- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

Spiralling inequality since the 1970s and the global financial crisis of 2008 have been the two most important challenges to democratic capitalism since the Great Depression. To understand the political economy of contemporary Europe and America we must, therefore, put inequality and crisis at the heart of the picture.

In this innovative new textbook Mattias Vermeiren does just this, demonstrating that both the global financial crisis and the European sovereign debt crisis resulted from a mutually reinforcing but ultimately unsustainable relationship between countries with debt-led and export-led growth models, models fundamentally shaped by soaring income and wealth inequality. He traces the emergence of these two growth models by giving a comprehensive overview, deeply informed by the comparative and international political economy literature, of recent developments in the four key domains that have shaped the dynamics of crisis and inequality: macroeconomic policy, social policy, corporate governance and financial policy. He goes on to assess the prospects for the emergence of a more egalitarian and sustainable form of democratic capitalism.

This fresh and insightful overview of contemporary Western capitalism will be essential reading for all students and scholars of international and comparative political economy.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1

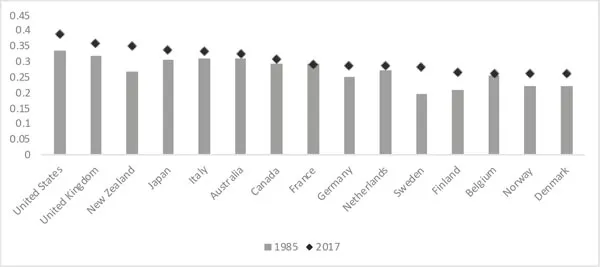

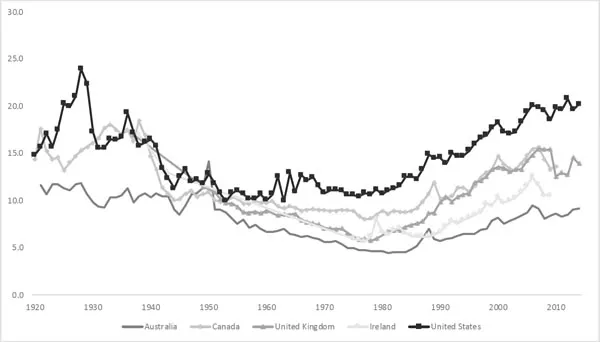

Rising Inequality in Advanced Capitalism

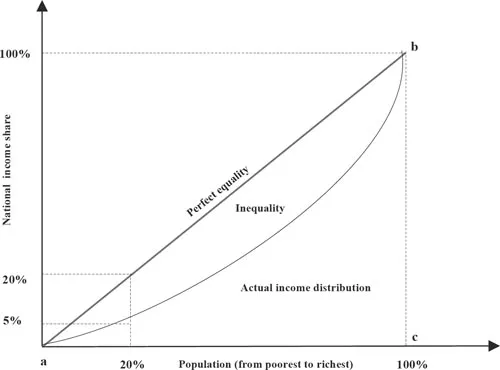

Measures of economic inequality

Personal income distribution

Table of contents

- Cover

- Table of Contents

- Dedication

- Title Page

- Copyright Page

- Figures, Tables and Boxes

- Abbreviations

- Introduction

- 1 Rising Inequality in Advanced Capitalism

- 2 The Rise and Fall of Egalitarian Capitalism

- 3 Macroeconomic Policy: From ‘Full Employment’ to ‘Sound Money’

- 4 Social Policy: Globalization, Deindustrialization and Liberalization

- 5 Corporate Governance: The Rise of Shareholder Capitalism

- 6 Financial Policy: Market-Based Banking and the Global Financial Crisis

- 7 Macroeconomic Imbalances Before and After the Crisis

- 8 The Future of Egalitarian Capitalism

- References

- Index

- End User License Agreement