eBook - ePub

Back to the Future : Postwar Reconstruction and Stabilization in Lebanon

Thomas Helbling, and Sena Eken

This is a test

Share book

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Back to the Future : Postwar Reconstruction and Stabilization in Lebanon

Thomas Helbling, and Sena Eken

Book details

Book preview

Table of contents

Citations

About This Book

NONE

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Back to the Future : Postwar Reconstruction and Stabilization in Lebanon an online PDF/ePUB?

Yes, you can access Back to the Future : Postwar Reconstruction and Stabilization in Lebanon by Thomas Helbling, and Sena Eken in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

1999ISBN

9781557757845

Lebanon’s Public Finances—An Overview

For many years, large budget deficits and a rapidly growing public debt have been the most important macroeconomic problems faced by the authorities. For a full appreciation of the current policy issues, the origins and evolution of the current fiscal problems need to be ascertained. As shown below, these problems can be traced to the fiscal disarray that resulted from the war years and the delays in implementing the planned fiscal adjustment after 1993.

Fiscal Policies and Budgetary Performance, 1972–97

Before the war, the government had a limited role in the economy.1 The country was well known for its conservative fiscal policies with low expenditure and low tax ratios, in a macroeconomic environment characterized by a stable currency, low inflation, sustained economic growth, and overall balance of payments surpluses. The civil war has had a profound impact on the level and structure of public finances in Lebanon, and, consequently, large fiscal deficits have become a chronic problem. Since the end of the war, the reconstruction needs coupled with a weak initial administrative capacity have only compounded the fiscal challenges that Lebanon has been facing.

The War Legacy

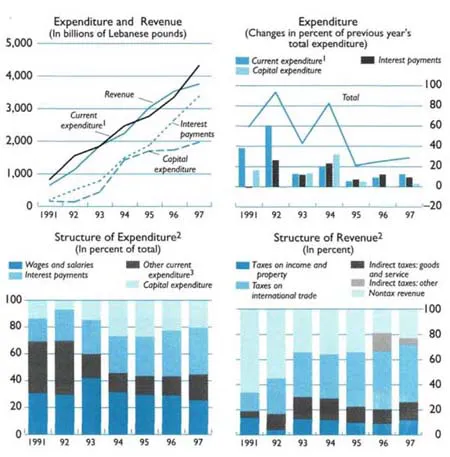

The war had four main effects on public finances. First, the general breakdown in government authority had a dramatic effect on the revenue-collection capability, and revenue plummeted from levels of more than 15 percent of GDP to levels that were generally below 10 percent (Table 3.1). The effects of the loss of control over the ports were particularly important because customs revenue was the main source of tax revenue.2 Second, the stagnant and irregular economic activity reinforced the decrease in collected revenue. Third, the accelerating inflation led to an erosion of real revenue as a result of the tax collection lags (often referred to as the Tanzi effect). Fourth, government expenditure, as a percentage of GDP, rose above 20 percent on account of the authorities’ attempt to maintain a minimum of public-services and social services–for example, through subsidies on various commodities and services or through transfers, higher military expenditures, and increased interest payments. As a result, sizable budget deficits emerged, which were to a significant extent financed by the central bank. At the end of the war, public finances and their administration were in a state of disarray: the administrative infrastructure of the ministry of finance was reduced to a bare minimum; the revenue structure was unbalanced in its reliance on a few indirect tax and nontax revenue sources; existing taxes were complicated and difficult to administer; and the newly formed government inherited a substantial amount of public debt (the net public debt amounted to 87 percent of GDP at the end of 1990).

Table 3.1. Government Operations1

Sources: Ministry of Finance; Banque du Liban (BdL); Council for Development and Reconstruction (CDR):IMF staff estimates.

1 Includes the treasury and the foreign and domestically financed CDR capital expenditure. Excludes other public entities except for budgetary transfers. See Table A6 in the Statistical Appendix for details of public finance data.

Postwar Normalization, 1991–92

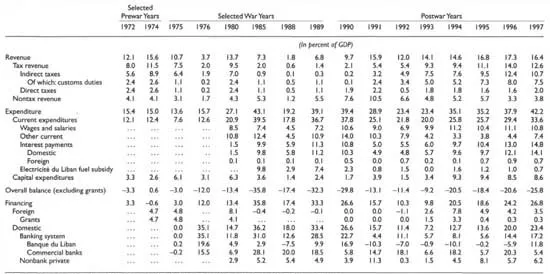

After the reestablishment of a government of national unity at the end of 1990, the fiscal situation in 1991 and 1992 improved markedly for several reasons (Figure 3.2). First, revenue recovered as the government regained control over revenue sources, particularly with respect to customs revenue and nontax revenue. Second, the rapid growth resulting from the normalization of economic activity reinforced the revenue increase. Third, the elimination of war-related expenditures and an expenditure restraint (including a hiring freeze) led to a decline of expenditure in terms of GDP. As a result, the overall fiscal deficit, as a percent of GDP, dropped from 30 percent in 1990 to 13 percent in 1991 and to 11 percent in 1992.

Figure 3.2. Public Finances

Sources: Data provided by Lebanese authorities; and IMF staff estimates.

1 Excluding interest payments.

2 The structure of tax revenue and current expenditure excluding interest payments is not entirely comparable before and after 1993 as a result of a reclassification of budget items. In 1995, following the tariff reform, the share of indirect taxes on goods and services declined as a result of the inclusion of excises on imports in customs revenue. Another reclassification of revenue items, affecting the shares of other indirect taxes and nontax revenue, became effective in 1996.

3 Excluding interest payments and wages and salaries.

Revenue Developments and Policies, 1993–97

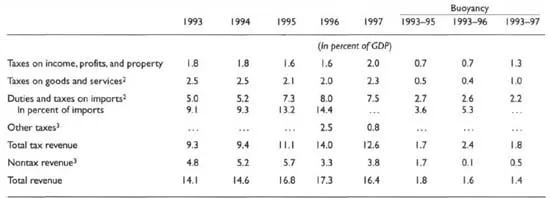

In contrast with the period 1991–92, during which revenue increases were primarily the result of the reestablished government authority over revenue sources and the normalization of economic activity, the authorities embarked on a number of reforms to mobilize revenue during the period 1993–97. Reflecting the favorable revenue effects of major reforms introduced during this period and the improvement in the tax administration, Lebanon’s tax ratio (total tax revenue as a percentage of GDP) increased from 5.4 percent in 1992 to 12.6 percent in 1997 (Table 3.2), and tax revenue registered a buoyancy ratio of 1.8 during 1993–97. The principal reform measures included the following steps.

Table 3.2. Revenue in Percent of GDP and Buoyancies of Major Categories of Taxes and Other Revenue 1

Sources: Ministry of Finance; and IMF staff calculations.

1 See Table A6 in the Statistical Appendix for details of the revenue data.

2 With the 1995 tariff reform, the principal excise and some other taxes on goods and services became part of customs duties and are recorded in duties and taxes on imports.

3 Under the revised budget classification scheme of 1996, some revenue, such as fiscal stamp duties, which were classified as nontax revenue until 1995, are now included in the new item “other taxes.”

Duties and taxes on imports. This category of taxes for the period 1993–97 registered the highest buoyancy ratio, 2.2, reflecting the favorable revenue effects of the 1995 tariff reform and the temporary increase in imports required for reconstruction. The reform measures included the introduction of a minimum tariff rate of 2 percent, the reduction of the number of tariff rates and the number of tariff lines, the consolidation of various taxes collected by different ministries at the customs into a single, unified tariff, and the inclusion of excise taxes on imported goods in the tariff. They also included the elimination of the so-called customs exchange rate for valuation purposes, which was overvalued compared with market exchange rates.3 Following these reforms, customs revenues in nominal terms almost doubled between 1994 and 1995, despite the relative decline of the share of imports in GDP. However, the inclusion of excises and various other taxes and fees in the tariff has led to some decline in revenue from taxes on goods and services and nontax revenue. Therefore, the overall revenue effect should be assessed using overall tax revenue rather than customs revenue alone.

Taxes on income and profits. This tax category, despite some progression in nominal rates, registered a buoyancy ratio of less than unity until 1996, reflecting the major income tax reform of 1993. The reform included the following measures: (1) the reduction in the nominal tax rates from 26 percent to 10 percent on corporate profits and from 15 percent to 5 percent on dividends and on other corporate distributions; (2) the reduction of the top marginal rates of individual income taxes from 32 percent to 10 percent for wages and salaries, and from 50 percent to 10 percent for individual business profits; (3) the adoption of an amnesty program that added 9,700 taxpayers; and (4) accelerating the payment of taxes withheld at the source by having the withholders release the funds quarterly (before the reform, these taxes were paid by withholders at the time of filing the declaration). The reduction of the nominal tax rates was intended to encourage the flow of international capital and direct investments and improve the voluntary compliance by taxpayers. In 1997, after significant strengthening of the tax administration, the revenue yield of their tax category improved and the buoyancy ratio reached a value of 1.3.

Taxes on goods and services. During the period 1993–95, the excise rates on tobacco and cigarettes were raised from 5 percent to 30 percent, and the prices of petroleum products were also raised a number of times to narrow the gap with the international prices. The taxation of real estate transactions also yielded increasing revenue given the real estate boom of 1993–95. Despite these developments, this category of taxes registered the lowest buoyancy ratio (1.0) during the period 1993–97. This can be attributed to the collection of principal excises at the stage of importing and recording of their revenue with that from customs duties, as explained earlier.

Analyzing the evolution of the structure of revenue over the period 1993–97 shows that the improvements in the tax revenue mobilization are primarily the result of the customs reform of 1995 (Figure 3.2). The decline in the share of taxes on income and profits until 1996 reflected the combination of the revenue effects of the 1993 reform and weaknesses in taxpayer compliance and tax collection (see below). The reform of income taxation has therefore not yet resulted in the expected increased yield even with the improvements registered in 1997. Today, Lebanon’s revenue structure is unbalanced, as it is relying heavily on three sources: imports, some excisable goods, and a plethora of taxable public-services and administrative fees. Most domestic transactions and a large part of income are not effectively subject to taxation.

The ministry of finance recognizes the need to enhance its administrative capacity and has embarked on an ambitious project of modernizing and computerizing the budget process and revenue administration. Regarding the latter, the creation of a database on taxpayers, particularly for taxes on income and profits, has been of utmost importance.4 The modernization project in the ministry’s revenue department has included a cou...