- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Promoting Fiscal Discipline

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Promoting Fiscal Discipline by Manmohan Kumar, and Teresa Ter-Minassian in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2007eBook ISBN

97815890660901 Fiscal Discipline: Key Issues and Overview

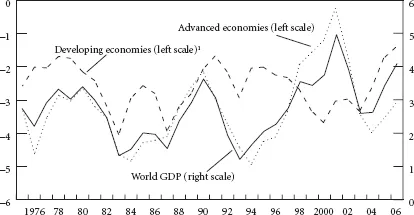

Since the early 1970s, fiscal deficits and rising public debt have been ubiquitous features of government budgetary positions. Indeed, in aggregate, fiscal balances of both industrial and developing economies have been negative in each of the past 30 years, with an average deficit of about 3 percent of GDP a year for both groups (Figure 1.1). In recent years, an improvement in the overall fiscal positions in the industrial economies during the economic and financial market boom in the 1990s was quickly reversed thereafter. In many developing economies, although there has been a welcome turnaround in budgetary positions over the last 4 years, this reflects in large part cyclical factors, higher commodity prices, and a benign global financial market environment.1

Fiscal deficits often indicate a variety of adverse domestic and external shocks that affect budgets directly as well as through their impact on the economic environment. In addition to the pace of economic activity, these can include terms of trade shocks, financial market turbulence, as well as political instability and natural disasters. However, the persistence of deficits, as well as the inexorable rise in public sector indebtedness, over the past three decades in so many countries suggests that some fundamental factors are likely to have played a key role. Both theoretical and empirical literature suggest that preeminent among these factors are inadequate fiscal discipline and weak fiscal management.

Figure 1.1. General Government Overall Balance

(In percent of GDP)

Source: IMF staff calculations; averages weighted with GDP at purchasing power parity.

1Excluding large oil exporters.

Fiscal discipline requires that governments maintain fiscal positions that are consistent with macroeconomic stability and sustained economic growth. To this end, it warrants avoiding excessive borrowing and debt accumulation. At the same time, policy needs to be judicious in pursuing resource allocation and distributional objectives, and in smoothing output fluctuations. Moreover, it is prudent to create budgetary cushions to allow for the possibility of a response to both adverse shocks and to deal with predictable fiscal pressures, such as those arising from population aging.

The record of fiscal management in seeking to meet these different objectives has been mixed. Reflecting deficit and debt sustainability problems, weak fiscal discipline has often compromised stability and growth, and in the worst cases has led to economic and financial crises. Moreover, while output stabilization would warrant countercyclical fiscal policy, governments tend to favor procyclical discretionary spending increases and tax cuts in “good times,” when the economy is doing well. In “bad times,” although countercyclical fiscal policy could be useful, pressing deficit and debt sustainability problems make such policy difficult if not impossible. Procyclicality in good times thus becomes an important underlying cause of poor fiscal discipline.

Maintaining fiscal discipline is essential to maintaining macroeconomic stability, reducing vulnerabilities, and improving aggregate economic performance. This is especially important if countries are to successfully meet the challenges, and reap the benefits, of economic and financial globalization. Fiscal discipline is essential if countries are to avail themselves of the opportunities offered by increasingly free trade and open capital markets, to enhance their longer-term economic prospects (see Hemming, Kell, and Mahfouz, 2002). But it is also necessary to reduce their exposure to changes in market sentiment and volatility in capital flows, and in the process contain the risk of debt crises.

The lack of fiscal discipline generally stems from the injudicious use of discretion in formulating and implementing budgetary policies. The benefits of such discretion are well known in helping policymakers respond to unexpected shocks to reduce disruptive consequences. Discretion also allows elected political representatives to fulfill their mandates through tax and spending decisions.2 But, as is generally acknowledged, discretion can be misused, which results in deficit bias and procyclical policies. These, in turn, lead to weak fiscal positions, rising debt levels, and over time, a loss in policy credibility.

The underlying reasons for the deficit bias and procyclical policies are well known: policymakers tend to focus primarily on the consequences of their discretionary actions in the short term and pay insufficient attention to the medium and the long term. There may also be political and distributive conflicts, which entails the “common pool” problem: that is, the basic tendency for any given political constituency or group to use the available resources for specific distributive purposes without regard to the overall budgetary position. In addition, deficit bias reflects time inconsistency, whereby policies that were agreed to ex ante are not adhered to ex post. For instance, it is often difficult for governments credibly to commit to saving revenue windfalls in good times because of strong spending pressures that inevitably arise during these times. The role of political budget cycles can also be important (see Rogoff, 1990).

A number of different instruments and approaches have the potential to improve the incentives for policymakers to use discretion responsibly, reduce deficit bias, and improve fiscal outcomes. These include various types of fiscal rules, fiscal responsibility laws, and fiscal agencies. The experience with them suggests that their design and implementation, as well as political commitment, are crucial if they are to be effective in strengthening fiscal discipline. The chapters in this book discuss both analytical and policy issues relating to them and provide systematic empirical evidence from industrial as well as developing countries.

Chapter 2 by Debrun, Hauner, and Kumar begins by exploring the role of discretion in fiscal policy. The debate in this area has generally been presented as entailing a trade-off between discretion on the one hand, and rules on the other, each with its advantages and disadvantages. The chapter suggests that while such an approach has its merits, it is more instructive to examine how distorted incentives may undermine a judicious use of fiscal discretion. The chapter reviews the key distortions, and discusses why fiscal policymakers may become complacent in the face of high deficits and rising debt—deficit bias—and why they find it difficult to resist fiscal expansions in good times, leading to systematic procyclicality. The role of distorted incentives in explaining these phenomena is corroborated by peripheral issues such as frequent attempts to reduce fiscal transparency and undermine democratic accountability. It argues that while financial markets could be expected to respond to the deficit bias and procyclicality in a way that promotes greater fiscal discipline by raising interest rates, and widening of credit spreads, evidence suggests that markets penalize fiscal profligacy often in a discontinuous fashion, and generally only with considerable lags. Institutional reforms aimed at reshaping policymakers’ incentives thus appear essential to ensure that fiscal policy choices remain consistent with the intertemporal budget constraint and macroeconomic stabilization.

The chapter argues that the challenge in designing fiscal institutions is to discourage the undesirable manifestations of fiscal discretion while retaining policymakers’ flexibility to respond to unexpected developments and to fulfill their democratic mandate. It discusses the various forms that these institutional arrangements can take, including in particular, fiscal rules. It notes that there are relative advantages and disadvantages of the deficit, debt, and expenditure rules, and the design of rules has to be country specific, taking into account existing economic and political institutions. In general, automatic and transparent rules tend to bring policy credibility, albeit at a cost in terms of forgone flexibility. Fiscal rules can be useful, but they are not a panacea, and their effectiveness depends on a political commitment to fiscal discipline.3

Chapter 3 by Balassone and Kumar explores the extent, consequences, and causes of procyclicality. It shows that there is clear evidence that discretionary fiscal policy tends to be markedly procyclical in good times in both industrial and developing countries. The evidence is consistent with the notion that in the boom phase, buoyant revenues are often accompanied by an even greater exuberance in government expenditures.

A variety of economic, financial, and political economy factors can lead to procyclicality, including lags in the formulation and implementation of policy and the availability of financing. However, the evidence that procyclicality tends to be asymmetric over the cycle—expansionary policies in the upswing, but neutral or mildly expansionary policies also in the downswings—suggests that political economy and institutional considerations play a preponderant role.

The chapter argues that procyclical fiscal policy exacerbates economic fluctuations, which, in turn, has adverse consequences for savings, investment, economic growth, and welfare. It also argues that, since the procyclical bias appears to be stronger in the upturn, deficits and debt built up during bad times are in general not offset during good times. This leads to the result noted above that fiscal positions deteriorate over time.

Chapter 4 by Balassone and Kumar examines a number of approaches to reducing procyclicality, and more broadly strengthening fiscal discipline. It focuses specifically on the role that automatic stabilizers and cyclically adjusted fiscal balances can play in this regard. Where countercyclical fiscal policy is warranted, and to avoid procyclicality there are merits in implementing it through automatic stabilizers that do not have identification and implementation lags, and are self-reversing. However, the use of automatic stabilizers is generally likely to have limitations, since their size often reflects factors unrelated to macroeconomic management, and in many developing countries they are small due to low tax progressivity and limited reliance on income-related transfers, as well as relatively small size of government.

With regard to the cyclically adjusted fiscal balances (CABs), there is agreement that targeting such balances can assist in principle in promoting discipline in good times. However, there are a range of issues that arise in calculating CABs, including the estimation of output gaps and the output elasticity of the budget, and forecasting errors and data revisions, that can limit their usefulness as fiscal targets in many countries. In these cases, the main role played by CABs could be to inform the choice of appropriate nominal deficit and/or debt targets. But the chapter also explores a variety of measures that can be taken to make CABs a more robust reference for policy. These include taking into account changes in the composition of output, estimating elasticities directly from tax and expenditure laws, and focusing on changes in output and budget balances rather than their levels. Moreover, the chapter points out that for many countries even relatively unsophisticated CAB calculations would represent a significant step forward.

The chapter also examines the role of expenditure targeting as a facilitating instrument in the implementation of countercyclical policy. Committing to a predetermined rate of growth of expenditure can curb the tendency to increase public spending in good times while leaving the automatic stabilizers on the revenue side free to operate. The issues arising in the implementation of this apparently simple framework, including the need for an anchor, are discussed. Finally, the chapter examines the role that a variety of market-related measures could play in helping reduce the procyclicality of policy in emerging markets.

Chapter 5 by Corbacho and Schwartz examines the contribution that fiscal responsibility laws (FRLs) can make in enhancing fiscal discipline. The design features of these laws differ significantly from country to country, with a key distinction being the relative emphasis placed on procedural and numerical rules. Well-designed procedural rules in FRLs can be instrumental in improving fiscal management. While numerical rules embedded in FRLs have some potential advantages, including helping to contain a deficit bias and addressing time inconsistency issues, they often lack flexibility and have faced implementation problems in some cases.

FRLs hold promise for strengthening fiscal management but cannot by themselves buy credibility or substitute for a commitment to prudent fiscal policy. Effective FRLs should cover all relevant fiscal and quasifiscal operations of the public sector, include comprehensive procedural and transparency requirements, and follow best practices in the design of rules and escape clauses. In addition, public expenditure management systems need to be sufficiently developed to mon...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Preface

- Abbreviations

- 1. Fiscal Discipline: Key Issues and Overview

- 2. Discretion, Institutions, and Fiscal Discipline

- 3. Cyclicality of Fiscal Policy

- 4. Addressing the Procyclical Bias

- 5. Fiscal Responsibility Laws

- 6. The Role for Fiscal Agencies

- Footnotes