- 1,000 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

An Introduction to Trading in the Financial Markets SET

About this book

How do financial markets operate on a daily basis? These four volumes introduce the structures, instruments, business functions, technology, regulations, and issues commonly found in financial markets. Placing each of these elements into context, Tee Williams describes what people do to make the markets run. His descriptions apply to all financial markets, and he includes country-specific features, stories, historical facts, glossaries, and brief technical explanations that reveal individual variations and nuances. Detailed visual cues reinforce the author's insights to guide readers through the material. This book will explain where brokers fit into front office, middle office, and back office operations.

- Provides easy-to-understand descriptions of all major elements of financial markets

- Heavily illustrated so readers can easily understand advanced materials

- Filled with graphs and definitions that help readers learn quickly

- Offers an integrated context based on the author's 30 years' experience

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access An Introduction to Trading in the Financial Markets SET by R. Tee Williams in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

An Introduction to Trading in the Financial Markets

Trading, Markets, Instruments, and Processes

Table of Contents

Cover image

Title page

Copyright

Preface for the Set

Features of the books

Acknowledgments

Preface

Overview

Taxonomy of markets

Entities

Instruments

Functions

Technology

Global markets

Risk management

Regulation

Compliance

Visual Glossary

PREFACE

OVERVIEW

PART 1: INVESTING AND TRADING

PART 2: MARKETS AND MARKETPLACES

PART 3: INSTRUMENTS

PART 4: PROCESSES

Part 1: Investing and Trading

Introduction

1. Investing

Investing concepts

Investment styles

2. Trading

Trading concepts

Trading tools

Trade motivation

Trading styles (approaches)

Retail behavior

The spectrum of orders

Trading economics

Conclusions

Related information in other books

Part 2: Markets and Marketplaces

Introduction

1. The Primary Market

Primary market methods

Market organization

Primary market economics

2. Secondary Markets

Secondary market structure

Types of markets

Market format

Market mechanics

Market tools

Liquidity behavior

Related information in other books

Part 3: Instruments

Introduction

1. Cash Instruments

Equities

Fixed income (fixed interest)

Currencies

Commodities

2. Derivative Instruments

Options

Futures

Complex derivatives

Conclusions and related information in other books

Part 4: Processes

Introduction

1. Primary Market Process

Steps in the underwriting process

2. Secondary Market Process

Steps in the trading process

Business process flow

3. Support Processes

Investment research

Steps in the investment research process

Street support processes

Customer support processes

Related information in other books

Conclusion

Book 1: an introduction to trading in the financial markets: market basics

Book 3: an introduction to trading in the financial markets: technology—systems, data, and networks

Book 4: an introduction to trading in the financial markets: global markets, risk, compliance, and regulation

Appendix: Historical settlement methods

Fixed Calendar Settlement Dates

Daily balance orders

Glossary

References

Copyright

Academic Press is an imprint of Elsevier

30 Corporate Drive, Suite 400, Burlington, MA 01803, USA

525 B Street, Suite 1900, San Diego, California 92101-4495, USA

The Boulevard, Langford Lane, Kidlington, Oxford 0X5 1GB, UK

Copyright © 2011 Elsevier Inc. All rights reserved.

All illustrations © 2011 R. “Tee” Williams. All rights reserved.

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or any information storage and retrieval system, without permission in writing from the publisher. Details on how to seek permission, further information about the Publisher’s permissions policies and our arrangements with organizations such as the Copyright Clearance Center and the Copyright Licensing Agency, can be found at our website: www.elsevier.com/permissions.

This book and the individual contributions contained in it are protected under copyright by the Publisher (other than as may be noted herein).

Notices

Knowledge and best practice in this field are constantly changing. As new research and experience broaden our understanding, changes in research methods, professional practices, or medical treatment may become necessary.

Practitioners and researchers must always rely on their own experience and knowledge in evaluating and using any information, methods, compounds, or experiments described herein. In using such information or methods they should be mindful of their own safety and the safety of others, including parties for whom they have a professional responsibility.

To the fullest extent of the law, neither the Publisher nor the authors, contributors, or editors, assume any liability for any injury and/or damage to persons or property as a matter of products liability, negligence or otherwise, or from any use or operation of any methods, products, instructions, or ideas contained in the material herein.

Library of Congress Cataloging-in-Publication Data

Williams, R. Tee.

An introduction to trading in the financial markets : trading, markets, instruments, and processes / R. “Tee” Williams.

p. cm.

Includes bibliographical references and index.

ISBN 978-0-12-374839-3

1. Capital market. 2. Stock exchange. 3. Financial instruments. I. Title.

HG4523.W5553 2011

332’.0415–dc22 2010039627

Set ISBN: 978-0-12-384972-4

British Library Cataloguing-in-Publication Data

A catalogue record for this book is available from the British Library.

For information on all Academic Press publications visit our Web site at www.elsevierdirect.com

Printed in China

11 12 13 14 15 10 9 8 7 6 5 4 3 2 1

Preface for the Set

The four books in the set are an exercise in reportage. Throughout my career, I have been primarily a consultant blessed with a wide array of projects for many different kinds of entities in Africa, Asia, Europe, and North America. I have not been a practitioner but rather a close observer synthesizing the views of many practitioners. Although these books describe trading and the technology that supports trading, I have never written an order ticket or line of computer code in anger.

The purpose of these books is to describe what individuals and entities in the trading markets do. Bob Simon of 60 Minutes once famously asked two founders of the dot-com consulting firm Razorfish to describe what they did when they got to work each day and took off their coats. That is the purpose of these books: to examine what participants in the trading markets do each day when they take off their coats. These books do not attempt to prescribe what should occur or proscribe what should not.

The nature of the source material for these books is broad observation. In teaching professional development courses over nearly two decades, I have found that both those new to the markets and even those who have been market participants for years become experts in their specific area of activity; however, they lack the context to understand how their tasks fit into the overall industry. The goal of this set of books is to provide that context.

Most consulting projects in which I have participated have required interviews with people working in all phases of the trading markets about what they do and their views on how the markets work. Those views and opinions helped frame my understanding of the structure of the markets and the roles of its participants. I draw on those views, but I cannot begin to document all the exact sources.

I have isolated fun stories I have heard along the way, which I cannot attribute to a specific source, into boxes within the text. These boxes also include asides that are related to the subjects being discussed but that do not specifically fit into the flow.

The structure of the books presents information in a hierarchical form that puts entities, instruments, functions, technology, and processes into a framework. Categorizing information into hierarchies helps us understand the subject matter better and gives us a framework in which to view and understand new information. The frameworks also help us understand how parts relate to the whole. However, my experience as a consultant convinces me that while well-chosen frameworks can be helpful and appealing to those first coming to understand new subject matter, they also carry the risk that their perspective may mask other important information about the subjects being categorized. So for those who read these books and want to believe that the trading markets fit neatly into the frameworks presented here: “Yes,” I said. “Isn’t it pretty to think so.”1

Features of the books

Figure FM.1 shows the books in this set with tabs on the side for each of the major sections in the book. The graphic is presented at the end of each major part of the books with enlarged tabs for the section just covered, with arrows pointing to the parts of other books and within the same book where other attributes of the same topic are addressed. I call this the “Moses Approach.”2

Figure FM.1 The books of this set are organized as a whole and concepts are distributed so that they build from book to book.

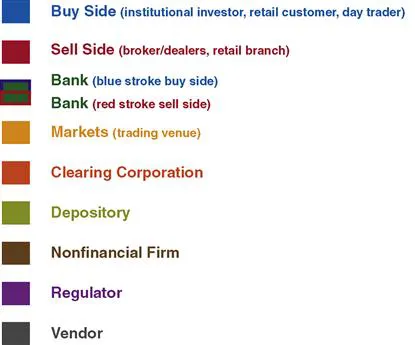

In addition to words and graphics, the four books use color to present information, as shown in Figure FM.2. Throughout, the following color scheme represents the entities as well as functions, processes, systems, data, and networks associated with them.

Figure FM.2 Color in these books identifies entities that are central to the trading markets, and also identifies the functions and processes that are associated with those entities.

A frustration of writing about the trading markets is the wealth of colorful and descriptive terms that permeate the markets. These terms are helpful in describing what happens in ...

Table of contents

- Cover

- Contents

- An Introduction to Trading in the Financial Markets: Market Basics

- An introduction to Trading in the Financial Markets

- An Introduction to Trading in the Financial Markets: Trading, Markets, Instruments, and Processes

- An Introduction to Trading in the Financial Markets

- Index