- 324 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Smart Card Report

About this book

The definitive guide to the smart card industry.

- Will help you to keep track of the major issues affecting the market

- Will enable you to identify new business opportunities

- Includes profiles of key players, assesses market trends and drivers, comprehensive technology review

Completely revised and updated, the 8th edition of The Smart Card Report examines the smart card market and major end-use sectors, identifying their needs for smart cards, assessing growth prospects and highlighting market opportunities.

The study looks at the structure of the industry, profiles key players, assesses market trends and drivers, discusses industry issues and investigates usage by geographical region and application area. A comprehensive technology review is also included.

We have drawn on the expertise from our existing portfolio, Card Technology Today newsletter and ID Smart: Cards for Governement & Healthcare conference to bring you vital information, analysis and forecasts that cannot be found anywhere else.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1

Introduction

This eighth edition of The Smart Card Report is published at a pivotal time for the smart cards industry.

Changes in the value chain among chip and card suppliers are introducing new challenges, with more companies moving to Position themselves as total solution providers. Meanwhile, the terminal manufacturer market is witnessing changes with further market consolidation taking place.

New market drivers in the wake of the events of September 11 2001 are helping to drive the case for volume shipments of cards and terminals in emerging sectors such as governmental and corporate identification, Commitment for chip technology through the Europay MasterCard Visa (EMV) specification is helping drive the impetus for smart cards throughout the financial sector, and although the number of deployments within this sector have been slower than many initially forecast, there is no doubt that the sector will steadily increase its market share of shipments during the coming years. Mass transit contracts continue to be announced on a regular basis too, a trend that the development of contactless technology can only help. As the mobile telecoms industry gets over the financial problems of the beginning of the 21st century, shipments of higher-powered Subscriber Identity Module (SIM) technology are starting to take off – albeit at a slower rate than volume shipments of SIM cards during the boom of the 1990s.

The development of multi-application technology IS offering opportunities for new business models based on cost sharing, and provides real potential for the deployment of smart card technology linking the public and private sectors.

All these issues and trends are explored in this, the latest edition of The Smart Card Report. The report also provides: a basic introduction to smart card technology; a glossary of industry terms; information on security, privacy and risk management, profiles of leading players; an industry directory; and, details of industry groups and specifications. In addition, you will find a representative sample of smart card industry applications including easy-to-reference tables. However, with an estimated 1900 million cards in the market in 2003, it is unrealistic to list every project worldwide. Inevitably, these tables will not be exhaustive and if we have missed a project that you feel is fundamental in its importance to the industry then please let us know.

1.1 Summary of Contents

• Chapter 2 looks at industry trends and potential output from 2003–2006.

• Chapter 3 covers standards, industry specifications and industry groups.

• Chapter 4 examines smart card security, privacy and risk management,

• Chapter 5 describes a representative sample of smart card applications and looks at key application issues.

• Chapter 6 provides profiles of a selection of companies working in the smart cards industry.

• Chapter 7 includes an address book of companies and organizations of interest to the smart cards industry.

• Appendix 1 offers a brief overview of smart card technology.

• Appendix 2 covers a glossary of key industry terms.

• Appendix 3 provides definitions of market segments.

1.2 Methodology

Research methodology for this report included extensive use of primary data, collected in person, from the Internet, by email and by telephone during 2003. Collection of secondary data included reviews of government and industry statistics, annual reports, press releases and trade journals – including Elsevier’s Card Technology Today newsletter.

2

Market Trends and Output 2003-2006

The smart card market is poised for good levels of future growth as several market segments are beginning to report a growing enthusiasm for the technology.

2.1 Market Shipments

We have taken market shipment figures for 2002 from the industry group Eurosmart as the benchmark for our projections on the future market. Eurosmart is widely respected throughout the industry as an association with links to the main smart card technology companies. The organization is also recognized as a strong player with all accurate view on the state of the industry.

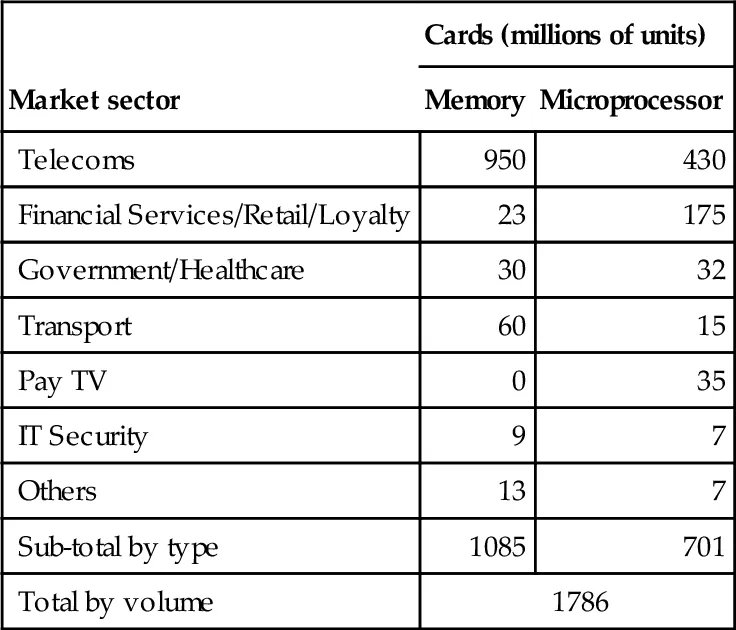

Table 2.1

Worldwide shipments by sector 2002

| Market sector | Cards (millions of units) | |

| Memory | Microprocessor | |

| Telecoms | 950 | 430 |

| Financial Services/Retail/Loyalty | 23 | 175 |

| Government/Healthcare | 30 | 32 |

| Transport | 60 | 15 |

| Pay TV | 0 | 35 |

| IT Security | 9 | 7 |

| Others | 13 | 7 |

| Sub-total by type | 1085 | 701 |

| Total by volume | 1786 | |

Source: Eurosmart, Reproduced by permission of Eurosmart

Using Eurosmart’s estimations as the foundation for our research, we have estimated total industry output for 2003, 2004, 2005 and 2006. These estimates are based on quantitative and qualitative research conducted with key industry players during 2003. This research covered areas such as potential market penetration within market segments, as well as regional markets. Definitions of each market segment can be found in Appendix 3.

Table 2.2

Estimated worldwide shipments of cards by year (million)

| Year | Memory cards shipped (million) | Microprocessor cards shipped (million) | Total (million) |

| 2002* | 1085 | 701 | 1786 |

| 2003 | 1095 | 852 | 1947 |

| 2004 | 1089 | 986 | 2075 |

| 2005 | 1062 | 1172 | 2234 |

| 2006 | 978 | 1335 | 2313 |

* Actual shipment figures from Eurosmart

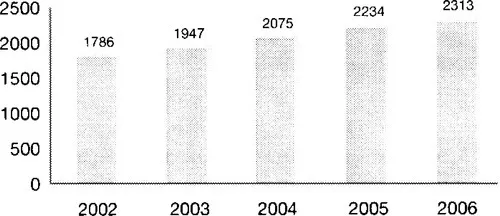

Figure 2.1 Estimated total global smart card shipment figures (millions) from 2002–2006

Our research shows that total smart card shipments will grow steadily between 2003 and 2006, increasing by 19% within this time period. Between 2002 and 2006, total shipments are expected to grow by 29%.

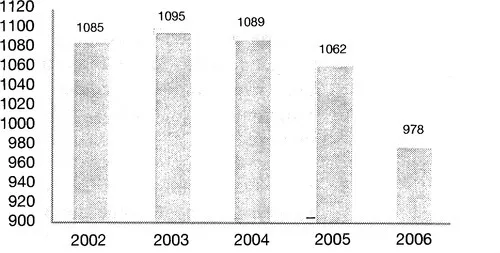

Our research indicates that although total smart card shipments will increase, the number of memory cards shipped between 2003 and 2006 will begin to fall. This is largely due to the growth in the market for microprocessor cards coupled with the decline in the public payphone market.

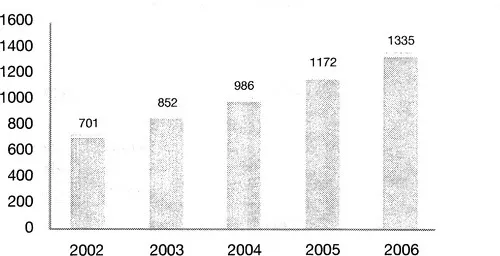

Our research highlights that the number of microprocessor cards shipped globally will continue to grow. In 2003, we estimate that 852 million microprocessor cards will be shipped worldwide. This will rise to 1335 million cards in 2006, representing growth of 57%.

Figure 2.2 Estimated total global shipments of memory cards (millions) from 2002–2006

Figure 2.3 Estimated total global shipments of microprocessor cards (millions) from 2002–2006

Based on these shipment figures, we estimate that this will be translated into revenues of:

• €2540 million in 2003

• €2881 million in 2004

• €3363 million in 2005

• €3723 million in 2006

However, it should be remembered that the translation of shipment figures into financial value must be treated with extreme caution, as numerous factors enter into the cost of a smart card. Such factors include (but may not be limited to):

• The number of cards deployed in each contract;

• The type of card deployed;

• Memory size of the card;

• Features on the card;

• Currency fluctuations;

• Personalization considerations; and,

• The security features included on the card.

As a result, cards sold in some market segments may range in value from as little as €1.50 to as much as €6. Our revenue figures are therefore designed to provide all indication of where the industry is going, but we urge readers to remember that specific contracts have individual requirements that will greatly impact on the price of the smart card deployed.

Our research shows that the market will continue to be dominated by the telecoms segment, while the financial and identification (ID) sectors will also become more and more important. The value chain will continue to be shaken up by mergers and acquisitions. Ongoing price pressures will be experienced, but a steady migration towards higher-value cards should help the onward growth of smart card revenue. As the push towards higher memory continues, Java-based operating systems will come to the fore.

Table 2.3

Estimated share of memory card market by sector 2003–2006 (%) based on total volume shipped

| Year | Telecom... |

Table of contents

- Cover image

- Title page

- Table of Contents

- Copyright page

- List of Tables

- List of Figures

- 1: Introduction

- 2: Market Trends and Output 2003-2006

- 3: Standards, Specifications and Industry Groups

- 4: Security, Privacy and Risk Management

- 5: Market Segments

- 6: Company Profiles

- 7: Address Book

- Appendix 1: Smart Card Technology

- Appendix 2: Glossary of Terms

- Appendix 3: Definitions of Market Segments

- Acknowledgements

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access The Smart Card Report by Wendy Atkins in PDF and/or ePUB format, as well as other popular books in Business & Business Strategy. We have over one million books available in our catalogue for you to explore.