eBook - ePub

The Italian Multinationals (RLE International Business)

- 4 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Italian Multinationals (RLE International Business)

About this book

This book, based on extensive, original, detailed research presents a comprehensive overview of the Italian multinationals and their activities during the 1990s. It:

- surveys the size, geographical and sectoral distribution of Italian multinationals

- examines why they went international, how and what they gained

- discusses the strategic position of Italian multinationals in the world economy

- examines the effect of multinationals investment both inward and outward on the Italian economy

- provides detail on individual companies

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Italian Multinationals (RLE International Business) by Fabrizio Onida,Gianfranco Viesti in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

1

Patterns of International Specialisation and Technological Competitiveness in Italian Manufacturing Industry

THE ITALIAN TRADE BALANCE THROUGH OIL AND DOLLAR SHOCKS AND COUNTERSHOCKS

As a country structurally oriented to transform imported raw materials and energy into manufactures, Italy has been submitted to a dramatic deterioration of its trade balance following the two oil shocks of 1973-4 and 1979-80.

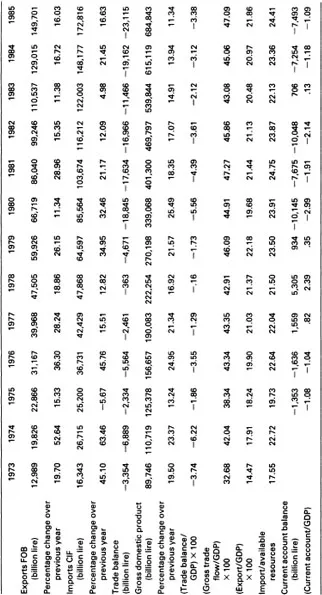

The Italian trade deficit hovered around 6 per cent of gross domestic product (GDP) both in 1974 and in 1980, shortly after the two shocks (Table 1.1). In both 1974 and 1980 the external deficit was overburdened by the cyclical situation, Italy being a late runner on the upswing which had preceded the ‘after-oil-shock’ recession, if compared to other major oil importing industrialised countries.

The adjustment to external conditions following the first oil shock was impressive. The strength of the OPEC cartel and the prompt catching up of international prices of raw materials, coupled with worldwide cyclical recovery, did not allow any significant improvement of terms of trade for major oil importers. In addition, Italian terms of trade had specifically deteriorated following the huge devaluation of the lira in early 1976. Emergency measures relating to domestic credit and foreign exchange transactions, together with a substantial real devaluation of the lira, were the main causes of an external adjustment that allowed Italy’s current account balance to swing from a deficit (near 4 per cent of GDP) in 1974 to a surplus (close to 2 per cent of GDP) in 1978-9. This improvement in Italy’s foreign balance was achieved despite a cyclical recovery that in 1978–9 put Italy back again among the faster-growing countries in the OECD.

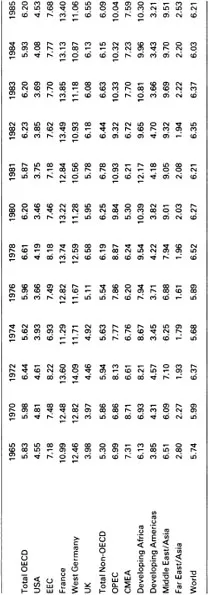

Table 1.1: Italy: trade and current account balance

Source: Istituto Centrale di Statistica (ISTAT) and Istituto per lo Studio della Congiuntura (ISCO)

The adjustment following the second oil shock in 1979-80 was far less impressive. It was mainly due, at first, to a relative, though persistent, moderation in the growth of domestic demand. In 1983 Italy experienced its late recession. Subsequently, following the ‘oil countershock’ and the fall of the US dollar in 1985-6, the improvement in the trade balance was overwhelmingly due to better terms of trade, since in volume terms imports continued to rise at a steadily higher rate than exports. An increasing burden of foreign debt, reinforced by the US dollar upvaluation and by historically high real interest rates, triggered a net interest payment deficit near US$ 4 billion each year on the current account balance. After the ‘low entry’ of the lira into the European Monetary System (EMS) in 1979, the lira real exchange rate vis-à-vis its European partners was forced to appreciate since monetary authorities consistently and successfully tried to lower inflationary expectations, by arranging subsequent realignments in amounts not fully offsetting past inflationary differentials vis-à-vis other EMS partners. Until 1985 the real effective lira exchange rate was kept relatively low by the soaring US dollar and by a sizeable downward realignment of the lira within EMS in July 1985. Subsequently, the exchange rate policy of Italian monetary authorities became increasingly stringent, while the falling US dollar cost of imported energy and raw materials, as well as a widespread wage moderation, helped to further reduce Italy’s inflationary differentials. As a result, Italian monetary authorities managed to avoid further significant losses in cost and price competitiveness, at the same time sticking to an exchange rate policy mainly aimed at reinforcing disinflationary signals to the market. On the whole, the most recent period did not allow Italian manufacturing firms to recover the loss in cost competitiveness relative to European partners which had been imposed in 1980–3. The international pattern of Italian firms’ competitiveness has, therefore, been significantly altered during the first half of the 1980s.

HIGH GEOGRAPHICAL MOBILITY OF ITALIAN EXPORTERS

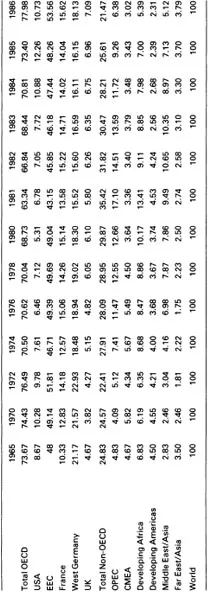

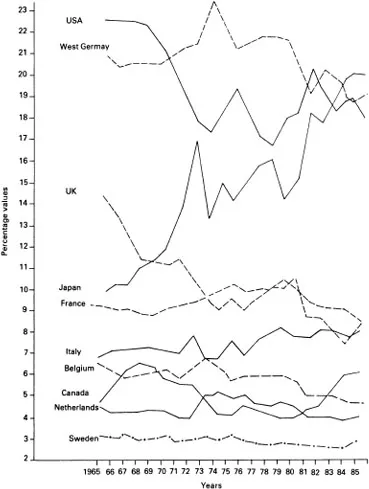

The geographical composition of Italian trade (Tables 1.2 and 1.3), however, was mainly affected by worldwide trends in relative prices and relative growth. Both imports and exports with oil producing and non-oil developing countries were on a downward trend, following the oil countershock and decreasing terms of trade of primary materials. The booming United States market and the rising dollar caused an impressive swing from Europe to the United States in terms of export growth and trade balance.

Table 1.2: Geographical composition of italian exports (percentage values of world total: selected countries and regions) 1985–1985

Source:OECD, monthly statistic of foreign trade

In the second half of the 1980s the share of industrial countries in total Italian exports has roughly recovered its pre-1973 level (see Table 1.2, first line), close to 75 per cent – this value is significantly higher than for United States or Japanese exports. Enlarged EEC markets are again close to representing 47 to 48 per cent of Italian exports and provide 45 per cent of Italian imports, after having fallen by as much as 42 per cent and 40 per cent respectively in 1980-1.

The overall performance of Italian manufacturing firms in world trade can be characterised in two respects.

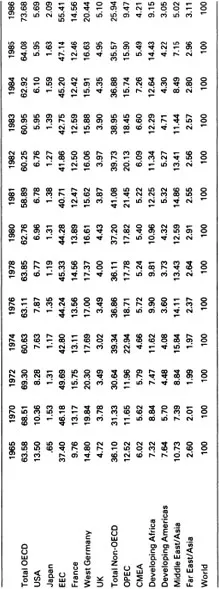

(1) OECD manufacturing export shares, both in volume and in value terms, show the considerable resilience of Italian exporters, if one correctly takes into account the extraordinary performance of the Japanese (Figure 1.1).

Aside from the secularly declining United Kingdom share and the large swings in the United States share, one may notice a weakening competitive trend for France since the end of 1970s, as well as for smaller European competitors (Belgium, Netherlands, Sweden) since the early 1970s. Therefore, overall Italian manufacturing exports have scored relatively well in world markets, although the underlying trend of growth in the 1980s seems to show a significant slowing down relative to the previous three decades of the post-Second World War period. In terms of growth of export propensity, measured against domestic industrial production and domestic value added at constant prices, Italy is second only to Japan in the 1970s (see Cipolletta-Calabresi 1984, Modiano 1984, Vona 1984, Valcamonici 1985).

(2) A geographical disaggregation provides a second feature of Italian exports, partly related to the previous one, i.e. a relatively high mobility from sluggish to more dynamic markets following the worldwide cyclical swings. (Table 1.4 provides some evidence in this respect: see the Italian share of OECD exports to the OPEC market, rising during the boom period 1974 to 1981 and shrinking thereafter, as well as the rising Italian share of the United States market during its boom phase in 1981–5.) Several quantitative exercises in ‘constant market share analysis’ provide a more rigorous evidence about this favourable ‘market composition effect’ in explaining overall Italian export performance during several post-Second World War periods. (Among most recent contributions see Onida 1980, Credito Italiano 1983, Rebecchini-Vona 1986.)

Table 1.3: Geographical composition of Italian imports (percentage values of world total: selected countries and regions) 1965–85

Source: OECD, monthly statistics of foreign trade

Figure 1.1: Manufacturing export shares in ten major OECD countries

Source: OECD, statistics on foreign trade, series A

Table 1.4: Italian export shares: as percentages of OECD exports, selected countries and regions, 1965–85

Source: OECD, monthly statistics of foreign trade

Such a high geographical mobility reflects at least two structural features of Italian export.

(1) The relatively large share of traditional consumer goods (see below) implies a lower requirement of investment in fixed and human capital related to distribution, after-sale assistance and customer relations. Market strategies for traditional final consumer goods can be more flexible and more quickly adapted to changing demand conditions than similar strategies in most ‘scale intensive’ final and intermediate productions (such as motor vehicles, consumer electronics, chemical and metal commodities), as well as in highly diversified ‘science based’ and ‘specialised suppliers’ productions where individual supplier-customer relations and specific commercial-technological agreements take a longer time to build and develop.1

(2) The second feature underlying high geographical mobility stems from the peculiar firm-size fragmentation of Italian exports, in its turn a reflection of the large share of small enterprises in the structure of Italian manufacturing industry.

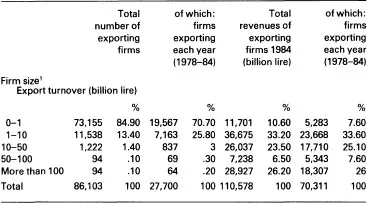

About 48,400 firms with individual export turnover below 10 billion lire (about £4 million in 1983-4) provided 45 per cent of the total value of exports in 1984 (Table 1.5). Slightly more than a quarter of total exports were generated by 94 firms with individual export turnover above 100 billion lire (about £40 million).

According to the only available disaggregation by industry and by firm-size, measured over a representative sample of Italian exports in 1982, while almost 54 per cent of all exports came from firms with export turnover below 25 billion lire (about £10 million), their share went as high as 80 per cent in textiles and clothing and near 90 per cent in leather goods, shoes and furniture (Table 1.6).

More than one third of total export revenue in 1984 came from firms which had not been regular exporters over the period 1978 to 1984. About 20 per cent of all exports in the same year originated in firms used to selling in less than six markets. As would be expected, the percentage of ‘permanent exporters’, as well as market diversification, tends to increase with the increase in average size of exporting firms.

Therefore, high geographical mobility and high speed of adjustment to market relative growth stem not only from a peculiar ability and flexibility in marketing strategies, but largely from structural composition (by sector, by firm size) of the Italian exporting industry. These aspects must be taken in mind in order to avoid superficial appraisals of Italian entrepreneurial ability to exploit market opportunities and to adapt commercial strategies.

Table 1.5: Italian exporting firms and export revenues by firm size1

1 In this table ‘firm size’ is approximated by its export turnover

Source: Istituto Nazionale por il Comme...

Table of contents

- Front Cover

- Half Title

- Title Page

- Copyright

- Title Page

- Copyright

- Contents

- Acknowledgements

- Introduction

- 1. Patterns of International Specialisation and Technological Competitiveness in Italian Manufacturing Industry

- 2. Size and Trends of Italian Direct Investment Abroad: A Quantitative Assessment

- 3. Geographical and Sectoral Pattern of Italian Direct Investment Abroad

- 4. International Strategies of Italian Multinationals

- 5. Italian Non-equity Ventures Abroad: Evidence from Field Interviews

- 6. Technological Interdependence, Market Structure and the Pattern of International Growth of Italian Firms

- 7. Italian Inward and Outward Direct Investment: A Comparison

- 8. Summary and Conclusions: Italy as an International Investor

- Appendix. Profiles of Major Italian Multinationals

- References

- Index