- 468 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Financial Systems of India

About this book

This is Volume II in a series of eleven on India: History, Economy and Society. Originally published in 1926, the object of the book is to describe and examine the working of the Indian Financial System.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Financial Systems of India by Gyan Chand in PDF and/or ePUB format, as well as other popular books in Social Sciences & Ethnic Studies. We have over one million books available in our catalogue for you to explore.

Information

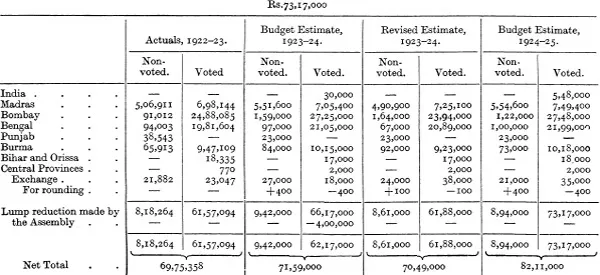

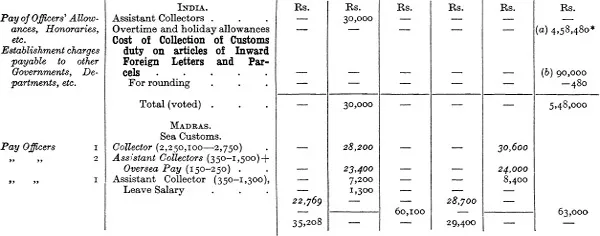

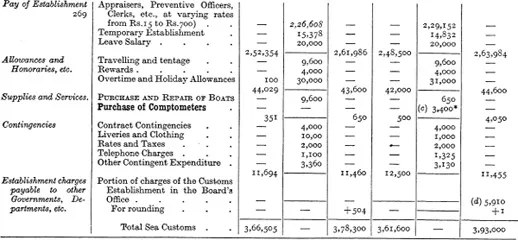

APPENDIX III

SPECIMEN OF A DEMAND

DEMAND NO. 1

CUSTOMS

New items of expenditure are printed in thick type.

Such of the items as have received the approval of Standing Finance Committee are marked with asterisk.

Not-voted items are printed in italics.

APPENDIX IV

RULES GOVERNING THE EXPENDITURE POWERS OF THE GOVERNMENT OF INDIA

Resolution from the Government of India, Finance Department, No. 1448–E.A., dated 29th September, 1922, as modified by resolution No. 518, Ex., dated the 2nd March, 1923:

His Majesty’s Secretary for India in Council has been pleased to make the rules appended to this resolution, defining the classes of expenditure from central revenues upon subjects, other than provincial subjects, which the Governor-General in Council may not sanction without the previous consent of the Secretary of State in Council. These rules supersede all previous rules of a similar nature and, subject to their observance, orders regarding specific cases of expenditure passed by the Secretary of State in Council under regulations previously in force will no longer be binding.

“2. If the sanction of the Secretary of State in Council is required by these rules to any expenditure, such sanction should ordinarily be obtained before the Legislative Assembly is asked to vote supply to meet the expenditure. The Governor-General in Council may depart from this rule in cases of extreme urgency, where the time available is so short that sanction cannot be obtained by telegraph; but in such a case a statement showing all schemes for which supply has been asked before sanction has been obtained must be submitted to the Secretary of State as soon as possible after the presentation of the demands to the Assembly.

“3. The Governor-General in Council may sanction an excess over an estimate which has, prior to the introduction of these rules, received the sanction of the Secretary of State in Council if the total cost of the estimate, as increased by the excess, is within the powers of sanction conferred upon the Governor-General in Council by these rules; and may sanction the extension of a temporary post which has received similar sanction if he would, under these rules, be competent to sanction the creation of such a post for the full term as extended.

“4. Subject to observance of these rules and to the provisions of Section 67 A of the Government of India Act, the Governor-General in Council has full power to sanction expenditure from central revenues upon subjects other than provincial subjects and, with the previous consent of the Finance Department, to delegate such power upon such condition as he may think fit either to any officer subordinate to him or to a Local Government acting as his agent in relation to a central subject. Any sanction given under this rule will remain valid for the specified period for which it is given, subject in the case of voted expenditure to the voting of supply in each year. Orders of delegation passed under this rule may contain a provision for delegation by the authority to which the powers are delegated.”

ACCOMPANIMENT TO THE ABOVE RESOLUTION

Rules relating to expenditure by the Government of India on subjects other than provincial.

The previous sanction of the Secretary of State in Council is necessary:—

(1) To the creation of any new or the abolition of any existing permanent post, or to the increase or reduction of the pay drawn by the incumbent of any permanent post, if the post in either case is one which ordinarily be held by a member of one of the services named in the schedule, or to the increase or reduction of the cadre of any of those services or of a service ordinarily filled by officers holding the King’s Commission.

(2) To the creation of a permanent post on a maximum rate of pay exceeding Rs.1200 a month, or the increase of the maximum pay of a sanctioned permanent post to an amount exceeding Rs.1200 a month.

(3) To the creation of a temporary post, on pay exceeding Rs.4000 a month, or the extension beyond a period of two years (or, in the case of a post for settlement operations, of five years) of a temporary post or deputation on pay exceeding Rs.1200 a month.

(4) To the grant to any Government servant or to the family or other dependents of any deceased Government servant of an allowance, pension or gratuity which is not admissible under rules made or for the time being in force under section 96 B of the Government of India Act, or under Army Regulations, India, except in the following cases:—

| (a) | Compassionate gratuities to the families of Government servants left in indigent circumstances, subject to such annual limits as the Secretary of State in Council may prescribe; and |

| (b) | pensions or gratuities to Government servants wounded or otherwise injured while employed in Government service, or to the families of Government servants dying as the result of wounds or injuries sustained while employed in such service, granted in accordance with such rules as have been or may be laid down by the Secretary of State in Council in this behalf. |

(5) To any expenditure on a measure costing more than Rs.5,00,000 (initial plus one year’s recurring) and involving outlay chargeable to the Army or Marine estimates.

(6) (a) To any expenditure on the inception of a Military Rorks project which is estimated to cost more than Rs.10,00,000.

(b) To any expenditure on a Military works project in excess of the original sanctioned estimate if,

| (i) | the excess is more than 10 per cent of the original sanctioned estimate, and the estimated cost of the project thereby becomes more than Rs.10,00,000. |

| (ii) | The original estimate has been sanctioned by the Secretary of State, and the excess is more than 10 per cent of that estimate or more than Rs.10,00,000. |

(c) To any expenditure on a Military works project, in excess of a revised or completion estimate sanctioned by the Secretary of State.

Provided that, for the purposes of clauses (b) (ii) and (c) of the rule, if any section accounting for 5 per cent or more of the estimated cost of a project sanctioned by the Secretary of State is abandoned the estimated cost of the works in that section shall be excluded from the sanctioned estimate of the project for the purpose of determining whether the Secretary of State’s sanction is necessary.

(7) To any expenditure on the purchase of imported stores or stationery, otherwise than in accordance with such rules as may be made in this behalf by the Secretary of State in Council.

(8) To any expenditure, otherwise than in accordance with such rules as have been or may be laid down in this behalf by the Secretary of State in Council, upon—

| (a) | the erection, alteration, furnishing, or equipment of a church; or a grant-in-aid towards the erection alteration, furnishing or equipment of a Church not wholly constructed out of Public Funds; or |

| (b) | the provision of additions to the list of special saloon and inspection railway carriages reserved for the use of high officials; or |

| (c) | the staff, household, and contract allowances, or the residences and furniture provided for the use of the Governor-General; or |

| (d) | railways. |

2. The foregoing rules do not apply to expenditure in time of war with a view to its prosecution. The Government of India have full powers with regard to such expenditure, subject only to the general control of war operations which is exercised by the Secretary of State for India in consultation with His Majesty’s Government; to the necessity of obtaining the sanction of the Secretary of State in Council to really important special measures required to carry out those operations, where in the judgment of the Government of India time permits a previous reference to him and to the obligation to keep as fully informed as circumstances allow of their important actions.

The Schedule

| (1) | Indian Civil Service. |

| (2) | Indian Police Service. |

| (3) | Indian Forest Service. |

| (4) | Indian Educational Service. |

| (5) | I... |

Table of contents

- Cover

- Title

- Copyright

- Contents

- PREFACE

- FOREWORD

- I. INTRODUCTION

- II. FINANCIAL STRUCTURE

- III. PREPARATION OF ESTIMATES

- IV. ESTIMATES IN THE LEGISLATURES

- V. RELATIONS OF CENTRAL AND PROVINCIAL FINANCE

- VI. COLLECTION OF REVENUES

- VII. ESTIMATES IN OPERATION

- VIII. WORKING OF THE TREASURY SYSTEM

- IX. BALANCES AND RESOURCE OPERATIONS

- X. PUBLIC ACCOUNTS

- XI. AUDIT OF PUBLIC ACCOUNTS

- XII. PUBLIC DEBT

- XIII. LOCAL FINANCE

- XIV. CONCLUSION

- I. EXTRACT FROM THE GOVERNMENT OF INDIA ACT

- II. EXTRACT FROM THE DEVOLUTION RULES—FINANCIAL ARRANGEMENTS

- III. SPECIMEN OF A DEMAND—DEMAND NO. 1 OF THE LIST OF DEMANDS SUBMITTED TO THE LEGISLATIVE ASSEMBLY IN 1924–25

- IV. RULES GOVERNING THE EXPENDITURE POWERS OF THE GOVERNMENT OF INDIA

- V. TREASURY ORDERS

- VI. LIST OF MAJOR HEADS OF REVENUE AND EXPENDITURE

- VII. RULES GOVERNING THE ALLOCATION OF RAILWAY EXPENDITURE BETWEEN CAPITAL AND REVENUE

- VIII. AUDITOR-GENERAL’s RULES

- IX. SEPARATION OF RAILWAY FROM GENERAL FINANCE

- X. ALLOCATION OF REVENUES BETWEEN THE CENTRAL AND THE PROVINCIAL GOVERNMENTS

- CHIEF REFERENCES

- Index