eBook - ePub

World Economic Outlook, April 2002 : Recessions and Recoveries

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

World Economic Outlook, April 2002 : Recessions and Recoveries

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access World Economic Outlook, April 2002 : Recessions and Recoveries by International Monetary Fund. Research Dept. in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2002eBook ISBN

9781589061071CHAPTER I ECONOMIC PROSPECTS AND POLICY ISSUES

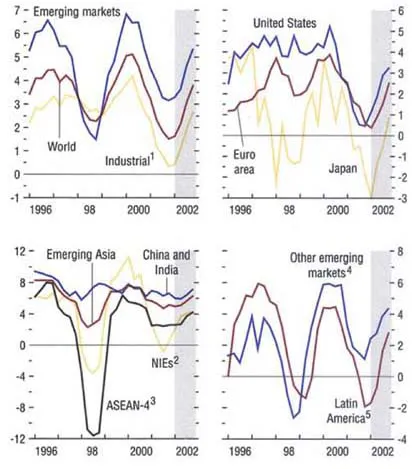

Over recent months, there have been increasing signs that the global slowdown has bottomed out, most clearly in the United States and to a lesser extent in Europe and some countries in Asia. While serious concerns remain in a number of countries, notably Japan and—for different reasons—Argentina, most indicators suggest recovery is now under way, broadly along the lines described in the Interim World Economic Outlook issued last December (Figure 1.1). With confidence stabilizing, uncertainties easing, and emerging market financing conditions improving more quickly than was then anticipated, the risks to the outlook have become more balanced, although the recent volatility in the oil market is a significant concern. While the stance of policies should remain relatively supportive for the time being, there is now—except in Japan—little case for additional easing, and in countries where the recovery is most advanced, attention will need to turn toward reversing earlier monetary policy easing. It will be important to take full advantage of the recovery to reduce remaining economic vulnerabilities, and to pursue a collaborative approach designed to promote an orderly resolution of global imbalances—which remain a serious risk to economic stability—over the medium term.

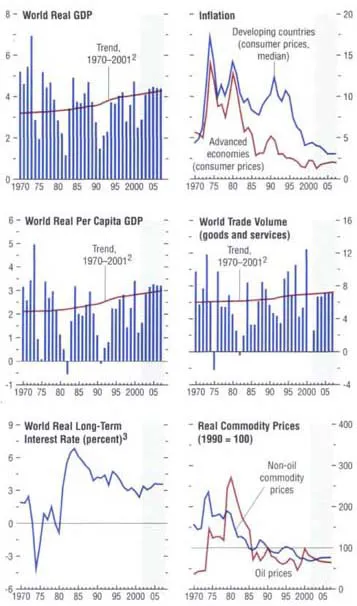

Figure 1.1. Global Indicators1

(Annual percent change unless otherwise noted)

While global growth is expected to increase moderately in 2002, this disguises a sharper pickup in activity during the year (see text). Inflation remains subdued.

1Shaded areas indicate IMF staff projections. Aggregates are computed on the basis of purchasing-power-parity weights unless otherwise indicated.

2Average growth rates for individual countries, aggregated using purchasing-power-parity weights; these shift over time in favor of faster growing countries, giving the line an upward trend.

3GDP-weighted average of the 10-year (or nearest maturity) government bond yields less inflation rates for the United States, Japan, Germany, France, Italy, the United Kingdom, and Canada. Excluding Italy prior to 1972.

There are now increasing signs that the global slowdown, which began in the middle of 2000, has bottomed out. As had been suggested in the October 2001 World Economic Outlook, the events of September 11 had a short-run impact on activity, but—in contrast to the fears that some expressed—have not prevented a recovery in the first half of 2002.1 Leading indicators have turned up (Figure 1.2); consumer and business confidence have strengthened; and industrial production—including the information technology (IT) sector—is leveling off. This has been most apparent in the United States and, increasingly, the euro area; in Japan, while activity may now be bottoming out, the outlook remains very difficult with few signs of a sustained recovery in domestic demand. In emerging markets, there are signs of recovery in a number of Asian emerging markets—particularly Korea—aided by the nascent improvement in the IT sector, although not as yet in most Latin American countries.

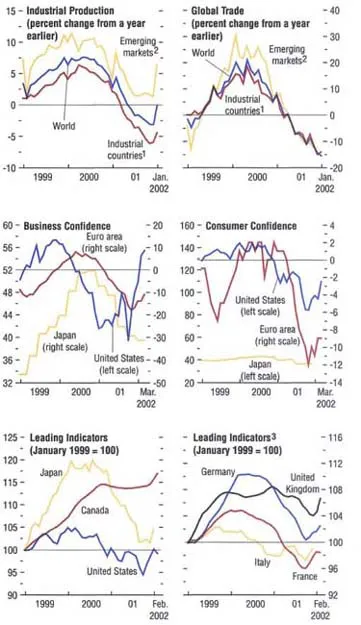

Figure 1.2. Emerging Signs of Recovery

Signs of recovery are suggested by recent improvements in confidence and other leading indicators, particularly in the United States and Europe.

Sources: Haver Analytic. Business confidence for the United States, the National Association of Purchasing Managers; for the euro area, the European Commission; and for Japan, Bank of Japan. Consumer confidence for the United States, the Conference Board; for the euro area, the European Commission; and for Japan, the Economic Planning Agency. Leading indicator for the United States, the Economic Cycle Research Institute; for Japan, the Cabinet Office; for Canada, Statistics Canada; and for Germany, France, Italy, and United Kingdom, OECD Main Economic Indicators.

1 Australia, Canada, Denmark, Euro area, Japan, New Zealand, Norway, Sweden, Switzerland, United Kingdom, and United States.

2 Argentina, Brazil, Chile, China, Colombia, Czech Republic, Hong Kong SAR, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, Singapore, South Africa, Taiwan Province of China, Thailand, Turkey, and Venezuela.

3 Seasonally adjusted.

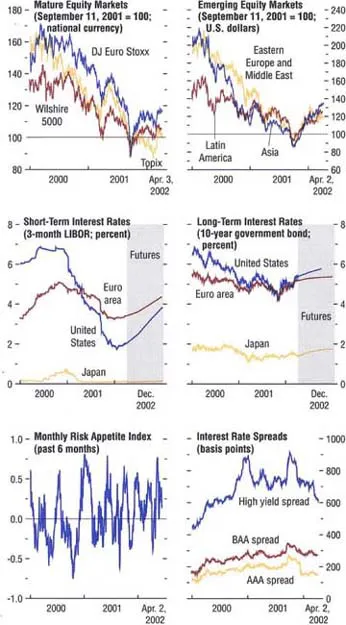

Growing expectations of recovery have been particularly apparent in financial markets, which recovered strongly after the events of September 11 (Figure 1.3). Equity markets have picked up sharply across the globe, although flattening off in the first quarter of 2002; yield curves have steepened; and risk aversion and spreads—in both mature and emerging markets—have declined. Partly reflecting market expectations of the relative pace of recovery, the U.S. dollar has strengthened further, accompanied by a moderate weakening of the euro, while the yen has fallen to three-year lows. In emerging markets, contagion from the crisis in Argentina has to date been limited, reflecting the fact that the crisis was well anticipated, and that gross international capital flows were already at low levels (Figure 1.4), as well as a number of technical factors, including the relatively low leverage in the system.2 Spreads for most emerging market debt have declined sharply since early November, and financing conditions for emerging market borrowers have improved more rapidly than earlier anticipated, with high-quality borrowers reaccessing markets toward the end of 2001, followed increasingly thereafter by non-investment-grade issuers.

Figure 1.3. Financial Market Optimism

As expectations of a recovery have increased, financial markets have strengthened in almost all countries, accompanied by steepening yield curves and declining risk premiums and spreads.

Sources: Bloomberg Financial Markets, LP; State Street Bank; and IMF staff estimates.

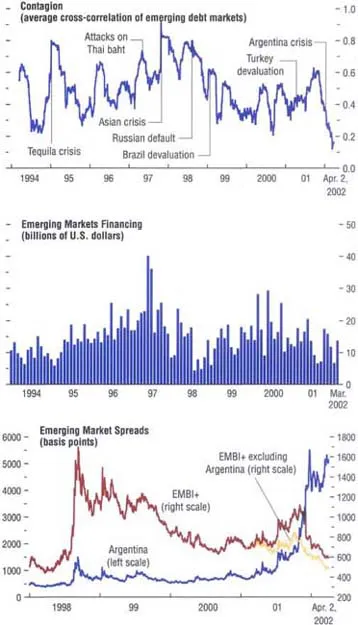

Figure 1.4. Emerging Market Financing Conditions

Emerging market financing conditions have improved markedly, while contagion from the crisis in Argentina has been limited.

Sources: Bloomberg Financial Markets, LP; and IMF, Emerging Market Financing.

The recovery is being underpinned by a number of factors. First, and most important, macroeconomic policies in advanced countries have been substantially eased over the past year, notably in the United States, and—particularly since interest rate cuts were anticipated by markets, and therefore built into asset prices in advance—should now be providing increasing support to demand. Policies in a number of emerging market countries, especially in Asia, have also been eased, although in most others the scope has been relatively limited. Second, the completion of ongoing inventory cycles, which appears most advanced in the United States but is also under way in Europe, will support economic activity. Finally, activity has also been supported by the decline in oil prices since late 2000. Since late February, however, oil prices have risen significantly, reflecting concerns about possible military intervention in the Middle East, the deteriorating security situation in Israel and the West Bank and Gaza, as well as the strengthening global recovery. At the time the World Economic Outlook went to press, oil prices had returned to broadly their mid-2001 level, still well below their fall 2000 peak, and prices in futures markets were only moderately higher than the oil price assumption on which the forecasts in this World Economic Outlook are based (Table 1.1). Nonetheless, the past fall in oil prices will provide less support to recovery than earlier expected, while the potential for further volatility has become a significant risk to the outlook.

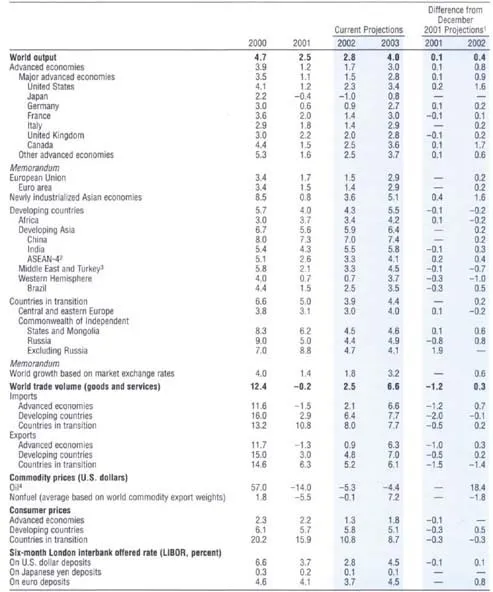

Table 1.1. Overview of the World Economic Outlook Projections

(Annual percent change unless otherwise noted)

Note: Real effective exchange rates are assumed to remain constant at the levels prevailing during February 11–March 11, 2002.

1 Using updated purchasing-power-parity (PPP) weights, summarized in the Statistical Appendix, Table A.

2 Includes Indonesia, Malaysia, the Philippines, and Thailand.

3 Includes Malta.

4 Simple average of spot prices of U.K. Brent, Dubai, and West Texas Intermediate crude oil. The average price of oil in U.S. dollars a barrel was $24.28 in 2001; the assumed price is $23.00 in 2002, and $22.00 in 2003.

Inflationary pressures have continued to ease, reflecting weaker global activity. In advanced countries, inflation is projected to fall to 1.3 percent in 2002, the lowest level on record, and—while important wage negotiations in the euro area are still in train—wage increases have in general been moderate. Indeed, if sustained, inflation this low could be a concern, since it could limit the ability of central banks to engineer negative real interest rates when necessary.3 Deflation remains a central issue in Japan, where prices appear set to fall for the fourth successive year. Elsewhere, however, the forces restraining prices are likely to ease as recovery gets under way, as excess capacity declines and commodity prices—especially oil—pickup (see Appendix 1.1). In emerging and developing countries, inflation is also projected to fall, although it remains of concern in the Common-wealth of Independent States—especially the less advanced reformers—some European Union (EU) accession countries, and a few countries in Latin America and Africa.

Assuming that the recovery is sustained, this global slowdown—while seriously affecting many countries and regions—will have proved to be more moderate than most previous downturns, and would probably not qualify as a full-fledged global recession (Box 1.1). Global GDP growth and global per capita GDP growth (the best measure of the impact on global welfare) would remain above the troughs experienced in the three major global recessions of the past 30 years (although below the level experienced during the Asian crisis in 1997–98). This partly reflects long-run structural trends, including the tendency toward milder recessions in industrial countries (see Chapter III), and the growing role of China and India, which—being relatively closed—are less affected by global downturns (although these factors are at least partly offset by countervailing forces, including increasing financial and corporate sector linkages). However, it clearly also reflects the generally prompt and aggressive response of policymakers to the slowdown, and—linked to that—the progress that has been made in reducing vulnerabilities and strengthening economic fundamentals in advanced and developing countries.4 As experience during the past year has shown, managing the downturn has been considerably easier in countries with the scope for policy flexibility, while others have been forced to follow more procyclical policies, deepening the downturn and likely also slowing the ensuing recovery.

The main elements of the IMF’s global forecast published in the Interim World Economic Outlook last December—which projected an up-turn in the first half of 2002—have remained broadly unchanged. Global growth in 2002 is projected at 2.8 percent, somewhat higher than expected in December (Table 1.1). Growth in the United States—and countries with close economic links—has been revised significantly up-ward, as the pace of recovery has exceeded expectations. Elsewhere, adjustments to the forecast are more modest—with the exception of the Western Hemisphere, mainly due to the crisis in Argentina; the Middle East, due to lower than expected growth in oil exporters; and the Common-wealth of Independent States, reflecting the improved outlook for Russia. It is important to recognize that, while global GDP growth for 2002 is projected to be only slightly higher than in 2001, this disguises a substantial pickup during the year. As can be seen from Figure 1.5, global growth is projected to rise from 1½ percent in the last quarter of 2001 to nearly 4 percent by the end of 2002. As the full impact of this is felt, global growth is expected to rise to 4.0 percent in 2003, significantly above the long-run trend.

Figure 1.5. Global Recovery

(Percent change from four quarters earlier)

Real GDP in most regions is expected to have bottomed out in late 2001, with a recovery beginning in the first half of 2002.

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Assumptions and Conventions

- Preface

- Foreword

- Chapter 1. Economic Prospects and Policy Issues

- Chapter II. Three Essays on How Financial Markets Affect Real Activity

- Chapter III. Recessions and Recoveries

- Annex. Summing Up by the Acting Chair

- Statistical Appendix

- Boxes

- Footnotes