eBook - ePub

Pricing, Risk, and Performance Measurement in Practice

The Building Block Approach to Modeling Instruments and Portfolios

- 398 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Pricing, Risk, and Performance Measurement in Practice

The Building Block Approach to Modeling Instruments and Portfolios

About this book

How can managers increase their ability to calculate price and risk data for financial instruments while decreasing their dependence on a myriad of specific instrument variants? Wolfgang Schwerdt and Marcelle von Wendland created a simple and consistent way to handle and process large amounts of complex financial data. By means of a practical framework, their approach analyzes market and credit risk exposure of financial instruments and portfolios and calculates risk adjusted performance measures. Its emphasis on standardization yields significant improvements in speed and accuracy.Schwerdt and von Wendland's focus on practical implementation directly addresses limitations imposed by the complex and costly processing time required for advanced risk management models and pricing hundreds of thousands of securities each day. Their many examples and programming codes demonstrate how to use standards to build financial instruments, how to price them, and how to measure the risk and performance of the portfolios that include them.

- The authors have designed and implemented a standard for the description of financial instruments

- The authors have developed an approach for pricing and analyzing any financial instrument using a limited set of atomic instruments

- The book builds a practical framework for analysing the market and credit risk exposure of financial instruments and portfolios

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Pricing, Risk, and Performance Measurement in Practice by Wolfgang Schwerdt,Marcelle von Wendland in PDF and/or ePUB format, as well as other popular books in Economics & Finance. We have over one million books available in our catalogue for you to explore.

Information

Lab Exercise 1.1: Implementation Planning

- 1. Download the file ImplementationPlanning.pdf and work through the step-by-step planning tutorial for either a fictitious or real project within your organisation.

Chapter 1 Introducing Model Implementation with the Building Block Method

This chapter introduces the building block approach. Any known financial instrument from the most simple to the most complex and esoteric can be put together from a small set of atomic components. With traditional data models you need to extend your data model every time you get a new unexpected combination of features. Then you need to develop new valuation and risk models for the new type of instrument. With the building block approach neither of the two steps are needed. All you need to do is to compose the new instrument from predefined building blocks that cover all imaginable features.

The fact that building blocks can be added easily and all instruments can be composed from a small set of building blocks means that a small number of building block valuation and risk models can handle an endless variety of actual financial instruments, rule sets can be built from simple components and configured to validate specific combinations of features dynamically, and data base, modelling, and portal software are not impacted by new instrument types but instead support them as soon as they arise.

1.1 Why Use a Building Block Approach?

Financial instruments come in a bewildering variety. There are virtually limitless possibilities to create new instruments by combining even just the more mainstream features in different combinations in order to match constantly changing market conditions and needs of investors. It is hence impossible to create a unique off-the-shelf valuation model for each combination of features used in the market. While most instruments are specimens of the pure plain vanilla variety of common instrument types like money market discount instruments, zero coupon bonds, fixed or variable coupon bonds, equity as well as derivatives make up a large fraction of all instruments in use at any point in time, this still leaves a large set of instruments that are more complex and often unique in one or more aspects.

However, help is at hand. Nearly two millennia before modern physics discovered the real atoms, Greek philosophers used the word atomos, meaning that which is indivisible, to describe the basic substance from which they thought all material things were constructed.

When you take on the task of valuing financial instruments with a comprehensive set of atomic instruments, it will allow you to split up more complex investments into combinations of simpler ones. This means that you will need a much smaller set of tools than you would have otherwise.

Robust and sophisticated tools whose behaviour is well known can be constructed to allow you to determine the value, risk, and profitability of the atomic parts of any instrument and ultimately that of the instrument of which they form a part. In addition, the smaller set of tools will be more manageable to learn and master.

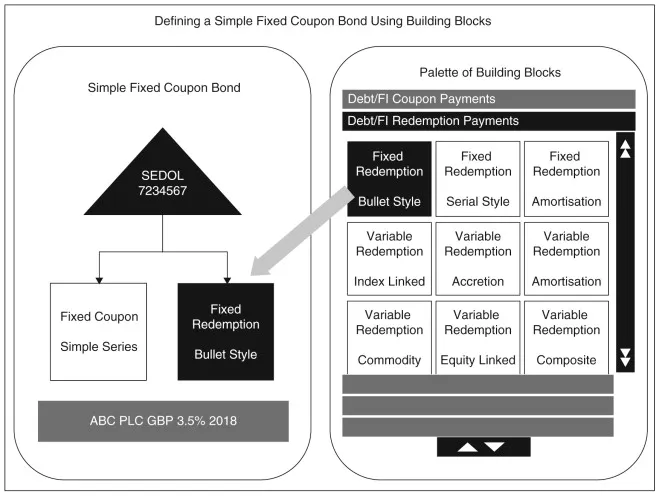

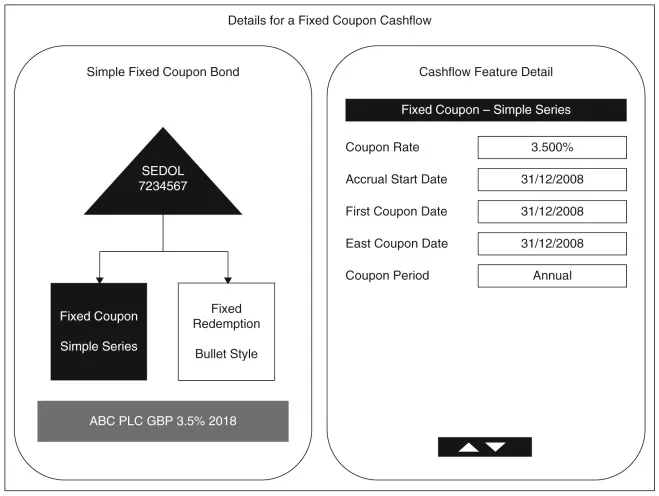

Figure 1.1 illustrates how you can quickly build actual financial instruments by dragging common building blocks from a palette onto the instrument definition. In the example a Fixed Coupon Bond is composed from two building blocks: a Fixed Coupon and a Bullet Style Fixed Redemption building block. In Figure 1.2 you can see the details for the Fixed Coupon building block of the example Fixed Coupon Bond.

Figure 1.1: Composing a financial instrument from a palette of building blocks.

Figure 1.2: Completing and viewing the details of a component building block.

Fixed Coupon Bonds of course are handled easily by more conventional models, but there are many structured products that combine endless combinations of different plain vanilla and exotic features into different unique products. One of the big attractions of the building block approach is that you can easily create instruments of any complexity using a graphical drag-and-drop wizard tool (such as the one on the companion web site).

This is where the building block approach starts to pay off. With traditional data models or approaches you would need to extend your data model every time you get or want to use a new unexpected combination of features. You would now need to develop new valuation and risk models for the new type of instrument. With the building block approach neither of the two steps are needed. All you need to do is to compose the new instrument from predefined building blocks that cover all the separate features.

Very occasionally a new building block will be needed but this usually can be added without any data model changes again since the underlying data frame for all building blocks—called the Cash Flow Element—already has a super set of attributes that allows the definition of a near limitless variety of new building block types.

The fact that building blocks can be added easily and all instruments can be composed from a small set of building blocks not only allows very intuitive user interfaces for the creation of new instruments such as the Graphical Instrument Wizard from Fincore Financial, but it also means that a small number of building block valuation and risk models can handle an endless variety of actual financial instruments. Rule sets can be built from simple components and configured to validate specific combinations of features dynamically. Data base, modelling, and portal software is not impacted by new types of instruments but instead supports them as soon as they arise.

1.2 An Implementation Framework

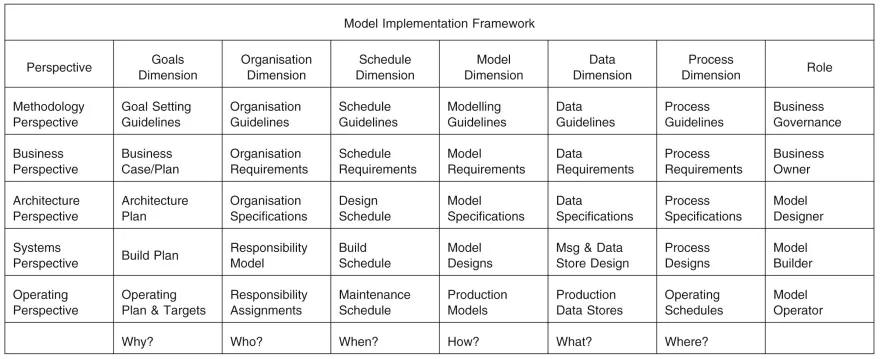

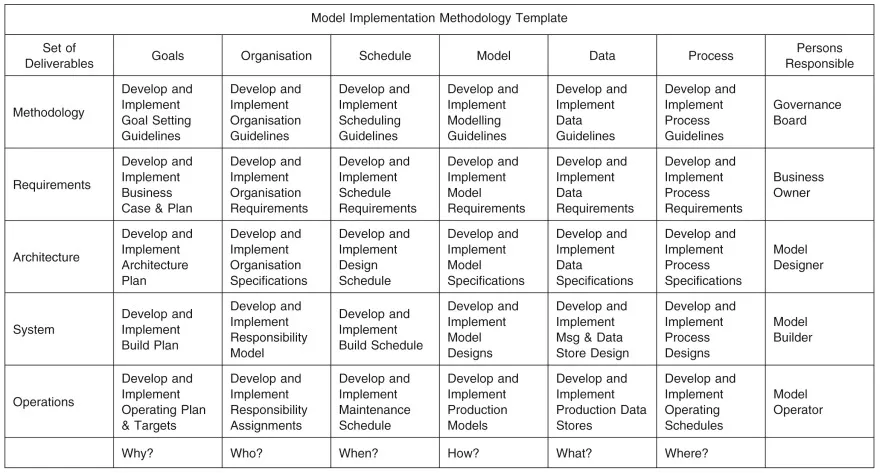

Implementing valuation, risk, and performance measurement models is a complex task even in the simplest cases. Fortunately the task can be broken down into many smaller steps that are much easier to complete. To do this successfully you will need a framework and methodology to hold all the smaller steps together. In this chapter we introduce such a framework. This framework has been derived from a framework set out in Innmon, Zachman, and Geiger, 1997. In Figure 1.3 we outline the model implementation framework. Figure 1.4 provides an overview diagram for a generic methodology for implementing models.

Figure 1.3: Model implementation framework.

Figure 1.4: Model implementation methodology template.

In the remainder of this chapter we will look at how to apply the implementation framework and methodology. Because implementing models is such a complex endeavour, only the most simple ones can be implemented in one go from the first identification of a need right through to ongoing use of the model for decision making.

As a first step we will therefore look at the role of iterative cycles in the implementation process. The pattern we suggest to use is the iterative fountain model with short parallel planning and delivery cycles. Then we will look at each perspective in the framework and methodology starting with the methodology perspective. Although it might appear surprising to cover the task of methodology definition in an iterative and practical approach, there are good reasons to do so. The usefulness and reliability of risk modelling efforts in a particular context are highly dependent on the way the models are developed, implemented, and operated. What may have worked well in one context may well prove of little value or downright dangerous in another.

Next we will look at the requirements perspective. It may seem an obvious step but it is often underestimated. The results of modelling are highly dependent on the question we try to answer. It is important to ensure that the questions we try to answer with a set of risk models are really the ones that need to be answered to make the right decisions for a successful outcome from a business perspective.

Following the requirements perspective comes the architecture perspective. Any nontrivial risk model implementation is a complex (software) engineering task and will produce a nontrivial software (engineering) system as a result. To ensure that the overall system will fulfil the expectations placed on it when it is first delivered, and likewise years later after accommodating many changes, it is vital that it is built on the basis of blueprints that ensure its overall efficiency and effectiveness as much as its resilience in the face of change.

The system perspective will complete the sequence of steps necessary for the develop...

Table of contents

- Cover

- Title

- Advance Praise for Pricing, Risk, and Performance Measurement in Practice

- Copyright

- Table of Contents

- About the Authors

- Preface

- Acknowledgements

- Chapter 1 - Introducing Model Implementation with the Building Block Method

- Chapter 2 - Introducing the Building Block Data Model

- Chapter 3 - Modelling Financial Instruments

- Chapter 4 - Introduction to Practical Valuation

- Chapter 5 - Implementing Valuation Models

- Chapter 6 - Introduction to Practical Risk Modelling

- Chapter 7 - Implementing Risk Models

- Chapter 8 - Introducing Performance Measurement

- Chapter 9 - Implementing Performance Models

- Chapter 10 - Understanding Valuation Theory

- Appendix A - Building Block Data Model

- Appendix B - Code Lists

- References

- Index