eBook - ePub

The Global Private Health & Fitness Business

A Marketing Perspective

- 236 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Global Private Health & Fitness Business

A Marketing Perspective

About this book

For decades, sports management has not been considered a priority area of interest within sport, and there is a lack of professionalization within the multiple approaches and key performance areas in sports management. However, in recent years, the importance and impact of the sports economy in the percentage of GDP has coincided with an increase in the volume of literature dedicated to the study of sports management, and specifically around fitness centers, the commercialization of their services and the loyalty chain of the users of this business model.

The Global Private Health & Fitness Business shows the globalization of the health and fitness industry, and its different forms of management according to different countries, the objective being to show the various business models in the fitness industry in twenty countries around the world and explore their methods of marketing. The content will provide insight into the current situation and what challenges it faces in the future. In addition to these contexts, each chapter ends with the description of the main chains in each country and information on the complexity in the commercialization and loyalty of their services.

This book provides a great opportunity to further analyze sports management in different countries, with contributions from leading academics and professionals who share the current situation as well as the challenges of the coming years, providing an excellent resource for all practitioners working in sports management, researchers and students with future projection towards this area.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access The Global Private Health & Fitness Business by Jerónimo García-Fernández, Pablo Gálvez-Ruiz, Jerónimo García-Fernández,Pablo Gálvez Ruiz in PDF and/or ePUB format, as well as other popular books in Business & Digital Marketing. We have over one million books available in our catalogue for you to explore.

Information

Chapter 1

Introduction

1. Introduction

The sports sector is an industry that houses different and numerous business opportunities and, therefore, marketing. Different studies and reports show how the number of companies and organisations that promote and offer sports products and services worldwide has increased. This fact has also had an impact on the increase in sports practitioners and consumers, who demand services and products for better and greater sports practice.

Among the different industries developed by this sector, is the fitness industry. This industry has become a permanent wave of news and innovations in sports services, which has increased its interest in the scientific community due to the speed with which they produce changes that affect both the management of organisations and consumers. In fact, more and more research can be observed that analyses how fitness organisations behave and what the behaviour of their consumers is.

But the fitness sector could be different depending on each region and each country. Thus, depending, for example, on the socio-cultural aspects of a country, the needs of its inhabitants, the culture or sports tradition or simply depending on the purchasing power of the regions, fitness centres could have some peculiarities that would make them different between different regions. In fact, business models in the fitness sector could differ according to the countries and therefore also the sports offer they promote. Likewise, these differences would also have an impact on innovations in sports services and therefore on the differences between consumers who attend sports facilities.

At the same time, although the services they offer are new, it is important that fitness centres know how to market their services and therefore can get more consumers and for longer. Thus, marketing actions are totally necessary in a market that is beginning to professionalise and, therefore, competition is increasing.

These differences between regions of the business models, the offer of sports services as well as the marketing actions that are carried out depending on the countries and each culture, could help to better understand the sector, and, therefore, would help to have a global vision of the business models, the behaviour of its consumers and its marketing actions aimed at both recruitment and loyalty.

For this reason, the aim of the book is to show what are the business models in the fitness industry in 20 countries around the world and share their ways of marketing. The content provide knowledge about the current situation and what are the challenges of the future. In particular, this book describes the status of business models, the type of sports consumer and how fitness centres communicate/relate to different countries. In short, a book that shows the globalisation of the fitness industry, and its different ways of marketing according to different countries.

For an introduction to the chapters included in this book, the contents are divided into four sections. Each section includes different relevant countries in the fitness sector from each of the main regions of the world: Europe, the North–South America, Asia-Pacific and Africa and Middle East.

The first block of chapters, the Europe industry, provides data of interest from United Kingdom, Spain, Portugal, Greece, Lithuania, Turkey and Italy. The second part, the North–South America industry, includes four chapters of interest about the countries of the United States of America, Mexico, Chile and Brazil. The third part, the Asia-Pacific industry, provides information from countries as India, Australia, Japan and China. Finally, the last section, the Africa and Middle East industry, shows the fitness sector from Morocco, Saudi Arabia, Egypt, Kenya and Iran.

In relation to the structure of each chapter and for a better understanding of the contents, it has been decided to divide all the chapters into equal blocks, facilitating the understanding of what the differences are between regions and countries, and above all it provides knowledge of what are the actions to be developed by countries with a more professionalised sector.

For these reasons, each chapter is divided into six sections. A first introductory section that shows what is the social and economic reality of the country, what are the lifestyles of its habitants or what are the different motivations why consumers attend fitness centres. The second section aims to show which are the business models in the fitness sector in each country, providing information on prices, types of sports facilities, types of sports services offered and curiosities related to the models that grow in each country. The third section of each chapter aims to show which are the main actions carried out by fitness centres to attract new customers, the fourth section being a continuum of this, that is, what are the actions carried out by the sector in the specific country in terms of customer loyalty. The fifth section of each chapter aims to show a specific chain in the country, detailing all data of interest to the community and that can help improve the fitness sector. Finally, the sixth section aims to be a concluding text with which the authors of each chapter show what the fitness sector in their country contributes, and what it can teach professionals from other countries.

In short, a book that wants to provide knowledge of the reality and current affairs of business models in the world fitness sector, and what are the marketing actions carried out in each country to attract and retain their consumers.

The Global Private Health & Fitness Business: A Marketing Perspective, 1–2

Copyright © 2021 by Emerald Publishing Limited

All rights of reproduction in any form reserved

doi:10.1108/978-1-80043-850-720211001

Copyright © 2021 by Emerald Publishing Limited

All rights of reproduction in any form reserved

doi:10.1108/978-1-80043-850-720211001

Part I

The Europe Industry

Chapter 2

The Fitness Industry in the United Kingdom

1. Introduction

The United Kingdom (UK) comprises the four nations of England, Scotland, Wales and Northern Ireland. Its population is estimated to be 66.8 million people in mid-2019 compared with 58.7 million people 20 years earlier. This represents a compound annual growth rate (CAGR) of 0.64% over 20 years. For comparison, the 28 countries that comprise the European Union (EU) saw their population grow 0.28% over the same period.

The UK has the second-largest economy in Europe which was valued at £2 trillion in 2019 (Office for National Statistics, 2020). Its economy has been growing steadily at a CAGR of 3.86% over the 20-year period 1999–2019.

2. Measuring the Prosperity of a Country

Many countries now measure the prosperity of a country beyond the financial value of what it produces or consumes. In 2010, the UK Office for National Statistics launched the National Wellbeing Programme. David Cameron, the then Prime Minister, stated:

We will start measuring our progress as a country not just by how our economy is growing, but by how our lives are improving, not just by our standard of living, but by our quality of life…

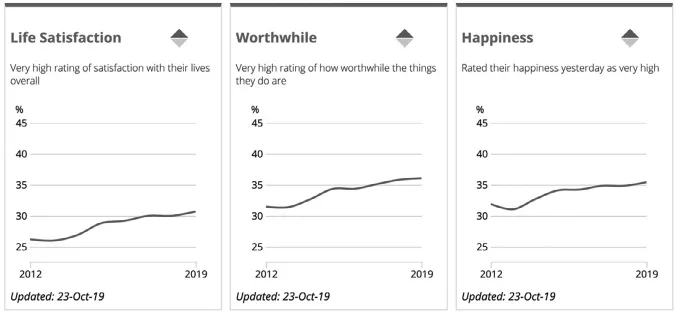

This means that questions such as ‘Overall, how satisfied are you with your life nowadays?’ and ‘Overall, how happy did you feel yesterday?’ now feature as important non-financial measurements. Fig. 1 illustrates how life satisfaction, the worth or purpose of the things people do and happiness have all been increasing since 2012, though only approximately one-third of the population rated their experience ‘very high’.

Fig. 1. Life Satisfaction, the Worth (Purpose) of the Things People Do and Happiness. Source: UK Office for National Statistics.

3. Life Expectancy

As in many other advanced industrialised nations, life expectancy has been steadily increasing. This means that baby boys born in the UK in 2019 are now expected to live on average for just under 88 years, compared to 90 years for girls. Of course, what is important is how many of these years are lived disease-free and in a healthy condition. Healthy life expectancy was estimated to be 63 years for both men and women in 2017, which is approximately three-quarters of overall life expectancy (Office for National Statistics, n.d.).

4. Leaving the EU

The UK has been an influential member of the EU since 1973. Over time and as the European ‘project’ has grown there has often been a tension between those that sought closer integration with Europe and those that preferred that the UK be more autonomous, with less influence from Europe. In 2016, the people of the UK were offered a referendum which asked one question: ‘Should the UK remain a member of the EU or leave the EU?’ In a surprise result, 52% voted to leave the EU and so on 31 January 2020, the UK left Europe.

5. National Physical Activity Levels

People across the UK are generally less active than they were compared to the 1960s. Public Health England has estimated a 20% decline in physical activity since the 1960s, which is caused by myriad reasons. Manual and energy-intensive jobs are now increasingly mechanised, more people are migrating to urban areas and ‘passive’ leisure activities are steadily increasing. For example, in 2019, the average UK adult was spending almost 97 hours each month watching broadcast television, which excludes streaming services (Ofcom, 2019).

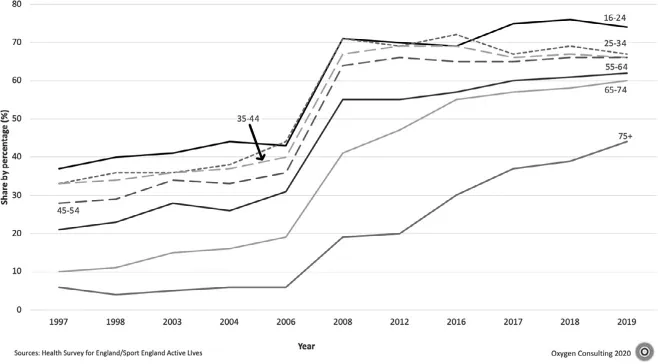

Physical activity levels are measured independently by each of the four nations, which means that aggregated data for the UK is surprisingly limited. Fig. 2 captures time-series data for adults (aged 16 and over) that meet the Chief Medical Officer’s recommended guideline of 150 minutes of weekly moderate intensity physical activity. Progress is being made especially among older adults (aged 65 and over), where the figure has risen from a very low point in 1997. However, what is clear about this emerging change in physical activity behaviour is that certain parts of the population are choosing not to take part or are being excluded in some way. For example, people in lower-skilled jobs are less likely to be physically active, as are the unemployed. Also, someone with a long-term disability is more likely to not reach recommended weekly physical activity levels, and the reasons for this can be complex. What this means is that across the UK around 4 out of every 10 adults (approximately 20 million people) do not meet the government recommendations for weekly physical activity.

Fig. 2. Share of Adults Meeting Recommended Physical Activity Levels in England from 1997 to 2019, by Age Group. Source: Health Survey for England/Sport England Active Lives.

6. The SARS-CoV-2 Pandemic

The SARS-CoV-2 virus which causes COVID-19 has had a dramatic impact on the UK. The UK’s first reported death from COVID-19 was in early March 2020 and, since this time, there have been just under 45,000 deaths across the UK attributed to COVID-19 (at July 2020). This is the third-highest death rate in the world behind the United States and Brazil. With 286,000 recorded cases of COVID-19, the case fatality rate is 15%.1

As in many other countries, this pandemic shut down the UK’s economy. On 20 March 2020, the UK health and fitness industry was told to close immediately. This formed part of a strategy to suppress the spread of this coronavirus. A substantial package of economic measures was announced by the UK Chancellor to support industries during this closure period. Normal property taxes on fitness premises were waived for one year, grants were offered and the wages of employees were subsidised to avoid large-scale redundancies.

During May 2020, the government published its COVID-19 recovery strategy which outlined how they intended to slowly phase the reopening of different industries. The indoor health club industry featured in phase three of this reopening strategy and was granted permission to reopen in England on 25 July 2020.2

7. Business Models

The commercialisation of the UK private health and fitness club industry started in the late 1970s. It was during this time that brands such as David Lloyd, Holmes Place and Cannons emerged. Before the arrival of private sector health clubs, the alternative was public sector leisure centres. However, the quality of these venues was often poor due to years of underinvestment. This meant that there was unmet demand from people who were increasingly interested and motivated to exercise but seeking a more appealing and attractive indoor environment. Consequently, where a town had previously been served by a publicly operated leisure centre and community sports clubs, now an increasing number of private sector gyms began emerging.

8. Growth Drivers

Some key drivers of growth during this time were a strategic shift from bodybuilding to more general fitness and the introduction of group exercise classes, which attracted women into clubs for the first time. However, the membership pricing for these new brands was relatively high and so attracted a more affluent client base. It would take another 10 years for gyms to open themselves to a wider spectrum of the general population, with brands such as Fitness First launching in 1992 with an ‘affordable fitness’ proposition and £29 monthly memberships. This was at least half the cost of the existing ‘premium’ brands and so unlocked a greater number of people joining commercial gyms for the very first time.

Business model innovation in the health and fitness industry seems to operate in approximately 10- to 15-year cycles. Following the global economic crisis of 2007/2008, the low-cost gym movement emerged in the UK, taking inspiration from countries such as Germany and the Netherlands. Health clubs had been competing by offering ever-increasing amounts of new facilities and programmes and as a result, ...

Table of contents

- Cover

- Title

- Chapter 1. Introduction

- Part I. The Europe Industry

- Part II. The North–South America Industry

- Part III. The Asia-Pacific Industry

- Part IV. The Africa and Middle East Industry

- References

- Index