![]()

1 · GOVERNANCE UNSEEN

When Senator Mary Landrieu held a town hall meeting in Louisiana in the summer of 2009 in order to hear her constituents’ views on health care reform, she encountered a boisterous crowd. One man stood up, waving a copy of the U.S. Constitution, and asked, “Where does the federal government get any right to stick its hands anywhere in the health care system?”1 Members of Congress heard similar sentiments expressed at such meetings across the nation. Meanwhile, letters to the editor in newspapers throughout the country contained protestations like that voiced by Ohio resident Ray Brown, who wrote to the Columbia Dispatch: “There are no circumstances on this Earth under which we should let our government have anything at all to do with our excellent health-care system.”2 In each case, opponents of reform implied that the U.S. health care system as we know it was borne and persists sui generis, a natural development that has been nurtured only by the market economy.

Such characterizations are, quite simply, wrong. As Senator Landrieu explained patiently to the man who questioned her, “Some aspects of our system are nationalized,” noting that government programs such as Medicare and Medicaid cover a significant portion of the population, nearly one in three people.3 She could have explained, further, that the so-called “private” insurance plans provided by employers, through which 59 percent of Americans under age sixty-five receive insurance, are subsidized by government, which privileges them with tax-exempt status.4 She might have added that the construction of vast numbers of the nation’s hospitals was funded by a federal policy enacted in 1948, signed into law by President Harry Truman.5 Or that a significant portion of students in the nation’s medical and nursing schools are funded by federal scholarships.6

In fact, the health care system experienced by Americans of the early twenty-first century has been fostered by public policy and highly subsidized by government spending for three-quarters of a century. It is fairly well known that the United States spends more per capita on health care than any other nation; in 2009 this amounted to $2.5 trillion, or 17.6 percent of GDP.7 Less commonly known is the fact that government itself foots most of the bill—some estimate 56 percent, amounting to more than in any other country.8 Remarkably, however, many Americans have been largely unaware of government’s substantial role in health care, and therefore reform legislation in 2009–10 appeared to them to be a startling new and foreign intervention into a system that belonged mostly if not entirely to the private sector.

The misunderstanding that many people possess about health care policy is unsurprising, however, because much of it—like other areas of contemporary social provision—is embedded within the submerged state. When most people think of government programs, they likely envision cavernous, austere buildings located in the vicinity of Washington, D.C., filled with bureaucrats sitting in cubicles who directly oversee the delivery of goods and services to citizens, as exemplified by Social Security. Many would also acknowledge that states and local governments often play the role of “supporting actors,” carrying out much of the day-to-day work of the federal government by following its mandates and dispensing its funds, for example, in unemployment insurance or welfare offices. But, in fact, much of the activity financed by the federal government today fits neither of those standard descriptions. Rather, it disguises or subverts government’s role, making the real actors appear to be those in the market or private sector—whether individuals, households, organizations, or businesses. The mechanisms or tools through which such activities occur have proliferated to include a great variety, such as loans subsidized and guaranteed by government but offered through private banks and government-sponsored enterprises; social benefits in the form of tax incentives and tax breaks for those engaging in activities that government wishes to reward; and benefits and services provided by nonprofits and private third-party organizations that are subsidized or “contracted out” by government.9

Take student loans, for example. Several years ago, while teaching an undergraduate course on public policy, I included student loans among a list of government social programs. One student objected, saying, “But student loans shouldn’t be called a social program! I’m paying for my tuition with student loans and I got them through a bank—not a government agency. And I have to pay them back after I graduate, with interest.” Another student quickly countered the first, saying, “But if any of us just went to a bank ourselves and applied for a regular loan—not a student loan guaranteed by government—they probably wouldn’t be willing to lend to us. At our age, we don’t look like very safe bets for paying back what we borrow. And even if they did lend to us, the loan would cost us a good deal more than it does with government’s help.” A lively discussion ensued, reflecting different understandings of how student loans operate and different views of the characteristics that define public policies.

These disparities in perceptions owe to the fact that student loans, like much of U.S. health care policy, have long operated primarily by subsidizing private actors to provide social benefits. In the 1960s, policymakers sought means to make college affordable for more students. Banks were typically reluctant to loan to students, considering them a bad risk, and when they did, they imposed high interest rates, typically ranging from 11 to 14 percent and above.10 The Higher Education Act of 1965, signed into law by Johnson, established the Guaranteed Student Loan Program, giving banks incentives to lend to students at lower rates of interest. It did so by offering that the federal government would pay half the interest on such loans and would guarantee them, promising to repay them entirely if a borrower defaulted. In 1972 policymakers provided further impetus to student lending by creating the Student Loan Marketing Association (SLM, otherwise known as “Sallie Mae”), a “government-sponsored enterprise,” meaning that while being privately owned and operated, it would enjoy special privileges—flowing from tax benefits and special regulatory treatment—unavailable to any competitor.11 In the decades since, student lending became a lucrative business, attracting many banks to participate.

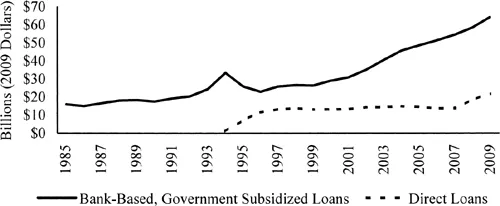

The amounts borrowed annually through these government-subsidized and government-guaranteed loans, renamed as Family Federal Education Loans (FFEL), escalated rapidly, as shown in figure 1.1. Even after Clinton’s reform effort in 1993 led to the beginnings of “direct lending,” in which government itself made loans using federal capital rather than subsidizing lenders to do so, the well-established bank-based system still continued to predominate, making 80 percent of all loans until the credit crisis hit in 2008.12 The banks and Sallie Mae possessed marketing power lacked by the U.S. Department of Education, granting them greater leverage in promoting their products to students. In addition, their ability to offer perks and benefits to financial aid offices on college campuses in many cases helped them to secure the privileged status of “preferred lenders,” a practice eventually curtailed after an investigation by New York Attorney General Andrew Cuomo.13

Not surprisingly, then, even many student loan beneficiaries themselves perceived the program to be private rather than public. A 2008 survey asked such individuals, “Do you think of student loans primarily as a public program—that is, belonging to government—or as a private program, that is, belonging to lenders, banks, or academic institutions?” Half of respondents—50 percent—reported that they viewed the program as private, only 43 percent described it as public, and the remainder volunteered that it was both, equally. Despite the fact that such loans would not be available without government—which took the initiative to encourage lending, provided generous subsidies to lenders, and bore the risk of defaults—most users did not perceive its role.14 These citizens, like my undergraduate recipients of such loans, had the quintessential experience of the submerged state: it benefited them, providing opportunities and relieving financial burdens, without them even knowing it.

FIGURE 1.1. U.S Federal Student Loans: Bank-Based, Government Subsidized versus Direct, 1985–2009 (2009 Dollars)

Source: National Center for Education Statistics, U.S. Department of Education, “Federal Support and Estimated Federal Tax Expenditures for Education, by Category: Selected Fiscal Years, 1965 through 2009,” Digest of Education Statistics (2009), http://nces.ed.gov/programs/digest/d09/tables/dt09_373.asp.

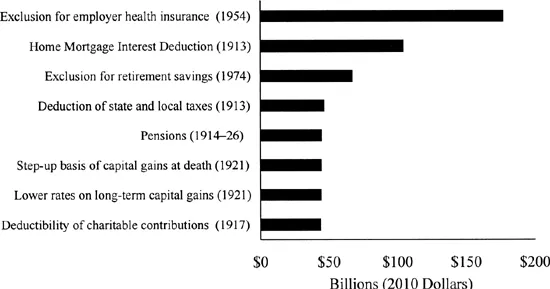

Several of our most expensive federal social policies today are situated within the income tax system. “Social tax expenditures,” as they have been termed formally in federal budgeting parlance since 1969, or “tax breaks” or “tax loopholes,” as they are more commonly known, permit particular households to pay less in taxes because they are either involved in some kind of activity or they belong to a class of persons that policymakers deem worthy of public support.15 Rather than government sending checks to people, as is the case for Social Security or Temporary Assistance for Needy Families, instead families or individuals receive social benefits either in the form of smaller tax bills or refunds from the Internal Revenue Service. Today, as seen in figure 1.2, the largest social tax expenditure emanates from the nontaxable nature of health insurance benefit provided by employers, which is expected to cost $177 billion in 2011; it is followed by the Home Mortgage Interest Deduction, $104.5 billion; and the exclusion from taxes of employer-provided retirement benefits, $67.1 billion.16 The number of such tax breaks continues to grow, and their purposes are varied, assisting Americans with everything from paying college tuition to purchasing energy-efficient windows and appliances to paying for child care. Their costs are substantial: on net, as of 2008, the amount lost in federal revenues due to social tax breaks was equivalent to 7.4 percent of GDP, up from 4.2 percent in 1976.17 To put this in perspective, “visible governance,” meaning total direct federal spending—on all domestic programs, the military, and interest on the debt—amounts to approximately 18 percent of GDP, making social tax expenditures comparable to between one-third and one-half as much.18

FIGURE 1.2. Largest Social Tax Expenditures: Year Enacted and Estimated Cost in 2011 (Billions of Dollars)

Sources: Christopher Howard, The Hidden Welfare State: Tax Expenditures and Social Policy in the United States (Princeton, NJ: Princeton University Press, 1997), 176–77; Office of Management and Budget, Analytical Perspectives, Budget of the United States Government, FY2011 (2010), http://www.gpoaccess.gov/usbudget/fy11/pdf/spec.pdf.

From an accounting perspective, direct social benefits and tax breaks both have the same effect: they impose costs on the federal budget, whether incurred in the form of obligations or lost revenues. As southern Democrat Russell Long, chair of the Senate Finance Committee from 1966 to 1981, said of the term “tax expenditures”: “That label don’t bother me. . . . I’ve never been confused about it. I’ve always known that what we’re doing was giving government money away.”19 But for most beneficiaries, the experience is starkly different: those who receive direct benefits such as unemployment insurance or food stamps usually recognize that a government program assisted them, whereas few equate their lowered tax bills with comparable aid. Many Americans are unaware of how tax expenditures function, or even that they exist. For example, a poll in 2008, referring to what has become our most expensive social tax break, queried respondents about whether workers are required to pay taxes on the amounts their employers contribute to their health insurance benefits or not. Only half of the respondents, 50 percent, answered correctly by saying “no”; 29 percent mistakenly believed that people were required to pay such taxes, and 21 percent simply said they did not know.20 In short, it is unsurprising that the energy Obama generated as a candidate evaporated once he turned to governance, for the agenda he pursued sought to transform policies that Americans barely know exist, and to create some new policies that they are unable to see.

Considering Governance from Citizens’ Perspective

By Reagan’s second term in office, scholars began to notice that traditional ways of thinking about government programs no longer reflected much of how public policies were actually designed and administered. In 1988 Donald Kettl depicted the new reality as “government by proxy,” meaning “the provision of government goods and services through proxies such as contractors, grantees, and recipients of government tax breaks and loans.”21 In the years since, several scholars have elucidated these new forms of governance. Brinton Milward described the “hollow state,” highlighting the “contracting out” of government services to nonprofits and for-profits; Christopher Howard revealed the political development of the “hidden welfare state” of tax expenditures; Jacob Hacker explained how government came to regulate and subsidize social benefits provided by private employers; Paul Light pointed to the “shadow of government,” which emerges from the sum of these types of mechanisms; and Andrea Campbell and Kimberly Morgan detailed the workings of “delegated governance,” meaning the allocation of authority for social welfare policy to nonstate actors.22 Combined, these ...