

Legal Authority to Collect CPIS Data (Compulsory/Voluntary Reporting)

The Census and Statistics Act of 1905 provided the authority to conduct the CPIS on a compulsory basis. This legislation permitted Australian statisticians (or their delegates) to issue, if necessary, a “Notice of Direction” that instructs a person or organization to provide the information requested by a specific date. If compliance does not result, the matter may be referred to the director of public prosecutions for settlement through the courts. However, the ABS has always preferred to seek the cooperation of people and businesses being surveyed, and the vast majority of respondents recognized the importance of official statistics to the community and provided the required information without recourse to the compulsory powers available under the law.

Survey Approach

The ABS collected aggregate data from custodians and end-investors. Information for the CPIS was collected through the regular, quarterly Survey of International Investment (SII) covering large units that collectively account for approximately 90 percent of the nonresident investment in Australia and Australian investment abroad. In addition, a special collection of data was taken from all smaller resident enterprises known to have relevant portfolio investment activity. (In keeping with the SII methodology prevailing at the time, such enterprises were usually surveyed annually at the June 30 fiscal year end.) The regular, aggregate SII collection was deemed to provide, in terms of coverage and accuracy, satisfactory quarterly outputs. Some minor adjustments were made to comply with CPIS requirements. Collection, on a security-by-security basis, of information from custodians was investigated but proved to be impractical.

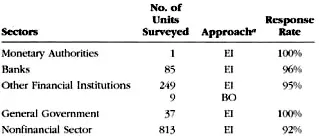

Coverage of Institutional Units by Sector

a EI (end-investor), CU (custodian), or BO (both end-investor and custodian)

Exemption/Simplification Thresholds

No threshold was established for survey coverage. For holdings of nonresident, short-term debt securities, data obtained from the SII were combined with estimated contributions from smaller units. (Information on small units that were not sampled was extrapolated from census data obtained one year earlier.)

Exclusion of Direct Investment

Respondents were asked to record separately data for direct investment and portfolio investment. Guidance notes to the CPIS provided clear definitions of direct investment, direct investment relationships, and portfolio investment. Respondents were required, for each instrument, to record separately the particulars of nonresident direct investors, direct investment groups residing abroad, and other nonresident investors. This method of reporting further emphasized the distinctions and relationships among these three categories.

Market Price Valuation

Respondents were asked to report portfolio investments at market prices. Guidance notes to the CPIS described possible methods for determining market value in the absence of market price data. Positions denominated in foreign currencies were converted to Australian dollars at the midpoints of appropriate buy and sell rates applicable on the reference dates.

Treatment of Accrued Interest

Respondents were asked to report market prices that did not include accrued interest. Accrued interest was added to market prices to obtain market value positions.

Country Attribution of Portfolio Investment Assets/Liabilities

Respondents were asked to identify the countries in which immediate nonresident creditors or debtors resided. For assets, these attributions were accurate parallels to countries of issuers. However, it was not possible to determine the countries of ultimate beneficial owners...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Preface

- Contents

- I. Introduction

- II. Allocation of Portfolio Investment Assets Among Major Partner Countries

- III. Tables Showing CPIS Data of Individual Countries

- IV. Survey Notes of Individual Countries

- V. Bibliography

- Footnotes