Rethinking Valuation and Pricing Models

Lessons Learned from the Crisis and Future Challenges

- 652 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Rethinking Valuation and Pricing Models

Lessons Learned from the Crisis and Future Challenges

About this book

It is widely acknowledged that many financial modelling techniques failed during the financial crisis, and in our post-crisis environment many techniques are being reconsidered. This single volume provides a guide to lessons learned for practitioners and a reference for academics.Including reviews of traditional approaches, real examples, and case studies, contributors consider portfolio theory; methods for valuing equities and equity derivatives, interest rate derivatives, and hybrid products; and techniques for calculating risks and implementing investment strategies. Describing new approaches without losing sight of their classical antecedents, this collection of original articles presents a timely perspective on our post-crisis paradigm.- Highlights pre-crisis best classical practices, identifies post-crisis key issues, and examines emerging approaches to solving those issues- Singles out key factors one must consider when valuing or calculating risks in the post-crisis environment- Presents material in a homogenous, practical, clear, and not overly technical manner

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1

The Effectiveness of Option Pricing Models During Financial Crises

Chapter Outline

1.1 Introduction

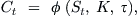

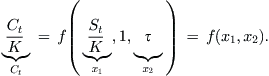

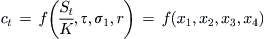

1.2 Methodology

Table of contents

- Cover image

- Title page

- Table of Contents

- Editor’s Disclaimers

- Copyright

- Foreword

- Editors

- Contributors

- 1. The Effectiveness of Option Pricing Models During Financial Crises

- 2. Taking Collateral into Account

- 3. Scenario Analysis in Charge of Model Selection

- 4. An “Economical” Pricing Model for Hybrid Products

- 5. Credit Valuation Adjustments– Mathematical Foundations, Practical Implementation and Wrong Way Risks

- 6. Counterparty Credit Risk and Credit Valuation Adjustments (CVAs) for Interest Rate Derivatives–Current Challenges for CVA Desks

- 7. Designing a Counterparty Risk Management Infrastructure for Derivatives

- 8. A Jump–Diffusion Nominal Short Rate Model

- 9. The Widening of the Basis: New Market Formulas for Swaps, Caps and Swaptions

- 10. The Financial Crisis and the Credit Derivatives Pricing Models

- 11. Industry Valuation-Driven Earnings Management

- 12. Valuation of Young Growth Firms and Firms in Emerging Economies

- 13. Towards a Replicating Market Model for the US Oil and Gas Sector

- 14. Measuring Systemic Risk from Country Fundamentals: A Data Mining Approach

- 15. Computing Reliable Default Probabilities in Turbulent Times

- 16. Discount Rates, Default Risk and Asset Pricing in a Regime Change Model

- 17. A Review of Market Risk Measures and Computation Techniques

- 18. High-Frequency Performance of Value at Risk and Expected Shortfall: Evidence from ISE30 Index Futures

- 19. A Copula Approach to Dependence Structure in Petroleum Markets

- 20. Mistakes in the Market Approach to Correlation: A Lesson For Future Stress-Testing

- 21. On Correlations between a Contract and Portfolio and Internal Capital Alliocation

- 22. A Maximum Entropy Approach to the Measurement of Event Risk

- 23. Quantifying the Unquantifiable: Risks Not in Value at Risk

- 24. Active Portfolio Construction When Risk and Alpha Factors are Misaligned

- 25. Market Volatility, Optimal Portfolios and Naive Asset Allocations

- 26. Hedging Strategies with Variable Purchase Options

- 27. Asset Selection Using a Factor Model and Data Envelopment Analysis– A Quantile Regression Approach

- 28. Tail Risk Reduction Strategies

- 29. Identification and Valuation Implications of Financial Market Spirals

- 30. A Rating-Based Approach to Pricing Sovereign Credit Risk

- 31. Optimal Portfolio Choice, Derivatives and Event Risk

- 32. Valuation and Pricing Concepts in Accounting and Banking Regulation

- 33. Regulation, Regulatory Uncertainty and the Stock Market: The Case of Short Sale Bans

- 34. Quantitative Easing, Financial Risk and Portfolio Diversification

- 35. Revisiting Interest Rate Pricing Models from an Indian Perspective: Lessons and Challenges

- 36. Investment Opportunities in Australia’s Healthcare Stock Markets After the Recent Global Financial Crisis

- 37. Predicting ASX Health Care Stock Index Movements After the Recent Financial Crisis Using Patterned Neural Networks

- Index