1 Goodwill: Meaning and Relevance

THE HIDDEN VALUE OF ENTERPRISES

Goodwill is the part of the enterprise value that does not appear in financial statements but that emerges only when acquired (individually or in a business combination). It is a hidden value that, generally, the accounting standards define in the following way (in particular, see accounting standards SFAS 141, SFAS 142 and IFRS 3):

- the value of the future economic benefits;

- arising from assets that are not individually identified and separately recognized.

The internally generated goodwill (also known as going-concern goodwill) cannot be recognized by the accounting and recorded as an asset into the enterprise capital. However, at the same time, goodwill has become more and more relevant, because the origin of the value created by firms has gradually moved towards the economic phenomena of intangible nature. Goodwill is the synthesis, sometimes ambiguous and often very volatile, of just such phenomena. All that is enough to state that:

- goodwill weighs in a more and more relevant way on the overall enterprise value;

- goodwill is a value not easy to interpret and/or quantify; it needs to be analyzed and expressed through a theoretically reliable and sufficiently structured approach.

This first chapter deals with some introductory matters, functional for the later development of the book. In particular, this chapter is concerned with the following issues:

- the economic nature of goodwill, namely the existing relationship between goodwill and enterprises’ abnormal earnings;

- the relationship between the goodwill value and firms’ objectives;

- the link between goodwill and enterprises’ intangible resources;

- finally, the rules established by the international accounting standards for the accounting of the goodwill, when business combinations occur.

THE ECONOMIC NATURE OF GOODWILL

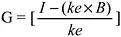

To understand the economic nature of goodwill, it is necessary to introduce some basic notions about its determination. These preliminary considerations will be developed by assuming some simplifications concerning the adoption of a generic configuration of perpetual expected income, the hypothesis of an unlevered enterprise and the use of a single rate ke (cost of equity). More realistic discussions about evaluation methods will be provided in the second chapter. According to a theoretical definition, goodwill is equivalent to the capitalization of the abnormal earnings flows expected by the firm (Schmalenbach 1908, Zappa 1910, Besta 1922, Hatfield 1927),

G: goodwill

I: perpetual expected earnings flows

ke: cost of equity

B: equity book value

I —(ke×B) : abnormal earnings

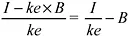

In this way, goodwill is directly evaluated through the capitalization of the abnormal earnings flows, which have to be intended as higher than the normal remuneration of the equity capital, given a specific configuration of an enterprise’s risk. It is also possible to reach the goodwill value through a different approach, known as the indirect method. In fact, since the goodwill is a component of the overall enterprise value, given VE the economic value of equity, it will be:

VE = B + G

from which it is possible to infer that goodwill is also determinable through a differential approach as:

G = VE—B[1.2]

The value of goodwill, determined in this way (indirect approach), is more meaningful the more the accounting value of B has been adjusted and expressed at current value, in particular with respect to manufacturing facilities, plant, equipment, warehouse, investment in associates, fixed interest securities and deferred debts and credits. It is easily demonstrated that the value reached with both methods (direct and indirect) is the same. In fact, the preliminary hypothesis being unchanged, the VE value is equal to the capitalization of the total expected earnings flows. That is

By comparing the two different evaluation approaches of goodwill, the following result is obtained:

and, therefore, it is possible to confirm the similarity of the two procedures:

It is interesting to remark the nature of the link between the economic value of the firm’s equity and the profitability associated with it. In fact, just as the total value of VE is broken down into two different values (B and G), so the underlying earnings values are split into two flows: an average normal earnings flow and an abnormal flow:

I = In + Ia[1.4]

where:

In: average normal flow

Ia: abnormal flow

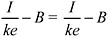

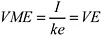

While Ia is determinable through the relation [I —(ke×B)], In is the average normal remuneration implicit in the equity book value, B. The example that follows is based, as mentioned at the beginning of this section, on the hypothesis of an unlevered firm (Figure 1.1).

Figure 1.1 Economic value of equity, average normal earnings and abnormal earnings.

I: perpetual expected earnings flow = 10

ke: cost of equity = 0.1

VE: economic value of equity = 100 = (10/0.1)

B: equity book value = 60 = assets value

Ia: abnormal earnings (10–6) = 4

G: goodwill = 40 = (4/0.1) = (100–60)

The total flow equal to 10 has been broken down into an abnormal earnings flow equal to 4 (which being remunerated at 10 per cent leads to a goodwill value of 40) and a flow equal to 6, which represents the average normal remuneration of B (remunerated at 10 per cent).

* * *

The relevance of goodwill in determining the market value of the equity changes according to circumstances such as, for instance, the features of the competitive arena in which the firm works. Focusing the analysis on the variables examined, it is possible to work out the following relation (Ohlson 1991, 1995):

VME = β×I+(1–β)B+α[1.5]

where:

- VME: equity market value

- β: parameter positively related to the persistence of abnormal earnings and negatively related to the cost of capital (ke)

- α: other information.

In the borderline case in which β reaches the maximum value of 1 (perpetual persistence of abnormal earnings), the book value becomes insignificant for the estimation. In contrast, the more the value of β is low—small persistence of abnormal earnings—the more the book value plays an important role in the determination of the equity market value. It stands to reason that the goodwill value takes shape just when the price to book value ratio is greater than 1. That ratio, in fact, identifies the relationship existing between the equity market value VME and the equity book value B. Assuming a rational behavior of the market and simplifying the analysis, the value of VME will depend on the future earnings of the enterprise and on the capitalization rate applicable to them (equalizing in this sense the VE value), that is:

Dividing everything for the book value of the equity, B, it results:

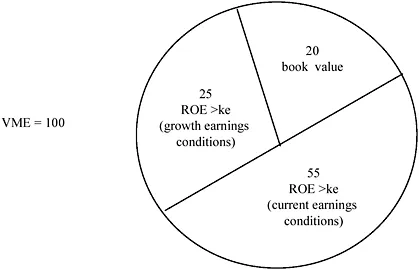

from which it is possible to infer that the price to book ratio is equal to the ratio between the expected return of equity and the opportunity cost of equity (ke): if this ratio is equal to 1 (ROE = ke), the market value of equity should tend towards its book value. Instead, it stands to reason that the goodwill area of value takes shape where: ROE > ke

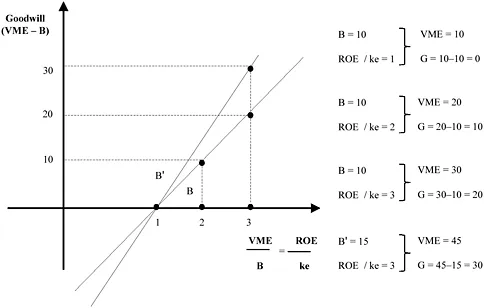

Of course, the inclination of the straight line (in Figure 1.2) will depend on the value of B, as is demonstrated by the numerical example shown in the figure. It is necessary to add another consideration: in defining it has been implicitly assumed that the ratio ROE expresses the profitability at the current conditions whereas the market value embodies also growth expectations. Let us assume the following data: - book value of equity (B) = 20

- ROE = 30%

- ke = 8%

- VME = 100

- price to book value

Figure 1.2 Goodwill and ROE/ke ratio.

With a price to book value equal to 5, the market value sustained by ROE (current profitability projected in perpetual) is equal to 75 (20 × 3.75). About this value we know that 20 is traceable to the book value and 55 is traceable to the capitalization of the current abnormal earnings. The remaining value of 25, instead, is not sustained by current profitability, but it embodies growth conditions (Figure 1.3).

Figure 1.3 Book value, current earnings conditions and growth earnings conditions.

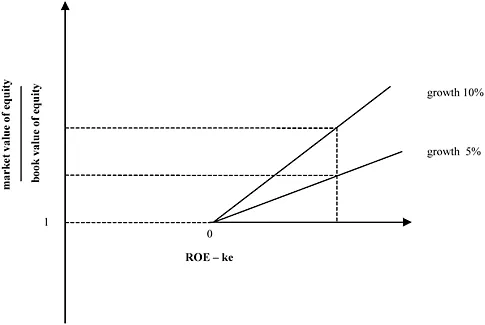

The relation between the current profitability and the growth is shown in Figure 1.4, where the ratio between market value and book value is a function of the difference between ROE and ke, with the growth that determines the inclination of the line.

Figure 1.4 Relation between current profitability and growth.

* * *

Therefore, the goodwill is that part of the enterprise’s value that exceeds the equity book value:

- in part because of the conservative accounting methods, due to the historical cost convention and to the necessity of evaluating in a prudent way the assets (in any case, the progressive shift since the mid-1990s toward a fair value approach to reporting losses and gains must be borne in mind) (Cotter & Donnely 2006);

- most of all, because of the value of abnormal earnings expected for a specific future period, based on the hypothesis assumed about current profitability and growth.

THE GOODWILL AND THE OBJECTIVE FUNCTION OF FIRMS

What role does goodwill play in the objective function of a firm operating in a free market? Assuming an institutional point of view, goodwill becomes a relevant value to identify and estimate the objectives of an enterprise (Zappa 1957, Schmalenbach 1949, Amaduzzi 1978, Beretta Zanoni 2006). Unlike what happens in contractualism or neo-institutionalism, the institutional perspective considers the enterprise as an autonomous institutional entity that tends to its own evolution, driven by the main objective to survive over time. In other words, the ultimate objective of firms is their own existence, through the maintenance, in the long term, of their economic equilibrium. In a free market economy, economic equilibrium can be achieved by remunerating, at market conditions, all the resources employed and by assuring the enterprise an additional quantity of financial resources necessary for its future development. Since the goodwill expresses the value of the abnormal earnings expected in the future, it indicates the expected capability of the firm to:

- remunerate, at market terms, all the production factors, including the risk capital;

- generate an additional value (economic profit) that can be addressed at different purposes, defined from time to time (self-financing and additional return for risk capital);

- do all things mentioned before from a perspective of stability (survival in the long term).

How do these conclusions interrelate with the objectives of the different economic actors, shareholders or other stakeholders, and consequently, with the shareholder and stakeholder theory (Driver & Thomson 2002)? It is necessary first to state that the maximi...