- 368 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Globalization and the Asia Pacific Economy

About this book

This book looks at globalisation in historical perspective and*examines the experience of East Asian economies during the financial crisis*provides an account of globalisation through the activities of Japanese multinational enterprises*deals with the social consequences of exposure to the financial market risks of globalisation in East Asia*details the experience of East Asian economies in managing the financial crisis*draws lessons from East Asian experience with financial market liberalisation*asks what approaches to international financial cooperation, trade policy and corporate governance can assist East Asian interests in the world economy.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Globalization and the Asia Pacific Economy by Kyung Tae Lee in PDF and/or ePUB format, as well as other popular books in Business & International Business. We have over one million books available in our catalogue for you to explore.

Information

1

Globalization

Historical perspective and prospects

Rachel McCulloch

International commerce now plays a central role in the economic life of most nations. As the new century begins, goods and services move more freely among countries than ever before. The same is true for capital, know-how, and technology. Ongoing declines in the cost of long-distance communication and transportation, as well as in national restrictions on international trade and investment, have allowed economies around the world to become increasingly integrated, thereby enhancing productivity growth and expanding consumer choices in every corner of the globe. In parts of the developing world and especially in East Asia, this process of’ globalization’ has been accompanied by an increase in living standards hardly imagined just a generation ago.

At the same time, globalization has also become the focus of widespread controversy. It has been held responsible for adverse consequences to income distribution within and between countries, environmental quality, and national sovereignty, fueling policy initiatives that now threaten to turn back the clock. A primary focus of the attacks is the increasing role of market forces and capitalist institutions in the developing and transition economies. Dissatisfaction has centred on the World Trade Organization (WTO), successor to the General Agreement on Tariffs and Trade (GATT) in fostering multilateral trade liberalization, and the World Bank and International Monetary Fund (IMF), institutions that provide loans and technical assistance to developing countries in conjunction with market-friendly structural reforms.

Recent criticism of the IMF has somewhat understandably been tied to its controversial role in the Asian financial crisis that began in 1997. A more noteworthy and troubling development is the emergence of a popular backlash to globalization in the United States at a time when the country has been enjoying record growth and the lowest unemployment rate in decades. Organized protests aimed at disrupting the December 1999 WTO meeting in Seattle and the April 2000 IMF and World Bank meetings in Washington, as well as widespread (though ultimately unsuccessful) opposition to US legislation establishing ‘permanent normal trade relations’ with the People's Republic of China, reveal the American public's profound ambivalence toward globalization. And if globalization is so controversial when the US economy is doing well, what can be expected once the nation's long period of expansion finally comes to an end?

This chapter examines several dimensions of globalization. It reviews alternative measures of the extent to which today's world economy is indeed globalized and identifies some of the forces that have brought us there, as well as the forces that limit globalization. Data comparing international integration at the end of the twentieth century with corresponding data for the start of the century reveal that much of our recent progress has merely restored international linkages already in place a hundred years ago—but rolled back by the isolationist and protectionist national policies of the 1920s and 1930s and the upheavals of World Wars I and II. As Keynes described that earlier episode of globalization in The Economic Consequences of the Peace (1920:10–1),

What an extraordinary episode in the progress of man that age which came to an end in August 1914! …the inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth…he could at the same time and by the same means venture his wealth in the natural resource and new enterprise of any quarter of the world…he could secure forthwith, if he wished it, cheap and comfortable means of transit to any country or climate…most important of all, he regarded this state of affairs as normal, certain, and permanent, except in the direction of further improvement, and any deviation from it as aberrant, scandalous, and avoidable.1

Yet while the historical comparison underlines remarkable similarities in terms of some broad indicators, there are also important differences in the nature of postwar global integration. Today's integration goes deeper; it affects more industries, more markets, and thus more lives. What the historical perspective makes clear is that globalization is as much a product of facilitating political conditions as of technological advance. Although the barriers to trade imposed by transportation and communication costs declined more or less steadily throughout the twentieth century, globalization and its associated benefits experienced major setbacks from the start of World War I until the end of World War II. The near-collapse of international trade and finance during the 1930s confirms the enormous power of inward-directed national policies to reverse the tide. For better or worse, globalization is by no means inevitable or irreversible.

HOW GLOBALIZED ARE WE NOW?

Are we globalized? On the verge of globalization? Answering these questions requires a basis of comparison: globalized compared to what? Below we consider two possible benchmarks. The usual approach is to compare indices of international economic integration today with some reference point in the past. This exercise seeks to measure the change in the extent of globalization over time. An alternative approach is to compare the current scope of cross-border transactions with what we would expect to find in a fully integrated global economy, that is, one with a single (global) government, a single (global) monetary unit, and total absence of internal policy barriers restricting transactions between political sub-units such as states, provinces, or prefectures. Of course, even this idealized global economy would fall short of the economist's model of full integration, which typically assumes away such real-life influences as cultural and linguistic differences, imperfect information, and the resource costs of transporting goods and services between distant points.

MEASURING GLOBALIZATION

Whether in celebrating the benefits or deploring the costs, political discourse and press reports regularly convey the impression that distance and national borders no longer impede flows of goods, services, financial capital, and ideas. Support for this widespread view comes from two types of evidence. The first documents declining technological and policy-imposed barriers: ongoing and in some cases spectacular improvements in the speed and cost of transportation and communication, together with significant progress toward elimination of trade-distorting national policies. Logically, these trends should facilitate the integration of distant markets, and empirical evidence from gravity models of bilateral trade flows confirms their role (for example, Frankel, 1997).

The second type of evidence lies in the large increases in most types of international transactions that have occurred in recent decades, presumably a consequence of those declining barriers. Some comparisons are dramatic. From 1970 to 1990, US merchandise trade grew more than twice as fast as gross domestic product (GDP). For the world as a whole, trade grew 30 per cent faster than output over the same period (Table 1.1). The increase was even more impressive for international investment. Total holdings of foreign assets relative to world product more than tripled between 1980 and 1995 (Table 1.2). However, closer examination suggests that these comparisons both overstate and understate the differences between the world economy of 2000 and that of 1900.

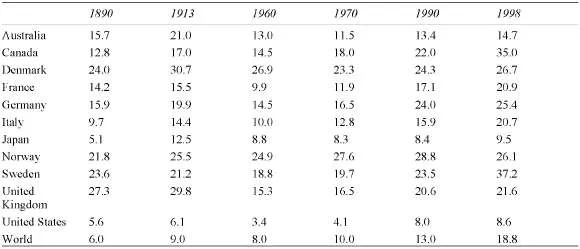

The comparisons above tend to overstate the differences because globalization has not been a monotonic development. The longer view provided by Table 1.1 does not bear out the story of an unstoppable push toward globalization, at least if we measure advance in terms of merchandise trade relative to GDP. While these data confirm the impression that exposure to trade has grown over the period since World War II, they also show that the ratio of merchandise trade to GDP for Australia, Denmark, Japan,

Table 1.1 Merchandise trade in relation to GDP (per cent)

Note: Merchandise trade is measured as an average of imports and exports (exports only for 1998). See Feenstra (1998) for additional notes.

Sources: Feenstra (1998), Crafts (2000), World Bank (2000a: Tables 1 and 20).

Table 1.2 Foreign asset holdings in relation to gross world product

| Year | % |

| 1870 | 6.9 |

| 1900 | 18.6 |

| 1914 | 17.5 |

| 1930 | 8.4 |

| 1945 | 4.9 |

| 1960 | 6.4 |

| 1980 | 17.7 |

| 1995 | 56.8 |

Source: Crafts (2000: Table 2.3).

and Great Britain was actually higher just before World War I than in 1998. For the others, the trade ratio in 1998 was only modestly higher than a century before, tempting us to conclude, along with Krugman (1995), that the influence of trade on domestic activity and income distribution can be at most secondary.

Yet the data confirm a large increase for the United States and a tripling for the world as a whole. The latter implicitly acknowledges the enormously increased role of developing nations in global activity. In 1890 the ‘backward regions’ of Asia, Africa, and Latin America, including many European colonies, participated in global markets mainly as suppliers of primary products. A century later almost all of those colonies have gained independence, and low-and middle-income developing countries are now increasingly important as exporters of manufactured goods (Table 1.3).

The ratio of merchandise exports to GDP is a useful measure of a country's exposure to international markets. However, it is likely to represent a downward-biased indicator of increasing globalization for at least two reasons. The first reason is that it compares trade in merchandise—physical goods—with total domestic value-added over a time period when corresponding domestic production has been shrinking as a fraction of total output. Table 1.4 compares merchandise trade with only the corresponding part of domestic output, that is, merchandise value-added. This measure shows large increases in international activity for most countries in the group. When sectors are further disaggregated, the growth of trade relative to domestic production or consumption becomes still more apparent. This is especially true for manufactured goods, such as machinery and transportation equipment, which a century ago constituted only a minor fraction of trade (Bordo, Eichengreen and Irwin, 1999). In 1900, agriculture still absorbed a lar...

Table of contents

- Cover

- Half Title

- Full Title

- Copyright

- Contents

- List of illustrations

- List of contributors

- Abbreviations

- Preface

- Introduction

- 1 Globalization: historical perspective and prospects

- 2 Coping with globalization and financial crisis: rethinking East Asian strategies

- 3 Engines of globalization: big and small multinational enterprises in the global era

- 4 Social consequences of the East Asian economic crisis: a case of globalization gone wrong

- 5 The potential role of foreign direct investment in Indonesia's recovery

- 6 Foreign exchange market liberalization policies in South Korea: past assessment and future options

- 7 Capital flows and capital controls: the Malaysian experience

- 8 Performance of East Asian corporations before and after the crisis

- 9 Risks of financial liberalization and reform for financial stability

- 10 Integrating financial markets in East Asia

- 11 Managing small open economies: exchange rate systems and real sector shocks

- 12 Impacts of globalization on China: an assessment of China's reforms and liberalization

- 13 Evaluation of changes in the corporate governance system of South Korean chaebols

- 14 Globalization on the rocks

- 15 A quest for a new international financial architecture: an Asia Pacific perspective

- 16 East Asian integration as a determinant of the international economic architecture

- Index