eBook - ePub

World Economic Outlook, April 2011 : Tensions from the Two-Speed Recovery: Unemployment, Commodities, and Capital Flows

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

World Economic Outlook, April 2011 : Tensions from the Two-Speed Recovery: Unemployment, Commodities, and Capital Flows

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access World Economic Outlook, April 2011 : Tensions from the Two-Speed Recovery: Unemployment, Commodities, and Capital Flows by International Monetary Fund. Research Dept. in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2011eBook ISBN

9781616350598CHAPTER 1 GLOBAL PROSPECTS AND POLICIES

The Recovery Has Solidified, but Unemployment Remains High

The global recovery is continuing broadly as anticipated in the October 2010 and January 2011 World Economic Outlook (WEO) projections (Figure 1.1;Table 1.1). World growth decelerated to about 3¾ percent during the second half of 2010, from about 5¼ percent during the first half. This slowdown reflects a normal inventory cycle. As fears of a global depression receded in 2009, businesses at first slowed their rate of destocking, and then, as confidence continued to improve, began to rebuild depleted inventories. This fostered a sharp rebound in industrial production and trade, which lasted through the first half of 2010. As this phase progressed, inventory rebuilding and, as a consequence, industrial production and trade moved into lower gear in the second half of last year. In the meantime, however, reduced excess capacity, accommodative policies, and further improvements in confidence and financial conditions encouraged investment and sharply reduced the rate of job destruction. Consumption also regained strength. Consequently, the recovery has become more self-sustaining, risks of a double-dip recession in advanced economies have receded, and global activity seems set to accelerate again.

Nonetheless, the pace of activity remains geographically uneven, with employment lagging.

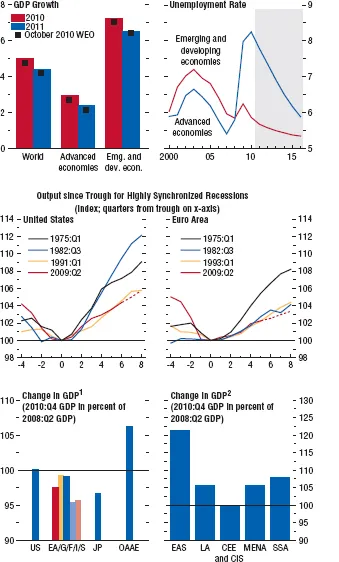

- In major advanced economies, economic grow this modest, especially considering the depth of the recession, reaching just 3 percent in 2010. In the United States and the euro area, the economy is following a path as weak as that following the recessions of the early 1990s, despite a much deeper fall (Figure 1.1, middle panel).

- In contrast, many emerging and developing economies have seen robust growth, reaching more than 7 percent in 2010, and have low unemployment rates, although unemployment tends to disproportionately affect young people. In a growing number of these economies, there is evidence of tightening capacity constraints, and many face large food price increases, which present other social challenges.

- Overall, growth is insufficiently strong to make a major dent in high unemployment rates (Figure 1.1, top panel). Some 205 million people are still looking for jobs, which is up by about 30 million worldwide since 2007, according to the International Labor Organization. The increase in unemployment has been very severe in advanced economies; in emerging and developing economies, high youth unemployment is a particular concern, as noted above.

The recovery is broadly moving at two speeds, with large output gaps in advanced economies and closing or closed gaps in emerging and developing economies, but there are appreciable differences among each set of countries (Chapter 2). Economies that are running behind the global recovery typically suffered large financial shocks during the crisis, often related to housing booms and high external indebtedness. Among the advanced economies, those in Asia have experienced a strong rebound (Figure 1.1, bottom left panel). The recovery of euro area economies that suffered housing busts or face financial market pressures has been weaker than in Germany and some other euro area economies. Among emerging and developing economies, those in Asia are in the lead, followed by those in sub-Saharan Africa, whereas those in eastern Europe are only just beginning to enjoy significant growth.

Financial Conditions Are Improving

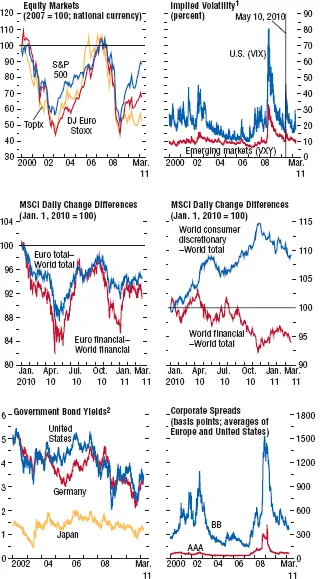

Reinforcing and reflecting generally positive outcomes, strong profits have spurred equity price gains and lowered bond prices, and volatility has decreased (Figure 1.2, top and bottom panels). Stock prices in emerging Asia, Latin America, and the United States have approached precrisis peaks (Figure 1.2 and 1.3, top panels). Financial stocks in the euro area, however, have been sluggish, reflecting continued vulnerability to peripheral euro area economies (Figure 1.2, middle panel). Government bond and bank credit default swap spreads in peripheral euro area economies remain high, pointing to significant vulnerabilities (Figure 1.4, middle panel). Stocks in Japan are lagging because of the appreciation of the yen and the impact of the recent earthquake. Credit growth remains very subdued in the advanced economies. Bank lending conditions in the major advanced economies, including those of the euro area, are slowly easing after a prolonged period of incremental tightening (Figure 1.4, top panel); for small and medium-size firms, they are easing or tightening only modestly. In the meantime, credit growth has again reached high levels in many emerging market economies, particularly in Asia and Latin America (Figure 1.3, bottom panel).

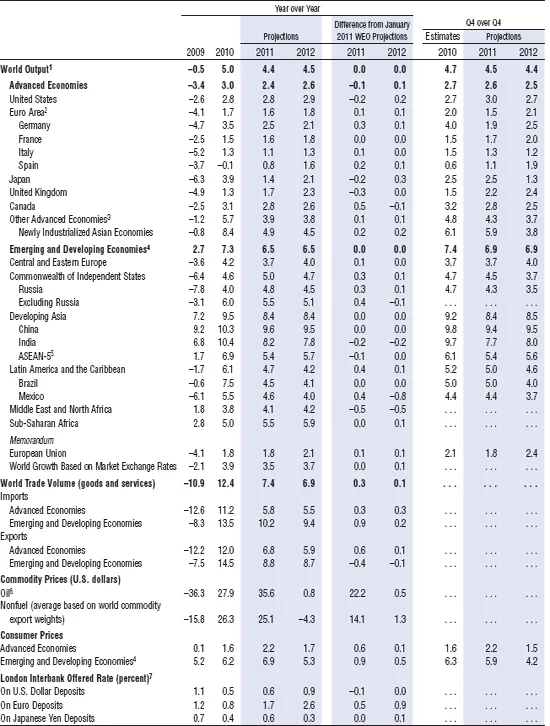

Table 1.1. Overview of the World Economic Outlook Projections(Percent change unless noted otherwise)

Note: Real effective exchange rates are assumed to remain constant at the levels prevailing during February 8-March 8, 2011. When economies are not listed alphabetically, they are ordered on the basis of economic size. The aggregated quarterly data are seasonally adjusted.

1 The quarterly estimates and projections account for 90 percent of the world purchasing-power-parity weights.

2 Excludes Estonia.

3 Excludes the United States, Euro Area, and Japan but includes Estonia.

4 The quarterly estimates and projections account for approximately 79 percent of the emerging and developing economies.

5 Indonesia, Malaysia, Philippines, Thailand, and Vietnam.

6 Simple average of prices of U.K. Brent, Dubai, and West Texas Intermediate crude oil. The average price of oil in U.S. dollars a barrel was $79.03 in 2010; the assumed price based on futures markets is $107.16 in 2011 and $108.00 in 2012.

7 Six-month rate for the United States and Japan. Three-month rate for the Euro Area.

Global capital flows rebounded sharply following the collapse during the crisis, but they are still below precrisis averages in many economies (Figure 1.5,middle and bottom panels; Chapter 4). Accordingly, stock markets and credit in emerging market economies have rebounded unusually fast from deep falls (Box 1.1). Strong growth prospects and relatively high yields are attracting flows into emerging markets. Sluggish activity and damaged financial systems continue to depress flows between advanced economies. These forces raise policy challenges that are discussed in more detail later in this chapter as well as in the April 2011 Global Financial Stability Report.

- Capital flows to some larger emerging market economies—for example, Brazil, China, India, Indonesia, Mexico, Peru, Poland, and Turkey—are all within the range of or above precrisis levels. The recovery has been led so far by portfolio and bank flows, with a falling share of foreign direct investment inflows. These developments mark a departure from earlier experience and may raise the risk of future instability, including capital outflows. However, during fall 2010 the capital-flow-drivenrally in emerging market assets slowed again. Other regions, such as east and west Africa, have yet to see much of a rebound in capital inflows.

- Flows between advanced economies have been hit hard by the financial disintermediation wrought by the crisis (Figure 1.5, middle panel). Capital flows from the United States have returned to precrisis levels but have been redirected to emerging market economies and away from advanced economies. Capital flows from the euro area, especially via banks, are still well below precrisis levels. Reduced flows to other advanced economies account for most of this reduction, although flows to emerging market economies are also weak.

Figure 1.1. Global Indicators (Annual percent change unless noted otherwise)

Global activity has evolved broadly in line with the October 2010 WEO forecast. Growth is low in advanced economies and unemployment is high. In the United States and the euro area, the recoveries are tracking those of the 1990s, despite much deeper falls in output during the Great Recession. Emerging and developing economies that have not been hit hard by the crisis are already in expansionary territory.

1 US: United States; EA/G/F/I/S: euro area/Germany/France/Italy/Spain; JP: Japan; OAAE: other advanced Asian economies.

2EAS: emerging Asia; LA: Latin America; CEE and CIS: central and eastern Europe and Commonwealth of Independent States; MENA: Middle East and North Africa; SSA: sub-Saharan Africa. Due to data limitations, annual data are used for MENA and SSA.

Figure 1.2. Recent Financial Market Developments

Equity prices have moved close to precrisis peaks in the United States but are lagging in Europe and Japan, reflecting, respectively, concerns about the financial sector and exports. Volatility has receded. Corporate spreads have returned to a low level. Long-term government bond yields have moved up in response to stronger activity but remain below levels reached in early 2010.

Sources: Bloomberg Financial Markets; and IMF staff calculations.

1VIX = Chicago Board Options Exchange Market Volatility Index; VXY = JPM organ Emerging Market Volatility Index.

2Ten-year government bonds.

Changes in financial conditions are unlikely to give significant additional support to output growth over the near term. Given the state of the “real” recovery, risk aversion and volatility are already low in the major financial markets, as evidenced by the vigorous recovery of equity markets and a narrowing of credit risk spreads. Although bank lending conditions in advanced economies are still far from normal, further progress is likely to be slow. Securitization markets remain in disrepair. Banks will need time to switch toward more stable deposits and long term wholesale funding. Supervision and regulation are being tightened for good reason. In addition, conditions are likely to remain volatile because of continued uncertainty about how the crisis in the euro area will be resolved. Indices of broad financial conditions compiled by the IMF staff confirm this qualitative reading. They suggest that conditions are easing slowly and to a similar degree in the United States, the euro area, and Japan; simple forecasts point to further, very gradual easing (Figure 1.4, bottom panel; Appendix 1.1).

Robust capital flows to key emerging market economies may well continue, although questions about macroeconomic policies and geopolitical uncertainty could slow flows over the near term. The growth differential between these economies and advanced economies is not forecast to diminish significantly. Together with emerging economies’ demonstrated resilience during the financial crisis, this supports further structural reallocation of portfolios toward these economies. However, uncertainty about the extent and possibility of ...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Assumptions and Conventions

- Preface

- Foreword

- Executive Summary

- Chapter 1. Global Prospects and Policies

- Chapter 2. Country and Regional Perspectives

- Chapter 3. Oil Scarcity, Growth, and Global Imbalances

- Chapter 4. International Capital Flows: Reliable or Fickle?

- Annex: IMF Executive Board Discussion of the Outlook, March 2011

- Statistical Appendix

- World Economic Outlook, Selected Topics

- Boxes

- Updates

- Footnotes