![]()

1

Remediation Engineering

State of the Practice

1.1 INTRODUCTION

The environmental remediation industry has grown from its small roots in the late 1970s to be a multibillion dollar global industry during the last four decades. At its birth, hazardous waste handling, transport, and disposal were the primary activities in the industry. During the 1980s, the face of the industry changed with the introduction of the underground storage tank (UST) regulations and passage of the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA or Superfund) and the Hazardous and Solid Waste Amendments to the Resource Conservation and Recovery Act (RCRA). The volume and complexity of the hazardous waste cleanup sites set the stage for the growth of the remediation industry. Traditional engineering and construction firms were the first to enter this market followed by many smaller, regional firms in addition to many niche firms with specialized skills and expertise.

Today, the remediation industry is quite different in comparison to its early beginnings. Regulatory trends are in a constant state of flux with a variety of standards enforced at national, state, and local jurisdictions. Dramatic swings along legislative, technological and economic fronts have occurred during the growth and expansion of this relatively young industry. The staggering dimensions of cleaning up our nation’s hazardous waste sites, and also across the world, produced a substantial need for the introduction and development of efficient and cost-effective technologies.

The hazardous waste cleanup business was supposed to be working itself out of a job since much of the contamination at these legacy sites had their origin from the operation of industrial facilities prior to the establishment of modern regulations. Before the onset of current regulations, methods of hazardous waste disposal included industrial lagoons, unlined landfills and dumps, and waste piles. Thus, the historical inventory of sites requiring cleanup was very large and varied from region to region depending on the degree of industrial activity. However, for those of us in the remediation business, the work has kept coming as waves of new sites have come into play over the past decade as new and emerging contaminants are identified and regulated. In addition, new categories of contaminated sites like manufactured gas plants, fire training locations, and shale gas sites will require remediation due to upcoming regulatory developments.

As the remediation industry started to evolve over the years, advances in cleanup technologies have gained acceptance from both an economic and technical efficiency perspective. Science and technology have never been static in our business. Motivated by “there must be a better way,” scientists and engineers always look for innovative methods and solutions that evolve into accepted practice and preferred techniques. However, it should also be noted that the ability to separate emerging technologies built on a sound scientific platform from the ones practiced on a speculative basis has always been a challenge in our still maturing industry.

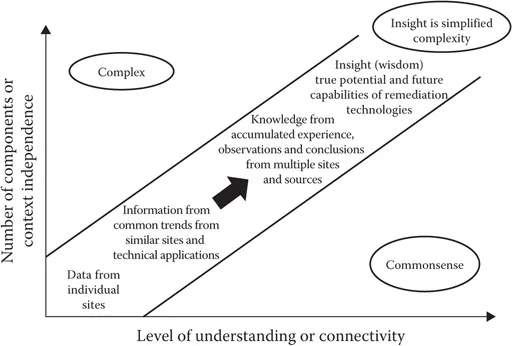

Since the time the term “remediation engineering” was coined by Suthersan and Blake in 1990,1 an enormous amount of data and information have been collected within the umbrella of this overarching and multi-disciplinary technical discipline. This rising tide of data and information should be viewed as an abundant, vital, and necessary resource to continuously expand the depth and breadth of the scientific knowledge within remediation engineering. The sequential evolution and conversion of data to information to knowledge to insights represent an emergent continuum, and the progress along this continuum was essential for this relatively young technical discipline to become the foundational pillar of a growing, global industry (Figure 1.1).

1.1.1 GROWTH OF AN INDUSTRY

In spite of nearly four decades of efforts in our country and across the globe, remediation of contaminated sites to its pristine, precontamination conditions remains a significant technical and institutional challenge. Since the 1970s, billions of dollars have been spent to mitigate the human health and ecological risks posed by contaminants released to the subsurface environment. These investments and efforts have shown reasonable progress within the major regulatory programs. For example, 20% of the 1723 sites listed on the National Priorities List have been permanently removed by the U.S. Environmental Protection Agency (USEPA) because all the remediation actions required to remove the risks posed to human health and the environment were completed.3,4 Of the 3747 hazardous waste sites regulated under the RCRA corrective action program, 70% also have achieved control of human exposure to contamination, and 686 have been designated as corrective action completed.5 The UST program has reported the most significant success with the closure of over 1.7 million USTs since the initiation of the program in the early 1980s.6

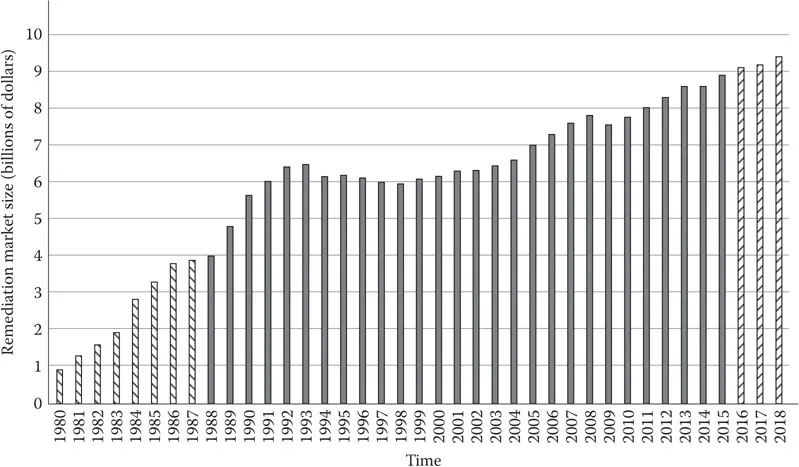

Growth rates of many environmental industry segments have been strong in recent years. Traditional environ-mental markets are driven by the demand for essential services (such as water supply and wastewater collection and treatment) and have increasingly become mature markets. However, the emerging regulation-driven markets like remediation are still expanding due to globalization, identification of emerging contaminants, and the investments on technologies, equipment, and delivery systems (Figure 1.2). Regulation-driven markets also fall into their own cycles depending on the time frames set for complying with the new standards or regulations or economic factors such as real estate booms and busts.

The current remediation market is becoming global with international competition on all continents where the legislation and regulatory requirements have been in place for a while. Competition is driven by experience and the presence of large global companies from mature markets that have expanded their activities outside their traditional borders and operate at the global level. Broader geographic coverage also matters for firms that need to meet the demands of multinational clients who are focused on maintaining their image on environmental con-sciousness and sustainability across the globe.

In spite of the progress mentioned earlier, thousands of contaminated sites across federal, state, and local programs are thought to still have contamination at levels preventing them from reaching closure. The source of funding for the implementation of remediation projects is an important consideration on the rate and volume at which these projects are undertaken and completed. Responsible parties required to implement remediation ac-tivities face a certain level of uncertainty initially in determining the maximum level of costs and in ensuring that the total expenditure produces a certificate of regulatory compliance at the end. It is widely agreed that long-term management will be needed at some sites for the foreseeable future, particularly for the more complex sites in terms of the type of contamination and/or the geologic conditions.

Considering the extent of the number of hazardous waste sites that require remediation, one question that has arisen consistently is the definition of site closure in relation to these sites. Does a closed site mean no residual contamination above regulatory limits or is the definition flexible enough depending on the exposure pathways to the residual contamination at the site? This confusion may not be limited to the general public but also to all the stakeholders, which may include the regulators too. It should be noted that the definition of site closure varies within the different regulatory programs. Based on this discussion, it becomes philosophically im-portant to distinguish remediation from another category of corrective action, namely restoration. Attempts at restoration more typically lead to new end points and environments that share substantial, ecological, and aes-thetic properties with the original precontamination site. Remediation aims to return a space to the exact condition in which it existed before the contamination took place, whereas restoration aims to return the space to a usable condition similar to which existed before with new materials. If the logic of restoration is one of reproduction or recreation, the logic of remediation is one of counteraction or undoing the harm.

The remediation industry’s future relies upon trends in ecological management of the natural and built envi-ronments, and sustainability and resilience is its evident future. Another significant issue facing the remediation industry is the need for long-term stewardship at sites with institutional and engineering controls. By their defini-tion, these controls are intended to last for an extended period of time and, in most cases, in perpetuity, or until new technologies are developed and implemented to further decrease the risk posed by the residual contamina-tion. Although recorded on deeds, there is generally little a property owner can do to ensure that these controls remain in effect after the property is sold. The industry is grappling with this issue and is in the process of devel-oping policies and procedures to address this issue. The term “stewardship” has become an industry buzzword that is defined in numerous ways or not defined at all within the context of cleanup projects. To date, no formal policies or consistent procedures have come from within the regulatory programs specifically defining long-term stewardship related to remediation, specifically institutional and engineering controls. What is needed is a com-prehensive definition of the term stewardship that includes a specific long-term plan for implementing real-istic and fully enforceable institutional controls at remediation sites.

Establishing universally accepted standards for the delivery of remediation services and promoting the integration of environmental performance in construction standards are also important for further maturation of the industry. In the framework of the industry’s efforts to promote sustainable field activities and consumption, the development of sustainability standards and quality labels for environmental goods and services will contribute to promote their quality and to develop further market expansion. As technical standards are not systematically harmonized at the national or global level, some emerging advanced technologies face barriers when trying to penetrate new markets. Establishing technical standards will also play a decisive role in ensuring the customer of a guaranteed level of quality. Integrating environmental performance requirements in production standards for the building and transportation industry can strongly develop markets for eco-construction in general and for technologies related to recycled materials, energy efficiency, water and waste management, noise reduction, and renewable energy consumption.

Technology development is key in this industry as the suppliers are differentiated by technical solutions that make it possible to achieve the cleanup goals at reasonable cost. High level innovation capacity and the ability to provide creative solutions for complex problems is a critical factor to be successful in this competitive market as they enable the participants to continuously adapt to new market demands. The development of new remediation technologies has historically suffered from the fact that investing in such research activities presents a strong financial risk due to uncertainties in the potential markets for these technologies. Financial support for research and development efforts is critical to ensure continuous innovation and to maintain the sector’s competitiveness.

The influence of collaboration between the federal government and the remediation industry on research and development activities is already very high through the financial support provided to research programs and pro-jects and through the ability to highlight potential new market opportunities. Evaluating the commercial application of emerging environmental technologies, most of which fail to reach the market either because the technology is not sufficiently mature or because it does not meet the market’s current needs, is crucial for the technology evolution. Focusing on support for technologies that present the highest potential for market application could be an efficient way to promote the most relevant research programs.

1.1.2 TECHNICAL DISCIPLINE TO PRACTICE

Remediation engineering is a unique technical discipline with a history of integration of components from many scientific subjects and different fields of engineering. The reality of dealing with significantly complex systems, such as the subsurface environments contaminated by a multitude of chemical compounds, led us to appreciate the need for the evolution of this emerging engineering discipline. Prior to the 1970s, civil (or sanitary) engineers were primarily responsible for environmental protection through design of municipal and industrial wastewater treatment plants. By the 1980s, sanitary engineers with civil engineering training were renamed “environmental engineers” to better integrate the broader engineering mission. Technological advances during the last three decades...