eBook - ePub

Multinational Joint Ventures in Developing Countries (RLE International Business)

- 14 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Multinational Joint Ventures in Developing Countries (RLE International Business)

About this book

This book examines how joint ventures work in practice. Drawing on extensive personal experience and using case study examples where appropriate the author analyses the various stages, discusses the problems of partner selection, implementation and control and points out the various benefits and pitfalls. He draws out the implications for improving practice and discusses how the experience of joint ventures affects the theory of the multinational enterprise.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Multinational Joint Ventures in Developing Countries (RLE International Business) by Paul Beamish in PDF and/or ePUB format, as well as other popular books in Economics & Business General. We have over one million books available in our catalogue for you to explore.

Information

1

Introduction

1.1 Importance of Joint Ventures

Joint ventures, not wholly-owned subsidiaries, are the dominant form of business organisation for multinational enterprises (MNEs) in less developed countries (LDCs) (Vaupel and Curhan, 1973), and are frequently being used by Fortune 500 companies in the developed countries (Harrigan, 1985). In fact, for US-based companies, all cooperative arrangements (involving such things as licences or local shareholders) outnumber wholly-owned subsidiaries by a ratio of four to one (Contractor and Lorange, 1987).

The number of joint ventures is growing worldwide at an increasing pace. Mergers and Acquisitions (1983) reported a 59 per cent increase between 1981 and 1983 in the number of international joint ventures involving US firms. Active joint venturers include General Motors, Dana, Eaton, Beatrice, Pillsbury, Carnation, Borden and Control Data Corporation. Besides being major players in their respective industries, each operates anywhere from five to 20 joint ventures in developing countries. And these are not just any type of joint venture — in none of the 71 LDC-based joint ventures of these eight American firms do they have a majority equity interest (Franko, 1986).

Yet, given the relative importance of joint ventures in LDCs, it is surprising to find a negligible amount of research into ways of improving their performance. This is particularly significant since the limited literature on joint ventures suggests that performance problems are more acute in developing rather than developed countries (Janger, 1980; and Franko, 1976). Over 100 nations are classified as developing countries. These potential markets are too big to ignore. For example, total GNP for Brazil exceeds that of Canada, or Norway, Sweden, Denmark and Finland combined; Nigeria’s GNP exceeds that of Austria; Mexico’s GNP exceeds that of Switzerland (Matthews and Morrow, 1985). Japanese and North American companies are not ignoring them. Existing and potential investment in these countries is substantial. Knowing how to operate successfully in these countries can be a problem, however.

The purpose of this research is to address the question of how the performance of joint business ventures in developing countries can be improved. Frequent performance problems of joint ventures in LDCs are an important issue for both MNE and host-country interests. Performance difficulties are costly for the MNE in time and capital. In addition, although the research does not emphasise it, there are also social costs to the host country when joint ventures experience difficulties or fail (Casson, 1979).

Organisations such as the United States Agency for International Development, the Canadian International Development Agency (CIDA) and the World Bank have recently been encouraging greater private sector involvement in developing countries. ‘Much of the focus of the development agencies has been on the use of joint ventures, since joint ventures are a proven mechanism for transferring technology from the industrialised countries to LDCs. Not surprisingly, a number of government programmes have been established to assist in setting up joint ventures in LDCs. For example in Canada, CIDA activities have included the publication of a guide on how to establish a successful international joint venture, and the setting up of an industrial cooperation programme to assist financially in the promotion of mutually profitable business relationships between Canadian companies and their developing country counterparts.

By creating viable joint ventures in LDCs, international development can be speeded up. However, given the declining share of direct investment flows from the industrialised countries to LDCs (Robock and Simmonds, 1983), the costs of joint venture failure in LDCs are magnified.

Other researchers have independently examined joint ventures in developing countries, joint ventures in developed countries, and joint-venture performance. This research combines several of these elements by focusing in depth on the performance of joint ventures in developing countries. (The distinction used for developed/less developed countries is: 1978 per capita GNP over/under US $3,000. Based on World Bank figures, nearly three-quarters of the world’s nations would be classed as LDCs.)

In this research, joint ventures are defined as shared-equity undertakings between two or more parties, each of which holds at least five per cent of the equity. The research is concerned with joint ventures that have been formed between a company, group or individual from a developed country with a similar entity in a less developed country. While such groups can and do include local governments as partners, the focus of the research is on joint ventures in which the local government is not a share-holder. None of the core ventures involves government partners. The importance of focusing on this particular form of foreign equity investment is supported by recent research on US multinational enterprises in developing countries: ‘Both US MNEs and host-country executives believe that a joint venture with a private local firm offers more advantages when compared with any other form of foreign equity investment for the US MNE and the host country’ (Raveed and Renforth, 1983). Inclusion in the study required that the venture be in manufacturing (rather than services, mining or distribution) and to have been in operation for at least three years (whether it still operated or not). Non-manufacturing ventures are excluded because mixing joint ventures in a sample where the scale of investment is commonly much higher (mining) or lower (distribution) could potentially affect the joint-venture decision process. Because many joint ventures never get off the ground, those firms which had been fully operating businesses for less than three years are also excluded, to increase the comparability of the sample.

The most common partner for MNEs in LDCs is a local private firm. Other partner combinations are not included in the sample because they are either not typical (i.e. two MNE partners in an LDC) or because the partners might not share the same profit motivation (i.e. government partners being more concerned with employment than profitability). Also excluded from the study are one-shot, project-oriented ventures (sometimes known as fade-out joint ventures) and ventures in which the parent company views its involvement principally as a portfolio-like investment.

Incorporated into this research are modifications to other researchers’ methodologies and emphases. For example, previously used proxies for joint-venture performance, such as stability, are improved upon, and emphasis is extended beyond the more common examination of ownership/control influences on performance by introducing the concepts of joint need and commitment. In addition, these latter variables are related to performance using improved data collection and analysis procedures.

1.2 Key Variables

The largest part of this research investigates the effect on joint-venture performance of two variables to which other researchers have paid limited attention — need and commitment. It is hypothesised that greater need and commitment between partners results in more satisfactory performance.

Following a series of pilot-survey interviews, the potential impact of these variables upon performance emerged. In the subsequent focus on these variables, partner-need was assessed over a span of time in terms of the relative importance of each partner’s contribution to the joint venture in a number of aspects such as capital, knowledge and staff. Joint-venture commitment was assessed in terms of the firm’s commitment to international business, the joint-venture structure, the particular venture and the particular partner. Measures of need and commitment based on the early interviews and literature reviews are developed. The literature examined included both joint-venture and international business literature, and literature adapted from other disciplines such as organisational behaviour and management-information systems. These other disciplines are specifically examined for assistance in defining and measuring commitment. The need and commitment results are combined to form a managerial guideline for the establishment of successful joint ventures in LDCs.

The dependent variable — joint-venture performance — is defined according to whether there was mutual agreement between the partners regarding their overall satisfaction. The performance measure, with its basis in both partners’ being satisfied, proved to be a better way of evaluating performance than the single-perspective measure used by other researchers, in which only the MNE partner’s view is considered. Because partners sometimes differ in their assessment of performance, other measures of joint-venture performance are not as accurate. Emphasis on ensuring the long-term viability of the venture underlies the discussion of success in this research. Seven of the twelve core ventures classed as satisfactory performers use this system.

The research also investigates the effects of a number of independent variables, (e.g. ownership, control) considered important by researchers examining joint-venture performance primarily in developed countries. Investigation of their effect upon performance represents a replication of the work of other researchers, to some extent, although on what was considered to be a different population of joint ventures — those in developing countries.

1.3 Overview of Conclusions

The principal conclusions of the research are noted below in the order in which they were derived. This order is also maintained in subsequent material — with the exception of the research methodology, presented in the section following. In considering methodology, the research question, the research design employed and the data collection process are detailed.

The first conclusion (Chapter 2) notes that characteristics of joint ventures in LDCs differ from those in developed countries. These characteristics — assessed in terms of stability, performance, ownership, reason for creating the venture, frequency of government partners and autonomy — were observed to differ following an analysis of, and comparison with, developed-country joint-venture samples.

This research suggests next that decision-making control in joint ventures in developing countries should be shared with the local partner, or split between the partners. There was support for the observation that there is a weakening of the link between joint-venture performance and the multinational having dominant management control, when one considers developing, rather than developed, countries.

Two important conclusions in Chapters 3 and 4 are that both partner need and commitment prove to be good predictors of both satisfactory and unsatisfactory joint-venture performance. For example, there is a positive association with performance of MNEs using local management, being willing to use voluntarily the joint venture structure, and looking to the local partner for knowledge of the local economy, politics and customs.

In Chapter 5 a management guideline for implementing an existing or potential joint-venture strategy is provided. The data on which this chapter is based come from joint ventures in Latin America, Africa, Southeast Asia and the Caribbean region. The co-authors were able to interview both parties to the joint ventures and their general managers in a number of situations. The information was collected by a variety of means: experience, case research, structured interviews and questionnaires. Lane was involved in the formation of a joint venture in Africa and has conducted extensive case research on joint ventures and cross-cultural management in Latin America and Southeast Asia.

Chapter 6 examines the role of the joint venture general manager (JVGM). It draws extensively on Jean-Louis Schaan’s original research on joint-venture control in Mexico. The JVGM plays a critical role in the successful operation on any joint venture, but has frequently been the forgotten person in joint-venture research.

Chapter 7 concludes that the joint-equity ventures do have a role in the theory of the multinational enterprise. With few exceptions, the theory has considered joint ventures as limited-term, contractual arrangements. As risky as joint ventures might be, there are conditions under which they are most appropriate for MNEs investing in foreign countries.

Chapters 8 and 9 look at joint ventures in a different group of developing countries, those with non-market economies. This study of joint ventures in China is based on new data, and lays particular emphasis on legal implications and the separating of fact from fiction regarding this market.

The appendices provide partial lists of firms contacted, as well as joint-venture management case studies.

1.4 Methodology

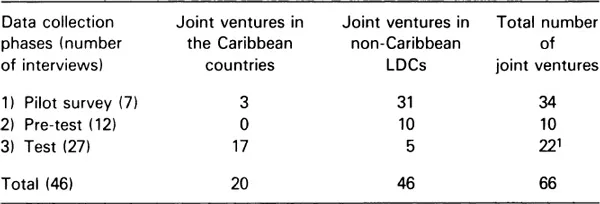

Data were collected by Beamish (1984) in three stages on a total of 66 joint ventures located in 27 LDCs. Within the third stage, particular emphasis was placed on twelve comparative core cases. Interviews were conducted with, and questionnaires administered to, the local partner, MNE partner, and joint-venture general manager (where possible) in each of these core ventures. This attempt to solicit information from both partners and the general manager for each venture represents a major point of departure from many previous works on joint-venture performance. This is important because it provides a more balanced picture of the actual operation of the joint venture and increased confidence in the research findings.

The questionnaires administered in the core ventures lent themselves to non-parametric statistical analysis of data. Although questionnaire findings from the twelve core ventures are emphasised, they are supplemented by interview comments from 46 senior executives in 66 joint ventures.

Table 1.1: Data collection

Note: 1. Complete data (from all partners) were available for twelve of these ventures.

Interviews were conducted in five countries — Canada, the United States, the United Kingdom and two Caribbean nations. The 46 interviews averaged more than three hours in length each, and were, with five exceptions, conducted in person; the other five took place by telephone.

Over 100 executives were contacted in obtaining the 46 interviews. A larger original pool was required because of the need to find joint ventures that satisfied methodological constraints. Companies agreed to participate in the research in approximately 90 per cent of cases where the interviewer was able to establish that the companies’ venture fitted the sample design. These core ventures were all between either American, British, or Canadian MNEs and local, private firms. Ten of the twelve joint ventures were located in the Caribbean, with most of these in a single country. The core ventures were concentrated in two sectors. There were both high- and low-performing ventures in each sector. Even though this required a longer search for companies, holding industry and country constant was considered an important step in reducing the number of rival explanations of joint-venture performance. All of the joint ventures in these industries were sampled. The research used structured interviews and a self-administered questionnaire. These questionnaires were administered with the researcher present so that questions could be immediately clarified. This also permitted the checking of responses to ensure consistency with comments made earlier in the interview.

The sample of joint ventures was not a random sample of the joint ventures in the region. A stratified sample of joint ventures between foreign private and local private firms, primarily in one country, was used.

Average sales for the venture were US $4.5 million, and all of the twelve ventures had sales between US $1 million and $10 million. There was no correlation between sales and performance. Five of the ventures sold to both industrial customers and consumers; two, to industrial customers only; and five, to consumers only. Half of the joint ventures exported, with no correlation between exporting and performance.

Average market share for the core ventures was 42 per cent, with a high standard deviation. There was no correlation between market share and joint-venture performance. The joint ventures were formed between 1959 and 1978 and had been in operation an average of 11.5 years. There was no correlation between age and performance.

None of the core ventures had effective monopoly positions. Either local manufacturing competition existed or tariffs were low enough to allow competitive import. The MNE held a minority equity share in five of the twelve ventures. Half of the core ventures exported (up to 25 per cent of sales), with no correlation between exporting and performance.

The basis for the measure of success used in this study was the long-term viability of the joint venture. Performance of the joint ventures was measured by a managerial assessment in which only when both partners were satisfied was the venture considered successful. If one or both partners were dissatisfied with the performance, the venture was conside...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright

- Dedication

- Contents

- List of Tables

- Preface

- 1. Introduction

- 2. Characteristics of Joint Ventures

- 3. Partner Selection and Performance

- 4. Commitment

- 5. A Management Guideline for Joint Ventures in Developing Countries

- 6. Joint Venture General Managers

- 7. Equity Joint Ventures and the Theory of the Multinational Enterprise

- 8. Investing in China via Joint Ventures

- 9. Joint Ventures in China: Legal Implications

- Appendix 1: Partial List of Firms Contacted

- Appendix 2: Management Case Studies of Joint Ventures in LDCs

- Bibliography

- Index