eBook - ePub

Distributed Generation and its Implications for the Utility Industry

- 552 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Distributed Generation and its Implications for the Utility Industry

About this book

Distributed Generation and its Implications for the Utility Industry examines the current state of the electric supply industry; the upstream and downstream of the meter; the various technological, business, and regulatory strategies; and case studies that look at a number of projects that put new models into practice.

A number of powerful trends are beginning to affect the fundamentals of the electric utility business as we know it. Recent developments have led to a fundamental re-thinking of the electric supply industry and its traditional method of measuring consumption on a volumetric basis. These developments include decreasing electricity demand growth; the rising cost of fossil fuels and its impact on electricity costs; investment in energy efficiency; increasing numbers of prosumers who generate for some or all of their own needs; and market reforms.

This book examines the implications of these trends in chapters focusing on distributed and decentralized generation, transactive energy, the role of electric vehicles, any much more.

- Discusses the technological, business, and policy trends most impacting the electric utility sector

- Provides an assessment of how fast and how soon distributed energy resources may make an impact on utility sales/revenues

- Explores, through a series of international case studies, the implementation of strategies that may help retain the viability of the utility industry

- Features contributions from a number of scholars, academics, experts and practitioners from different parts of the world focused on examining the future of the electric supply industry

Information

Part I

What is Changing?

Chapter 1

Decentralized Energy

Is It as Imminent or Serious as Claimed?

Fereidoon P. Sioshansi

Abstract

The recent rise of decentralized energy resources or distributed energy resources (DERs), which has caught the attention of incumbent stakeholders, is the culmination of three drivers: slowing demand growth, high and/or rising retail tariffs, and ambitious renewable targets plus supportive policies favoring decentralized generation. These powerful forces, currently manifested in a number of advanced economies, are likely to spread to other regions over time, pushed by rising retail tariffs, pulled by falling costs of DERs, and propelled by disruptive nature of technology. As with any disruptive technology, there will be winners and losers.

Keywords

Distributed generation

Utility business model

Disruptive technology

Renewable energy

Utility strategy

1 Introduction

Up to now, the rise of decentralized or distributed energy resources (DERs) has been limited to a handful of countries or regions where one or more of the following conditions prevail:

• High and/or rising retail tariffs

• Ambitious renewable targets or mandates

• Supportive policies favoring DERs

One might ask, “where do these conditions currently apply?” The answer includes Germany, Japan, California, and Australia, among others. The speculation is that with passage of time, a growing number of mature economies will follow.

This chapter examines some of the fundamental drivers responsible for the rise of DERs and their implications for the electricity supply industry (ESI). At the outset, it must be noted that the term distributed or decentralized energy resources or DERs refers to both energy efficiency (EE)—using electricity more judiciously and sparingly—and distributed generation or DG. The latter is extensively covered in a prior volume edited by the author;1 the present volume is primarily focused on DG, broadly defined as generation on customer side of the meter.2

Another caveat, reinforced in various chapters of the book, is that at least at this stage, few are prepared to write the eulogy of the incumbent utilities. While some (e.g., owners of thermal generation) may face challenging times in markets with excess capacity and depressed wholesale prices, others (e.g., owners of critical transmission and distribution networks) may in fact thrive in a decentralized future with little or no demand growth once they make the necessary adjustments in how they deliver and—more important—capture value from vital balancing and reliability services provided by the “grid.” As with any disruptive technology, there will be winners and losers in this game.

The chapter is organized as follows: Section 2 examines some of the fundamental reasons for the observed slowing demand growth. Section 3 briefly examines the rise of renewables and the push towards low-carbon energy. Section 4 examines the drivers of DER growth. Section 5 questions the seriousness and immediacy of the threats—or opportunities—implied by DERs, followed by the chapter's conclusions.

2 What Is Behind the Slowing Demand Growth?

The rise of DERs would not be as noticeable if the underlying demand for electricity was growing at historical rates. In other words, if the total size of the electricity demand pie were growing, the growing DER slice would not be as worrisome. The stagnant growth—recently experienced in a number of countries—makes the growth of renewables and DERs so much more pronounced and painful for incumbent generators while impacting grid operators3 and owners of transmission and distribution networks.

While there are many reasons and interpretations for the tepid or nonexistent demand growth among mature OECD economies—the reasons vary from place to place and are not necessarily applicable to rapidly growing global economies—the following stand out:

• Structural change in the composition of mature economies

• Demand saturation

• Rising retail tariffs

• Negawatts cheaper than megawatts

• More efficient appliances

• Codes and standards

• Regulatory fiat

The first is the irrefutable structural change taking place imperceptibly among the mature OECD economies. As economies advance, they slowly move away from energy-intensive industries to services, finance, education, innovation, and other knowledge-based, high-value added sectors where relatively little energy is needed to generate large amounts of output—measured in terms of energy intensity or similar metrics.

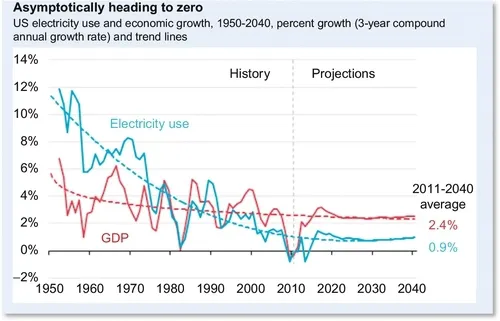

Figure 1 shows the long-term relationship between economic growth and electricity consumption for the United States for the period 1950 to present with projections to 2040. The basic message—similar trends are observed within most OECD countries—is that mature economies can sustain reasonable economic growth rates with relatively little growth in energy/electricity consumption. As described by Faruqui and Grueneich, there are many who believe that the phenomenon of flat, or possibly declining, electricity demand growth may be permanent.

Figure 1 Historical/projected trends in economic and electricity demand growth in the United States. Source: U.S. Energy Information Administration, Annual Energy Outlook 2013 Early Release.

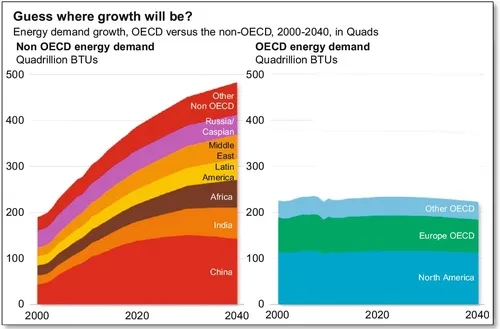

According to the International Energy Agency, the total energy consumption within OECD in 2012 was the same as in 2002, while GDP of the rich countries over the same period grew by 22%.4 As illustrated in Figure 2, projections for total demand growth within OECD are virtually flat, while economic output is projected to grow. It is, of course, a different story for the developing countries. The critical question is how long before the rapidly growing economies of the world reach the same stage of maturity. In case of China, for example, the peak is projected in mid-2020s, according to ExxonMobil's The Outlook for Energy: A View to 2040, published in Dec 2012.5

Figure 2 Total energy demand is projected to remain virtually flat or slightly declining over time within OECD block (right), while it continues to grow for some time in developing countries (left), in quadrillion BTUs. Source: The outlook for energy: A view to 2040, ExxonMobil, Dec 2012.

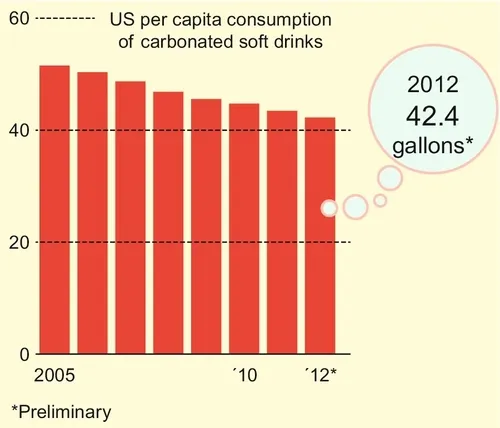

Another explanation for the stagnant demand growth—not just for electricity but also for many goods and services—is the phenomenon of demand saturation. The basic explanation is that consumers in rich countries can afford and already use as much of the basic commodities and services they need and want. This applies to soda consumption in the United States6 (Figure 3) or pasta consumption in Italy.7 In the former case, after growing for decades, Americans are now moving away from sweetened fuzzy drinks to bottled water, juices, coffee, and other beverages driven by concerns about obesity and diabetes. In the latter case, Italians appear to have had enough pasta and are consuming more vegetables and other foods.

Figure 3 U.S. per capita soda consumption, 2005-2012, in gallons/person/year. Source: The Wall Street Journal, 19 Jan 2013.

Demand saturation phenomenon, of course, is manifested in numerous forms in many rich countries. Consider, for example, per capita car ownership where the United States, Germany, and Japan have already reached peak levels (Figure 4). In the case of the Untied States, there are now more cars than licensed drivers. In Japan, car ownership is constrained by lack of parking space in urban areas. Moreover, in many congested cities in developing countries, car ownership does not automatically translate into inc...

Table of contents

- Cover image

- Title page

- Table of Contents

- Copyright

- Author Biographies

- Foreword

- Preface

- Introduction: The Rise of Decentralized Energy

- Part I: What is Changing?

- Part II: Implications and Industry/Regulatory Response

- Part III: What Future?

- Epilogue

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Distributed Generation and its Implications for the Utility Industry by Fereidoon Sioshansi,Fereidoon P. Sioshansi in PDF and/or ePUB format, as well as other popular books in Technology & Engineering & Energy. We have over one million books available in our catalogue for you to explore.