- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Sequencing Financial Sector Reforms

About this book

NONE

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

1991eBook ISBN

97815577577911 Managing Financial Sector Liberalization: An Overview

The papers in this volume illustrate the structural linkages among different components of financial sector reforms and the impact of these reforms on macroeconomic performance, based on country experiences. An underlying theme throughout the volume is that specific financial sector reforms should be properly sequenced and coordinated in order to complement and support macrostabilization objectives, and to reflect the technical linkages among various components of financial sector reform. An appropriate sequencing of financial sector reforms that supports stabilization can help to derive the full benefits of these reforms in terms of efficiency and growth. The book is therefore concerned with the elements that contribute to orderly liberalizations of financial systems, and with avoiding the pitfalls from inappropriately sequenced or insufficiently supported financial reforms.

The objective of developing the monetary and exchange system, and more broadly the financial system, derives from the simple proposition that the more efficient and more stable such systems are, the better a country’s economic performance will be. Stable and efficient financial systems will provide the foundation for implementing effective stabilization policies and successfully mobilizing capital and putting it to efficient use, and, therefore, achieving higher rates of economic growth. This proposition will be valid not only in the mobilization and use of national savings but also in harnessing foreign savings. In a world of increasing capital mobility, capital will move not only as a response to competing monetary policies but also to competing financial systems. Inefficient and unstable monetary and exchange systems are likely to be increasingly penalized, placing a premium on developing financial sector institutions and sound macroeconomic policies.

The efficiency of financial systems is governed by the range of intermediaries and the role of markets in mobilizing and allocating financial resources; in providing liquidity and payment services, including through the convertibility of currencies; and in gathering information on which to base investment and savings decisions and influence corporate governance. Stability is concerned with safeguarding the value of liabilities of financial institutions that serve as stores of value and wealth, and media of domestic and international exchange. It is also concerned with the interrelationship between financial systems and macroeconomic management. This aspect involves questions of monetary control, prudential supervision and financial regulation, and broader questions of good governance.

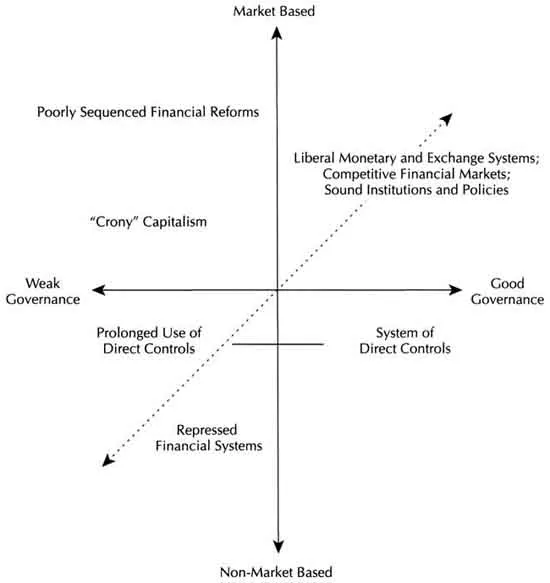

Figure 1.1 illustrates the types of trade-offs that might be thought to exist between stability and efficiency depending on the nature of market arrangements and type of governance. Market-based systems with strong internal governance (upper right quadrant) are likely to have better economic performance than those in the lower left quadrant. Nonmarket-based systems that rely on direct controls may or may not involve instability, depending upon the quality of governance, but invariably involve inefficiency compared with market-based arrangements. Maintenance of direct controls for prolonged periods is more likely to be associated with instability given the scope for avoidance of direct controls. Seriously repressed financial systems are more likely to be associated with instability and inefficiency and lower economic growth. Success in moving toward higher rates of growth will depend on the sequencing of reforms. An inept approach to sequencing reforms may result in instability and weaker improvements in efficiency than better sequenced reforms. A banking crisis, associated with poorly managed reforms, would damage economic performance. The “quality” of financial reform matters.

Figure 1.1. Factors Influencing Financial Sector Efficiency and Stability

Against this background, financial sector liberalization can be viewed as a set of operational reforms and policy measures designed to deregulate and transform the financial system and its structure with the view to achieving a liberalized market-oriented system within an appropriate regulatory framework. Such worldwide financial sector reforms have led to greater flexibility in interest rates, an enhanced role for markets in credit and foreign exchange allocation, increased autonomy to commercial banks, a greater depth for the money, securities, and foreign exchange markets, and significant increases in cross-border flows of capital. In parallel, the framework for monetary and exchange policy has undergone major changes. Bank-specific credit ceilings and selective credit allocations have been replaced by market-based instruments to implement monetary policy. Prudential supervision systems have been put in place to foster sound credit decisions and effective management of market risks. A regime of strong exchange and trade restrictions and limited foreign exchange markets has given way to a multilateral international exchange and payment system with significant progress toward currency convertibility and active interbank foreign exchange markets.

In support of such a transition, financial sector reforms have, in varying degrees, involved:

- Increasing autonomy to central banks in monetary management.

- Developing market-based monetary control procedures and money and interbank markets to bolster interest rate regimes.

- Reforming prudential regulations and the banking supervision system.

- Recapitalizing and restructuring weak financial institutions, supported by enterprise restructuring policies.

- Reforming selective credit regulations and reducing the scope of directed credit and interest subsidies.

- Fostering autonomy and competition in the financial system, and promoting institutional development of both banks and nonbank financial intermediaries (NBFIs).

- Developing long-term capital markets, including domestic public debt management and government securities markets.

- Reforming clearing and settlement system for payments.

- Developing foreign exchange markets supported by appropriate prudential regulations on foreign exchange exposure.

- Eliminating restrictions on payments and transfers for current international transactions and liberalizing controls on capital movements.

The relative importance of these components and the specific measures within each component have varied from country to country, depending upon, among other things, the prevailing initial conditions, the commitment to reform on the part of the authorities, and the speed of reform process. Examination of country experiences shows that there are close structural linkages among specific components of financial sector reforms, and these linkages have implications for the appropriate sequencing of reforms. Smooth implementation of financial sector reforms would typically also require a wide range of legislative measures and organizational changes. In particular, the organization and functioning of the central bank would need significant strengthening to facilitate implementation of financial sector reforms.

In all cases, however, these reforms have been motivated by the need to pursue stabilization and broader structural reforms in an efficient and effective manner, and thereby step up savings mobilization, improve the efficiency of investment allocation, and achieve sustainable growth. These broader issues are reviewed briefly in the next section, before outlining the structure of the book and the main themes.

The Link Between Stabilization and Financial Sector Reforms

The resurgence in academic interest in the role of financial systems in economic development dates to the early work of Gurley and Shaw (1960) on the interaction between financial structure and economic activity, and especially on the role of intermediaries in the credit supply process. Many authors have argued that credit market conditions and balance sheet developments such as debt-equity ratios, ratio of net worth to liabilities, and other similar ratios can have important effects on output and investment (see, for example, Gertler, 1988; and Sundararajan, 1987). In addition, the information asymmetries and the resulting market failures, such as equilibrium credit rationing, credit market collapse, bank runs, and weak secondary markets, suggest that governments can, through appropriate regulations, improve on the types of contractual arrangements that would arise in an unfettered private economy.1 Empirical literature has also increasingly emphasized the importance of financial sector variables in economic cycles.2 Recently, several studies have reported positive correlations between levels of financial development and economic growth (e.g., King and Levine, 1993a; and Japelli and Pagano, 1992).

It is widely recognized that certain structural adjustments are necessary to support the effectiveness of stabilization, and at the same time, the successful pursuit of stabilization policies is necessary for the effectiveness of broader structural reforms—price reforms, exchange and trade reforms, industrial restructuring and enterprise reforms (see Barth, Roe, and Wong, 1994). Both stabilization and general structural reform policies, however, need to be supported by complementary financial sector reforms. As discussed later in this volume, wide-ranging structural changes in the financial sector are often needed for the effective and efficient conduct of monetary and exchange policies, without which sustained progress toward macroeconomic and financial stability would be difficult to achieve.

The policy implications of this work are that important gains for economic performance are to be had from financial sector reforms, and therefore these reforms should be accelerated. Countries wishing to attract or retain private savings so as to achieve adequate rates of economic growth have little option but to reform their financial systems and to follow policies that will maintain financial stability. Often, rapid financial liberalization can overcome inertia and be a catalyst for broader economic reforms. Moreover, rapid reforms can add credibility to the government’s commitment to carry out reforms and help the mobilization of external resources. This realization comes in the form of both tangible evidence that the authorities are moving ahead with reforms and the evidence of increased willingness of the government to subject itself to discipline from markets.

Nevertheless, financial reforms carry risks if they are sequenced inappropriately or insufficiently supported, and the academic literature has tended to place financial sector reform relatively late in the overall sequence of reform and to favor a gradual approach.3 The literature suggests broad propositions on the optimal sequencing of economic reforms, including that: (1) macroeconomic stabilization is a prerequisite to successful structural adjustments; (2) the liberalization of domestic financial markets should precede the removal of controls on international capital flows; and (3) trade liberalization and real sector adjustments should precede capital account liberalization. Nevertheless, the potential role of financial systems in improving economic performance argues for examining ways of accelerating the financial sector reforms while seeking to reduce the possible adverse consequences for macroeconomic control and resource allocation of poorly sequenced or managed reforms. Acceleration of reforms is especially important where restrictive financial systems have failed to deliver adequate economic performance; people appear to be circumventing existing controls; and countries are confronting critical macroeconomic and structural problems that make it difficult to delay reform.

The challenge of financial sector reform is to evolve strategies that can improve financial sector efficiency while achieving or maintaining financial stability—or at least to identify the risks and tradeoffs between the efficiency and stability of different strategies. The first task often is to understand the costs of maintaining a high degree of financial repression and the benefits of proceeding with financial sector reform. The second task is to design reforms that can help minimize the costs and risks and, thus, promote more successful transitions to market-oriented financial systems and better economic performance. The development of such strategies requires taking into account the interrelationships among different structural components of financial systems, and between the microeconomic and structural features of financial markets and institutions on the one hand and macroeconomic policy on the other. In particular, conditions in the financial sector could influence the instrument mix and effectiveness of macro policies, while macroeconomic developments could, in turn, affect financial sector soundness and efficiency. These interrelations are complex, however, and the dependence of outcomes on specific institutional structures and policy mixes so far has not been amenable to theoretical analysis. Nevertheless, the experience of different countries with financial reform is rich in information and lessons about the feasibility and risks of different strategies.

Sequencing of Reforms: Country Experiences

This book brings together a number of research papers that address the issue of pace and sequencing of financial sector reforms based on country experiences. Discussions focus on what is feasible in terms of financial sector reform to support stabilization and avoid major risks, and on the practical approaches that can be followed for this purpose. The chapters take a pragmatic and empirical approach aimed at understanding the operational experiences and institutional reforms that shape the financial liberalization process. More specifically, the papers address issues of monetary control and money market development, sequencing of financial sector reforms, sequencing of prudential supervision and bank and enterprise restructuring policies, exchange market and capital account liberalization, and real sector consequences of financial sector reform. Collectively, these papers are the result of work over nearly a 10-year period (1988-97), building on years of advisory work provided by IMF staff.4

Chapter 2 examines the development of monetary control procedures and the supporting institutional reforms. It reviews the experiences of nine developing countries that have introduced such instruments, and provides quantitative estimates of their importance in monetary management. It also discusses the implications of increased capital flows for the design of monetary policy frameworks and the effectiveness of monetary policy instruments.

Chapter 3 reviews the historical experiences of five developing countries—Argentina, Chile, Indonesia, Korea, and the Philippines—regarding the sequencing of financial sector reforms. Each country’s approach varied considerably, but their results showed a great deal of commonality. Three of these five countries experienced a banking crisis following the reforms, and this chapter examines the background leading up to the crises, and the lessons learned concerning the design of monetary and prudential regulatory policy and the avoidance of financial crisis.

Chapter 4 considers issues in the sequencing of prudential supervision and financial restructuring of banks in the course of financial liberalization. The recognition of major two-way linkages between banking soundness and macroeconomic policy calls for appropriate strategies to foster banking soundness in the course of transition to market-based monetary and exchange systems.

To understand the benefits and potential risks of financial sector reforms more fully, Chapter 5 examines the links between financial sector reform and economic growth and efficiency. The research reported is based on an examination of panel data from 40 countries that reformed their financial systems. This chapter also analyzes prefinancial reform, reform, and postreform data for countries that had successful financial liberalizations, as well as countries that faced a financial crisis following the reforms.

Finally, Chapter 6 evaluates the sequencing of capital account liberalization, drawing lessons from four emerging market economies that have experienced large capital inflows—those of Chile, Indonesia, Korea, and Thailand. The impact of capital account liberalization on economic performance varied, and three of the countries experienced a currency crisis. This survey leads to broad conclusions about the conceptual framework for an orderly liberalization of the capital account. This survey also reviews the role of capital account liberalization in the currency crisis in Asia, and draws lessons for the sequencing of liberalizations.

Main Themes and Findings

The major themes and findings are summarized b...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Content Page

- Foreword

- Acknowledgments

- 1. Managing Financial Sector Liberalization: An Overview

- 2. Financial Sector Reform and Monetary Instruments and Operations

- 3. Sequencing Financial Reform and Liberalization in Five Developing Countries

- 4. Prudential Supervision, Bank Restructuring and Financial Sector Reform

- 5. Financial Sector Reform and the Real Sector

- 6. Sequencing Capital Account Liberalization: Lessons from Chile, Indonesia, Korea, and Thailand

- Bibliography

- Footnotes