- 449 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Advanced Trading Rules

About this book

Advanced Trading Rules is the essential guide to state of the art techniques currently used by the very best financial traders, analysts and fund managers. The editors have brought together the world's leading professional and academic experts to explain how to understand, develop and apply cutting edge trading rules and systems. It is indispensable reading if you are involved in the derivatives, fixed income, foreign exchange and equities markets.

Advanced Trading Rules demonstrates how to apply econometrics, computer modelling, technical and quantitative analysis to generate superior returns, showing how you can stay ahead of the curve by finding out why certain methods succeed or fail.

Profit from this book by understanding how to use: stochastic properties of trading strategies; technical indicators; neural networks; genetic algorithms; quantitative techniques; charts.

Financial markets professionals will discover a wealth of applicable ideas and methods to help them to improve their performance and profits. Students and academics working in this area will also benefit from the rigorous and theoretically sound analysis of this dynamic and exciting area of finance.

- The essential guide to state of the art techniques currently used by the very best financial traders, analysts and fund managers

- Provides a complete overview of cutting edge financial markets trading rules, including new material on technical analysis and evaluation

- Demonstrates how to apply econometrics, computer modeling, technical and quantitative analysis to generate superior returns

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1 Technical trading rules and regime shifts in foreign exchange

1.1 INTRODUCTION

Techniques for using past prices to forecast future prices have a long and colourful history. Since the introduction of floating rates in 1973, the foreign exchange market has become another potential target for ‘technical’ analysts who attempt to predict potential trends in pricing using a vast repertoire of tools with colourful names such as channels, tumbles, steps and stumbles. These market technicians have generally been discredited in the academic literature since their methods are sometimes difficult to put to rigorous tests. This chapter attempts to settle some of these discrepancies through the use of bootstrapping techniques.

For stock returns, many early studies generally showed technical analysis to be useless, while for foreign exchange rates there is no early study showing the techniques to be of no use. Dooley and Shafer (1983) found interesting results using a simple filter rule on several daily foreign exchange rate series. In later work, Sweeney (1986) documents the profitability of a similar rule on the German mark. In an extensive study, Schulmeister (1987) repeats these results for several different types of rules. Also, Taylor (1992) finds that technical trading rules do about as well as some of his more sophisticated trend-detecting methods.

While these tests were proceeding, other researchers were trying to use more traditional economic models to forecast exchange rates with much less success. The most important of these was Meese and Rogoff (1983). These results showed the random walk to be the best out-of-sample exchange rate forecasting model. Recently, results using nonlinear techniques have been mixed. Hsieh (1989) finds most of the evidence for nonlinearities in daily exchange rates is coming from changing conditional variances. Diebold and Nason (1990) and Meese and Rose (1990) found no improvements using nonparametric techniques in out-of-sample forecasting. However, LeBaron (1992) and Kim (1989) show small out-of-sample forecast improvements. During some periods, LeBaron (1992) found forecast improvements of over 5 per cent in mean squared error for the German mark. Both of these papers relied on some results connecting volatility with conditional serial correlations of the series.

This chapter breaks off from the traditional time series approaches and uses a technical trading rule methodology. With the bootstrap techniques of Efron (1979), some of the technical rules can be put to a more thorough test. This is done for stock returns in Brock, Lakonishok and LeBaron (1992).1 This chapter will use similar methods to study exchange rates. These allow not only the testing of simple random walk models, but the testing of any reasonable null model that can be simulated on the computer. In this sense, the trading rule moves from being a profit-making tool to a new kind of specification test. The trading rules will also be used as moment conditions in a simulated method of moments framework for estimating linear models.

Finally, the economic significance of these results will be explored. Returns from the trading rules applied to the actual series will be tested. Distributions of returns from the exchange rate series will be compared with those from risk-free assets and stock returns. These tests are important in determining the actual economic magnitude of the deviations from random walk behaviour that are observed.

Section 1.2 introduces the simple rules used. Section 1.3 describes the null models used. Section 1.4 presents results for the various specification tests. Section 1.5 implements the trading rules and compares return distributions and section 1.6 summarizes and concludes.

1.2 TECHNICAL TRADING RULES

This section outlines the technical rules used in this chapter. The rules are closely related to those used by actual traders. All the rules used here are of the moving average or oscillator type. Here, signals are generated based on the relative levels of the price series and a moving average of past prices:

For actual traders, this rule generates a buy signal when the current price level is above the moving average and a sell signal when it is below the moving average.2 This chapter will use these signals to study various conditional moments of the series during buy and sell periods. Estimates of these conditional moments are obtained from foreign exchange time series, and these estimates are then compared with those from simulated stochastic processes. Section 1.4 of this chapter differs from most trading rule studies which look at actual trading profits from a rule. Actual trading profits will be explored in section 1.5.

1.3 NULL MODELS FOR FOREIGN EXCHANGE MOVEMENTS

This section describes some of the null models which will be used for comparison with the actual exchange rate series. These models will be run through the same trading rule systems as the actual data and then compared with those series. Several of these models will be bootstrapped in the spirit of Efron (1979) using resampled residuals from the estimated null model. This closely follows some of the methods used in Brock, Lakonishok and LeBaron (1992) for the Dow Jones stock price series.

The first comparison model used is the random walk:

Log differences of the actual series are used as the distribution for εt and resampled or scrambled with replacement to generate a new random walk series. The new returns series will have all the same unconditional properties as the original series, but any conditional dependence will be lost.

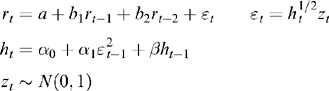

The second model used is the GARCH model (Engle, 1982; Bollerslev, 1986). This model attempts to capture some of the conditional heteroskedasticity in foreign exchange rates.3 The model estimated here is of the form:

This model allows for an AR(2) process in returns. The specification was identified using the Schwartz (1978) criterion. Only the Japanese yen series required the two lags, but for better comparisons across exchange rates the same model is used.4 Estimation of this model is don...

Table of contents

- Cover image

- Title page

- Table of Contents

- Butterworth-Heinemann Finance

- Copyright

- Foreword

- Contributors

- Introduction

- Chapter 1: Technical trading rules and regime shifts in foreign exchange

- Chapter 2: Foundations of technical analysis: computational algorithms, statistical inference and empirical implementation

- Chapter 3: Mean-variance analysis, trading rules and emerging markets

- Chapter 4: Expected returns of directional forecasters

- Chapter 5: Some exact results for moving-average trading rules with applications to UK indices

- Chapter 6: The portfolio distribution of directional strategies

- Chapter 7: The profits to technical analysis in foreign exchange markets have not disappeared

- Chapter 8: The economic value of leading edge techniques for exchange rate prediction

- Chapter 9: Is more always better? Head-and-shoulders and filter rules in foreign exchange markets

- Chapter 10: Informative spillovers in the currency markets: a practical approach through exogenous trading rules

- Chapter 11: Stop-loss rules as a monitoring device: theory and evidence from the bond futures market

- Chapter 12: Evolving technical trading rules for S&P 500 futures

- Chapter 13: Commodity trading advisors and their role in managed futures

- Chapter 14: BAREP futures funds

- Chapter 15: The need for performance evaluation in technical analysis

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Advanced Trading Rules by Emmanual Acar,Stephen Satchell in PDF and/or ePUB format, as well as other popular books in Business & Investments & Securities. We have over one million books available in our catalogue for you to explore.