Asian Foreign Direct Investment in Europe

- 168 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Asian Foreign Direct Investment in Europe

About this book

This book analyses the most recent trends in Foreign Direct Investment from the major Asian economies to the EU, focusing on China and Japan's FDIs in the EU, and Poland in particular. The authors assert that, from a European perspective, there is a strong need for further Asian FDIs into EU nations, which will establish mutual benefits.

This is the first book to explore the outflow of FDI from Asian nations to other countries, especially to EU member states, whereas the extant literature focuses on the inflow of FDI to Asian nations. The authors analyse a multidimensional range of issues, covering macroeconomics, finance, technology, and examine the governments, local authorities, and institutions that support such investments. FDI has an instrumental role in the development of host countries. Large-scale capital flow becomes a vehicle for providing foreign technology, knowledge, skills, and other inputs for the integration with international marketing, production, and distribution networks and for improving the economic competitiveness of firms and economic performance of the host country.

The analysis in the book is presented using statistical and econometrical approaches, emphasising a profound level of investigation, which will be particularly useful for graduate and PhD students of International Economics, Business and Trade.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

1

Research literature analysis on FDI and FDI flow between Asia and the EU member states

1.1 Introduction

1.2 Composition of the research literature

| Theoretical constructs emerging through literature | Literature |

|---|---|

| | |

| Eclectic paradigm or OLI (ownership, location, and internalisation) model of FDI | Dunning (1970), Hymer (1972), Dunning (1979), Dunning (1988), Denisia (2010), Mateev(2014) |

| Internationalisation approach of FDI Internalisation occurs when firms perceive the benefits of external investment being greater than that of the cost involved. The process involves knowledge and technology flows by linking them to improved production efficiency from an upstream production facility to a downstream facility or vice versa | Hymer (1972), Findlay (1978), Mansfield and Romero (1980), Hennart (1982), Borensztein et al. (1995), Kokko (1994), Kokko et al. (1996), Dent (1999), Rodrik (1999), Shatz and Venables (2000), Smarzynska, (2002), Alfaro (2003), Ramachandran(2004), Tolentino (2008), Denisia (2010), Subramanian et al. (2010), Herzer (2011), Ahmed (2014), Dhar and Wani (2017), Hertenstein et al. (2017) |

| Institutional approach of FDI The approach links the institutional variable like economic, financial political, and judicial institutional set up, with the FDI flows | Kobrin (1976), Hennart (1982), Moran (1998), Lim Ewe-Ghee (2001), Gorgulu (2015), Baier andWelfens (2019), Abotsi(2018) |

| Resource-based approach or spring board approach of FDI The approach suggests that FDI decision of a firm is guided by its international and management experience and competencies, resource capabilities, and environmental necessities | Luo and Tung (2018), Tolentino (2008), Pradhan(2008),Ali etal. (2018), Luo and Tung (2018) |

| Linkage, leverage, learning approach of FDI This approach looks at firm-specific advantages of emerging market multinationals and suggests that the international expansion of emerging market multinationals is driven by resource linkage, leverage, and learning | Mathews (2006), Andres et al. (2013), Morris and Jain (2013) |

| CAGE distance approach of FDI The approach identifies that the cultural, administrative, geographic and economic differences, or distances between countries can be used to understand patterns of trade, capital, information, and people flows | Ghemawat (2001), Dent (2001), Bitzenis (2004), Wei and Andreosso-o'callaghan (2008), Witkowska (2009), Morris and Jain (2013), Witkowska (2013), Roman and Vasile (2018) |

| Strategic asset-seeking orientation It emerges that the intent of seeking strategic assets is a determining factor in explaining the FDI made in developed markets by the emerging market MNEs | Pradhan (2008), Yang et al. (2014), Meyer and Peng (2016), Hertenstein et al. (2017), Ramon et al. (2017), Haasis et al. (2018) |

| Economic growth and income inequality and FDI | Alter (1994), Blomstiom et al. (1994), Lipsey (2002), Gorg and Greenaway (2002), Tytell and Yudaeva (2005), Herzer and Schrooten (2007), Kowalewski and Weresa (2008), Wang (2009), Balgar and Dragoi (2014), Kurecic (2015), Alili (2015), AH (2017), Dhar and Wani (2017), Okara (2018), Escobar and Muhlen (2018), Sultanuzzaman et al. (2018), Jurcic et al. (2020), Sayed Hasant Shah et al. (2020) |

| Exchange rate movement and FDI Taxes, subsidies and FDI Export and import and bilateral treaties and FDI | Aliber(1970), Cushman(1985) Baltzer and Hansen (2011)Camarero and Tamarit (2003), Andreosso-O'Callaghan and Nicolas (2007), Bankole and Adewuyi (2013) |

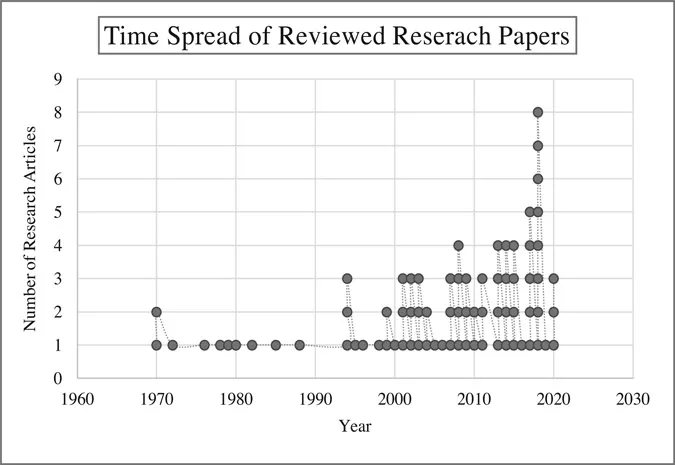

1.3 Literature trend on the determinants of FDI

Table of contents

- Cover

- Half Title

- Series Page

- Title Page

- Copyright Page

- Contents

- List of figures

- List of tables

- List of contributors

- Preface

- 1 Research literature analysis on FDI and FDI flow between Asia and the EU member states

- 2 The global financial crisis and FDI in Europe

- 3 The effect of capital flows on Asian/Euro exchange market pressure

- 4 FDI outflow from China to Poland – two decades of Chinese FDI in Poland

- 5 Japanese FDI in Poland

- 6 Japanese FDI in Spain: why do Japanese firms locate in Catalonia?

- 7 FDI outflow from China to EU countries – exploring alternative futures for Chinese investments in European digital platforms

- 8 FDI outflow from China to Germany

- 9 Role of government authorities in facilitating Asian FDI outflow to EU member states

- Acknowledgements and conclusions

- Index