- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Cost and management accounting

About this book

A comprehensive introduction to cost and management accounting from a South African perspective. Includes numerous examples to illustrate how management accountants apply their expertise to the problems they are required to solve in the business environment as well as an extensive glossary. Aimed at undergraduate students.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Cost and management accounting by Van Rensburg M in PDF and/or ePUB format, as well as other popular books in Education & Higher Education. We have over one million books available in our catalogue for you to explore.

Information

1

Introduction to cost and management accounting

CHAPTER OUTLINE

- 1.1 Introduction

- 1.2 Relationship of Financial and Management Accounting to Cost Accounting

- 1.3 Recent developments in Management Accounting

- 1.4 Ethics

- 1.4.1 Chartered Institute of Management Accountants (CIMA) code of ethics for chartered management accountants

- 1.5 Points to note

- 1.6 Summary

- Questions

1.1 Introduction

Most students will be busy with or have completed an introductory financial accounting course prior to reading this text. Financial Accounting entails the recording of transactions to reflect the financial outcome or position as a result of a business’s activities. The annual financial statements, such as the Statement of Comprehensive Income, the Statement of Financial Position, etc., communicate the financial results of a business’s activities to various internal and, mainly, external stakeholders at a certain date. Stakeholders are individuals or groups that have an interest in the business. Examples of internal stakeholders are employees and management. External stakeholders include creditors, investors, society and the environment in which the business operates, and government with respect to taxes, economic statistics, etc.

The financial transactions of a business are recorded by financial clerks/accountants according to a set standard so that different companies’ results can be compared across the world. Most countries use International Financial Reporting Standards (IFRS), with the exception of a few by the end of 2015. The financial statements are thus prepared according to IFRS, and depending on specific regulations, companies must publish them at least annually.

The field of accounting entails more than just Financial Accounting. Other accounting-related designations include Cost and Management Accounting, Internal Auditing, Auditing, Tax and Financial Management. All these designations fulfil a different role in a business. This book describes the field of Cost and Management Accounting.

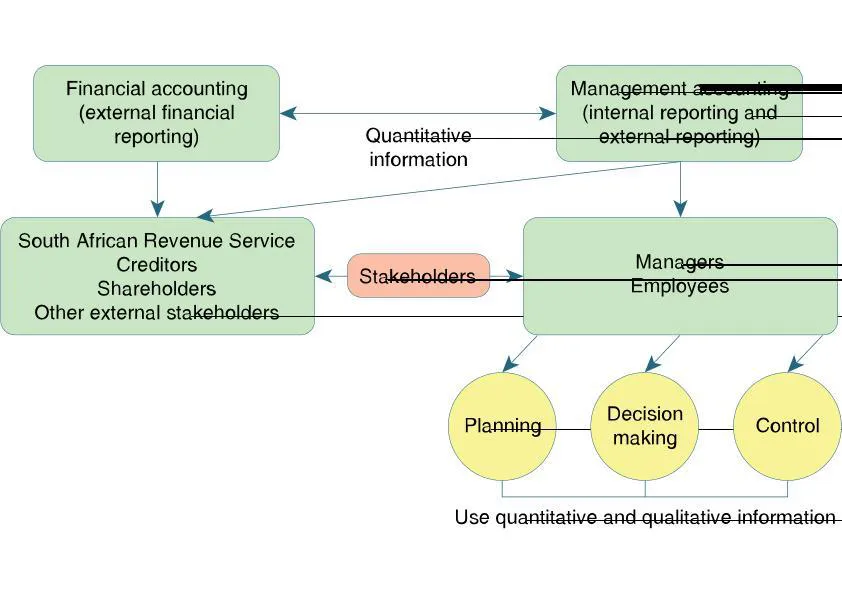

Historically, Cost and Management Accounting attempted to satisfy internal information needs for management functions and to provide product or service costing information (valuation of inventory) for preparing the financial statements. Since the advent of Integrated Reporting <IR>, the role of Management Accounting has changed in such a way that management accounting information is also necessary for external company reporting, for example Sustainability Reporting and <IR>. Management functions include decision making, planning, controlling and organising. To execute these functions, management needs quantitative and qualitative information. Quantitative information includes both financial (money) and non-financial (e.g. labour hours used; number of customer complaints) aspects. The difference between Cost Accounting and Management Accounting is that Cost Accounting is mainly concerned with determining product (or service) cost for the purpose of giving a value to inventory. There are several costing methods that can be used: job costing, process costing, standard costing, etc. Management Accounting assists in planning, controlling, performance measurement and decision making by using quantitative and qualitative information.

The primary differences and similarities between Financial Accounting and Management Accounting are shown in Figure 1.1. Recent developments in the field of Management Accounting will be discussed in paragraph 1.3.

Figure 1.1 Management Accounting compared with Financial Accounting

Financial accounting information is mainly used for the purpose of financial reporting to external stakeholders, although internal stakeholders have an interest in the financial statements. For example, management is concerned with profit made during a certain period. Management accounting information is necessary for both internal and external reporting, using both quantitative (financial and non-financial) and qualitative information. Internal as well as external stakeholders have an interest in management accounting information. Externally, management accounting information is used for reporting of financial and non-financial information in the annual financial statements, sustainability report, <IR>, etc. Management accounting information is very important for internal users, specifically in providing relevant information for planning, control, decision making and corporate governance aspects (King 3 Report published in 2009 and King 4 Report to be published during 2016 or 2017) where it is required either by law or by listing requirements.

Table 1.1 Users of management accounting versus financial accounting information

| Management Accounting | Financial Account... |

|---|

Table of contents

- Title Page

- Imprint Page

- Preface

- Contents

- Abbreviations and acronyms

- Chapter 1: Introduction to cost and management accounting

- Chapter 2: Cost concepts, classification and behaviour

- Chapter 3: Material and inventory control

- Chapter 4: Labour costs

- Chapter 5: Classification and analysis of overheads

- Chapter 6: Cost flows and manufacturing companies

- Chapter 7: Cost-volume-profit (CVP) analysis

- Chapter 8: Integrated accounting system and cost ledger accounting system

- Chapter 9: Basic job costing systems

- Chapter 10: Contract costing

- Chapter 11: Budgeting

- Chapter 12: Process costing

- Chapter 13: Joint and by-products

- Chapter 14: Direct and absorption costing

- Chapter 15: Pricing decisions

- Chapter 16: Standard costing

- Glossary

- Index