- 504 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Risk Management in Civil Infrastructure

About this book

This book presents several original theories for risk, including Theory of Risk Monitoring, and Theory of Risk Acceptance, in addition to several analytical models for computing relative and absolute risk. The book discusses risk limit, states of risk, and the emerging concept of risk monitoring. The interrelationships between risk and resilience are also highlighted in an objective manner. The book includes several practical case studies showing how risk management and its components can be used to enhance performance of infrastructures at reasonable costs.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Risk Management in Civil Infrastructure by Mohammed M. Ettouney,Sreenivas Alampalli in PDF and/or ePUB format, as well as other popular books in Technology & Engineering & Civil Engineering. We have over one million books available in our catalogue for you to explore.

Information

1 Introduction

1.1 OVERVIEW

1.1.1 RISK MANAGEMENT LANDSCAPE

Recent devastating man-made and natural hazards brought to focus the need for civil infrastructures to implement measures to reduce their harmful effects. Implementing many such measures, whether physical or operational, is very expensive and could pose a major problem to infrastructure stakeholders. Budget and personnel resource limitations in the current environment make this problem even more critical. To balance the need for adequate performance at optimal/reasonable costs, risk management can offer the best, perhaps only, management paradigm to face the challenges. This chapter introduces the major components of risk and risk management.

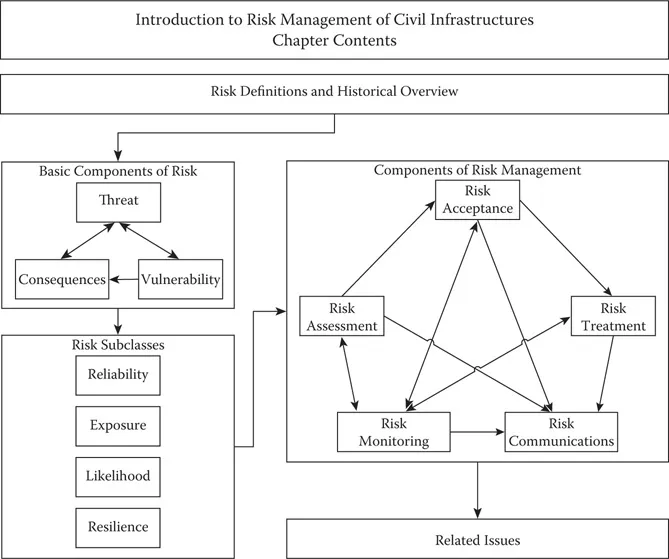

It should be recognized that only by finding an appropriate balance between expected performance levels and cost can an expected level of service from the infrastructure during its life span be realized. Risk, at its foundation, is built to address threats, vulnerabilities, and consequences all at once in a balanced and objective manner. Thus, risk management is the appropriate venue for addressing this issue. To show how risk can assist in overcoming this seemingly impossible task, the present chapter introduces the concept of risk from several viewpoints. Initially, the chapter discusses the concept of risk and then offers a suitable definition of risk that serves us best to explore risk management concepts in civil infrastructures. We then discuss the three basic components of risk and emphasize the universality of risk concept. The relation between risk and other popular concepts, such as reliability and resilience, is explored followed by a discussion of five risk management concepts. We end the chapter with a discussion of the essential attributes for risk management and the benefits (potential return on investment) to different stakeholders for implementing appropriate risk management. The layout of the chapter is shown in Figure 1.1.

1.1.2 WHAT IS RISK?

We start by asking the simple and obvious question: What is risk? The answer is also simple, and perhaps is obvious. Risk, in its most general form, is an estimate of a potential of a nondesirable outcome due to an event. The many manifestations of risk include the following:

- Hazards risk: Hazardous events abound. These can be natural hazards such as floods or man-made hazards such as bomb blasts and hazardous material spills. Additionally, hazards can be related to health or result from climate change, and so forth. All these hazards have the potential of producing undesirable outcomes. The metric we normally use to measure these potential outcomes are hazard risks. They can be abnormal (such as earthquakes, floods, or bomb blasts) or mundane and stealthy (such as routine wear and tear, fatigue, corrosion, or freeze–thaw cycles).

- Operational risk: Because most decisions in all operations involve some uncertainty, some uncertainty is associated with all outcomes. Thus, some have the potential to yield less than desirable outcomes and can generically be defined as risk. We reach the conclusion that, irrespective of type of the operation, some measure of operational risk is associated with it, and the decision makers’ responsibility is to reduce such an operational risk.

- Financial risk: This type of risk involves potential of monetary losses associated with a particular financial portfolio or project execution. Though usually associated with the finance community, it is becoming relevant to civil infrastructures because of innovative infrastructure project delivery/finance options, such as design-build and design-build-maintain with public–private partnerships.

- Strategic risk: This risk deals with the risk associated with strategic decisions and depends on the topological scale of interest (such as international, national, local, corporate, or networkwide civil infrastructure). The nature of strategic risk depends on the topology, the events, and the metric of strategic risk. For example, it can be a national security risk, international risk of health-related issues, or a risk of civil infrastructure aging in a specific network or private financing used for a public works project.

FIGURE 1.1 Chapter layout.

This book includes any type of the above-discussed risks that can afflict civil infrastructures. As such, risks associated with oil spills, epidemic health, or strategic international security are not of immediate interest; thus, we limit our context to risks that afflict single infrastructure assets (buildings, bridges, tunnels, etc.) and/or infrastructure networks.

1.1.3 HISTORY OF DESIGN PARADIGMS AND RISK

Most design specifications started with working stress methodologies that did not consider risk explicitly. Load factor designs that accounted for uncertainty in loading followed. In recent years, load and resistance factor design (LRFD) accounts for uncertainties in both demand and capacities. LRFD methodologies consider reliability as one component of risk but do not explicitly account for consequences. As we are moving toward performance-based design, when reliability of a structure and consequences are accounted for, risk-based design concepts are evolving rapidly. As software and computing capabilities mature and data required for risk-based approaches are well understood, a risk paradigm in design will become more predominant. This section gives an overview of some work noted in the recent literature.

It has been fairly well recognized that possible structural responses are necessary for probabilistic performance assessment of structures and risk analysis. Incremental dynamic analysis (IDA) (Vamvatsikos and Cornell 2002) can assist in this aspect for more detailed seismic performance predictions of structures subjected to different seismic excitation levels. IDA can be used for fragility curves development and to predict failure probabilities. Tehrani and Mitchell (2014) note that this method has been successfully used for buildings and have applied this method to predict the seismic risk assessment of four-span bridges, designed using Canadian bridge design code with different column heights and diameters in Montreal. They studied the seismic risk associated with exceeding different damage states in the columns, including yielding, cover spalling, bar buckling, and structural collapse (i.e., dynamic instability). Based on the estimated mean annual probability of exceeding different damage states in the columns, they concluded that the probabilities of exceeding different damage states were reasonably low.

Uncertainties in flooding and flood-related hazards have been studied from the risk viewpoint. For example, Archetti and Lamberti (2003) examined failure, damage, and risk in the context of a debris-flow-prone basin and presented a risk based on the structural reliability methods (SRMs) of Thoft-Christiansen and Baker (1982) and Burcharth (1992). They caref...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Dedication

- Contents

- Preface

- Acknowledgments

- Authors

- Chapter 1 Introduction

- Chapter 2 Graph Networks

- Chapter 3 Risk Assessment

- Chapter 4 Risk Acceptance

- Chapter 5 Risk Treatment

- Chapter 6 Risk Monitoring

- Chapter 7 Risk Communication

- Chapter 8 Risk Management Applications

- Appendix A: Truncated Normal Distributions

- Appendix B: Statistics of Histograms

- Index