![]()

Part 1

An Overview

![]()

Chapter 1

Doing International Business: A Global Overview

V. H. (Manek) Kirpalani

The world marketplace is receiving increasing attention from governments and business. Exports have been growing faster than gross world product as the world becomes more interdependant. Products and services from abroad are flooding into most national domestic markets. It is becoming obvious to all businessmen that they have to become more aware, and if necessary take participative action in this tidal wave of foreign commerce and investment.

The international businessman must know the dimensions, structure, and potential of the foreign economies with which he wishes to do business and of the international marketplace. He has to have a clear picture of international trade and the reasons why trade flows between nations occur. Furthermore, it is crucial that he properly understands what is causing change in the world marketplace and in nations. This comprehensive knowledge is essential for the strategy, planning, and commitment of international business effort. It is the basis for optimal performance and choice of foreign markets. Accordingly, this first chapter gives a global overview of doing international business; strategy and management are dealt with after delineating the environment. The chapter starts with international influences affecting nations, then covers the environment for international business, including the important topics of consumer behavior for international business and business behavior. It proceeds to outline international business opportunities and sources of information, and the emphasis then shifts to practical methods of entry into the arena, conflict areas, and ways of resolving such conflicts. Finally, it explains how effective corporate strategies, planning, organization, and control have resulted in success. So, the international business manager can profit from knowing how others have done such business.

INTERNATIONAL INFLUENCES AFFECTING NATIONS

These influences emanate from three basic sources: trade, capital flows, and international agreements.

International Trade

About 20% of gross world product (GWP) is internationally traded. Five basic causes are influencing the massive growth in international trade, which is increasing at a trend rate of 7% a year, compared with the world economy’s growth rate at about half this pace. These causes are likely to maintain the continued growth of world trade. The five basic causes are outlined without order of priority because they are interlinked: (a) Government decisionmakers and multinational corporations (MNCs) realize that international trade based on comparative advantage is a major stimulant to economic growth, (b) The technological improvement in the efficiency of production processes often results in an economic output level that cannot be absorbed by single nation markets, (c) Production is internationalized on a worldwide scale. (d) Global shopping center markets for many products have grown since rising affluence has brought relatively similar standards of living across large parts of the world economy, (e) Large MNCs have proliferated whose revenues are greater than the economies of most countries, and whose cash flow is far higher than most governmental budgets.

The automobile industry can be used to illustrate. In the context of what has been stated above, it is interesting to note that General Motors (GM) has been involved in international business since the corporation’s formation in 1908. By 1920 GM had successfully entered the competitive European auto market. Mass production techniques in the U.S. had lowered costs compared to the European manufacturers’ low volume and high unit costs. Today, GM operates worldwide with many auto and component plants manufacturing abroad. Not only has it internationalized its production, but a worldcar has been developed. This auto, using standard components, is being sold in many countries.1 Thus GM, a present-day giant MNC whose annual revenues of close to $120 billion are larger than the Gross National Product (GNP) of all but 15 countries in the world, has taken advantage of the global shopping center and technological efficiency of its production processes. Where advantageous, it has formed joint ventures, for example, with Toyota in the U.S. for small car development expertise. Furthermore, it has internationalized its production and, driven by the search for comparative advantage, has sought out cheaper cost locations. Many small companies have also globalized their operations. Pierre Cardin has clothes made of his design in countries like Hong Kong and India where manufacturing is cheaper. He now puts his name on many other products, such as belts, ties, and shoes. His products are marketed in all countries of the Western world and quite a few other relatively affluent lands.

Trading Patterns

World trading patterns have changed considerably in the past 20 years. In 1970 there was nearly twice as much trans-Atlantic as trans-Pacific trade. Today it is about the same. The major cause of this shift is the impact of U.S. imports. The U.S. has become a huge importer, gobbling up 63% of the growth of world imports in the mid 1980s, with the rest being relatively equally shared between Western Europe, Southeast Asia, Japan, and others. Japan and Southeast Asia have been the main beneficiaries. In the mid-1970s the U.S. took only 23% of world import growth, with 50% being taken by Western Europe.2

Japan and West Germany vie as the world’s largest exporters of manufactured goods. Some 50% of West German exports go to the Common Market, whereas Japan seeks outlets everywhere. But the Western World is not about to stop Japan, which has become a world lender of a size unparalleled since Britain in the nineteenth century and America in 1920-1982. Much of this lending is to the U.S. which has a huge trade deficit that in 1987 amounted to about $150 billion.

The U.S. has been going into external trade debt faster than any other major industrialized country has ever done before. A fall in the value of the dollar is not an answer. The dollar has dropped by more than 40% against the Deutsch Mark and the Yen since its peak in February, 1985. But Europe and Japan account for only 40% of U.S. trade and little more than half its trade deficit. Almost all the balance of the latter comes from four Asian newly industrializing countries (NICs), Canada, and Latin America. The currencies of the NICs and Canada are basically unchanged against the dollar, but those of Mexico and others in Latin America have sharply devalued by more than enough to compensate for the dollar’s fall.

The U.S. trade deficit may well persist, although on a smaller scale, into the 1990s. It may not need to vanish if the U.S. can maintain a surplus on services trade and continue to attract a flow of foreign capital. The U.S. government seems to recognize that a long-term global solution must be found. Parties to the General Agreement on Tariffs and Trade (GATT) are pledged to bring services within their purview. This is an important step that will slowly lead to reduction of barriers to the international flow of services. This is vital for the Western industrialized world where manufacturing now accounts for only about a quarter of all jobs. This is also vital for the less developed countries (LDCs) which, by and large, are entering the manufacturing phase and lack the support of sophisticated services, particularly technology, finance, and transportation.

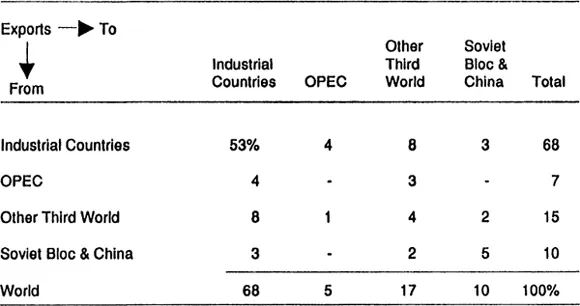

The world’s largest trader is the Common Market. Table 1 is broadly descriptive of who trades with whom, and Table 2 shows merchandise exports and imports by major trading region/country. It should be realized that the Common Market trade has expanded precisely because it is a Common Market; the more it becomes one market without barriers, the more its trade is likely to increase. Netherlands trade is so high precisely because Rotterdam is the largest port in Europe and much of Europe’s imports and exports flow through it. As these products cross Netherlands boundaries they are registered as imports and exports. The same is true for Belgium with its major port, Antwerp.

Table 1-1 1986: Who Markets to Whom (Percentages of World Exports = 100)

Source: Adapted from data in U.N. Statistical Yearbooks, U.N. Monthly Bulletin of Statistics (various issues).

Trade in Services

The global market for services is difficult to measure. It has been estimated that one-quarter of world trade is made up of services and is therefore “invisible.”3 Recently some 26% of this was receipts from an amalgam of services, the principal of which was probably technology transfer, 32% from international banking and charges on transfers of investment income, 19% from tourism, and 23% from transport.

Services trade is dominated by the industrial countries that regularly run a large surplus. This is probably underreported due to lack of adequate statistics, although OPEC and the LDCs show big deficits.

Opportunities for the international transfer of technology/skills are continuously escalating as countries become richer and desire ever more economic growth. Global research and development (R & D) is highly unbalanced. Just six countries, the U.S., U.K., France, Japan, U.S.S.R., and West Germany, account for nearly 85% of all R & D spending. Relatively recently, GM and IBM each spent more on R & D than India, Spain, and South Korea combined. The industrialized countries generate 90% of the new technology in the world and 90% of this is traded among these countries themselves.4 A high proportion of that trade occurs within the intra-company network of MNCs. Expertise has been one of the fastest growing items within the world marketplace and this will continue. Although LDCs account for only 10% of all technology trade, virtually all of that is imported. LDCs increasingly recognize that the critical resource for the productive utilization of land, labor, and capital is knowledge. Moreover, technology/skills are essential catalysts during the change of traditionally static societies into those capable of rapid growth. North-South technology transfer is vital to their growth and, from an international businessman’s viewpoint, vital to peaceful coexistence.

Table 1-2: World Trade by Regions and Selected Countries (1986: Billion Dollars)

| Regions | Exports (f.o.b.) | Imports (c.i.f.) |

| World | 2166 | 2250 |

| Industrial Countries | 1463 | 1529 |

| Oil Exporters | 118 | 93 |

| Non-Oil LDCs: | 371 | 416 |

| Centrally Planned Economies: U.S.S.R. & Europe | 184 | 172 |

| Centrally Planned Economies: Asia | 30 | 40 |

| Selected Countries | | |

| U.S. | 217 | 387 |

| West Germany | 243 | 191 |

| Japan | 210 | 128 |

| France | 124 | 129 |

| U.K. | 107 | 126 |

| Italy | 98 | 99 |

| U.S.S.R. | 90 | 78 |

| Canada | 90 | 85 |

| Netherlands | 79 | 75 |

| Belgium | 69 | 69 |

| Sweden | 37 | 33 |

| Switzerland | 37 | 41 |

| South Korea | 35 | 32 |

| Hong Kong | 35 | 35 |

| China | 30 | 40 |

| Brazil | 22 | 16 |

| Singapore | 22 | 26 |

| Saudi Arabia | 20 | 25 |

| South Africa | 18 | 13 |

| Indonesia | 15 | 11 |

| Nigeria | 13 | 9 |

| Poland | 12 | 12 |

| Iran | 7 | 11 |

| Kuwait | 7 | 6 |

| India | 6 | 8 |

Source: U.N. Monthly Bulletin of Statistics (various issues), IMF International Financial Statistics (various issues).

International trade in financial services is escalating. Much of the OPEC surplus on current account went into the Eurocurrency markets; national currencies deposited outside their own borders. Many unidentified funds also found their way into Eurocurrency markets as well. Almost every major bank in the world is an international bank. Today, half of the Bank of America’s deposits are foreign, as are 75% of Citicorp’s. In the 1980s, the main international banks had foreign deposits of over $1,000 billion, representing roughly half of world export revenues today. The Eurocurrency market is unregulated and a 2-3% profit on $1,000 billion translates into $20-$30 billion in earnings, but the market is overlent. Only 20 LDCs account for more than 80% of Eurocurrency borrowing and five of these for over 40%. Thus international banks have unhealthily concentrated loan portfolios, and some borrowers have stretched their debt-servicing facilities to the limit. International businessmen in Brazil, for example, should know that Brazil’s oil imports and interest payments cost over 65% of its export earnings.5

Two polarized scenarios pinpoint the present dilemma. In the first, lending dwindles with concomitant defaults. The LDCs will buy less goods from the industrialized countries and the rich countries will stagnate. In the second, politicians in rich countries, unwilling to impose austerity, will encourage their banks to provide plenty of liquidity both at home and to the LDCs. The resulting inflation, with its attendant disruptions, will end up paralyzing the international capital flows upon which everybody’s trade and prosperity depend. The way out is to strengthen the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (World Bank), and many nations will have to accept a bearable slowdown in the growth rate of their economies while money supply is brought under cont...