- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Antitrust Law, Second Edition

About this book

The definitive textbook of antitrust law

Antitrust Law was fundamental to redefining the field of antitrust law and it remains the definitive textbook for those teaching or learning the subject, Richard Posner's book has played a major role in transforming the field of antitrust law into a body of economically rational principles largely in accord with the ideas set forth in the first edition. Today's antitrust professionals may disagree on specific practices and rules, but most litigators, prosecutors, judges, and scholars agree that the primary goal of antitrust laws should be to promote economic welfare, and that economic theory should be used to determine how well business practices conform to that goal.

In this thoroughly revised edition, Posner explains the economic approach to new generations of lawyers and students.

"The antitrust laws are here to stay," Posner writes, "and the practical question is how to administer them better-more rationally, more accurately, more expeditiously, more efficiently." This fully revised classic will continue to be the standard work in the field.

Antitrust Law was fundamental to redefining the field of antitrust law and it remains the definitive textbook for those teaching or learning the subject, Richard Posner's book has played a major role in transforming the field of antitrust law into a body of economically rational principles largely in accord with the ideas set forth in the first edition. Today's antitrust professionals may disagree on specific practices and rules, but most litigators, prosecutors, judges, and scholars agree that the primary goal of antitrust laws should be to promote economic welfare, and that economic theory should be used to determine how well business practices conform to that goal.

In this thoroughly revised edition, Posner explains the economic approach to new generations of lawyers and students.

"The antitrust laws are here to stay," Posner writes, "and the practical question is how to administer them better-more rationally, more accurately, more expeditiously, more efficiently." This fully revised classic will continue to be the standard work in the field.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Publisher

University of Chicago PressYear

2009Print ISBN

9780226684130, 9780226675763eBook ISBN

9780226675787PART ONE

SETTING THE STAGE

ONE

The Costs—and Occasionally the Benefits—of Monopoly

Economic analysis offers reasons—some firmly rooted in economic theory, some more conjectural—why monopoly reduces economic efficiency in some (not all) circumstances. My primary purpose in this chapter is to explain the theory of monopoly in terms comprehensible to readers who have no previous knowledge of economics yet I hope not wholly uninteresting to those possessed of such knowledge, and to develop the relevance of the theory to antitrust policy. My secondary purpose is to argue that the economic theory of monopoly provides the only sound basis for antitrust policy.

A monopolist is a seller (or group of sellers acting like a single seller) who can change the price at which his product will sell in the market by changing the quantity that he sells. Concretely, by reducing his output he can raise his price above the cost of supplying the market, which is the price level that competition would bring about, the competitive price. This “power over price,” the essence of the economic concept of monopoly, derives from the fact that market price is inverse to quantity. Some people will value the product more than other people do, so if supply is curtailed they will bid the price up to make sure they get it. Conversely, as supply is increased, the price must fall to induce people who value the product less to buy it. The seller who controls the supply of a product can therefore raise his price by restricting the amount supplied.

It is true that even in a highly competitive market, with many sellers selling the identical product, each would have some power over price; for if any seller reduced his output, the total output of the market would be smaller, at least temporarily, and the market price would therefore rise at least temporarily. But when a seller produces only a small fraction of the market's total output, the change in total output brought about by a fractional reduction in his output is unlikely to be great enough to affect the market price significantly; his power over price is slight and can be ignored. It is slight for a deeper reason. The smaller his output is in relation to that of the remaining sellers in the market, the likelier it is that any cut in his output will be promptly offset by an increase in the output of the other sellers, each of whom would need to increase his output only slightly in order to restore the market's total output to its level before the first seller's reduction. The incentive of the other sellers to increase their output comes from the fact that any increase in the market price over a seller's costs1 will open up a gap between price and cost that every seller will have an incentive to exploit by increasing his output, since until the gap is closed each additional unit sold will yield a supracompetitive return.

The sole seller of a product, a “monopolist,” need not worry, or at least need not worry as much, that if he raises his price above what a normal competitive price would be—that is, a price that would just cover his cost, including a profit just sufficient to attract the capital that he needs—the other sellers of the product will expand their output of the product and so drive the price back down. There are no other sellers. True, the higher price will give firms in other markets an incentive to enter this one in order to reap the monopoly profits available there. But presumably entry into the market will take time, so that unless the formation of the monopoly was anticipated well in advance the monopolist will enjoy a significant though not necessarily a permanent power over price.

It remains to be considered why and how he will exercise that power. We may assume that every firm wants to maximize its profits—the excess of its total revenue over its total cost. That is a close enough approximation to the truth to provide a generally adequate guide to antitrust policy, although we shall have to consider qualifying it when we discuss nonprofit firms in chapter 3.

Suppose that just before the market became monopolized, the market price was equal to the cost of making and selling the product in question. (“Cost” to the economist is a comprehensive concept and thus includes, as I have already indicated, a reasonable return on equity capital, which is the return necessary to attract the equity capital that the firm needs.) In that event the market price will be the competitive price. If the monopolist reduces his output below the competitive level, the market price will rise. How will his costs and revenues, and hence profits, be affected? His total cost will be lower since he will be producing less, while his revenue—price times output—will be higher or lower at the new price and output depending on whether the proportional increase in price is greater or less than the proportional reduction in output. Clearly, if the price increase is proportionately greater than the reduction in units sold, the price increase will be profitable to the firm. Its total revenue will be higher, while its total cost will be lower since it will be producing less, and so the difference between its revenue and cost—its profit—will be greater than at the competitive price.

The statement that the monopolist's cost will be lower because he will be producing less assumes that his total cost varies with his output; if it does not, a reduction in output will not reduce his cost. The cost of production generally involves both costs that are fixed in relation to output—such as the cost of buying a corporate charter, which is invariant to the corporation's output, or the cost of producing a software product, which is invariant to the number of copies of the product that are sold—and variable costs, which are costs that vary with output. Only variable costs are affected by a firm's decision on how much to produce of a given product. More precisely, in deciding whether to increase or reduce output by one unit, a firm will consider the effect of the decision on its marginal cost, that is, the effect on its total costs of a small change in output. It would not make sense to base a change in output on a cost that was unaffected by the change.

The monopolist will never be content to charge a price at which the demand for his product is inelastic, that is, a price at which the proportional reduction in the quantity demanded as a result of raising price slightly would be less than the proportional increase in price. Suppose the demand for the firm's product at a price of $5 is 1,000 units but at a price of $5.05 would be 999 units. Then demand is inelastic at an output of 1,000 units because a 1 percent increase in the price would bring about a proportionately smaller decrease in quantity demanded (one-tenth of 1 percent), with the result that the higher price would yield the monopolist a larger total revenue—$5,044.95 compared to $5,000. And since output would be less, his total costs would be no greater, and so the price increase would have to be profitable.

This analysis indicates that the monopolist will increase his price to at least the level at which a further price increase would cause a proportionately greater reduction in the quantity demanded. For until that point is reached, every successive price increase will raise total revenue while reducing total cost (or leaving it unchanged, in the extreme case in which all costs are fixed). In other words, the monopolist will always operate in the elastic portion of his demand curve. He may raise his price beyond the level at which demand turns elastic and his total revenues therefore begin to shrink, because he is interested in maximizing profits, not revenues, and so will stop raising his price only when any further increase would reduce his total revenues by more than the reduction in total cost resulting from the smaller quantity produced. In other words, he will raise his price (reduce his output—the one implies the other) until marginal revenue, the effect on his total revenues of the price change, equals marginal cost.2 That is the point at which the monopolist's profits are maximized. At a smaller output, he would be giving up a net profit opportunity, while at a higher output he would be losing more revenue from the lower price that he would have to charge than he would be gaining from the additional sale.

The optimum monopoly price may be much higher than the competitive price, depending on the intensity of consumer preference for the monopolized product—how much of it they continue to buy at successively higher prices—in relation to its cost. And the monopoly output will be smaller.3

So we now know that output is smaller under monopoly4 than under competition but not that the reduction in output imposes a loss on society. After all, the reduction in output in the monopolized market frees up resources that can and will be put to use in other markets. There is a loss in value, however. The increase in the price of the monopolized product above its cost induces the consumer to substitute products that must cost more (adjusting for any quality difference) to produce (or else the consumer would have substituted them before the price increase), although now they are relatively less expensive, assuming they are priced at a competitive level, that is, at the economically correct measure of cost. Monopoly pricing confronts the consumer with false alternatives: the product that he chooses because it seems cheaper actually requires more of society's scarce resources to produce. Under monopoly, consumer demands are satisfied at a higher cost than necessary.5

This analysis identifies the cost of monopoly with the output that the monopolist does not produce, and that a competitive industry would. I have said nothing about the higher prices paid by those consumers who continue to purchase the product at the monopoly price. Those higher prices are the focus of the layperson's concern about monopoly—an example of the often sharp divergence between lay economic intuition and economic analysis. Antitrust economists used to treat the transfer of wealth from consumer to monopoly producer as completely costless to society, on the theory that the loss to the consumer was exactly offset by the gain to the producer.6 The only cost of monopoly in that analysis was the loss in value resulting from substitution for the monopolized product, since the loss to the substituting consumers is not recouped by the monopolist or anyone else and is thus a net loss, rather than merely a transfer payment and therefore a mere bookkeeping entry on the social books. But the traditional analysis was shortsighted.7 It ignored the fact that an opportunity to obtain a lucrative transfer payment in the form of monopoly profits will attract real resources into efforts by sellers to monopolize and by consumers to avoid being charged monopoly prices (other than by switching to other products, the source of the cost of monopoly on which the conventional economic analysis of monopoly focused). The costs of the resources consumed in these endeavors are costs of monopoly just as much as the costs resulting from the substitution of products that cost society more to produce than the monopolized product, though we'll see that there may sometimes be offsetting benefits in this competition to become or fend off a monopolist.

One way of sharing in monopoly profits is by entering a market in which a monopoly price is being charged, thereby adding to the output of the market and depressing the market price, or by expanding one's output if one is already in such a market. These methods of “monopolizing” are unlikely to impose net costs on society.8 But they are properly analyzed as market responses that reduce the expected gains of monopoly by diminishing the monopolist's power over price rather than as responses that transform expected monopoly gains into costs.

Suppose that a cartel9 fixes prices somewhere above the competitive level and the entry of new firms or the expansion of existing firms (whether members or nonmembers of the cartel) is for some reason impeded. Each member of the cartel will have an incentive, by expending resources on making his output more valuable to consumers than the output of the other members of the cartel, to increase his sales relative to the other cartelists and thereby engross a larger share of the cartel profits. The process of increasing nonprice competition (competition in quality, service, credit terms, and so forth) will continue until, at the margin, the costs of the cartel members have risen to the cartel price level. The higher costs are a cost of monopoly, although there is a partially offsetting benefit since the additional nonprice competition has some value, though less than its cost, to the consumer. The reason it is only partially offsetting is that if consumers valued the additional services generated by this competition above its cost, presumably the services would have been produced in a price-competitive market as well. If entry into the cartelists' market is not blocked, the cartelists may expend resources on deterring entry, as we'll see in chapter 7.

If for some reason nonprice competition were infeasible and entry were blocked, and the expected profits of cartelizing were therefore very large, the analysis would be altered, but not fundamentally. Firms would expend real resources on forming or gaining admission to cartels in order to share in the expected profits. This process of competing to become a monopolist would continue until, at the margin, the expected gains of monopoly were just equal to the costs incurred in becoming a monopolist.

The qualification “at the margin” in the two preceding paragraphs is important. An activity that encounters sharply diminishing returns will be cut off long before the actor has expended resources equal to the maximum potential gains from the activity. The Microsoft Corporation had billions of dollars at stake in the antitrust suit that the Department of Justice and nineteen states brought against it in 1997, but it did not spend billions of dollars on lawyers and other defenders, because the marginal benefit of additional expenditures would have been less than the marginal cost, and indeed might well have been zero or even negative. Similarly, a would-be monopolist will not expend on obtaining a monopoly an amount equal to the entire present discounted value of his monopoly profits, but will stop at the point where an additional dollar (on advertising, service competition, lawyers, or what have you) would not yield a dollar in expected profits.10 On the other hand, there may be duplication of expenditures by several would-be monopolists; all these must be reckoned in as well.

The Microsoft example is actually somewhat inapt, because it assumes the existence of antitrust law. The issue under examination in this chapter is the social cost of monopoly in the absence of antitrust, since we need to know that cost, or at least have some sense of its approximate magnitude, in order to know whether to expend resources, and if so how many, on the control of monopoly. Antitrust generates both direct costs of enforcement and of defense, and indirect costs, such as the costs that cartelists incur to conceal their activity from the enforcement agencies. Cartels may forgo cost-minimizing cartel methods, such as exclusive sales agencies, in order to avoid detection. In particular, because cartel agreements are not legally enforceable (this was the common-law rule even before any antitrust laws were enacted), cartelists may be afraid to reduce their productive capacity to the level that is optimal for the cartel's reduced output, since competition may break out at any time. Thus there may be more excess capacity with illegal than legal cartels, and this too is a cost of antitrust law.

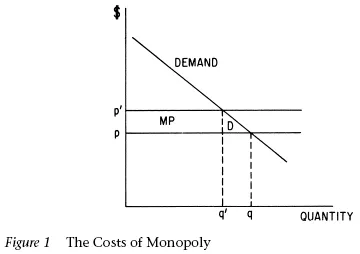

Despite this qualification and others to be made later, the tendency of monopoly profits to be converted into social costs places the economist's hostility to monopoly on even firmer ground than it would occupy if the only costs of monopoly were those that stem from the reduction in output brought about by monopoly. As shown in figure 1, if we assume that problems of cartel organization and enforcement and the threat of entry constrain the price level in the typical cartelized (or monopolized) industry to a level only moderately higher than the competitive price level, the social loss that is due to the reduction in output at the higher price—D in figure 1—wi...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Preface

- Introduction

- Part One: Setting the Stage

- Part Two: Collusion

- Part Three: Exclusionary Practices

- Part Four: Administering Antitrust Law

- Appendix: An Introduction to the Formal Analysis of Monopoly

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Antitrust Law, Second Edition by Richard A. Posner in PDF and/or ePUB format, as well as other popular books in Law & Antitrust. We have over one million books available in our catalogue for you to explore.