![]()

1

Possible Lives

A public debate is raging about the future of financial aid, with experts often trying to blame financial aid recipients rather than the system. Data on their academic performance have been used to question whether they belong in college in the first place. Data on their use of student loans have been used to question their financial literacy and how they live their lives. Data on their degree completion rates have been used to question whether the Pell Grant Program is a waste. Some even ask whether, since college credentials result in increased earnings, we should subsidize college participation for anyone. Let those who can afford it get ahead, while the others remain behind, they argue.1

Amid this national furor, students from lower-income families are simply trying to make a better life. In this chapter you’ll meet students in the Wisconsin Scholars Longitudinal Study, including the three men and three women who serve as focal points throughout much of the book. But first, let’s take a look at the original plans and designs of financial aid and what happened to them over time.

College Then and Now

In the 1960s, when federal financial aid policy was first formulated, the nation was in the midst of a period of economic growth and security, declining poverty, and great social change. Women, African Americans, immigrants, and working-class white people were all clamoring for a shot at middle-class jobs and the American dream, and politicians in Washington wanted to help. From President Lyndon Johnson on down, many policymakers believed that helping people improve their education and skills levels would in turn help the nation. Providing access to higher education was a clear and seemingly fair way to do that.2

Passage of the Higher Education Act of 1965 dramatically increased federal investment in higher education and provided grants and loans for students attending public and private colleges. In 1971, the U.S. Senate Subcommittee on Education debated a bill introduced by Senator Claiborne Pell that took things a step further, establishing as a policy of the federal government “the right of every youngster, regardless of his family’s financial circumstances, to obtain a postsecondary education.” His actions followed those of the Truman Commission, which in 1947 recognized that college costs impeded the nation’s ability to double the number of college goers (from 2.3 million in 1947 to 4.6 million by 1960).3 While that commission took steps to create more affordable institutions of higher education—most critically, the nation’s community colleges—Senator Pell and his colleagues believed that it was also important to indirectly subsidize the costs of college. The bill provided $1,200 annually for each student to use as a voucher to lower the amount of tuition they paid at the college or university of their choice.4 In 1972, the bill passed, and the Pell Grant was born.5

The creators of the current federal student aid system knew that college degrees brought real opportunities. The architects of the financial aid system did not, however, envision college as the only route out of poverty. During the same period, Congress invested in jobs programs, a safety net for those left behind, and Head Start for the children of poor families. The emphasis was on college as one option, one possible pathway, and the Pell Grant Program was organized to support that. The grant could be taken to any college or university in the nation participating in the federal student aid program, providing students with a wide range of options, and policymakers hoped that the higher education marketplace would respond by ensuring that opportunities were of the highest quality.6

The creation of the financial aid system followed more than a century of investment in public higher education, beginning with the Morrill Act of 1862 and continuing with the GI Bill (1944), the Truman Commission (1947), the National Defense Education Act (1958), and the California Master Plan (1960). By the time the Pell Grant was created in 1972, 80 percent of American college students were enrolled in public colleges and universities.7 Historian Roger Geiger described the scene this way: “American states poured enormous resources into building public systems of higher education: flagship universities were expanded and outfitted for an extensive research role; teachers colleges grew into regional universities; public urban universities multiplied and grew; and a vast array of community colleges was built.”8 Economists Claudia Goldin and Lawrence Katz have linked these major investments in public education to a growth in human capital that enabled the United States to thrive as a global economic powerhouse.9 These results would not have occurred if only the wealthiest or even only the highest-achieving students went to college.

Despite these overt commitments to higher education as a public good, not everyone shared Claiborne Pell’s vision for how to bring more equality of opportunity into the American system. In fact, the “system” of higher education has never been much of a system at all. It is instead a loose conglomeration of government institutions (at the local, state, and federal levels) and both public and private educational providers that share some similar interests but hold many different ones as well.

Soaring rhetoric about the value of hard work obscures the fact that family money has long been one of the best predictors of college success. In the words of the Truman Commission: “For the great majority of our boys and girls, the kind and amount of education they may hope to attain depends, not on their own abilities, but on the family or community into which they happened to be born or, worse still, on the color of their skin or the religion of their parents.”10

The children of wealthy families are still most likely to complete college, followed by students from middle-income families. Students from low-income families are the least likely to graduate.11 Should breaking the link between family income and degree attainment be a public priority supported by taxpayer dollars? In the late 1960s and 1970s, states including California, Florida, Michigan, and North Carolina said yes and invested resources in their public colleges and universities in order to keep the prices charged to students low, while also creating state need-based aid programs to complement the federal Pell.12 State fiscal support for higher education nearly tripled from $3.56 per $1,000 of state personal income in 1961, to $10.42 in 1979.13

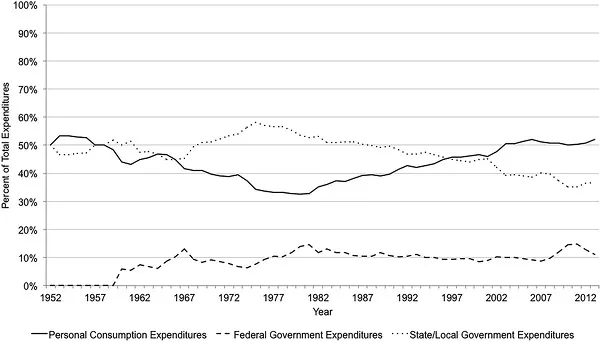

Other states disagreed. Massachusetts, New Hampshire, New Jersey, Pennsylvania, and Vermont, among other states, appropriated little money to public colleges and universities and instead relied on private institutions to offer opportunities.14 Rarely do state expenditures per student come anywhere close to matching the federal investment in the Pell Grant.15 Even the states that initially spent heavily on public colleges and universities reduced their support as more and more people went to college. Beginning in 1981, state appropriations began to decline, from $10.18 per $1,000 of state personal income in that year to $9.24 in 1990 to $7.52 in 2000 to $6.32 in 2010. Today, the share of state resources invested in higher education is about the same as it was in 1966 (about five dollars for every $1,000 of personal income).16

Wisconsin, the focus of this book, is among the states that reduced support to higher education the most.17 Perhaps this was a reaction to signals that college was now sufficiently accessible—after all, demand was rising—or perhaps competing needs (such as Medicare costs) simply required the funds.18 Or, as many have argued, disinvestment in higher education may be the direct result of shifts in political priorities.19 Whatever the case, no federal authority requires that states make college affordable, and tuition and other costs grew rapidly, even at public colleges and universities.20 Had states been required to maintain a reasonable level of commitment (say, the ten dollars or so per $1,000 of personal income provided in 1981), the total amount states contribute to higher education today would be about $146 billion, instead of the $81 billion contributed in 2015.21 That commitment would have likely prevented the rapid increases in tuition and fees in public higher education (see fig. 1) that fueled the declining purchasing power of the Pell and the need for so many middle-class families to turn to student loans. As figure 4 illustrates, the federal commitment to higher education has long been smaller but steadier. What has changed is state behavior—and this is what drove changes in the prices paid by individual Americans directly from their wallets (as opposed to collectively, through their taxes).

But the federal financial aid system is virtually silent on the role of colleges and universities in keeping the price of higher education reasonable. It also does little to ensure that the education delivered is high quality, and it says nothing about which colleges should admit which students. It does not mandate that institutions create their own need-based aid programs or direct resources to support economically vulnerable students. There are no requirements that the Pell Grant vouch for a meaningful amount of the cost of attending that college. A college that charges $60,000 a year can receive $5,000 Pell vouchers just as easily as a college that charges $6,000. The revenues available from the Pell, along with the array of other federal programs under Title IV of the Higher Education Act including student loans, flow into the coffers of colleges and universities without extracting any accountability for keeping costs affordable.22 For-profit colleges and universities benefit substantially, pocketing billons in federal student aid each year while producing degrees that employers value far less than community college degrees, often equating them with high school diplomas.23 The rapid growth of federal spending in that sector is one reason why the entire Pell program is being reexamined today.24 But some nonprofit private colleges and universities, and a few public flagships, benefit as well, making extensive use of Pell Grants even as they construct mammoth endowments worth billions of dollars and hoard opportunities for the wealthiest students.25

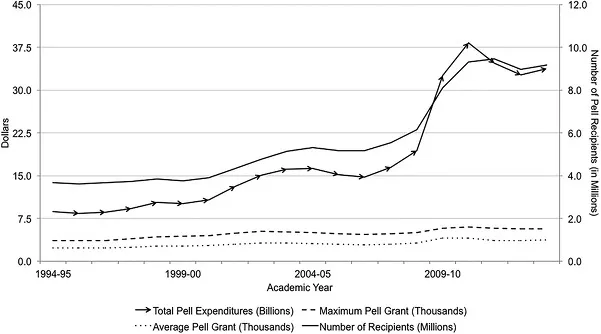

Over the past fifty years, America built a financial aid system with lofty ambitions and few teeth. That was fine, perhaps, at a time when a college degree was nice but not required. When the Pell program began, Pell Grants subsidized more than 80 percent of the cost of attending the average public university and all of the costs of attending a community college. Things are different now. Today the maximum Pell covers less than one-third of the cost of attending a public four-year college or university and barely 60 percent of the cost of attending a community college. Figures 5 and 6 illustrate the problem. Spending on the Pell program has lagged behind growth in the number of recipients for decades. These trends, along with rising college costs, have resulted in the significant erosion of the Pell purchasing power.