eBook - ePub

Financial Accounting Milestones in the Annual Reports of United States Steel Corporation

The First Seven Decades

- 272 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Financial Accounting Milestones in the Annual Reports of United States Steel Corporation

The First Seven Decades

About this book

This book, first published in 1986, examines extracts sections from the annual reports of United States Steel Corporation over the period 1902-1968. These extracts are milestones in the history of financial reporting in the United States, and the documents are presented as they originally appeared. They capture many historical events and the company management's reaction to them.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Financial Accounting Milestones in the Annual Reports of United States Steel Corporation by Richard Vangermeersch in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.

Information

1902 Annual Report

Income Account Shown First

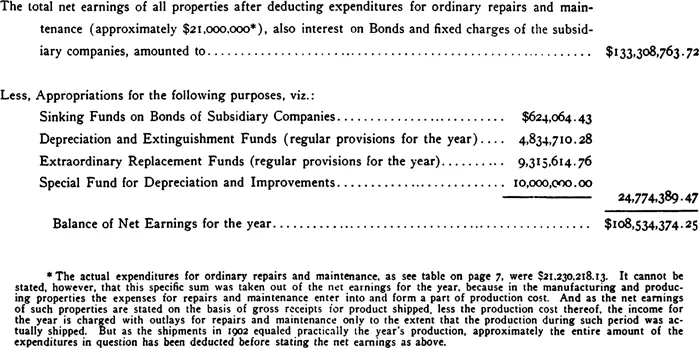

Dividends Subtracted from Net Earnings

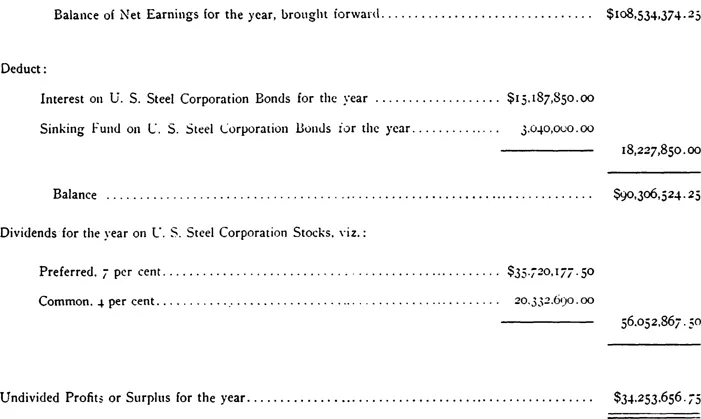

Working Capital Provided in Organization in Surplus Account

Quarterly Profits Given

Expenditures for Maintenance Detailed

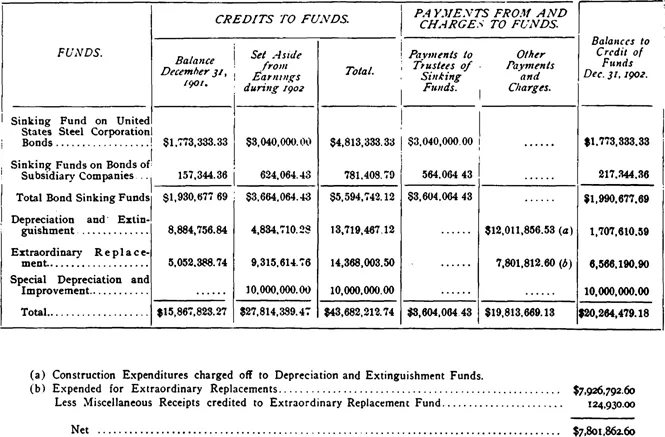

Disclosure of Various Funds

Production Data and Finished Products Shown

Inventories in Significant Detail

Capital Stock and Debt Described

Property Account Analyzed

Merger of Union-Sharon Discussed

Employee and Stockholder Data Given

Orders on Hand Shown

Organizational Philosophy Explained

Price Waterhouse the External Auditors

Detailed Balance Sheet and General Profit and Loss Account

Funds Statement Portrayed

Bonds in Even Greater Detail

Monthly Earnings on a Comparative Schedule

Manufacturing Plants Catalogued

Pictures of Plants Shown

FIRST ANNUAL REPORT

TO STOCKHOLDERS OF

United States Steel Corporation

Office of United States Steel Corporation,

51 Newark Street, Hoboken, New Jersey.

April 6, 1903.

51 Newark Street, Hoboken, New Jersey.

April 6, 1903.

To the Stockholders:

The Board of Directors submits herewith a combined report of the operations and affairs of the United States Steel Corporation and its Subsidiary Companies for the fiscal year which ended December 31st, 1902, together with the condition of the finances and property at the close of that year.

Income Account for The Year.

Undivided Surplus of U. S. Steel Corporation and Its Subsidiary Companies.

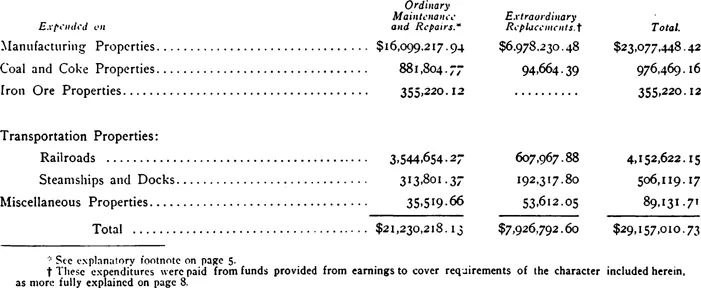

Net Profits and Surplus of United States Steel Corporation and Subsidiary Companies at Close of Each of The Quarters Named.

Quarter Ending | Net Profits for Quarter Available for Dividends. | Surplus at Close of Quarter before Declaration of Dividends* | Dividends on U S. Steel Corporation-Stock for Respective Quarters. | Balance of Surplus. |

June 30th. 1901 | $19,907,277.28 | $44,907.277.28 | $13.957.028.25 i | $30.950.249.03 |

September 30th. 1901 | 20.063.620.25 | 51,013.875.28 | 14.010,277 75 | 37.003.597.53 |

December 31 st, 1901 | 20,629,203.52 | 57,632.803.05 | 14,011.862.75 | 43.620,940.30 |

March 31st, 1902 | 16,700,221.26 | 60.321.161.56 | 14013.434.25 i | 46,307.727.31 |

Juue 30th, 1902 | 26.742.277.86 | 73,050.005.17 | 14,013,542.75 | 59,036 452.42 |

September 20th, 1902 | 25.849.817.58 | 84.880.280.00 | 14.012 946.25 j | 70,873.333.75 |

December 31st, 1902 | 21.014.207.55 | 91 887,541.30 | 14.012.944.25 j | 77 874 597.05 |

* Includes Capital Surplus of $25.000 000, provided at date of organization.

NOTE.—Special Depreciation and Improvement Fund of $10 000,000, set aside from 1902 Net Earnings, is distributed in above table, $2,500,000 to each quarter of 1902.

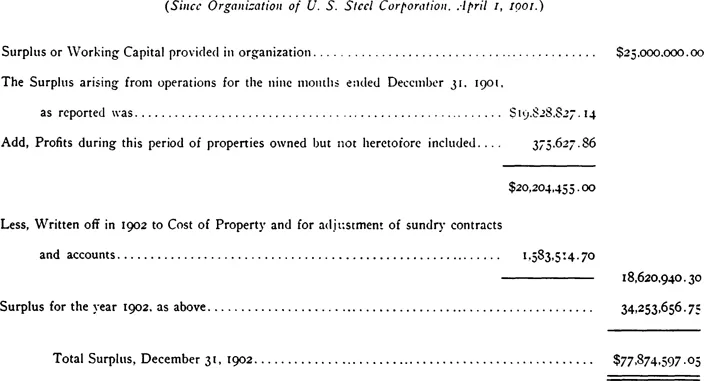

Maintenance, Renewals and Extraordinary Replacements.

The physical condition of the properties has been fully maintained during the year, the cost of which has been charged to cumin operations. The amount expended by all properties during the year for maintenance, renewals and extraordinary replacements aggregated $29,157,010.73.

This total is apportioned as follows:

Sinking, Depreciation and Extraordinary Replacement Funds.

Provisional charges are made monthly to operations for Bond Sinking Funds and to establish funds for Depreciation, and for reserves for Extraordinary Replacements. The purposes for which these funds are particularly designed are as follows:

Bond Sinking Funds.—These are the funds required by the respective mortgages to be set aside annually for retirement of the bonds issued thereunder.

Depreciation and Extinguishment Funds.—The appropriations for these purposes have been made with the idea that thus aided the bond sinking funds will liquidate the capital investment in the properties at the expiration of their life. These moneys are used not for current operating expenses, but to offset consumption and depreciation by the provision of new property or of reserve funds.

Extraordinary Replacement Funds.—These are designed to be used to improve, modernize and strengthen the properties. They are not used for ordinary maintenance, repairs and renewals (such expenses are included in current operating costs), but for the substitution of improved and modern machinery, plants, facilities, equipment, etc.

During the year ended December 31. 1902. the appropriations made for the foregoing funds, together with the payments therefrom, and the balances in the funds at the close of the year, were as follows:

The balances to the credit of the several funds on December 31, 1902, per the preceding ...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Original Title Page

- Original Copyright Page

- Table of Contents

- Introduction

- 1902 Annual Report: Income Account

- 1903 Annual Report: Income Account; Comparative Income Account; Undivided Surplus; Summary of Expenditures for Construction; Inventories

- 1904 Annual Report: Undivided Surplus

- 1908 Annual Report: Certificate of Chartered Accountants

- 1910 Annual Report: Consolidated General Balance Sheet

- 1911 Annual Report: Undivided Surplus; Inventories

- 1916 Annual Report: Inventories; Condensed General Profit and Loss Account

- 1917 Annual Report: Income Account; Condensed General Profit and Loss Account; Certificate of Independent Auditors

- 1918 Annual Report: Activities ... in the War; Condensed General Profit and Loss Account

- 1919 Annual Report: Condensed General Profit and Loss Account

- 1920 Annual Report: Inventories; Condensed General Profit and Loss Account

- 1921 Annual Report: Comparative Income Account; Inventories; General; Certificate of Independent Auditors

- 1922 Annual Report: Inventories

- 1923 Annual Report: Comparative Income Account

- 1929 Annual Report: Surplus; Operations for the Year; Production; Assets; Property Investment Accounts; Summary of Net Profits and Undivided Surplus; Inventories

- 1930 Annual Report: Consolidated Income Account; Operations for the Year; Production; Shipments and Business

- 1931 Annual Report: Consolidated Income Account

- 1932 Annual Report: Consolidated Income Account; Operations for the Year

- 1933 Annual Report: Surplus; Operations for the Year; Financial Position

- 1934 Annual Report: Condensed General Profit and Loss Account

- 1935 Annual Report: Balance Sheet, Statements of Accounts and Statistics; Property Investment Account; Summary of Net Profits and Undivided Surplus

- 1936 Annual Report: Assets; Property Investment Account

- 1937 Annual Report: Accident Prevention, Relief and Sanitation; Housing, Welfare and Unemployment Relief; Changes Proposed in Capital Structure

- 1938 Annual Report: Disposition of Intangible Assets; Comparative Consolidated General Balance Sheet; Gross Property Investment Account; Capital Surplus

- 1939 Annual Report: How the Corporation Earned Its Living in 1939; About Our Financial Affairs; Inventories; Consolidated General Balance Sheet

- 1941 Annual Report: Independent Auditors Report to Stockholders; Consolidated Statement of Income and Earned Surplus; Details of Balance Sheet Items

- 1942 Annual Report: Insurance and Pensions; Consolidated General Balance Sheet; Consolidated Statement of Income

- 1943 Annual Report: Consolidated Balance Sheet

- 1945 Annual Report: Consolidated Statement of Income; Consolidated Statement of Financial Position; Notes to Accounts

- 1946 Annual Report: The Coal Strikes of 1946; Steel Labor Situation; Profit and Loss Facts and Factors; Consolidated Statement of Income; Notes to Accounts

- 1947 Annual Report: How U. S. Steels 1947 Sales Dollar was Divided; Financial Summary; Consolidated Statement of Income; Notes to Accounts; Independent Auditors Report

- 1948 Annual Report: Wear and Exhaustion; Independent Auditors Report

- 1949 Annual Report: Financial Summary

- 1950 Annual Report: Employe [sic] Benefits

- 1954 Annual Report: Financial Summary

- 1955 Annual Report: Combined Pension Trusts

- 1958 Annual Report: Cost of Employe [sic] Benefits; Financial Summary; Independent Auditors Report

- 1965 Annual Report: Notes to Financial Statements

- 1968 Annual Report: Consolidated Statement of Income; Notes to Financial Statements; Independent Auditors Report