eBook - ePub

Fiscal Policy Formulation and Implementation in Oil-Producing Countries

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Fiscal Policy Formulation and Implementation in Oil-Producing Countries

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Fiscal Policy Formulation and Implementation in Oil-Producing Countries by Jeffrey Davis, Annalisa Fedelino, and Rolando Ossowski in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2003eBook ISBN

97815890617501

Fiscal Challenges in Oil-Producing Countries: An Overview

This volume brings together papers that deal with a wide range of macroeconomic and fiscal issues in oil-producing countries, and aims at providing policy recommendations drawing on theory and country experience. The scope of the essays reflects the significant operational involvement of the IMF with oil producers, particularly in terms of surveillance, program work, and technical assistance. This work has highlighted the difficult challenges that confront policymakers in these countries, and the possibilities in several areas for improved practice.

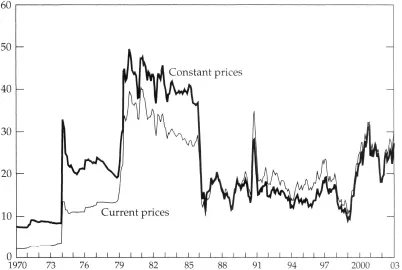

The volatility of oil prices in recent years has brought these major challenges into sharper focus. Over a period of just a few years, oil prices plunged to around US$12 per barrel in late 1998, surged to US$30 per barrel in late 2000—only to fall back to US$20 per barrel in early 2002 (Figure 1.1). This volatility can translate into significant fluctuations in fiscal revenue. A case in point is Venezuela, where public sector oil revenues fell from 27 percent of GDP in 1996 to less than 13 percent of GDP in 1998 before rising again to more than 22 percent of GDP in 2000. At the same time, oil is an exhaustible resource, which poses difficult intergenerational equity questions. While it may be a distant concern for some producers, for others the reality of a post-oil period is approaching. And, since oil revenue largely originates from abroad, its fiscal use can have significant effects on the domestic economy.

Figure 1.1. Crude Oil Spot Prices1

(In U.S. dollars per barrel)

Sources: IMF, International Financial Statistics (Washington, various issues); and IMF staff estimates.

1 Average of U.K. Brent, Dubai, and West Texas Intermediate. Constant prices deflated by the manufacturing unit value at January 2002 prices.

Many oil producers have had difficulties designing and implementing policies in this context. Studies have shown that resource-dependent economies tend to grow more slowly than nonresource dependent ones at comparable levels of development. Poverty is still widespread in a number of oil-producing countries. Downturns in oil prices have in a number of cases led to external and fiscal crises. And a pattern of fluctuating fiscal expenditures associated with oil volatility has entailed significant economic and social costs for a number of oil producers.

Oil-producing countries, however, do not form a homogenous group. First, there is significant variation in the extent of oil dependence. In some countries, oil accounts for the vast majority of fiscal revenue and exports, while in others it is less significant for the economy. Second, oil sectors are at different stages of development. There are several new or soon-to-be producers where the oil sector is being developed, and oil revenues can be expected to grow substantially over the next few years. At the other end of the spectrum, some oil producers like Yemen face the prospect of depleting their oil resources in the not-too-distant future. Third, governments’ financial positions also vary substantially. Some governments have accumulated sizable financial assets, while for others public debt is a major concern. This has implications for the options and constraints in responding to fluctuations in oil prices. And finally, the ownership of the oil sector also differs across countries. In countries such as Venezuela and Mexico, the oil sector is dominated by a state-owned producer. In other countries, the oil industry is largely in private hands.

Moreover, the way oil revenues are collected and used is not just an economic issue. Importantly, policies are framed within specific political and institutional frameworks. These frameworks—including their governance, transparency, and accountability characteristics—tend to vary among countries. Several papers in this volume incorporate wider institutional issues specifically into their analysis.

This book is structured around four broad sets of topics. The papers included in Part I examine fundamental macroeconomic and fiscal issues and institutional factors associated with the formulation and implementation of fiscal policy in oil-producing countries. Part II looks at more specific oil revenue issues, in particular the taxation and organization of the oil sector, national oil companies, and oil revenue and fiscal federalism. Institutional arrangements to deal with oil revenue instability, including oil funds and the use of oil risk markets, are the focus of the papers in Part III. Finally, the papers included in Part IV discuss domestic petroleum and energy-pricing issues.

Determining Fiscal Policy in Oil-Producing Countries

Countries with large oil resources can benefit substantially from them, and the government has an important role to play in how these resources are used. At the same time, the economic performance of many oil exporters has been disappointing, even to the extent of prompting some observers to ask whether oil is a blessing or a curse. The papers in this section address analytical and operational issues in the formulation of fiscal policy in oil-producing countries, as well as the political and institutional factors that may affect the design and execution of policy.

In Chapter 2, Hausmann and Rigobon introduce an innovative analytical approach to explain the “resource curse.” Their model relates the poor growth performance of many oil-dependent countries to the interaction of government spending of oil income, specialization in nontradables, and financial market imperfections. Both the level and volatility of government expenditure contribute to lack of diversification, which, according to empirical evidence, exacerbates the resource curse. The main policy conclusions are that welfare and macroeconomic performance can be improved by reducing the volatility, and in some cases the level, of government spending; improving budget institutions, debt management, and policy credibility; and enhancing the efficiency of domestic financial markets.

Barnett and Ossowski address operational issues in formulating and assessing fiscal policy in oil-producing countries in Chapter 3. They put forward operational guidelines based on lessons drawn from the experience of many oil producers. First, the non-oil fiscal balance should be given greater attention as an indicator of fiscal policy, and should figure prominently in the budget and in fiscal analysis. Second, the non-oil balance, and expenditure in particular, should be adjusted gradually, which requires decoupling, to the extent possible, government spending from oil revenue volatility. Third, the government should strive to accumulate substantial financial assets over the period of oil production, on both sustainability and intergenerational equity grounds. Fourth, while many oil producers can afford to run sizable non-oil deficits, there are strong precautionary motives that would justify fiscal prudence. Fifth, in setting fiscal policy, consideration needs to be given to supporting the broader macroeconomic objectives. Finally, a number of oil producers should pursue strategies aimed at breaking procyclical fiscal responses to volatile oil prices and ensuring that the government’s financial position is strong enough to weather downturns in oil prices.

Eifert, Gelb, and Tallroth (Chapter 4) provide an analysis of the underlying political and institutional determinants of the economic performance of oil exporters. Drawing on concepts from the comparative institutionalist tradition in political science, their paper develops a generalized typology of political states, which is used to analyze the political economy of fiscal and economic management in oil-exporting countries with widely differing political systems. Country experiences point to the key role played by constituencies for the sound use of oil rents, the importance of transparent political processes and financial management, and the value of getting the political debate to span longer time horizons.

Understanding the statistical properties of oil prices is important for fiscal policy formulation in oil-producing countries. In particular, whether oil price shocks are deemed to be temporary or persistent has implications for government wealth (including oil wealth)—a key input for assessing the sustainability of fiscal policy. In Chapter 5, Barnett and Vivanco test empirically the statistical properties of oil prices. Accepting that there are periodic permanent oil shocks (such as in 1973), their evidence suggests that most oil price movements are transitory. This implies that many year-to-year oil price fluctuations have only a minor impact on government wealth. For the most part, therefore—and looking only at sustainability considerations—governments should not adjust expenditure significantly in response to oil price changes.

Dealing with Oil Revenue

The papers included in Part II of this book address three sets of oil revenue issues. First, oil extraction plays a crucial fiscal role in generating tax and other revenue for the government in oil-producing countries. Therefore, the proper design of the fiscal regime for the oil sector is of key fiscal importance. Second, there is a need to look at the performance of national oil companies—including transparency and governance issues—since in many cases these enterprises play a major macroeconomic and fiscal role. Finally, three papers are devoted to fiscal federalism topics, as important questions arise over the assignment of oil revenues to various levels of government.

Sunley, Baunsgaard, and Simard argue in Chapter 6 that the fiscal regime must be properly designed to ensure that the state, as resource owner, receives an appropriate share of oil rent. Competing demands arise between the government and oil companies over sharing risk and reward from oil investments—where both aim at maximizing reward while shifting risk as much as possible to the other party. A balance also needs to be struck between the desire to maximize short-term revenue against any deterrent effects this may have on investment in the oil sector. The paper surveys various fiscal regimes to collect revenue from the oil sector; cross-country evidence suggests that good fiscal regimes should guarantee some up-front revenue with sufficient progressivity to provide the government with an adequate share of economic rent.

In Chapter 7, a paper by McPherson on national oil companies covers an important area where previous work has been limited. The author argues that the performance of national oil companies is generally poor, as these enterprises are often plagued by lack of competition, the assignment of noncommercial objectives, weak governance, limited transparency and accountability, lack of oversight, and conflicts of interest. These ills may be addressed by setting performance standards, increasing competition in the oil sector, divesting noncore assets, transferring noncommercial activities to the government, and conducting (and publishing) independent audits on a regular basis. The reform of national oil companies, however, faces formidable obstacles, including political opposition and entrenched vested interests. To be successful, reform programs need support from the highest political levels as well as from a wide range of public opinion.

The assignment of oil revenues to various levels of government raises a number of extremely complex issues in oil-producing countries. These include whether subnational regions should have the right to raise revenues from natural resources; the ability of subnational governments to cope with oil revenue volatility given their expenditure assignments; the implications of various intergovernmental fiscal frameworks for the maintenance of overall fiscal control by central governments; interjurisdictional equity and redistribution issues; and environmental and social concerns.

In Chapter 8, McLure provides a conceptual framework for analyzing the assignment of revenues from the taxation of oil to various levels of government in multilayer systems. The paper focuses, in particular, on whether subnational governments should have the power to tax oil, why, and (if so) how. Most of the considerations examined in the paper suggest that revenues from oil should be reserved for national governments. There may be overriding legal and political economy considerations, however, that may lead to the assignment of power to tax oil to subnational governments.

The next two papers also see the centralization of revenues as the best solution. Reflecting the complexity of the issues, however, their authors reach different conclusions regarding second-best policies.

Ahmad and Mottu present a topology of existing oil revenue assignments in Chapter 9. While recognizing that the centralization of oil revenue is preferable, they conclude that a second-best solution would be to assign oil taxation bases with stable elements (such as production excises) to subnational governments, supplemented by stable transfers from the central government. This would allow sub-national governments to finance a stable level of public services. The least preferred solution would be oil revenue sharing, which complicates macroeconomic management, does not provide stable financing of local public services, and may not diffuse separatist tendencies (oil-producing regions would still be better off by keeping their oil revenues in full).

Brosio also notes that a growing trend toward sharing of oil revenue with subnational governments bears out the principle that optimal policies (oil revenue centralization) often have to give way to second-best solutions (Chapter 10). Based on a review of various types of tax assignments and equalization mechanisms, he concludes that revenue sharing (including an equalization mechanism to limit regional disparities in revenues) should be preferred over the assignment of local taxes on oil. The main reasons are that oil is typically concentrated in a few regions; oil revenue is highly volatile and thus difficult for subnational governments to manage; oil taxes are complex and difficult to administer; and energy policy is a national responsibility.

Institutional Arrangements for Dealing with Oil Revenue Instability

Fiscal policymakers in oil-producing countries need to decide how expenditure can be insulated from oil revenue shocks, and the extent to which resources should be saved for future generations. The papers in this section discuss two institutional mechanisms that have been proposed to promote better fiscal management. First, oil funds have been suggested as an institutional response to stabilization and savings concerns, particularly when there are strong political pressures to increase spending. This is a topic where judgments on political economy issues can lead to different views, as reflected in the papers included in this section. Second, a potential way to deal with the oil price risks that affect the public finances of oil producers is to use oil risk markets.

Davis, Ossowski, Daniel, and Barnett look at the effectiveness of oil funds from both a theoretical and an empirical perspective (Chapter 11). The main types of funds include stabilization funds, savings funds, and financing (“Norwegian”) funds. The objective of stabilization funds is to minimize the transmission of oil price volatility to fiscal policy by smoothing budgetary oil revenue. Savings funds aim at addressing intergenerational concerns. Oil funds other than financing funds, however, ignore the fungibility of resources, and therefore do not effectively constrain expenditure. Moreover, these funds often do little to improve the conduct of fiscal policy and entail certain risks, including fragmenting fiscal policy and asset management, creating a dual budget, and reducing transparency and accountability. Econometric evidence and country experiences generally raise questions as to the effectiveness of oil funds.

In Chapter 12, Skancke describes the Norwegian Petroleum Fund. The fund, which is viewed as a tool to enhance transparency in the use of oil wealth, is fully integrated into the budget and has flexible operating rules, thereby avoiding the problems discussed in the previous paper. Since the budget targets a non-oil deficit that is financed from the fund, the accumulation of resources in the fund corresponds to net financial public savings. A large-scale buildup of public financial resources, however, requires a high degree of consensus, transparency, and accountability—traditionally present in Norway—and therefore the Norwegian model may not be easily “exported” to many other oil-producing countries.

Wakeman-Linn, Mathieu, and van Selm note in Chapter 13 that despite the ambiguous track record of oil funds in other countries, Azerbaijan and Kazakhstan have created funds to assist them in managing their new petroleum wealth. The decision to establish funds in these countries was motivated by the serious challenge posed by an unfinished transition from planned to market economy in the context of an oil boom, which in the view of the authorities argued for the separation of oil revenues from other revenues. Given the recent history of these countries’ oil funds, only preliminary conclusions can be drawn on how they have performed relative to their stated objectives. According to the authors, on balance these funds, if operated in accordance with existing rules, should contribute to better management of oil wealth and improved transparency. However, a further strengthening of these funds is urgently needed for their potential to be fully realized.

Hedging represents a possible way to reduce oil revenue volatility and limit oil price risk, as Daniel argues in Chapter 14. Hedging may allow for more realistic and certain budgeting, provide insurance against declines in oil prices, and lessen the chances of oil price falls forcing costly fiscal adjustments. As oil risk markets have matured in the last decade, their range and depth could allow many oil producers to hedge oil price risk. At the same time, concerns about the potential political costs of hedging (particularly the failure to benefit from upturns in prices), institutional capacity constraints, financial costs, and the depth of the market have discouraged many governments from actively using hedging. In many cases these concerns could be overcome, however, and ...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Foreword by the Managing Director

- Acknowledgments

- 1. Fiscal Challenges in Oil-Producing Countries: An Overview

- Part I. Determining Fiscal Policy in Oil-Producing Countries

- Part II. Dealing with Oil Revenue

- Part III. Institutional Arrangements for Dealing with Oil Revenue Instability

- Part IV. Designing Policies for Domestic Petroleum Pricing

- Footnotes