![]()

SECTION 1

THINGS TO CONSIDER BEFORE YOU START

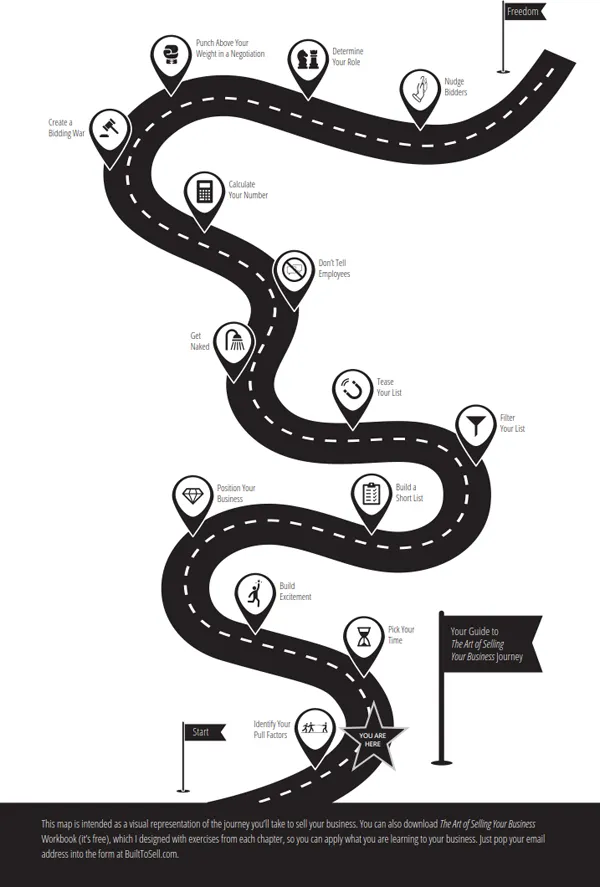

Think of selling your business as a long, tough journey into the back-country. You will encounter plenty of obstacles, but if you pack right, you’ll be fine. Consider this section an essential list of things you need to arrange before starting your trek.

![]()

Chapter 1

VALUE IS IN THE EYE OF THE ACQUIRER

AN INTRODUCTION TO THE ART OF SELLING

I’m not much of an artist, but if you gave me a can of white paint, I could probably make a close replica.

It’s called Bridge, but it’s just a square white canvas, painted all white. It was created by the late Robert Ryman, who was apparently a big deal in the contemporary art world. He was known for something called minimalism, which became a thing in the 1960s.

To me, it just looks like a white ceiling tile that was removed from a high school cafeteria. That’s why I find it so shocking that someone would pay $20.6 million for Bridge at a Christie’s auction.1

But here’s the thing: I know nothing about art. If I weren’t such a Neanderthal, I might appreciate the value of an original canvas from one of the 20th century’s most prolific artists.

But I don’t.

And that’s okay because someone does—in fact, a lot of people do.

One person’s ceiling tile is another person’s masterpiece. Similarly, your business can be worth different amounts depending on whom you’re asking. Sure, you can probably look up a standard industry benchmark for valuing your company, but you can also look up the cost of a white ceiling tile.

There’s an art to selling a business well. It comes down to how you package it, the story you tell about it, and the feeling it gives potential buyers when they imagine owning it. As you’ll see in chapter 16, it’s how Gary Miller got IBM to almost quadruple its acquisition offer for Aragon Consulting Group from three times earnings before interest, taxes, depreciation, and amortization (EBITDA) to almost 11 times.2 It’s the same reason Stephanie Breedlove sold her $9 million payroll company for $54 million3 (also covered in chapter 16).

There is a systematic way to calculate the value of your company—but if you’re all head and no heart, you will miss the point.

The Art of Selling Your Business is designed to be your playbook for navigating both the hard rules and the softer edges of selling well. It features a set of instructions to follow at each step of the process and describes the professionals you’ll need to lean on to get a deal done.

MY STORY

I’ve started and exited a few small businesses, and I’ve tried to describe what I have learned about making them valuable in a book I wrote called Built to Sell: Creating a Business That Can Thrive Without You, which was published in 2011. In 2015, I wrote a companion book called The Automatic Customer: Creating a Subscription Business in Any Industry, which illustrates how to create a recurring revenue model—one of the value drivers I covered in Built to Sell.

The books led to my creating a company called The Value Builder System™, where our community of approximately 1,000 Certified Value Builders™ have helped more than 50,000 business owners maximize the value of their business.

Based on my experience running The Value Builder System and writing a couple of books on the topic of building to sell, I occasionally get asked to speak to groups of entrepreneurs. My standard talk covers eight things acquirers look for when they evaluate your company as a potential acquisition—for example, how fast your company is likely to grow in the future, how much recurring revenue you have, how well you have differentiated your product or service, and how dependent your business is on your personal involvement.

Interestingly, the questions I get from a typical audience have less to do with my speech and more to do with the details of negotiating the sale of a business. Instead of theoretical questions about the drivers of value in a small business, I get asked stuff like:

• “How do I avoid an earnout?”

• “How do I let potential buyers know I’m interested in selling, without looking desperate?”

• “When should I tell my employees I’m thinking of selling?”

• “How can I create a bidding war for my company?”

• “What do I do when a potential buyer wants me to sign a ‘no-shop clause’?”

• “How do I handle a potential acquirer who wants to talk to my employees and customers as a part of their due diligence?”

Because these questions are around the mechanics of selling rather than the theories of building value, I began to realize that there was a need for impartial advice on how to go about negotiating the sale of a business.

THE BIRTH OF BUILT TO SELL RADIO

These post-talk Q&A sessions led me to see that business owners want actionable advice on selling their businesses, which inspired me to launch a podcast called Built to Sell Radio, where I interview a different founder every week and ask them about the sale of their business. Rather than have them explain how they got started, or how they grew their business, I focus my questions on their exit:

• “What triggered you to consider selling?”

• “How did you find a buyer?”

• “What was the negotiation like?”

• “How much did you get for your business?”

• “What were the deal’s terms?”

• “What proportion of your payment is at risk in an earnout?”

• “What was the most unexpected thing you got asked for during diligence?”

• “What would you do differently if you could negotiate the sale of your business all over again?”

This collection of hundreds of interviews with cashed-out entrepreneurs has become a treasure trove of techniques, hacks, ideas, negotiation strategies, and lessons learned about selling a small business, which I decided to amalgamate—along with my own personal experience—into this book.

The Art of Selling Your Business is not about how to start a business. There’s plenty out there on getting going. It’s also not about how to create a valuable company; that was my focus in Built to Sell and The Automatic Customer. Instead, this book assumes you already have a successful company and you’re trying to figure out how to sell it for a decent price.

I’m not talking about selling assets like your inventory and equipment—any auctioneer can get rid of your stuff. Instead, I’ll be talking about maximizing what accountants call “goodwill,” which is the difference between the market value of your business and the current value of your hard assets. The art of selling your business is getting someone to value something they cannot touch. In essence, they are buying a story about what your business could be in their hands.

I’m also not focused on companies with less than $1 million in annual revenue, which typically sell to an individual for a modest multiple of seller’s discretionary earnings (SDE).4 If you have a six-figure company, you may take something away from this book, but the process of selling a Main Street business involves listing it for sale like you might list a property, which takes away much of the art of selling well.

Instead, The Art of Selling Your Business is for the owner of a company worth somewhere between $1 million and $50 million, where the art form has the biggest impact. Unlike the sale of larger businesses in transparent auctions where acquirers often disclose deal terms to their shareholders, the sale of a business worth between $1 million and $50 million is shrouded in mystery. Details are hidden behind the nondisclosure agreements (NDAs) that sellers are required to sign, leaving us few examples to follow in order to navigate the treacherous waters of selling a business.

I’ve divided the book into three distinct sections, which correspond to the process you’ll go through to sell your business:

1. Section 1 tackles some things to do before you start— consider it an essential packing list before you set out on your journey to sell.

2. Section 2 looks at how to create negotiating leverage by drumming up multiple offers.

3. Section 3 provides a recipe for coming out on top in a negotiation to sell your business.

Before we dive into soliciting acquisition offers and the dark art of negotiation, there is one essential question you need to answer first.