eBook - ePub

Global Financial Stability Report, October 2010 : Sovereigns, Funding, and Systemic Liquidity

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Global Financial Stability Report, October 2010 : Sovereigns, Funding, and Systemic Liquidity

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Global Financial Stability Report, October 2010 : Sovereigns, Funding, and Systemic Liquidity by International Monetary Fund. Monetary and Capital Markets Department in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2010eBook ISBN

9781589069480CHAPTER 1. Economic Uncertainty, Sovereign Risk, and Financial Fragilities

A. What Is the Outlook for Global Financial Stability?

Despite the ongoing economic recovery, the global financial system remains in a period of significant uncertainty. The baseline scenario is for balance sheets to strengthen gradually as the economy recovers, and as further progress is made in addressing legacy problems in key banking systems. However, substantial downside risks remain. Mature market governments face the difficult challenge of managing a smooth transition to self-sustaining growth, while stabilizing debt burdens under low and uncertain economic prospects. Without further bolstering of balance sheets, banking systems remain susceptible to funding shocks that could intensify deleveraging pressures and place a further drag on public finances and the recovery. Emerging market economies have proven resilient to recent turbulence, but are vulnerable to a slowdown in mature markets and face risks in managing sizable and potentially volatile capital inflows. Policy actions need to be intensified to contain risks in advanced and emerging economies, address sovereign debt burdens, tackle the legacy challenges of the crisis for the banking system, and put in place a new regulatory and institutional landscape to ensure financial stability.

Note: This chapter was written by a team led by Peter Dattels and consisting of Sergei Antoshin, Giovanni Callegari, Joseph Di Censo, Phil de Imus, Martin Edmonds, Kristian Hartelius, Geoffrey Heenan, Talib Idris, Silvia Iorgova, Hui Jin, Matthew Jones, William Kerry, Paul Mills, Ken Miyajima, Christopher Morris, Nada Oulidi, Jaume Puig, Marta Sánchez-Saché, Christian Schmieder, Narayan Suryakumar, and Huanhuan Zheng.

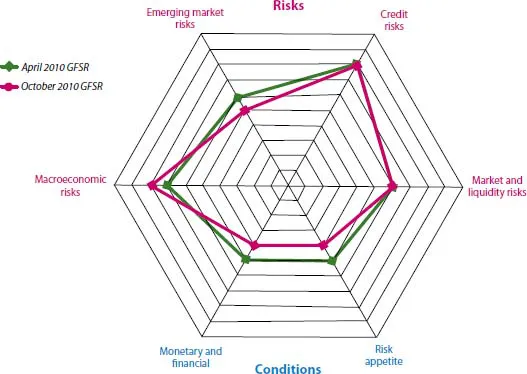

Overall progress toward global financial stability has suffered a setback since the April 2010 Global Financial Stability Report (GFSR), as illustrated in our global financial stability map (Figure 1.1) and the associated assessment of risks and conditions (Figure 1.2). The turmoil in sovereign debt markets in Europe highlighted increased vulnerabilities of bank and sovereign balance sheets arising from the crisis. The forceful response by European policymakers helped to stabilize funding markets and reduce tail risks. The additional transparency provided by the disclosure of European bank stress test results also reduced uncertainty over sovereign exposures, and provided relief for bank and sovereign funding markets. However, the outlook is still subject to considerable downside risks, and tail risks remain elevated.

Figure 1.1. Global Financial Stability Map

Note:Away from center signifies higher risks, easier monetary and financial conditions, or higher risk appetite.

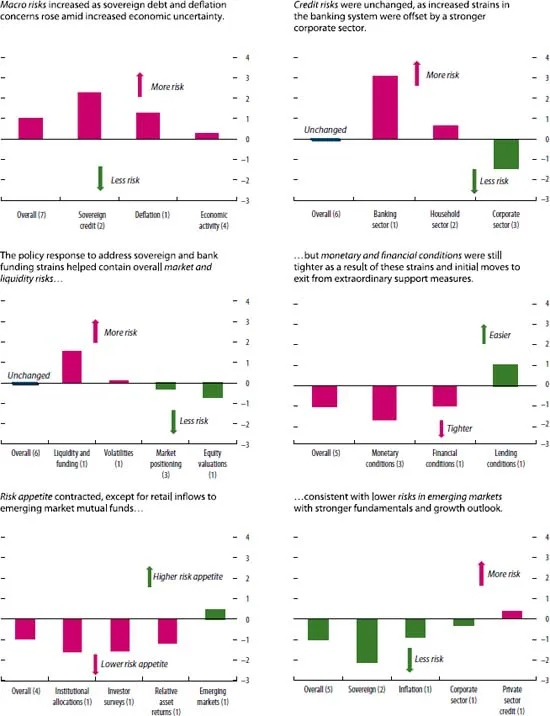

Figure 1.2. Global Financial Stability Map: Assessment of Risks and Conditions

(In notch changes since the April 2010 GFSR)

Source: IMF staff estimates.

Notes: Changes in risks and conditions are based on a range of indicators, complemented with IMF staff judgment (see Annex 1.1. in the April 2010 GFSR and Dattels and others (2010) for a description of the methodology underlying the global financial stability map). Overall notch changes are the simple average of notch changes in individual indicators. The number next to each legend indicates the number of individual indicators within each sub-category of risks and conditions. For lending standards, a positive value represents a slower pace of tightening or faster pace of easing.

Macroeconomic risks have increased, as heightened market pressures for fiscal consolidation have complicated the challenge of managing a smooth transition to self-sustaining growth. The recovery has begun to lose steam, after better-than-expected growth in early 2010. Consumer confidence and other leading indicators have started to level off, reflecting rising uncertainty about the next phase of the recovery. Section B examines the many sovereign risk vectors that could undermine financial stability, as well as the difficult challenge that many governments of advanced economies face in stabilizing debt burdens under low and uncertain growth prospects.

The improvement in overall credit risks experienced in the last year has paused. The recovery has strengthened corporate balance sheets and stabilized some indicators of household leverage. However, against the backdrop of heightened economic uncertainty, continuing deleveraging, and sovereign spillovers, core banking systems remain vulnerable to confidence shocks and are heavily reliant on government support. Risks remain in the euro area from the negative interactions between sovereign and banking risks. Challenges also remain for banking systems in the United States and Japan. Uncertainties surrounding the U.S. housing market and the risks of a “double dip” in real estate markets remain high. Overall, bank balance sheets need to be further bolstered to ensure financial stability against funding shocks and to prevent adverse feedback loops with the real economy.

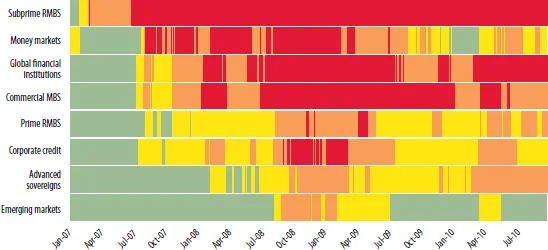

The forceful policy response in Europe helped to reverse the sharp rise in market and liquidity risks experienced in April and May, leaving them broadly unchanged from the April 2010 GFSR (Figure 1.3). However, downside risks remain elevated, given the sizable refunding needs in the banking sector. Indeed, general levels of risk appetite have declined, with financial sector equities and credit experiencing the largest sell-offs during the crisis on concerns about exposures to sovereign debt. Monetary and financial conditions have also tightened as a result of these strains and because of initial steps by central banks to start unwinding support measures introduced in response to the global credit crisis.

Figure 1.3. Markets Heat Map

Source: IMF staff estimates.

Note: The heat map measures both the level and one-month volatility of the spreads, prices, and total returns of each asset class relative to the average during 2003-06 (i.e., wider spreads, lower prices and total returns, and higher volatility). The deviation is expressed in terms of standard deviations. Light green signifies a standard deviation under 1, yellow signifies 1 to 4 standard deviations, orange signifies 4 to 9 standard deviations, and red signifies greater than 9. MBS = mortgage-backed security; RMBS = residential mortgage-backed security.

Emerging market risks have nevertheless declined. Spillovers from the sovereign debt turmoil in Europe remain fairly limited outside some emerging European countries with stronger linkages with the euro area. Nevertheless, emerging markets face the challenge of managing large and possibly volatile capital flows. Their higher growth prospects and sounder fundamentals point to a structural asset reallocation from advanced countries (Section D).

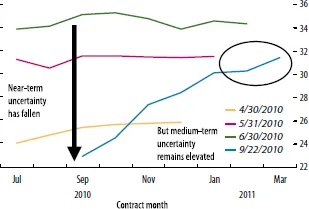

In sum, although the financial situation has improved after the turmoil in European sovereign debt markets, substantial market uncertainties persist and tail risks are elevated, with markets still expecting volatility to remain high (Figure 1.4). Policy actions are needed to contain low-probability but high-impact events by adequately addressing sovereign risks, tackling legacy problems in the banking system, and providing greater clarity on the new financial regulatory landscape.

Figure 1.4. Short-Term Uncertainty Has Fallen, but Uncertainty Remains High in the Medium Term

(Term structure of the VIX, in percent)

Source: Bloomberg LP.

Note: The VIX is the Chicago Board Options Exchange Market Volatility Index.

B. Sovereign Risks and Financial Fragilities

Coordinated support programs and the announcement of ambitious fiscal reforms in countries facing the greatest sovereign funding difficulties have helped contain the turmoil in the euro area after its rapid escalation in April-May. Nevertheless, sovereign risks remain elevated as markets continue to focus on high public debt burdens, unfavorable growth dynamics, increased rollover risks, and linkages to the banking system. As policymakers continue the difficult process of improving fiscal sustainability, they must also attenuate the channels of transmission from the sovereign to the financial system. This will help reduce the risk that sovereign debt concerns compromise financial stability.

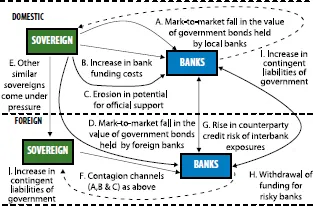

The financial turmoil that engulfed parts of the euro area in April-May provided a stark reminder of the close linkages between sovereign risk and the financial system, as well as the potential for cross-border spillovers (Figure 1.5). Spreads on sovereigns perceived to face greater fiscal and growth challenges rose rapidly in the wake of Greece’s funding difficulties. Similarly, markets began to differentiate more among sovereigns within the euro area and among banks with the greatest exposures to those economies.

Figure 1.5. Spillovers from the Sovereign to the Banks and Banks to Sovereigns

Source: ...

Table of contents

- Cover Page

- Title Page

- Contents

- Preface

- Executive Summary

- Chapter 1. Economic Uncertainty, Sovereign Risk, and Financial Fragilities

- Chapter 2. Systemic Liquidity Risk: Improving the Resilience of Institutions and Markets

- Chapter 3. The Uses and Abuses of Sovereign Credit Ratings

- Glossary

- Annex: Summing Up by the Acting Chair

- Statistical Appendix

- Boxes

- Footnotes