- 448 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

European Energy Industry Business Strategies

About this book

Since the European Union's de-regulation policy for electricity and energy suppliers was implemented, new strategic configurations have emerged. Traditional restraints of geographical limitations on energy companies have been partly removed: the diversity at national regulatory and company level means that the European scene is one of a multiplicity of strategic configurations and developments, whilst also being complex and segmented.This book highlights the strategic and regulatory challenges of European deregulation, with its main focus being on the business strategies within the emerging de-regulated electricity markets; various regulatory implications which are being raised in this new climate are discussed. Some of the central strategic issues facing the electricity industry in its new competitive context are explored and reviewed, with classical themes debated as a prelude to the following empirical investigation of actual business strategies pursued by the electricity and energy industries.The main section of this work consists of 7 national case studies of business strategies which also include one North and one South American case. These were considered important inclusions as the North American companies are large investors in the European market, whilst the European companies invest in the South American market. The final chapter is a comparison and summary of the national patterns of market structures, business strategies and regulatory styles with a brief look at some challenges to be faced in future.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access European Energy Industry Business Strategies by Atle Midttun in PDF and/or ePUB format, as well as other popular books in Politics & International Relations & Business Strategy. We have over one million books available in our catalogue for you to explore.

Information

Chapter I

Perspectives on Commercial Positioning in the Deregulated European Electricity Markets

ATLE MIDTTUN

The commercial re-positioning of the European energy industry following deregulation raises fundamental strategic issues. This chapter will elaborate on some of the underlying theoretical issues of economic organisation as a prelude to the following national case studies and the final comparative analysis.

I. Globalisation/Europeanisation or National Styles: Competition under Institutional Diversity

The tension between globalisation and/or Europeanisation, on the one hand, and path dependency/national styles of industrial organisation, on the other, is fundamentally built into the European electricity market deregulation. On the one hand the deregulation project has a vision of an integrated European market with competition on equal terms for all. On the other hand, national interests have limited the competitive scope and tailored their deregulation to national taste according to the so-called subsidiarity principle.

More theoretically formulated, the so-called convergence perspective argues that, on facing a common competitive market, companies will tend to scale up and converge in function and organisational structure. Against the convergence perspective the national business systems literature argues that industrial development is highly shaped by national styles and national institutions.

One of the most clearly articulated proponents of the convergence perspective is Kenichi Ohmae (1985, 1995) whose basic argument is that as the 21st century progresses, industry, investment, individuals and information flow will be relatively unimpeded across national borders. In this situation, he argues, the strategies of modern, multinational companies are no longer shaped and conditioned by reasons of state, but rather, by the desire—and the need—to serve attractive markets wherever they exist and to tap attractive pools of resources wherever they sit. He claims that the capital markets in most developed countries are flush with excess cash for investment and that the investors will look for multinational companies with their competencies to play key roles in local developments, rather than support local industry. The global orientation of financial sources will, therefore, also serve to support large globally converging firms. Modern commercial dynamics, such as that which is being unleashed by the present European electricity market deregulation, pushes companies to spread across borders in a new way, tapping into global or at least European markets for technology, investment and consumers. In this context, Ohmae argues that national diversity will diminish rapidly and that the nation states no longer have a market-making role to play.

Yet another type of argument in favour of strategic convergence—the so-called institutional isomorphism argument—is put forward by the new institutionalist school in organisation theory. The basic argument here is that national differences are challenged by international learning, co-operation and/or dominance. This constitutes forces towards cross-national harmonisation of strategies and organisational models, or what Di Maggio and Powell (1991) have termed institutional isomorphism. They point out three mechanisms through which institutional isomorphic change occurs.

1. Changes towards organisational convergence may occur as mimetic processes, where changes in relevant reference nations act as a signal to own change, perhaps in response to uncertainty;

2. organisational convergence may also occur through what Di Maggio and Powell call coercive isomorphism, where the need for political legitimacy acts as a driving force for institutional isomorphism; and

3. isomorphism may be closely associated with normative pressure arising from professionalisation.

Against the globalisation and institutional isomorphism arguments a national business systems literature launches a competing perspective with a core argument that differences in major national, regional and sectoral institutions generate significant variations in how firms and markets are structured and operate. On this basis, the national styles literature argues that analytical perspectives that reduce this variation to unidimensional convergence are missing out essentials.

This general argument is developed under several labels: business systems (Whitley, 1992), social systems of production (Campbell et al., 1991) and modes of capitalist organisation (Orru, 1994). The essence of this literature is again that industrial development proceeds differently in different countries, as national industrial ‘milieus’ draw on specific traditions and competence in their national surroundings.

Implicitly, and sometimes also explicitly, the national styles literatures draw on a broader path dependency argument that points out that industrial systems cannot develop independently of previous events (David, 1993). Local positive loops serve to propagate traditional patterns into future strategic decisions. This implies a development with several equilibrium points, where small events at one point in time may play an important role for future development by determining the course of a long-term development. The path dependency and national styles literatures thus foresee that institutional, social and organisational factors will continue to reproduce differences in strategic orientations that may reproduce themselves even under international competitive conditions.

Applied to the European electricity market deregulation, we find elements that fit both positions: the Commission’s ambition to develop an internal market with pan-European competition clearly launches a programme with strong drivers towards harmonisation of markets and with strong isomorphic pressures on the competing companies.

However, two major factors serve to make competition in the European deregulated electricity markets very much of a competition under institutional diversity. Firstly, the partiality of the EU deregulation and the subsidiarity in applying this partial market opening to various national contexts implies that market rules and market institutions are extensively shaped to national taste. Secondly, national and even sub-national municipal idiosyncrasy also characterises the players in the electricity markets. The market players are companies with varying mixes of public and private ownership, with varying financial constraints, and with different combinations of political and commercial mandates.

The very cautious pace of market opening spelled out in EU’s electricity directive, and the plurality of models open to national choice, indicated a soft tone vis-à-vis national vested interest. The member states were here clearly given the possibility to limit competition both in generation and supply, allowing them considerable control over the construction of new capacity and the fuel mix. The result has been a variety of regulatory trajectories and energy policies running side by side in Europe:

The Nordic deregulation took a radical, direct and structural approach with an emphasis on full-free trade competition between several decentralised actors.1 Major parts of the Continental European development, however, seems to take a more gradual ‘contestable market’ path, where market deregulation rather takes the form of gradual market opening under few structural constraints. The English and Welsh reform could be characterised as somewhere in between, with radical change in ownership structure, but without sufficient market deconcentration and consumer participation to fulfil strong free-trade criteria in the first round. However, with the recent opening up of the market to small-scale consumers this has changed.

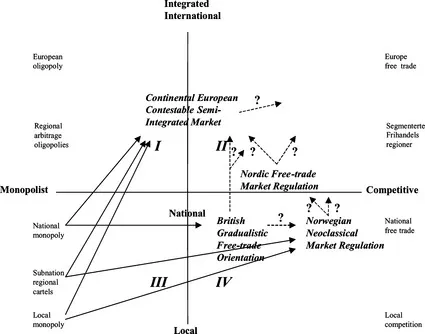

The analytical possibility-space for a European market-development may be described in terms of a two-dimensional matrix with degree of market opening to competition along the horizontal axis and the geographical expansion of the market along the vertical axis (Fig. I.1). The Continental European development can be seen to follow a path from national monopolistic planned economy (square III) towards a European semi-competitive and semi-integrated market system (between squares I and II). There is reason to expect that this peculiar mixture of competitive and restraining regulation will characterise the strategic context for years to come, even if the European liberalisation project in a longer time-perspective may provide full integration with open trade between national markets (square II). However, even in the case of extensive market opening in Europe, mergers, acquisitions and other forms of strategic integration may limit competition.

Fig. I.1 Market opening and competition.

This is a conceptual model and the rankings are highly judgmental.

This is a conceptual model and the rankings are highly judgmental.

As opposed to the Continental development, where the attempt has been to deregulate and internationalise in the same movement, the British and Norwegian deregulation projects were one-country projects, where the move was along the horizontal dimension (from square III to IV) rather than along the vertical dimension. Norway then subsequently moved into a Nordic market, when Sweden and Finland, and gradually Denmark also followed it in deregulation six to nine years later.

From a globalisation and isomorphism perspective it might be argued that this development contains strong convergence elements. Firstly, convergence through internationalisation and institutional harmonisation; but secondly also convergence in regulatory style as all systems have adopted some market elements.

However, from a national styles position, it is easy to point out strong national elements, both in the institutional specification/delineation of competition and in the type of openness that is established between the national market and its environment. In addition to differences in market scope and regulatory regimes, the European scene is also characterised by extensive differences in company ownership and in competitive exposure of companies within their domestic markets.

This again ob...

Table of contents

- Cover image

- Title page

- Table of Contents

- Elsevier Science Internet Homepage

- Copyright

- Preface

- About the Contributors

- Introduction

- Chapter 1: Perspectives on Commercial Positioning in the Deregulated European Electricity Markets

- Chapter 2: Nordic Business Strategies

- Chapter 3: Corporate Strategies in the British Electricity Supply Industry

- Chapter 4: Dutch Business Strategies Under Regime Transition

- Chapter 5: Corporate Strategies in the German Electricity Supply Industry: From Alliance Capitalism to Diversification

- Chapter 6: Change and Sustainability in the French Power System: New Business Strategies and Interests versus the New Relaxed Status Quo

- Chapter 7: Business Strategies Evolving in Response to Regulatory Changes in the US Electric Power Industry

- Chapter 8: New Strategies for Power Companies in Brazil

- Chapter 9: Strategic Development and Regulatory Challenges in West-European Electricity Markets

- Subject Index