- 340 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Fund Custody and Administration

About this book

Fund Custody and Administration provides an overall perspective of investment funds without limiting its analysis to specific fund structures, as other books do. Since governance and oversight of investment funds are now major regulatory requirements, administrators and custodians must place greater emphasis on the custody and safekeeping of fund assets, on the independent and robust valuation of the assets, and on collateral management. By focusing on both the asset transactions made by the investment manager for the portfolio and on the transactions in the shares or units of the fund itself, it gives readers insights about the essential elements of investment fund management and administration, regardless of their geographical backgrounds.

- Explores the key stages in the investment process, from setting up a fund through its launch and operation

- Explains the roles of participants as well as the ways regulation affects the fund and its operation

- Describes the work flow associated with custody and administration procedures and processes

- Defines the role of compliance and risk management in the context of the fund and also how compliance requirements apply to custodians and administrators

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Part 1

Introduction to Investment

Abstract

This part focuses on the investment environment by looking at the objectives of investment and then moving on to the basis for collective investment schemes. The investment management process is then explained covering portfolio management, assets classes, some example strategies, and finally discusses investment performance.

Keywords

investment

portfolio management

fund management

assets classes

unregulated funds

Investment environment

The process of investment is a concept that has been around for a long, long time. For the purposes of this book we will be considering the investment industry from the 1900s onward.

It is always interesting to ponder the question of what is gambling and what is investment?

Is the pursuit of profit greed or a structured contingency against future requirements, for example, a pension?

In the 1800s canal and railway mania in the UK created and lost fortunes so was this gambling, speculation, or structured investment?

Certainly for the lucky ones it was a foundation for enormous wealth that has sustained the family through generations. Others lost all their money and often ended in debtors jails with families broken and living in terrible deprivation. This was not a UK phenomenon but spread across the globe as the industrialization and growth of economies, often on the back of colonization and empires captured the imagination of entrepreneurs, businessmen, and of course speculators.

In the United States, which originally was what we would call today an emerging market, an example would be the gold rush and this was also in evidence in Australia and New Zealand, Africa, and other countries. In Asia and the Caribbean, the spice trade was heavily “invested in” and of course at the other end of the spectrum slavery was another “investment” that generated huge fortunes for individuals and families.

Today we can look back at this “market” and recognize that most fortunes were built on exploitation, often brutal and uncaring, of people, often children like in mining and industry, and the natural resources of other countries with little or no benefit to the people of that country.

Traders, merchants, and speculators were totally dominant and profit and returns came before all.

Ironically, today we have some disturbingly similar parallels with investment (or some will say exploitation) in “emerging markets” where the wages, working and living condition of workers is appalling, particularly compared to the standards found in the mature markets of the United States and Western Europe.

The kind of highly speculative investment found in the 1800s underwent an evolution and to all intent a purpose became the forerunner of the investment industry we are familiar with today, as those with insufficient capital to take a reasonable stake in an enterprise joined together to create “collective investment” often in the form of syndicates and partnerships.

Earlier “investors” were exposed to some extraordinary risks, often without being aware of such risks, and their general naivety left them vulnerable to scams and frauds.

Today investment is a structured process with collective investment schemes (CIS) created in the form of investment funds, many of which are regulated. In many jurisdictions around the world investors, especially those with limited knowledge of finance and awareness of risk are offered high levels of protection.

Those investors with greater knowledge and awareness can opt to invest their capital in more lightly regulated products and even products that are unregulated.

The need for the regulation of investment and the adoption of change can be found in numerous case studies, some a long time ago but also some more recent.

Fund management became an enormously important component of what was rapidly becoming a key part of the capital markets as the increasing wealth of individuals sought returns and the capital needs of growing companies and indeed economies had to be financed.

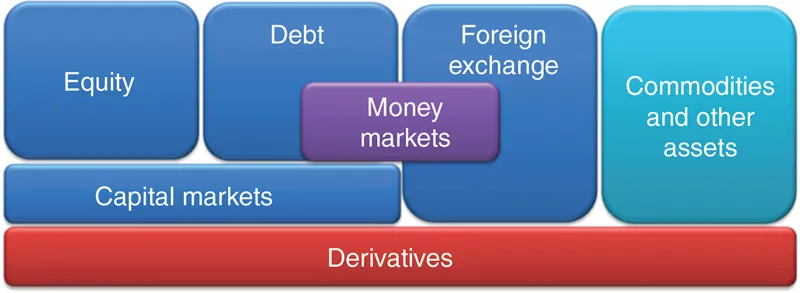

Diagram 1.1 shows the general structure of the capital markets broken into sectors. Purists may consider commodities and other assets as being outside the scope of capital markets.

Diagram 1.1 The markets. (Source: The DSC Portfolio Ltd.)

Investor’s pooled capital in a CIS became a prime source of the capital flow. Their capital was either passively managed, which meant it was placed in a fixed, unchanging portfolio of assets or one that tracks a benchmark like an equity index, or is actively managed, which means that an investment manager creates and manages the portfolio seeking to generate a return higher than a benchmark. We will consider this again shortly.

In the capital markets, financia...

Table of contents

- Cover

- Title page

- Table of Contents

- Copyright

- About the Author

- Preface

- Introduction—What Is Fund Administration and Custody

- Part 1: Introduction to Investment

- Part 2: Regulation and Fund Structures

- Part 3: The Day-to-Day Operation of a Fund

- Part 4: Risk

- Part 5: Introduction to derivatives

- Part 6: Summary—Fund Administration Notes

- Part 7: The Future of Fund Custody and Administration

- Appendix 1: The Investment Association Categorization of Funds

- Appendix 2: Source-Investment Association

- Appendix 3: Glossary of Risk Terminology

- Appendix 4: Organization of the SESC

- Appendix 5: Reporting Annex IV Transparency Information Under the Alternative Investment Fund Managers Directive

- Appendix 6: Questions and Answers: Application of the AIFMD

- Appendix 7: China Securities Regulatory Commission (CSRC)

- Appendix 8: October 2015—Top 10 Performing Funds

- Appendix 9: Global OTC Derivatives Market-Source BIS

- Appendix 10: Global OTC Derivatives Market-Source BIS

- Appendix 11

- Glossary of Terms

- Useful Websites and Links

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Fund Custody and Administration by David Loader in PDF and/or ePUB format, as well as other popular books in Business & Investments & Securities. We have over one million books available in our catalogue for you to explore.