International Financial Reporting Standards Implementation

A Global Experience

- 372 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About this book

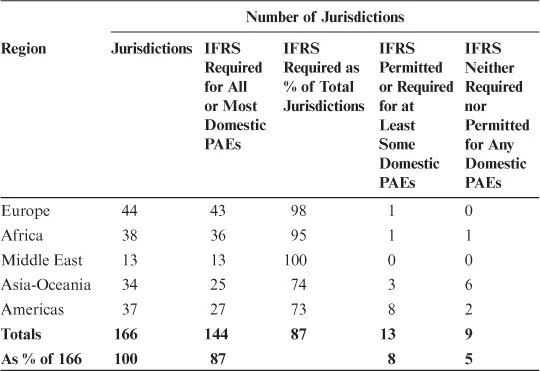

The vast majority of national authorities have made a public commitment supporting a single set of high-quality global accounting standards as of January 13, 2021 requiring or permitting the use of IFRS Standards for domestic, publicly accountable companies and institutions. This includes all member states of the European Union (EU) and the European Economic Area (EEA), in which IFRS Standards are mandatory for all companies whose securities trade in a regulated market.

Despite this, there still remains a lack of research on International Financial Reporting Standards (IFRS) implementation and this inaugural volume of Contributions to International Accounting (CIA) aims to address this vital gap, focusing on providing relevant and timely information for local and international policymakers.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

Introduction – International Financial Reporting Standards (IFRS): Where are We Now

US$ (billions) | Percentage | |

GDP of 166 profiled jurisdictions | 84,417 | 100 |

GDP of jurisdictions that require IFRS for all or most domestic PAEs | 39,474 | 46.8 |

GDP of jurisdictions that require IFRS for some (but not all or most) domestic PAEs | 50 | 0.1 |

GDP of jurisdictions that permit IFRS for all or most domestic PAEs | 5,926 | 7 |

GDP of jurisdictions that neither require nor permit IFRS for domestic PAEs | 38,966 | 46.2 |

- 12 jurisdictions permit, rather than require, IFRS: Bermuda, Cayman Islands, Guatemala, Honduras, Japan, Madagascar, Nicaragua, Panama, Paraguay, Suriname, Switzerland, Timor-Leste.

- One jurisdiction requires IFRS for financial institutions but not listed companies: Uzbekistan.

- One jurisdiction is in process of adopting IFRS in full: Thailand.

- One jurisdiction is in process of converging its national standards substantially (but not entirely) with IFRS: Indonesia.

- Seven jurisdictions use national or regional standards: Bolivia, China, Egypt, India, Macao SAR, the United States, and Vietnam.

- One (Japan) permits IFRS on a voluntary basis for domestic companies (as of June 2018 companies accounting for 33% ...

Table of contents

- Cover

- Title

- Chapter 1. Introduction – International Financial Reporting Standards (IFRS): Where are We Now

- Chapter 2. Implementation of International Financial Reporting Standards (IFRS) in Developing Countries

- Chapter 3. The Cultural Impact of International Financial Reporting Standards (IFRS) Implementation

- Chapter 4. The Economic Impact of International Financial Reporting Standards (IFRS) Implementation

- Chapter 5. Disclosure, Transparency, and International Financial Reporting Standards

- Chapter 6. Theory of International Financial Reporting Standards (IFRS) Implementation

- Chapter 7. Antecedents of IFRS Adoption in BRICS Nations: A Meta-synthesis

- Index

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app