eBook - ePub

Available until 8 Dec |Learn more

Econometrics (Routledge Revivals)

A Varying Coefficients Approach

This book is available to read until 8th December, 2025

- 372 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Available until 8 Dec |Learn more

About this book

Originally published in 1981, this book considers one particular area of econometrics- the linear model- where significant recent advances have been made. It considers both single and multiequation models with varying co-efficients, explains the various theories and techniques connected with these and goes on to describe the various applications of the models. Whilst the detailed explanation of the models will interest primarily econometrics specialists, the implications of the advances outlined and the applications of the models will intrest a wide range of economists.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Econometrics (Routledge Revivals) by Baldev Raj,Aman Ullah in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

Part One

Single Equation Varying Coefficient Models

1. Introduction

1.1 PREAMBLE

Econometric model building is concerned mainly with statistical inference of such behavioural economic relationships as the consumption and investment functions, wage equations and the production function. The econometric methods employed to estimate economic relationships often assume that the regression coefficients do not change from observation to observation. The assumption that the coefficients are fixed is restrictive and sometimes even unnecessary. Consider, for example, the regression of the quantity demanded of a certain commodity on its price. If time series data are used on these variables, it is quite likely that the price elasticity of demand will not remain the same over the sample period.

Similarly, in a cross-section study of the production function of firms, labour and capital elasticities might vary from small firms to large firms due to economies of scale, managerial abilities, etc. In another example of a regression relationship between savings and incomes of a sample of households, the marginal propensity to save is likely to differ for each household because of different average ages and wealth holdings. This indicates that the assumption of fixed coefficients in modelling economic relations is restrictive and that a more flexible approach to econometric modelling requires that regression coefficients vary from observation to observation.

1.2 CAUSES OF COEFFICIENT VARIATION

Essentially, an econometric model is an approximation of reality and as a result is subject to a number of misspecifications such as the exclusion of relevant variables, a wrong choice of functional form, etc. These lead to a variation in coefficients. Five of the main causes for such variation are discussed below.

(i) Coefficient Variation due to Omitted Variables

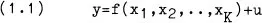

Consider an econometric relationship

where y is (say, linearly) related to a set of explanatory variables. The error in regression u captures the influence of the omitted explanatory variables which are normally assumed to have a minor effect on the dependent variable. However, the omitted variables may be more significant than assumed. Then it is clear that the regression relationship needs to be respecified by including the significant omitted variables. This may not always be possible, however, because of the limitation of the number of observations and hence the degrees of freedom. If so, their inclusion may actually reduce the explanatory power of the model. Variables, moreover, may have to be omitted because of problems of measurement.

Often an alternative is to assume a first order autoregressive process for u, that is, u=ρ u−1 + v, where the subscript −1 represents a lagged value of u and the v is a serially uncorrected error. The problem with this alternative is that even though the incorporation of this may change the value of a coefficient it...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Original Copyright Page

- Table of Contents

- List of Tables and Figures

- Preface

- One: Single Equation Varying Coefficient Models

- Two: Multi Equations Varying Coefficient Models

- Appendix A

- Bibliography

- Authors Index