![]()

Chapter 1

Introduction – International Financial Reporting Standards (IFRS): Where are We Now

Mohammad Nurunnabi

Prince Sultan University, Riyadh, Saudi Arabia

There is clear momentum towards accepting IFRSs as a common financial reporting language throughout the world. Today, multinational companies are benefiting from reduced compliance costs associated with the removal of the need for the consolidation of different national accounts into a single statement to meet their home country’s requirements. Investors are able to make comparisons of companies operating in different jurisdictions more easily. Regulatory authorities are now more able to develop more consistent approaches to supervision across the world. (Sir David Tweedie, 2008, p. 3)

Following the uncertainty of regulatory reform under Brexit and the Donald Trump Administration Era, this instalment of Accounting Matters explores the future of IFRS, Mr Hans Hoogervorst, Chairman of the International Accounting Standards Board (IASB), and Mr Michael Izza, Chief Executive of the Institute of Chartered Accountants in England and Wales (ICAEW), were both optimistic about the future of IFRS (Nurunnabi, 2019; The International Financial Reporting Standards Foundation, 2020).

The adoption of IFRS increases the transparency of financial information and the globalisation of capital markets and attracts foreign direct investment (FDI; Albu, Albu, & Alexander, 2014; Ding & Su, 2008; Lin, 2012; Nurunnabi, 2014a, 2014b, 2015a, 2015b; The World Bank, 2011; Zeghal & Mhedhbi, 2012). The G20 and other major international organisations (International Organization of Securities Commissions (IOSCO), World Bank), as well as very many governments, business associations, investors, and members of the worldwide accountancy profession strongly support the goal of a single set of high-quality, global accounting standards (The International Financial Reporting Standards Foundation, 2020). According to G20 (2012), G20 leaders’ declaration, 2012, in Mexico:

We call for accelerated progress by national authorities and standard setting bodies in ending the mechanistic reliance on credit ratings and encourage steps that would enhance transparency of and competition among credit rating agencies. We support continuing work to achieve convergence to a single set of high-quality accounting standards. We welcome IOSCO’s report on the functioning of the credit default swap markets and ask IOSCO to report on next steps by the November 2012 Finance Ministers and Central Bank Governors’ meeting.

Table 1. GDP Analysis of 166 Jurisdictions.

| US$ (billions) | Percentage |

GDP of 166 profiled jurisdictions | 84,417 | 100 |

GDP of jurisdictions that require IFRS for all or most domestic PAEs | 39,474 | 46.8 |

GDP of jurisdictions that require IFRS for some (but not all or most) domestic PAEs | 50 | 0.1 |

GDP of jurisdictions that permit IFRS for all or most domestic PAEs | 5,926 | 7 |

GDP of jurisdictions that neither require nor permit IFRS for domestic PAEs | 38,966 | 46.2 |

Data sources: World Bank,2 United Nations,3 and CIA World Fact Book.4

According to The International Financial Reporting Standards Foundation (2020), the gross domestic product (GDP) of jurisdictions that require or permit the use of IFRS for domestic publicly accountable entities (PAEs listed companies and financial institutions) constitutes 54% of the GDP of all profiled jurisdictions (based on the GDP data of 20181) (see Table 1). The GDP of jurisdictions that do not permit the use of IFRS for any domestic PAEs constitutes 46% of the GDP of all profiled jurisdictions. Three jurisdictions (China, India, and the United States) account for nearly all (95%) of the GDP of profiled jurisdictions that do not permit the use of IFRS for any domestic PAEs. The population of domestic listed companies that are required or permitted to use IFRS is 31,290, which represents 64% of the total 48,913 domestic listed companies on World Federation of Exchanges (WFE). Three jurisdictions (India, the United States, and China) account for nearly all (87%) of domestic listed companies that are neither required nor permitted to use IFRS.

As of 13 January 2021, 94% jurisdictions (156 of the 166) have made a public commitment supporting a single set of high-quality global accounting standards. The 10 jurisdictions have not made a public commitment of IFRS including Albania, Belize, Bermuda, Cayman Islands, Egypt, Macao, Paraguay, Suriname, Switzerland, and Vietnam have not. The 166 profiles include all 31 member states of the European Union (EU) and the European Economic Area (EEA), in which IFRS are required for all companies whose securities trade in a regulated market. According to The International Financial Reporting Standards Foundation (2020):

The 144 jurisdictions classified as requiring IFRS Standards for all or most domestic publicly accountable entities include the EU and EEA Member States to which the IAS 39 Financial Instruments ‘carve-out’ applies. The carve-out affects fewer than two dozen banks out of the 8,000 IFRS companies whose securities trade on a regulated market in Europe. The 144 also include several jurisdictions that have adopted IFRS Standards nearly word for word as their national accounting standards (including Australia, Hong Kong, New Zealand and Korea (South)). The 144 also include three jurisdictions that have adopted recent, but not the latest, bound volumes of IFRS Standards: Macedonia (2009); Myanmar (2010); and Venezuela (2008). Those jurisdictions are working to update their adoption to the current version.

In particular, 87% jurisdictions (144 of the 166) require IFRS for all or most domestic PAEs (listed companies and financial institutions) in their capital markets. All but one of those have already begun using IFRS. Bhutan will begin using IFRS in 2021. Some comments on the remaining 22 jurisdictions that have not adopted:

12 jurisdictions permit, rather than require, IFRS: Bermuda, Cayman Islands, Guatemala, Honduras, Japan, Madagascar, Nicaragua, Panama, Paraguay, Suriname, Switzerland, Timor-Leste.

One jurisdiction requires IFRS for financial institutions but not listed companies: Uzbekistan.

One jurisdiction is in process of adopting IFRS in full: Thailand.

One jurisdiction is in process of converging its national standards substantially (but not entirely) with IFRS: Indonesia.

Seven jurisdictions use national or regional standards: Bolivia, China, Egypt, India, Macao SAR, the United States, and Vietnam.

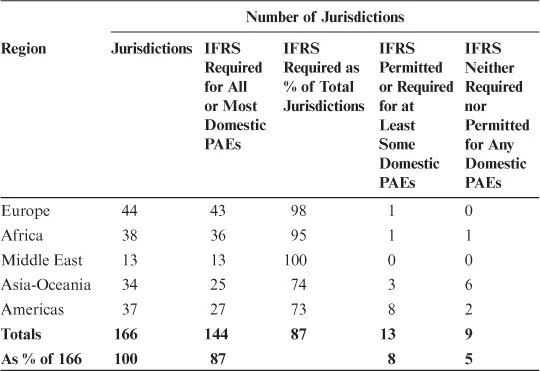

Table 2 provides the use of IFRS in the 166 jurisdictions by region of the world (see also Figs. 1–3):

Table 2. The Use of IFRS in the 166 Jurisdictions.

Fig. 1. The Use of IFRS by Regions.

Fig. 2. IFRS Are Required for Domestic Public Companies.

Source: The International Financial Reporting Standards Foundation (2020).

Fig. 3. IFRS Are Required or Permitted for Listings by Foreign Companies.

Source: The International Financial Reporting Standards Foundation (2020).

With regard to G20,5 all of the G20 jurisdictions have made a public commitment supporting a single set of high-quality global accounting standards. Fifteen of the G20 jurisdictions have adopted IFRS for all or most companies in their public capital markets. Of the remaining five G20 jurisdictions: