![]()

Chapter 1

Introduction

1.1 Introduction

This book defines concepts and details processes involved when undertaking property development. It a practical book which describes the process of property development, enabling the reader to obtain a comprehensive understanding of the fundamental concepts and conceptual framework for property development. The content of this text is suitable for new property developers and students who are looking to identify and understand the important components of undertaking a property development, as well as for experienced property developers seeking to understand the theoretical concepts underpinning this discipline.

This is the sixth edition of the book – since the fifth edition of Property Development was published in 2007 major changes have affected the property development discipline. In a similar manner to many other areas of business activity, there has been a substantial move towards globalisation and now property development is undertaken on a global as well as national and local scale. The concepts and discussions in this text apply in many different regions and countries with emerging markets, as discussed in the final chapter. The trend towards adopting sustainability in development has continued and now directly and indirectly affects the type of property developments perceived as desirable in the marketplace. Sustainability is therefore firmly embedded within the text, in addition to the inclusions of a ‘Sustainability’ chapter. Property development processes have been significantly affected by advances in technology in terms of communication technology, advances in building materials and in construction processes. For example, the internet provides easy access to property search engines which has speeded up the globalisation of business and allowed best practice in sustainability and property development to be communicated rapidly around the world. Accordingly this edition includes a chapter on ‘Technology’ in the context of property development. Since the previous edition of this text was published the world has experienced an inevitable downturn in economic markets known as the ‘Global Financial Crisis’ (GFC). The status of the property cycles at any given point in time can adversely affect the success of any property development and the developer needs to be fully aware of its status. Accordingly a new chapter has been added to discuss the theory behind property cycles, as well as how to interpret and work around changes in supply and demand interaction.

The term ‘property development’ evokes many feelings depending on varying perspectives. The definition adopted in this text is that property development is ‘a process that involves changing or intensifying the use of land to produce buildings’. It is not simply the buying or selling of land for financial gain, since the land is only one of the essential components in a property development. Other components include the building materials, labour, infrastructure, financial capital and professional services. It is a global activity as reflected in the coverage of this text with relevance to the UK and Europe, the USA, Asia-Pacific and the rest of the world.

Property development is an exciting and occasionally frustrating activity often involving the use of scarce resources and large sums of money to develop a product which is largely indivisible and illiquid. It is, at times, a high-risk activity involving a high level of planning and co-ordination to maximise the use of limited resources. As the development process is often lengthy and can take years from initial conception until completion, the performance of external factors, such as the broader economies at the local and national levels, are an important consideration in the successful completion of a development, especially as the assumptions made at the outset may have dramatically changed by completion. Success often depends on attention to the detail of the process, although success is not always judged in terms of profit and loss and for some it is measured in social, emotional or aesthetic terms. However property development is, for many, a worthwhile and very rewarding discipline.

The emphasis in the text is on the practical application of property development where the reader is taken carefully through all of the stages involved in the process. In each chapter a series of discussion points are provided to prompt the reader to reflect on the content of the previous section. Furthermore a number of illustrative industry-based case studies are included to demonstrate the application of certain development stages covered in the chapters. This text is intended for (a) those who already practise in this field and also (b) as an introductory guide to students and those new to the field. The aim of this book is to provide a framework for successful property development at a local and international level.

1.2 The process of development

Undertaking a property development is largely about the ‘process’ of developing a property. There are different perceptions about what the process actually involves, which is due in part to the actual country within which a property development is occurring and the actual location itself. A major property development in London or New York, for example, will be considerably different in many aspects from a major property development in a rural town in the southern hemisphere. While the underlying concept is similar, each parcel of land is different which ensures every property development has its own unique aspects and interesting development challenges.

In a very simplistic format, property development has similarities with other industrial production processes and involves the combination of various inputs at specific timings in order to achieve a desired output or final product. In the case of a successfully completed property development, the final product is the result of a change of land use and/or a new or altered building in a process which combines the factors of land, labour, materials and finance to produce a varying level of profit and risk. However, in practice the successful implementation of this framework ensures the process can be very complex if poorly understood, especially since a development often takes place over a considerable time period, usually years. When the property development is completed the end product is then unique, either in terms of its physical characteristics, its location or both. No other process operates under such constant public attention, nor in recent times has received so much interest in broader society. For example the international quest to construct the world’s tallest building throughout history is clear evidence of the interest in new property developments, with this view further supported by a high international profile and demand by individuals to visit such properties.

The development process can be sequentially divided into these major stages:

1 initiation

2 investigation and analysis of viability

3 acquisition

4 design and costing

5 consent and permission

6 commitment

7 implementation

8 leasing/managing/disposal.

The individual stages may not always follow this exact sequence and at times may overlap or be repeated. For example, commitment (6) may occur at an earlier stage when the purchase contract is subject to planning consent and permission (5), normally preceding (6), which may then be formally confirmed at a later stage. Another consideration is whether the development is a speculative project or a design-and-build project. The sequence listed above is typical of a speculative development where an occupier had not been identified when the commitment (6) phase of the property development took place. Alternatively if the development was undertaken based on a design-and-build approach and was pre-sold to an occupier or pre-let to a long-term tenant, then stage (8) would precede stages (2)–(7).

1.2.1 Initiation

The first stage of development process typically occurs when either one of two events occurs:

• a parcel of land or site is considered suitable for a different or more intensive use than its existing use; or

• there is an increased level of demand for a particular land use, which in turn leads to a search for a suitable site.

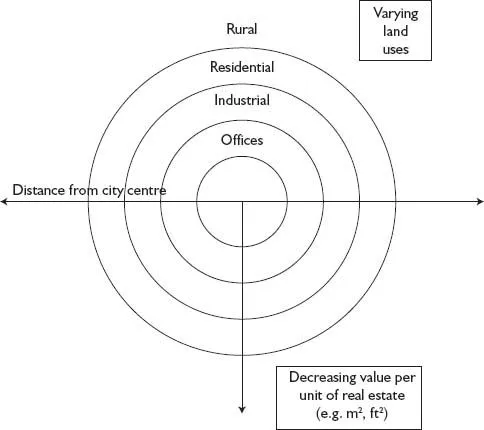

Figure 1.1 Relationship between land uses (Source: adapted from Von Thunen I 826)

There are underlying fundamentals for the property development process which are commonplace across different land use types. With reference to improving land, the amount of resources needed can vary from minimal structural improvements relative to the substantial land component in rural land, to major structural improvement in comparison to a minor land component in a city centre high density land use – for example, an office building. There are a range of land uses between these two extremes including residential, industrial, retail and office. The location for each type of development is usually driven by its proximity to cities, towns and transport networks. See Figure 1.1 for the underlying rationale for the location of each land use, where Von Thunen’s original model published in 1826 provides a broad framework for understanding variations in highest and best land uses based on limited supply in the city centre and the hierarchy of higher yet diminishing returns for office, then retail, industrial and so forth. In a purely practical sense this model is very theoretical (i.e. not realistic with perfect concentric circles) and also ignores any limitations imposed by legal or planning regulations designed to protect against non-conforming uses.

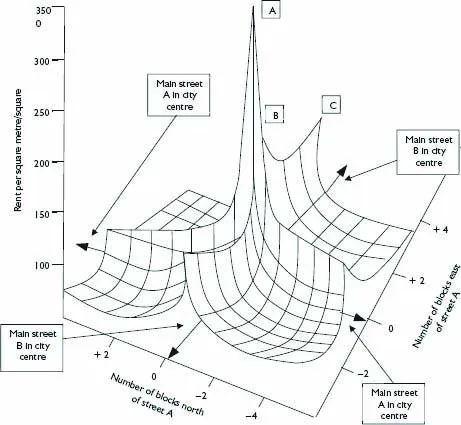

The main focus in this book is towards the more intensive land uses in Figure 1.1 where there is increased pressure to develop the land to its optimal capacity. Emphasis is placed on land uses where property development is most likely to occur. For example, retail property has a relatively high level of obsolescence, partly due to constantly changing demand trends and consumer tastes, which in turn ensures the continual development or redevelopment of retail property including larger shopping centres. You will find examples included in this book of higher intensity land uses such as retail, office and industrial property although the development framework is applicable to other land uses including residential development. The diagram in Figure 1.2 has been adapted from a landmark rent-bid model for the high density Chicago office market (Alonso 1964) which closely examines actual property location and the rent per unit of measure. In Figure 1.2 the highest rent per spatial unit (e.g. square metre or square foot) is at location (A) at the intersection of Main Street A and Main Street B in the city centre. The rental level then decreases (B) in a location being one block east of this intersection, then decreases to (C) being two blocks east of the intersection and so forth. This type of rent-bid model can usually be easily adapted for most high density areas and can greatly assist property developers to analyse the levels of demand for various uses land in areas such as an inner-city centre. When this model is adapted for a residential development it would be affected by other variables such as access to leisure facilities and schools for families. In recent decades many city centres have re-emerged as mixed-use locations, combining office, retail and residential uses. In fact it is now commonplace for a property development to contain mixed land uses, such as an office building incorporating ground-level retail, or an industrial building with partial office space.

Figure 1.2 Office rent in the Chicago CBD (Source: adapted from Alonso 1964)

Increasingly such new mixed-use property developments have used creative planning and design strategies to combine multiple land uses. Examples include:

• Office/retail/residential: buildings which are predominantly office although with a large component of retail on the lower levels with residential on the upper levels.

• Hotel/residential: multi-level buildings with the lower half as a hotel and the upper half as private residential, both land uses having full use of all amenities including pool, gym and common areas.

• Retail/office/residential: regional shopping centres with a substantial office component and also a large medium density residential component.

• Residential/retail: especially with inner-city multi-level developments the bottom levels can include restaurants and retail outlets to cater for the residents of the building.

With the increasing pace of change in society and the added influence of sustainability, many real estate markets are now looking for buildings which are ‘agile’ and can be readily adapted to potential future changes in demand – for example from industrial land use to residential land use. The potential to ‘adapt’ the building from one land use to another, with relatively minimal disruption and time delay, has become an important design feature in the built environment. This process requires forethought in the design phase to ensure the structural features of the building do not constrain its future use and prevent adaptive changes – for example from ‘office’ to ‘residential’ by locating services (e.g. water, sewerage) and supporting columns in the building where they will not have an adverse effect for both land uses. Agile buildings are particularly sought after in the inner-city areas where there are often multiple adjoining land uses in a particular precinct which can include office, retail and residential for example.

The starting point for the property development itself can vary. Often it can be linked back to one of the stakeholders in the property development looking for an appropriate new site to meet their needs; for example a finance company may seek vacant land to construct a new office building so they can amalgamate their smaller expiring leases throughout town. Alternatively a stakeholder may be looking to redevelop or expand an existing site, such as a retail shopping centre, and need to acquire neighbouring residential houses for land required for a retail extension. These changes in demand may be due to any number of influencing factors resulting from the constant state of change that occurs within the market. Typically the factors which negatively affecting an existing land use or development use are usually referred to as a form of obsolescence such as economic, social, environmental, physical, legal, historical and so forth. Often it is impossible to disentangle which form of obsolescence affects a particular property and to what extent, as several factors frequently interact and negatively affect property which in turn will cause a decrease in value over time.

It is an essential concept in property and real estate markets for every parcel of land, in addition to any improvements which are affixed to and form part of the land, to be at its ‘highest and best (legal) use’. (The reference to ‘legal’ use refers directly to statutory planning authorities who seek to separate non-compatible uses and maximise efficiencies in urban landscape through planning legislation.) Of course this scenario may vary substantially from the existing use. One example would be a residential area which has gradually become predominantly commercial over time although a small number of homes are still occupied. Due to this gradual change, the ‘highest and best’ land use for that particular area has also changed. This trend must be acknowledged by the property developer as soon as possible otherwise a new development may become obsolete relatively quickly, e.g. within five years.

1.2.2 Investigation and analysis of viability

In the preliminary stages of a property development it is essential for detailed market research to be undertaken. With developments in technology and the availability of decision support systems to assist the developer, including GIS and scenario modelling software, the risk of not developing to ‘highest and best use’ in the current and foreseeable market has been substantially reduced. The stage of fully investigating, evaluating and modelling the detailed process of a property development is crucial to the successful completion of the project. Errors or misjudgements here will often have an adverse effect on the financial viability either during each development phase or at the end. There have been many high profile property developments on an international scale which have made a substantial loss following completion. The process of undertaking a hypothetical development has been substantially assisted by computer software programs where detailed costings and potential scenarios via a sensitivity analysis can be closely examined. The critical importance of undertaking a rigorous investigation and evaluation cannot be overstated here if financial losses due to poor planning or undue haste are to be avoided.

The evaluation stage is arguably the most important part of the property development process. Simply explained, ‘failing to plan is planning to fail’. This stage enables the developer to create the essential framework for the entire project management of the development which guides decision-making throughout the whole development process. A comprehensive investigation and evaluation will include detailed market research, both in general and specific terms, and examine in detail the financial viability of the proposal. There are proven methods for assessing the financial viability of a property development (see Chapter 3), although the data input will depend on the depth of the market research (see Chapter 8). The real estate market works largely on the premise that ‘knowledge is power’ so reliable and detailed property data is commonly not typically available for free. In many countries it is very expensive to gain access to this detailed informatio...