![]()

Chapter 1

Introduction

Introduction

The issue of global climate change and its consequences has become one of growing concern in recent years. In fact, in December 2009 the Environmental Protection Agency announced that emissions of greenhouse gases (GHG) are an endangerment to public health.1 Despite the fact that there is no specific regulation, one is expected in the near future and will affect utilities profoundly, especially those with coal-fired generation. According to Public Utilities Fortnightly, utilities will have to build 250 GW of new generation capacity to offset retirements and meet new demands through 2035, and this new supply will be composed primarily of natural gas and renewable capacity. Subsequently, there has been an increased focus on energy efficiency and on the development of alternative sources of energy, particularly renewable resources, but also nuclear and clean coal technologies, such as carbon capture and storage (CCS).2 “Going green” has become the buzzword of the early 21st century.

As a result, much of the work that is being performed at utilities has been focused on the potential impacts of conservation and energy efficiency on load forecasts, resource planning that includes retirements of generating older units with replacement by renewable resources, and, in the case of investor-owned utilities, shareholder value. What seems to be missing are well-designed rate-setting mechanisms that will provide the proper incentives to consumers to make the appropriate choices in energy efficiency; in other words, the majority of the methodologies by which electric rates are set in the United States (and some other countries that regulate rates paid by end users) provide neither the proper incentive to consumers nor the reward for “doing what is right.” The bottom line is that rates are not based on economic efficiency, which occurs when fixed costs are recovered via fixed charges (i.e., customer- or demand-related costs) and variable costs (i.e., marginal costs) via an energy charge. Instead, other motivations tend to guide the rate-making process, politics among them.

Competitive Paradigm

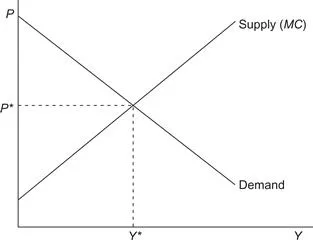

In competitive markets the intersection of supply and demand sets the market-clearing price. You may recall from introductory economics texts that the supply curve represents the marginal cost of production in a competitive paradigm. As such, it is the case that P*, the market-clearing price, is equal to marginal cost, which is efficient both allocatively and productively. This is displayed in Figure 1.1.

Figure 1.1 A competitive market in equilibrium.

As such, marginal cost pricing yields a welfare-maximizing outcome in which both the consumer and the producer receive the maximum benefit possible. Also known as a pareto-optimal outcome, this is the classic model introduced in the economic textbooks. This is discussed in much more detail in chapters on pricing and regulation.

However, and as we all know, the generation, transmission, and distribution of electricity require large and highly sunk investments in capital equipment. As such, the market structure certainly cannot be described as competitive (except possibly the generation stage), which is described in much detail in Chapter 2. Nonetheless, and as we will see, marginal cost pricing could be used in pricing the variable component (i.e., the amount of electricity consumed by end users), which yields a significant increase in efficiency compared to the average Cost Pricing mechanism often used by utilities. This is discussed later and in more detail throughout this book. For now, an excerpt from “Marginal Cost Pricing for Utilities: A Digest of the California Experience” makes this point well.

Marginal Cost Pricing Doctrine

The “marginal cost pricing doctrine” is shorthand for the proposition that utility rates should be predicated upon marginal costs for the purpose of attaining economic efficiency by means of accurate price signals.

The doctrine stems from Professor Alfred E. Kahn’s hugely influential two-volume book The Economics of Regulation (1970, 1971). Kahn espoused marginal cost pricing as a means of bringing “economic efficiency” to regulated utilities. This pricing would result in “price signals” to consumers of sufficient accuracy so that they could evaluate the appropriate economic level and timing of their use of utility services. Thus, the buying decisions of consumers would be the means by which the end purpose of economic efficiency would be reached.

Theory

Quoting Professor Kahn, normative/welfare microeconomics concludes that “under pure competition, price will be set at marginal cost” (the price will equal the marginal cost of production), and this results in “the use of society’s limited resources in such a way as to maximize consumer satisfactions” (economic efficiency) (Kahn, 1970, pp. 16–17).

The basis for the theory is clear cut: because productive resources are limited, making the most effective use of these limited resources is a logical goal. In a competitive economy, consumers direct the use of resources by their buying choices. When they buy any given product, or buy more of that product, they are directing the economy to produce less of other products. The production of other products must be sacrificed in favor of the chosen product.

From this point, marginal cost theory takes a giant step. In essence, it states that if consumers are to choose rationally whether to buy more or less of any product, the price they pay should equate to the cost of supplying more or less of that product. This cost is the marginal cost of the product. If consumers are charged this cost, optimum quantities will be purchased, maximizing consumer satisfaction. If they are charged more, less-than-optimum quantities will be purchased: the sacrifice of other foregone products will have been overstated. If they are charged less, the production of the product will be greater than optimum: the sacrifice of other foregone products will have been understated. A price based on marginal costs is presumed to convey “price signals,” which will lead to the efficient allocation of resources. This is the theory, drawn from the microeconomic model of pricing under perfect competition, upon which the doctrine rests (Conkling, 1999).

To be fair, the reticence to adopt marginal cost pricing is due in large part to the thus-far inability to accurately estimate/calculate the marginal cost of distributing electricity to various types of end users. This is also the aspect of the puzzle that has been ignored thus far and the primary motivation of this book: How do we accurately estimate the true cost of providing electric service so that rates can be set in an efficient manner, which will provide the proper incentives to both producers and consumers to make the appropriate investments in energy efficiency, demand-side management, and conservation in general. This is addressed in a case study in which an appropriately specified cubic cost model is used to estimate the marginal cost of serving end-use customers so that price could be set efficiently.

Before delving further into the contents of this book, the author would like to provide a brief overview of the U.S. electric power industry, including the types of players (i.e., suppliers) and a general overview of the regulatory environment and its relationship to greenhouse gasses.

A Brief Overview of the United States Electric Market

Structure of the United States Electricity Industry

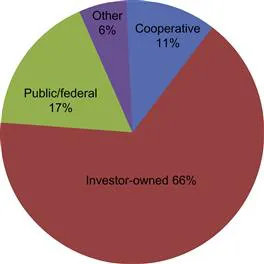

The majority of the electricity distributed in the United States is by investor-owned utilities, which tend to be vertically integrated, which means that the same entity generates, transmits, and distributes electricity to end users in its service territory. In the case of such investor-owned firms, traditional rate making is that a return to investors is earned on every kilowatt-hour sold, thus providing the incentive to sell as much as possible. Figure 1.2 displays the structure of the electric industry in the United States.

Figure 1.2 Structure of the electric industry in the United States. Breakdown of 2006 sales by type of supplier.

Players and Their Incentives

To assess the impact of various policies and rate-making schemes intended to affect climate change, it is necessary to distinguish each type of electric supplier and to examine the incentives that each type faces. Unlike investor-owned utilities of which the objective is profit maximization, publicly and cooperatively-owned utilities face their own set of circumstances and have their own objectives. Nonetheless, the ability to accurately estimate the true cost of providing service to various types of customers is tantamount to designing effective legislation, despite the different objective functions faced by each, which are described later.

First and foremost, all utilities in the United States have an obligation to serve that which is part of their franchise agreement, which means that they have been given an exclusive right to supply utility service to the customers that reside within that service territory. Whether a supplier is subject to certain types of regulation depends on the type of supplier, the state in which they are operating, and whether they are vertically integrated or not. Each has its own objective function, which is discussed in the next section.

Objective Functions: The Players

Investor-Owned Utilities: Profit Maximization

All investor-owned utilities in the United States are subject to some type of regulation, typically price and performance (e.g., an obligation to serve native load and reliability in providing service). The objective function of the regula...