- 96 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

What are the determinants of company performance? This book explores this question, providing a balanced assessment of new and old approaches to industrial organization.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Market Structure and Performance by J. Cubbin in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

1. BAIN’S METHODOLOGY

The study which has set the standard for research in this field is Joe S. Bain’s Barriers to New Competition [6] which was the culmination of work through the 1940s and into the fifties conceived originally under the leadership of E . S. Mason2 [127]. The time scale of this endeavour reflects the effort put into refining concepts and critically appraising data that was not always present in later empirical research attempting either to build on Bain’s contribution or to demolish it.

For example, Bain’s original sample contained only 20 industries out of a total list of 452; and this limits the reliability of any general conclusions drawn from the sample, as Bain himself acknowledges. This limited sample size arose from two considerations. The first was the need to choose industries listed in the Census of Manufacturers which corresponded to the Chamberlinian notion of a product group. The “industry” may consist of firms producing goods which are not close substitutes since the industry definition may be based on the technology used rather than products produced. Similarly, the “industry” may not contain products which are close substitutes in consumption although not in product (for example plastic and steel buckets).

The second consideration was the great deal of detail that Bain explored in order to classify his industries. “First, a lengthy preliminary survey was made of each industry, to provide the author with an orientation of its characteristics and a knowledge of the conspicuous blanks in existing information. Second, a detailed set of questions was designed for each industry in turn, to elicit information bearing on the condition of entry therein. Each industry was favoured with a separate and special list of questions, and no general purpose questionnaire was used. The questions generally involved some detailed reference to the specific characteristics of individual industries, and were grouped to refer separately to economies of scale, product differentiation, advantages of established firms, and their absolute cost advantages.”

Thus, in the trade-off between numbers of observations and quality of data, Bain chose the latter.

Bain assigned each industry in his sample to one of three categories: substantial; moderate to high; and low barriers to entry. He examined the relationship between high concentration and profitability in each of these categories, and found this to be significant only where barriers to entry were “substantial”. The relationship was not continuous; it appeared there was a critical (8-firm) concentration ratio of 70 per cent, implying (in terms of the S-C-P paradigm) a sudden switch in behaviour between collusion and competition. These results appeared consistent with the theoretical framework which suggests that both high concentration and barriers to entry are necessary to maintain a collusive equilibrium.

Bain’s work was a major pioneering achievement in the study of industrial organisation. Although he conceded that a sample of 20 industries was too small to draw reliable general conclusions, it was a big improvement on the “one, two or three industries that have constituted the apparent empirical reference of numerous past generalisations in the area under study.”

The developments of Bain’s work can be viewed as attempts to remedy the two major weaknesses — small sample size and subjectivity. The problem with Bain’s technique of evaluation by interview and questionnaire is the element of judgement in assigning industries to entry barrier categories. There may be a subconscious tendency to assign to the “substantial” entry barrier category industries which are known (or thought to be) profitable. This is a well known problem in the methodology of science and is dealt with, for example in medical research, by the use of “double blind” trials where neither the experimenter nor the subject knows whether a certain treatment is being applied. Economists have so far made little use of this technique, partly because it is much more difficult to apply in a non-experimental setting.

The problem of subjective categorization can be dealt with by the substitution of objectively-measured numerical data. For instance the economies of scale entry barrier might be measured by a combination of the ratio of minimum efficient scale to industry output and the cost penalty to suboptimal output levels. The use of such “objective” measures obviates the need for lengthy questionnaires and enables the sample size to be increased.

However, it does not eliminate all subjective choices. Probably the most critical are of subjective choice that remains is in sample industry selection; does an officially designated industry correspond to the notion of a Chamberlinian interdependent group? If this criterion is relaxed more industries can be included but there is an increasing tendency to be over or under-inclusive. Variables will be measured with more error and estimates of the effect of concentration will be biased downwards. This subjectivity seems to act very strongly in this area, and there seems to be a close correspondence between researcher’s prior policy beliefs and their empirical findings. One of the most difficult tasks in surveying this field is to filter out these subjective elements. Before we can attempt this task it is necessary to consider some of the details of the conceptual framework.

2 For a brief history of the field see Shepherd (ch 2) [169].

2. THE THEORETICAL BACKGROUND

Although this monograph is concerned largely with the empirical literature some theoretical discussion is necessary for its proper evaluation. For a more detailed exposition of many of the matters dealt with here the interested reader is referred to [35], [188], [161] [183] or indeed the monograph by Fudenberg and Tyrole [78] in this series.

Bain identified two major features of markets as responsible for determining performance within a market — concentration and entry barriers. His theoretical work, however, was much more concerned with the latter than the former and his contributions here are still central to contemporary analysis.

In recent years, however, it has come to be recognised [138], [63] that properly conceived, entry barrier theory is really a branch of oligopoly theory and that it is necessary to model the interdependencies between incumbents and potential entrants.

2.1. Economic performance

Industrial performance is a concept which has largely been left rather vague, but clearly refers in some sense to economic welfare. The assessment of performance almost inevitably requires both a measuring system (or metric) and a base from which to carry out the measurement. The problems of measuring almost any kind of economic welfare are well known and should be taken as implicit qualifiers to the following.

Two alternative bases of measurement suggest themselves. One possibility is the aggregation of producers’ and consumers’ surplus generated by the industry, and represents an answer to the question “How much worse off would society be if this industry did not exist?” Whilst one might conceive of some sort of answer to this question using partial equilibrium analysis for the video games industry, for example, in general any attempt to do this for such a core industry as automobiles is fraught with difficulties. Even if a credible figure could be arrived at for one industry the task of doing so for a wide range of industries would be a mammoth undertaking, and in any case it is not clear for what purpose such a measure would be useful.

An alternative basis for measurement, and the one used in practice, is the competitive norm. The ultimate motivation for this is the notion of the Pareto optimality of a full competitive equilibrium even though it is widely recognised that for any one industry in a imperfect economy the competitive outcome is unlikely to be the second best standard. However since we do not have the means to calculate this “second best” solution the competitive norm is our best practicable basis.

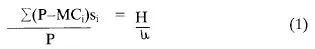

An example of this approach is provided by Dansby and Willig [1] 3 [59] whose proposed indices are for the purpose of directing government intervention into conduct. Their approach is partial equilibrium and marginalist. Specifically, the increment to welfare from producing an extra unit of output is the gap between price (= consumers’ marginal willingness to pay) minues marginal cost (= opportunity cost of marginal resources foregone). Using base prices as scaling factor this immediately suggest the Lerner Index Σ(Pi — MCi)/Pi as the “performance gradient index” for firm i. This leaves the problem of aggregating across firms. Weighting firm output adjustment by the unit price of each firm leads to the “industry performance gradient”

Ø = [Σ((Pi−MCi/Pi)2]1/2

which is one way of generalising the Lerner index to multiple-firm industries. Furthermore Ø will, in certain circumstances, be closely related to measure of concentration, depending upon the type of conduct characterising the industry. For example, in a Cournot industry Ø = 1/η√H where η is the industry demand elasticity and h is the Herfindahl index of concentration, whereas in an industry with n firms maximising joint profits with a fringe of competitive firms then

Ø= (√n/η)CRn

where n is the n-firm concentration ratio.

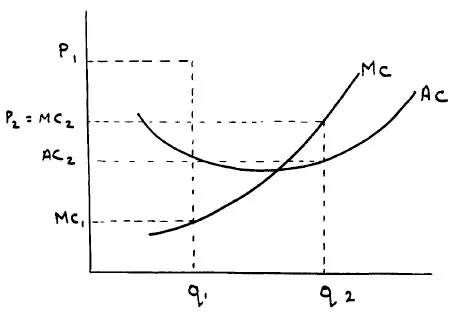

The underlying presumption behind these indices is that, at least in the first instance, correction of misallocation is best carried out by expanding the outputs of existing firms. However, Figure 1 shows an example where the Dansby and Willig measure fails to indicate the need for industry expansion.

Let the industry price be Pi initially and output of a representative firm be q1. Welfare is improved by an expansion of output to q2 which will lead to a fall in price to P2. Industry output should still be expanded, although not by the expansion of existing firms, but rather by the entry of new firms. This is measured by P2-AC2, the price — average cost margin, and under the assumption of produce homogeneity this is measurable by the rate of return [2]4

In summary, there are two margins at which output can be expanded, the intra-firm and the inter-firm, and as a rule of thumb we can say that Lerner-type indices measure the former and rates of

return the latter. Furthermore, as we discuss below the former are proximately determined by the degree of collusion whereas the latter are more closely related to the height of entry barriers, and these are discussed in turn in the following sections.

2.2. Oligopoly theory and the effects of concentration

Within oligopoly theory, the Cournot [44] model still holds sway as a standard of comparison. Its appeal is fourfold: i) by assuming quantitysetting behaviour and homogenous products it facilitates comparison with monopoly and perfectly competitive outcomes; ii) the solution has the game-theoretic property of a Nash equilibrium; iii) it predicts a continuous monotonic relationship between concentration and the deviation from the competitive outcome, with the latter as the limiting case for large numbers, and the standard monopoly result emerging when there is only one firm; iv) it dictates the use of a particular concentration measure, thus apparently eliminating a major problem for the empirical researcher. The paper which was most influential in gaining recognition for these merits is by Cowling and Waterson, whose conclusions may be summarised as follows.

Given an N firm homogeneous oligopoly, where firms have different cost functions, the Cournot oligopoly outcome is one in which

Where P = “industry” priceMCi = marginal cost of the ith firmSi = Market share of the ith firmη = industry elasticity of demandH = Herfindahl-Hirschman index of market concentration = ΣniS2i

If one then makes the further assumption that each firm operates in a region of constant returns to scale that MCi = average cost of firm i then equation (1) can be rewritten as

where π and R are the industry aggregate (economic) profits and revenue. The acid test of such a model — derived explicitly for empirical purposes — is its empirical support, which we shall be examining later. However, the Cowling and Waterson paper was widely adopted as powerful expression of the structure performance paradigm, having the considerable virtues of both elegance and precision.

Equation (2) shows an apparently fundamental strutural relationship between concentration and profits where “behaviour” or “the solution concept” is held constant. Cowling and Waterson also amended their fundamental equation to allow for systematic variations in behaviour with concentration using the concept of conjectural variations. To be specific consider a firm’s profit function

π = p(qi + Σqj) − c(qi) (3)

Th...

Table of contents

- Cover

- Half Title

- Fundamentals of Pure and Applied Economics

- Title Page

- Copyright Page

- Original Title Page

- Original Copyright Page

- Table of Contents

- Introduction to the Series

- Market Structure and Performance - The Empirical Research

- 1. Bain's Methodology

- 2. The Theoretical Background

- 3. Theoretical Concepts Versus Empirical Constructs

- 4. Econometric Problems

- 5. The Determinants of Market Structure

- 6. The Mainstream Tradition - Empirical Results

- 7. Concentration, Wages and Unionization

- 8. Market Structure and Performance - The Key Issues

- 9. The Persistence of Market Power and Profitability

- 10. Summary and Conclusions

- Acknowledgements

- Bibliography and References

- Index