Recycled fibres play a very important role today in the global paper industry as a substitute for virgin pulps. Paper recovery rates continue to increase each year in most parts of the world. The recycling rate in Europe reached 70.4% in 2011. Thirteen European countries exceeded the 70% recycling rate, 12 European countries were below 60%. Exports of recovered fibre from the USA to Asia have grown rapidly, representing a nearly three-fold increase since 2002. These exports are primarily destined for China. In 2009, approximately 36% of fibre recovered in the USA was exported to Asia. With rapid developments in deinking processes for the reuse of secondary fibres being made, the recycling process is becoming increasingly efficient. The quality of paper made from secondary fibres is approaching that of virgin paper. Its manufacture is much more eco-friendly than that of virgin paper. This chapter describes the paper and paperboard industry in the global market, general aspects of paper recycling, benefits of paper recycling, statistics and challenges for paper recyclers.

1.1 The Paper and Paperboard Industry in the Global Market

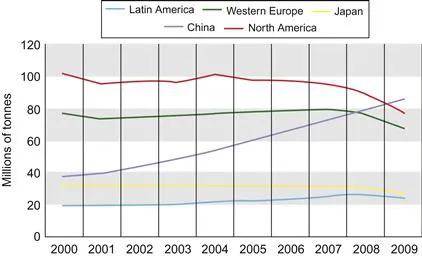

The pulp and paper industry is one of the largest industries in the world. It is dominated by North American, Northern European and East Asian countries. Latin America and Australasia also have significant pulp and paper industries. Over the next few years, it is expected that both India and China will become the key countries in the industry’s growth. World production of paper and paperboard is around 390 million tonnes and is expected to reach 490 million tonnes by 2020. In 2009, total global consumption of paper was 371 million tonnes (Figure 1.1). In North America, total paper consumption declined 24% between 2006 and 2009.

Figure 1.1 Total paper and paperboard consumption; North America versus other selected regions. Source: Reproduced with permission from EPN environmentalpaper.org/.../state-of-the-paper-industry-2011-full.pdf.

Growth is speedy in Asia; it accounts for almost 40% total world paper and paperboard production whereas the European Union (EU) and North America account for about one quarter each. The profitability of pulp and paper industry has been weak on the global level in recent years. Excess capacity has led to falling product prices that have, with the impact of rising production costs, eroded the industry’s profitability globally.

Consumption of paper and paperboard per person varies significantly from country to country. One person uses about 60 kg of paper a year on average; the extremes are 265 kg for each US resident and some 7 kg for each African. In the heavily populated areas of Asia, only around 40 kg of paper per person is used. This means that Asian consumption will continue to grow intensely in the coming years if developments there follow the example of the West. In Finland, consumption of paper and paperboard per person is about 194 kg. Although India’s population is about 7% of the world’s population, it consumes barely 2% of the global paper output with consumption per person at only 9 kg against a global average of 55 kg, 65 kg in China and 215 kg in Japan. Rapid growth in Asian paper production in recent years has increased the region’s self-sufficiency, lessening the export opportunities available to both Europeans and Americans. Moreover, Asian paper has started to enter Western markets – from China in particular. Global contest has increased noticeably as the new entrants’s cost level is considerably lower than in competing Western countries.

The European industry has been dismantling overcapacity by shutting down mills that do not make any profit. In all, over 5% of the production volume in Europe has been closed down in the past few years. Globally speaking, the products of the forest industry are primarily consumed in their country of production, so it can be considered a domestic-market industry. The largest trade flows are between the countries of Central Europe and between the Nordic countries and Central Europe. Furthermore, a lot of Canadian paper is exported to the USA. In Asia, Korea is a significant exporter. The most significant intercontinental trade flows are directed from Europe and North America to Asia, from Europe to North America as well as from North America to South America. The profitability of paper industry companies has been weak overall in the recent years. Overcapacity has led to falling prices and this, coupled with rising production costs, is eating into the sector’s profitability.

1.2 General Aspects of Paper Recycling

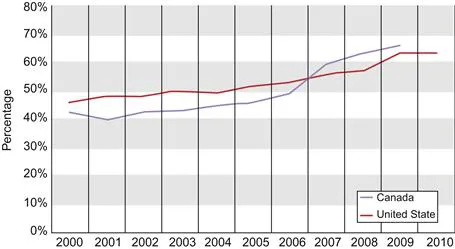

Paper recycling in an increasingly environmentally conscious world is gaining importance (Anon, 2004a,b, 2005a,b; Bajpai, 2006; DIPP, 2011; Edinger, 2004; Francois, 2004; Friberg & Brelsford, 2002; Friberg et al., 2004; Raivio, 2006; Robbins, 2003; Rooks, 2003; Selke, 2004). Recycled fibres play a very important role today in the global paper industry as a substitute for virgin pulps. Paper recovery rates continue to increase each year in North America and Europe (with the exception of 2009–2010 in Europe owing to a dip in production during the economic downturn). In March, the American Forest & Paper Association launched its Better Practices Better Planet 2020 initiative, establishing an ambitious goal of 70% paper recovery by 2020 (the recovery rate was 63.5% in 2010) (Jourdan, 2011). Much increase in paper recovery can be attributed to the increase in easy residential and commercial recycling through single-stream recovery systems, as 87% of Americans now have access to curbside or drop-off paper recycling programmes. Figure 1.2 shows the US and Canadian recovery rates.

Figure 1.2 US and Canadian recovery rates. Source: Reproduced with permission from EPN environmentalpaper.org/.../state-of-the-paper-industry-2011-full.pdf.

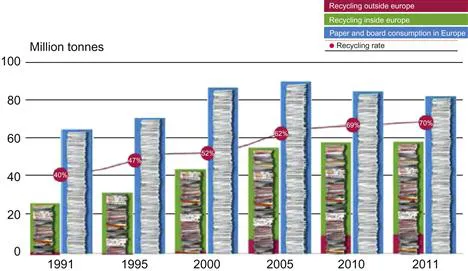

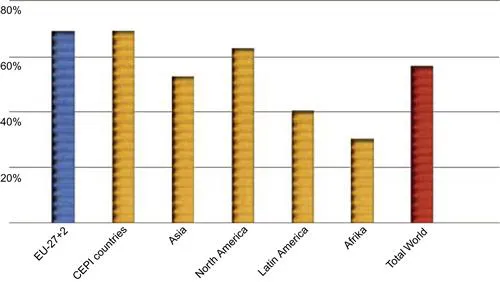

The recycling rate in Europe reached 70.4% in 2011 (Figure 1.3). The total amount of paper collected and recycled in the paper sector remains stable at 58 million tonnes, the same as in the previous years. However, this is an increase of 18 million tonnes since 1998, the base year for the first voluntary commitment the paper value chain set itself for increasing recycling in Europe. A net volume of 9.2 million tonnes (or 15.9%) of the total 58 million tonnes was imported for recycling by third countries outside the commitment region of the EU-27 plus Norway and Switzerland. Thirteen European countries exceed the 70% recycling rate, 12 European countries are below 60%. Figure 1.4 shows recycling rate in world regions in 2010. Europe is the leader in paper recycling.

Figure 1.3 European paper recycling (1991–2011). Source: Reproduced with permission from CEPI.

Figure 1.4 Recycling rates in world regions in 2010. Source: Reproduced with permission from CEPI.

Exports of recovered fibre from the USA to Asia have grown rapidly, representing a nearly three-fold increase since 2002. These exports are primarily destined for China. In 2009, approximately 36% of fibre recovered in the USA was exported to Asia.

With rapid developments in deinking processes for the reuse of secondary fibres being made, the recycling process is becoming increasingly efficient. The quality of paper made from secondary fibres is approaching that of virgin paper. Its manufacture is much more eco-friendly than that of virgin paper. The main drivers lead...