- 186 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Credit Insurance

About this book

This monograph is practically oriented, presenting a survey and explanation of credit insurance services for protection of short-term trade receivables primarily against commercial risk of insolvency and protracted default. The subject matter (i.e., main functions, features and principles of credit insurance with detailed description of credit insurance coverage, insurance conditions, and credit insurance policy management) follows procedural stages and presents commercial, financial, legal, and practical points of view which emphasize the needs of both the providers of these services and their clients – existing and potential credit insured companies – as well as other practitioners.

- Explains how credit insurance has changed from an esoteric type of property insurance into a flexible and frequently used credit risk mitigation tool used on a global basis

- Compares credit insurance with self-insurance and equivalent substitutes

- Describes the types of insurance available and how to obtain and manage credit insurance policies

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Credit Insurance by Miran Jus in PDF and/or ePUB format, as well as other popular books in Economics & Banks & Banking. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Introduction

Companies use credit insurance as one of the personal securities and frequently used high-quality means of protection against payment risks, that is, the possibility that the buyer (debtor) will not make payment for goods and services in full and in a timely fashion. These risks are economic phenomena of nonnegligible proportions thus influencing the business success. Effective protection against the debtors’ insolvency and default risks is one of the key factors for success in business operations.

The principal motive of companies is to make profit. The latter in general depends on the revenues and expenses resulting from the business operations. However, sound business decisions must give consideration to other factors as well, for example, indirect benefits and the risks of business transactions. Unless a company is adequately insured against the risks, the consequence may be losses which increase expenses, threaten profitability of business transactions, and the success of the company. Losses increase costs, reduce the profit or even eat away the capital of the company, and threatens its liquidity, solvency, or mere existence.

Credit insurers can provide companies with the required security for their business operations where risks—which will to a certain extent always exist (No risk—no fun!)—would be brought into line with revenues, other incomes, and assets of the company.

Trade without credit is almost inconceivable. Credit which is a word with many meanings (depending on the context in which it appears), loan and sale credit, is the lifeblood of a highly competitive contemporary business environment and a necessity for business operations as well as undisturbed trade flows. Today, we can talk about monetary economy and to a large extent also about credit-based economy where selling on credit terms is a requirement—Customer is the king!—imposed to the companies and brought on by harsh international competition. As the volume of trade is increasing, issues of trade finance, buyers’ and suppliers’ credits, and inherent risks as well as accessory credit insurance are becoming the concern of many business operators.

Payment—insolvency and default—risks are inherent to each credit transaction or sales on deferred payment terms. Credit risk and insurance against these risks thus become an even more important factor to be considered for the contemporary business operations. In commercial transactions on credit terms or trade financing, creditors with inadequate insurance cover remain exposed to a wide array of risks spectrum. There is always a possibility that delivered goods or services performed would not be paid for by the customer or principal and/or interests would not be repaid by the debtor, that is, the debtor simply does not pay his/her due debts (mora solvendi) under the terms and conditions or in the place as agreed upon in the underlying commercial or financial contract (peius). Such nonpayment, delayed payment, insolvency, or debtor’s default are quite common in practice and could turn the creditor into financial disaster and ruin. Even though careful selection of business partners and thoroughly stipulated commercial contracts may diminish the risks, the vendor selling its goods or services in terms of deferred payment is usually not fully protected against the above risks without collateral or additional first-class securities. When the delivered goods are no longer in the supplier’s possession, the buyer’s contractual obligations per se do not guarantee that the seller will be actually paid.

Credit (del credere) insurance has developed into an appreciated risk mitigation tool for industrialists or merchants, and is meant for protecting trade receivables—an important part of a company’s assets—against the broad spectrum of commercial and noncommercial risks. With credit insurance, sellers are able to trade soundly, despite unfavorable economic or political situations, customer bankruptcy, or poor payment discipline. In the past, credit insurance had been considered an esoteric insurance type well understood only by few in the business community with a reputation of being complicated. However, with rapidly evolving credit insurance market and competition among credit insurers, development of services, and information technology (IT), they have made the supply of these services more flexible, cut down prices, improved the response time of the insurers, and through simplifications made credit insurance less complex, user-friendly, and more customized and accessible for the companies. Modern credit insurance makes business, credit risk management, and debt collection easier, thus stimulating the companies on a global level to use it more and more frequently. Higher risk and product awareness has led to increased demand for credit insurance as a risk mitigation tool and it has gained global recognition.

Chapter 2

What Is Credit Insurance and What Does It Offer?

Insurance helps creditors to have a good night’s sleep!

2.1 DEFINITION

2.2 FUNCTIONS OF CREDIT INSURANCE

2.2.1 General—Sales and Exports Promotion

2.2.2 Assumption of Risk and Claims Payment

2.2.3 Preventive Function of Credit Insurance

2.2.4 Prevention of Claims, Their Minimization, and Recoveries

2.2.5 Credit Insurance Enhances External Financing

2.1 Definition

For suppliers selling goods and services in domestic or foreign markets on credit or deferred payment terms, credit insurance provides insurance coverage for outstanding trade receivables against the nonpayment risk of their customers or debtors and their eventual guarantors.

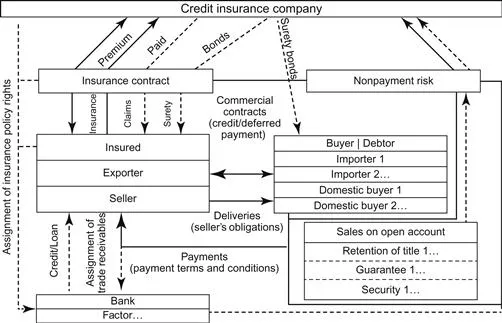

By concluding a credit insurance contract, exporters or sellers—that is, creditors of underlying sales and other commercial contracts—may partly or completely transfer commercial and/or noncommercial risks of business transactions to the specialized financial institution (credit insurance company). Such credit and/or manufacturing risks may cause damage (damnum), which could be in exchange for insurance premium compensated by insurer’s claims paid. Indemnification for loss sustained shall be made within the predetermined amount, if the seller (insured creditor/obligee) without his own fault is not paid by his domestic or foreign buyers (debtors/obligors or guarantors) for his goods or services sold on credit terms. As a condition for claim payment, such material loss incurred has to be caused by the insured event, for example, if the risk of nonpayment materializes due to permanent insolvency or protracted default of the debtor, which according to general and special insurance conditions represent specified insured event (including repudiation or buyer’s refusal to accept goods, political events, and other noncommercial risks). Figure 2.1 illustrates the credit insurance of underlying trade receivables, its participants, and their relations.

Figure 2.1 Credit insurance and its participants.

Should we attempt to classify insurance according to the insured subject matter (property insurance, personal insurance, and liability insurance), then credit insurance as one of the insurance classes belongs to the property insurance as accounts receivable from trade credits represent company’s assets—to be more precise in the credit insurance and suretyship subgroup (in a wider sense of the word fidelity insurance is also a part of this insurance class).

However, credit insurance may be perceived as quite different from other types of insurance, not just in the underwriting sense due to special nature of credit risks involved but in the legal sense as well. The fact that credit insurance involves more or less equal contractual parties and specific particularities of the credit insurance are the main reasons why certain provisions of governing Civil Codes on insurance contracts do not apply always for credit insurance (except sometimes by analogy), while contractual obligations of the parties are defined in detail within the insurance contracts and general credit insurance conditions. Legal sources for credit insurance must therefore not only be looked for in applicable substantive laws but also mainly in applicable general and special insurance conditions, business customs, and informal legal sources (“soft laws”), as well as in case law.

Table of contents

- Cover image

- Title page

- Table of Contents

- Copyright

- List of Abbreviations

- List of Figures

- About the Author

- Chapter 1. Introduction

- Chapter 2. What Is Credit Insurance and What Does It Offer?

- Chapter 3. Basics and Principles of Credit Insurance

- Chapter 4. Risk Management and Credit Insurance

- Chapter 5. Advantages of Credit Insurance

- Bibliography