eBook - ePub

The IMF and Aid to Sub-Saharan Africa

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The IMF and Aid to Sub-Saharan Africa

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The IMF and Aid to Sub-Saharan Africa by International Monetary Fund. Independent Evaluation Office in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2007eBook ISBN

9781589066359CHAPTER

1 Introduction

This report sets out the main findings and recommendations of an independent evaluation of the IMF’s role and performance in the determination of the external resource envelope in low-income countries in Sub-Saharan Africa (SSA). The evaluation concentrated on aid—the principal source of external financing for most such countries—and in particular on how the IMF has interfaced with country recipients and donors in shaping the provision and use of aid in the pursuit of poverty reduction and other development goals. It focused on programs supported by the Poverty Reduction and Growth Facility (PRGF)—the IMF’s primary instrument for operational work in SSA.

The evaluation focused on 1999–2005—a period of major changes in the external context for IMF activities in SSA. This was a time of improving macroeconomic performance in a number of SSA countries, with increasing growth rates and decreasing inflation rates—but almost no change in the share of the population living in poverty. It was a time when the international community came together on the Millennium Development Goals (MDGs), supported by the Monterrey Consensus on the need for better policies by developing countries and more and better aid and trade opportunities by developed countries. It was a time when aid to SSA recovered from the declines of the early 1990s, and donors began to move to multidonor budget support in many SSA countries. All had implications for the IMF’s work.

Within the IMF, the evaluation period begins with the introduction of the PRGF—in the final year of the term of then Managing Director Michel Camdessus—and ends with the launch of the Medium-Term Strategy (MTS). The new millennium was approaching, and pressures were building on IMF shareholders for action on debt forgiveness and poverty reduction. Major topics at the Annual Meetings of September 1999 were the enhanced HIPC Initiative, the Poverty Reduction Strategy (PRS) process, and the transformation of the Enhanced Structural Adjustment Facility (ESAF) into the PRGF. Under the new approach, which was opera-tionalized by the Executive Boards of the IMF and World Bank before end-1999, the roles of the IMF and the Bank closely intertwined through the PRSP and HIPC processes. The next few years saw much experimentation, with country ownership through the PRS process gaining momentum.

As the above changes unfolded during the period, variations on long-standing criticisms of the IMF’s work in SSA emerged, with three providing a point of reference for the evaluation. The first is that IMF-supported programs have blocked the use of available aid to SSA through overly conservative macroeconomic programs. The second is that such programs have lacked ambition in projecting, analyzing, and identifying opportunities for the use of aid inflows to SSA countries, which may in turn have tempered donors’ actual provision of aid. The third is that IMF-supported programs have done little to address poverty reduction and income distributional issues despite institutional rhetoric to the contrary.

Board-approved policies underpin the assessment framework used by the evaluation team in examining staff performance in these areas. Such policies summarize what the IMF Executive Directors have decided is to be the IMF’s role in these areas, thereby providing the mandate for staff behavior.1 Also relevant to the assessment framework is management’s translation of Board decisions into operational policies for guidance to staff on implementation. IMF communications, through management and senior staff speeches, EXR press releases, articles, and correspondence with newspapers, are germane as well. These communications constitute an important channel for articulating Fund positions and informing external audiences about what the IMF has undertaken to do.

A recurring theme of the evaluation concerned the disconnect in external perceptions between what the IMF committed to do on aid and poverty reduction and what it actually did at the country level. In a number of instances, the Fund’s partnership with the World Bank in support of the PRS process, Global Monitoring, and other initiatives—and related communications—has blurred perceptions of Fund accountabilities on aid and poverty reduction at the country level. To distinguish the Fund’s unique role and mandate from that of the World Bank and other partners—and the authorities whom their efforts support—the evaluation team focused narrowly on evidence from programs supported by the PRGF, which is the IMF’s instrument for supporting countries in implementing the PRSP approach, and on which 29 SSA countries drew during the 1999–2005 evaluation period.

Against this background, the report distills the main points of the evaluation, focusing on what the IMF actually did on aid and poverty reduction in SSA against what it had committed to do. The remainder of the report is structured as follows. Chapter 2 examines the empirical and documentary evidence on how SSA PRGFs have treated (1) the accommodation of aid via the design of macroeconomic policies; (2) the forecasting and analysis of aid; and (3) the PRGF pro-poor and pro-growth agenda. Chapter 3 looks at IMF staff interactions with the authorities—the Fund’s main client—bilateral and multilateral donors, and civil society on aid and related issues. Chapter 4 looks at drivers of Fund behavior—Board-approved policies, management leadership, communications, guidance, and staff views. Chapter 5 sets out the evaluation’s findings and recommendations. Annex 1 summarizes relevant Board conclusions. Annex 2 describes the evaluation’s quantitative analysis. Annex 3 profiles the 29 countries in the evaluation sample and discusses the findings of the country desk reviews. Annex 4 examines the case-study results. Annex 5 summarizes the evaluation survey’s methodology and results.

CHAPTER

2 Country Policies and Programs

This chapter reports on the evaluation’s findings about aid-related issues in the design of PRGF-supported programs. It covers (1) the links between aid and current account and fiscal adjustment in PRGFs; (2) PRGFs’ analysis of aid; and (3) the PRGF’s pro-poor and pro-growth agenda.1 The chapter’s focus is on program design—both for the initial PRGF program period and for subsequent program periods following reviews—as it is at the design stage that Fund staff’s inputs and contributions are most clearly seen.

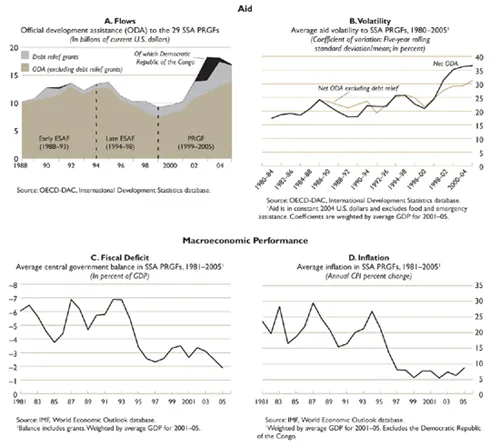

Figure 2.1 provides an overview of developments in SSA on aid, macroeconomic indicators, growth, and poverty reduction. Panel A summarizes recent aid trends. As illustrated, official development assistance (ODA) to the 29 SSA countries under study declined during the ESAF period, bottomed out in 1999, and recovered during the PRGF period. These developments reflect the changing aid environment for SSA since the adoption of the MDGs and the improving performance of many SSA countries, a factor in donor aid plans. Panel A also shows trends in debt relief grants, which surged starting in 2002.

Figure 2.1. Trends in Aid, Policies, and Outcomes in Sub-African Africa

Figure 2.1. (concluded)

Three factors in the changing aid profile are worth noting. First, the ESAF period’s aid downswing affected almost all SSA countries, while the PRGF period’s upswing has mainly affected two groups of countries—post-conflict countries and good-performing countries. Second, aid volatility has remained high throughout the period2 (see panel B). Third, the aid shown in panel A includes grants and concessional loans with a grant element of at least 35 percent. Under Fund guidelines, all PRGFs strictly limit—and often totally preclude—government contracting or guaranteeing of nonconcessional foreign debt, with specific limits placed on the minimum degree of concessionality.3

Figure 2.1 also illustrates the improving macroeconomic policies and outcomes in the 29 SSA PRGF countries. As shown in panels C and D, both the government deficit and inflation have dropped sharply since the mid-1990s. Growth in per capita income, while still low, has become much more consistently positive, and per capita incomes have begun to recover from their lows of the mid-1990s. Going forward, enormous challenges clearly remain, especially in terms of poverty reduction, which has not yet seen a significant reduction of the proportion of people living on less than $1 a day.

Accommodation of Aid

This section reports on the evaluation’s findings on the design of PRGF-supported programs as a basis for addressing critics’ concerns that the IMF “blocks” or prevents the full use of available donor funding. To this end, the evaluation looked at how changes in the aid forecast mapped into changes in programmed levels of the fiscal and current account deficits.4 In the parlance of the IMF’s 2005 “spend and absorb” framework (see Box 2.1), this section of the report asks: (1) how much of increased aid was programmed to be absorbed (in higher net imports); and (2) how much of increased aid was programmed to be spent (in higher net public expenditures)? It also examines (3) how PRGFs analyzed aid absorptive capacity and (4) PRGF program “adjusters” to see whether and how much of aid surprises could be spent and absorbed.

Current account adjustment

The evaluation’s empirical analysis finds that country conditions, as proxied by the level of international reserves, are the main determinants of whether and to what extent PRGFs permit the absorption of incremental aid. It also finds that on average SSA PRGFs do not call for current account adjustment during the first program year. This represents a departure from SSA ESAFs, which typically called for significant current account adjustment in the initial program year. The evidence points to increased expectations regarding aid inflows for the initial program year as well as improved reserve levels as reasons for this shift in program stance. Abstracting from these two determinants of program design, there is no evidence of an independent shift over time in program design with respect to the programmed absorption of increased aid.

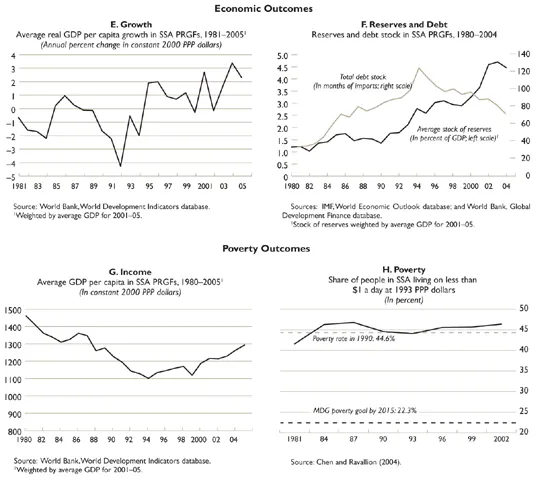

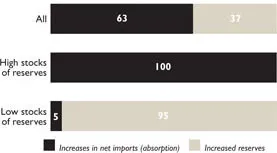

On average, across time and countries, SSA PRGFs programmed an immediate absorption of 63 percent of anticipated aid increases. As illustrated in Figure 2.2, anticipated aid increases in SSA PRGFs are on average correlated with a widening of the current account5 of 63 percent of the anticipated increase. The remaining 37 percent is programmed to increase international reserves.6 This relationship is significantly affected by the initial stock of reserves measured in months of imports.

Figure 2.2. Programmed Absorption of Aid Increases

Average programmed current account response to increases in aid in SSA PRGFs

(In percent of anticipated aid increase)

Note: The cutoff for low and high stocks of reserves is 2.5 months of imports. See Annex 2 for definitions, methodology, and a discussion of robustness.

Underpinning the average rate of programmed absorption out of incremental aid are country differences in net international reserves. As shown in Figure 2.2, for countries with reserves below a threshold of 2.5 months of imports, absorption of incremental aid is nearly zero—as those countries are programmed to build their reserve position. This result is consistent with the evidence from the evaluation’s desk reviews, which found programmed increases in internation...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Foreword

- Abbreviations

- Executive Summary

- 1 Introduction

- 2 Country Policies and Programs

- 3 IMF Relationship Management in Sub-Saharan Africa

- 4 Institutional Drivers of IMF Behavior

- 5 Findings and Recommendations

- Annexes

- References

- Boxes

- Statement by the Managing Director, Staff Response, IEO Commments on Management and Staff Responses, and the Acting Chair’S Summing up

- Statement by the Managing Director

- Staff Response

- IEO Comments on Management and Staff Responses

- The Acting Chair’s Summing Up

- Footnotes