- 82 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

OPEC and the World's Energy Future offers a complete account of OPEC's past, present, and possible future in relation to economic, political, and technological changes. It focuses on the impacts of recent international political and economic developments and analyzes the factors affecting OPEC as well as the world oil market.

- Offers readers a thorough understanding of the interplay among international economics, politics, and technological advances and their effect on the world oil market

- Describes the continued importance of oil and gas as major sources of energy throughout the world

- Examines OPEC's history and merits, highlights differences among OPEC members, and discusses OPEC's relations with the outside world

- Illustrates the impact of new technologies and how they may challenge and change the organization in the near and long term

Aimed at policy makers, managers, scientists, and technologists in the oil and gas industry, this work offers readers a thorough understanding of the interplay among international economics, politics, and technological advances and their effect on the world oil market.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access OPEC and the World’s Energy Future by Mohammed A. Alsahlawi in PDF and/or ePUB format, as well as other popular books in Technology & Engineering & Energy Industry. We have over one million books available in our catalogue for you to explore.

Information

PART I Introduction

1.1 Pre-OPEC

Since the mid-nineteenth century, oil wells have been drilled on a commercial basis in the United States. In fact, Lord Cochrane, the Earl of Dundonald’s great grandfather, had the first commercial patent for the use of oil and the birth of the world oil industry (The Westminster Review, vol. 21–22).

Europe and Russia have followed track, and with the increased importance of oil and more uses of oil having been introduced, oil has been discovered in new parts of the world. Refined oil product such as kerosene and middle distillates have been developed and put in use. Until the first two decades of the twentieth century, the United States was the leading country in oil production, refining, and consumption. The Middle East, on the other hand, shared less than 5 percent of the world’s production in 1960. This share has increased to around 33.5 percent in 2018 as shown in Table 1.1 (Alsahlawi, 2014).

TABLE 1.1

Share of World Crude Oil Production by Region (mbd), 1960 to 2018

Share of World Crude Oil Production by Region (mbd), 1960 to 2018

Region | 1960 | 1990 | 2018 | 2018 Share of Total |

North America | 9.20 | 13.85 | 22.58 | 23.86% |

Latin America | 2.90 | 4.51 | 6.69 | 6.9% |

Western Europe | 0.30 | 3.70 | 3.73 | 3.7% |

Eastern Europe | 3.20 | 12.4 | 14.48 | 15.3% |

Middle East | 5.30 | 17.54 | 31.76 | 33.5% |

Africa | 0.28 | 6.72 | 8.19 | 8.6% |

Asia and Pacific | 0.60 | 6.73 | 7.63 | 8.1% |

Total | 21.78 | 65.46 | 94.72 | 100% |

Source: BP Statistical Review of World Energy, London, 2018. With permission.

Spontaneously, the United States had the power of controlling oil prices in the world. However, the pricing system was not in the hand of the government, but under the control of major oil companies, which played as a tacit cartel in setting oil prices while the rest of world’s oil companies had to follow.

Before World War I, the world oil market was dominated by four major international oil companies: Shell, Standard Oil, Nobel, and Rothschild.

The latter two companies were in Russia and were liquidated as private companies by the 1917 Russian Revolution. Another major company founded by the British government, was the Anglo–Persian Oil Company (now British Petroleum). In the 1920s, the oil market was essentially controlled by these three companies. In the 1930s, new major oil companies developed as offshoots of the old standard oil company. They were Gulf, Texaco, Standard of California, Sohio, and Mobil.

With these new entrants, the degree of competition in the world oil market increased, but only to a certain extent. In the 1940s and 1950s, the Seven Sisters (Gulf, Texaco, Standard of California, Sohio, Mobil, British Petroleum, Shell) had balanced the supply and demand mainly by market-sharing and joint producing agreement. To some extent these agreements distorted world market competition, resulting in an oligopoly market structure characterized by substantial differences between production cost and market price.

The positive differential of oil prices from production costs allowed for vertical integration and controlling the market all the way from exploration to marketing. The share of the major oil companies in world oil production refining and marketing was about 60 percent.

This concentration ratio, which indicates the degree of monopoly in the world oil market, has decline dramatically, especially in the production sector.

This is due to the increased participation of oil-producing countries in production and to the evolution of the national oil companies. The market power of the majors has reduced but they still control the refining and marketing sectors and participate in production from technical side. On some occasions, the federal government agents. Mainly in the US, the Federal Treadle Commission (FTC) interferes in setting oil pricing if a monopoly power exists. During both world wars, the importance of oil became undoubtable and undeniable.

Subsequently, competition arose among international oil companies and between the main colonial powers. It became severe to the extent that oil became the source of conflicts. Since WWII, new political and economic systems have emerged, and new uses of oil have been developed to fulfil new needs and new economic development requirements. Regardless of world oil in the newly developed regions and countries which altered oil production and consumption, the patterns of power for controlling the oil price stayed in the hands of international oil companies – mainly the Americans – despite the survival of long-standing European oil companies, such as British Petroleum and Shell.

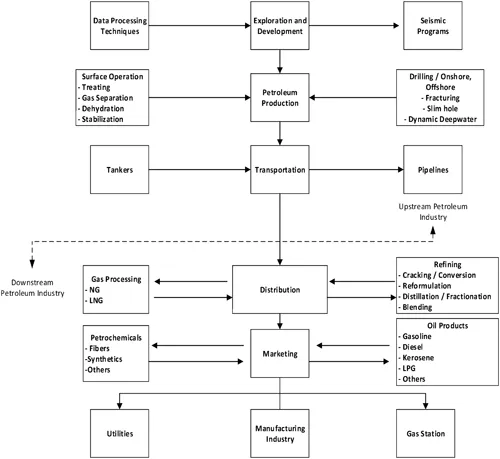

These companies maintained a good grip on the oil price because of the vertical advantages over different stages of the oil industry – from integration, exploration, and development to downstream sectors of refining, pricing, and distribution, as in Figure 1.1.

The competition between these companies appeared clear in securing oil and gas concessions in different countries all over the world.

There were – and still are – great prospects for oil and gas in the Middle East and South America. As a matter of fact, countries such as Saudi Arabia, Kuwait, and Iraq, have voluntarily offered a generous concession to international oil companies. The American companies are concentrated in Saudi Arabia, while the European companies wer...

Table of contents

- Cover

- Half-Title

- Title

- Copyright

- Contents

- Preface

- Acknowledgments

- Author

- Part I Introduction

- Part II OPEC’s Role in World Oil Market

- Part III Energy Technology and OPEC

- Part IV Forces Shape Energy’s Future

- Part V OPEC’S Existence

- Part VI Side Issues

- Part VII Wrap-Up

- Bibliography

- Index