- 54 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

This final volume of the Asia Small and Medium-Sized Enterprise Monitor 2020 sets out ADB's work so far on a new composite index called the Small and Medium-Sized Enterprise Development Index (SME-DI) to help guide support for the development of micro, small, and medium-sized enterprises (MSMEs). The SME-DI aims to measure MSME development and access to finance using multivariate analysis of national MSME data. The volume includes the results of testing a pilot index using data from Southeast Asia.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV by in PDF and/or ePUB format, as well as other popular books in Business & Small Business. We have over one million books available in our catalogue for you to explore.

Information

Estimation Results

By using the two datasets, we conduct the test-run of the two-stage PCA to measure selected dimensions for the regional and country (Cambodia) SME-DI. The main objective of this exercise is to test the feasibility of SME-DI and extract issues to improve and develop the index.

1. Regional SME Development Index Exercise Based on Aggregate MSME Data

First-Stage Principal Component Analysis

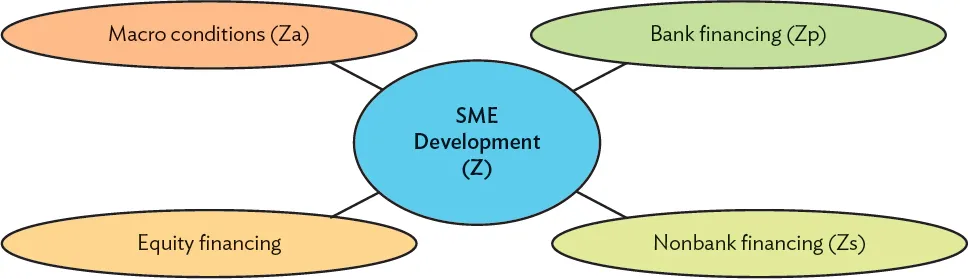

This exercise based on aggregate MSME data with time series focuses on three dimensions of the Nonfinance Sub-Index (scale of MSMEs, employment, and productivity) and one dimension of the Finance Sub-Index (financial depth) under the SME-DI. Due to limited data availability, we restructured and simplified factors affecting MSME development into four dimensions: (i) macro conditions, (ii) bank financing, (iii) nonbank financing, and (iv) equity financing (Figure 1).

For the first stage, we organize the 12 variables into four likely factors. Indicators on “inflation” and “lending rate” are extracted from International Monetary Fund/International Financial Statistics (IMF/IFS) end-of-year time series data. Other indicators are explained in the abovementioned “data selection.”

• Macro conditions (Macro): Number of MSMEs to total number of firms (“num”), MSME employees to total employees (“emp”), MSME contribution to GDP (“gdp”, and the annual inflation rate (“inf”).

• Bank financing (Bank): MSME bank loans to total (“bkc”), MSME bank loans to GDP (“bkc_gdp”), MSME nonperforming loans to total MSME bank loans (“bkc_npl”, and commercial bank lending rate (“len_r”).

• Nonbank financing (Nonbank): NBFI financing to total bank loans (“nbkc”), NBFI financing to GDP (“nbkc_gdp”), and NBFI nonperforming loans to total NBFI financing (“nbkc_npl”).

• Equity financing (Equity): Market capitalization to GDP (“m_cap”).

In equation form, we have the following (Huh and Park, 2017):

where Z(a)i is the i th principal component on macro conditions (Macro), Xa1 the number of MSMEs to total number of firms (“num”), Xa2 denotes MSME employees to total employees (“emp”), Xa3 denotes MSME contribution to GDP (“gdp”), and Xa4 is inflation (“inf”).

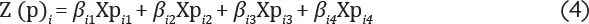

where Z(p)i is the i th principal component on bank financing (Bank), Xp1 denotes MSME bank loans to total (“bkc”), Xp2 denotes MSME bank loans to GDP (“bkc_gdp”), Xp3 denotes MSME nonperforming loans to total MSME bank loans (“bkc_npl”), and Xp4 is the commercial bank lending rate (“len_r”).

where Z(s)i is the i th principal component on nonbank financing (Nonbank), Xs1 denotes NBFI financing to total bank loans (“nbkc”), Xs2 denotes NBFI financing to GDP (“nbkc_gdp”), and Xs3 denotes NBFI nonperforming loans to total NBFI financing (“nbkc_npl”).

Table 6 shows eigenvalues of each component under each indicator (dimension)—Macro (D1), Bank (D2), and Nonbank (D3). Based on the results, we use the first two components for each dimension. Each eigenvalue is 0.95 or higher, with the exception of “emp” in D1 which has an eigenvalue of only 0.70. Because it adds another 0.17 to the cumulative, raising it from 0.69 to 0.86, we opted to include it in the analysis.

Table 6: Results of Principal Component Analysis, Regional SME-DI (First Stage)

obs = observation, SME-DI = Small and Medium-Sized Enterprise Development Index.

Source: Calculation based on ADB Asia SME Monitor 2020 database.

From this, by dimension, we calculated squared loadings of each variable in the selected principal components (Z1, Z2,…, Zi) (Table 7).

Table 7: Squared Loadings, Regional SME-DI (First Stage)

Dimension | Z1 | Z2 |

D1: Macro (74 obs.) | ||

PC1: num | 0.7044 | 0.0008 |

PC2: emp | 0.7567 | 0.1100 |

PC3: gdp | 0.8495 | 0.0555 |

PC4: inf | 0.4381 | 0.5294 |

D2: Bank (88 obs.) | ||

PC1: bkc | 0.9206 | 0.0003 |

PC2: bkc_gdp | 0.6524 | 0.0839 |

PC3: bkc_npl | 0.0514 | 0.7467 |

PC4: len_r | 0.2983 | 0.5761 |

D3: Nonbank (60 obs.) | ||

PC1: nbkc | 0.8709 | 0.0264 |

PC2: nbkc_gdp | 0.8727 | 0.0244 |

PC3: nbkc_npl | 0.0980 | 0.9019 |

obs = observation, SME-DI = Small and Medium-Sized Enterprise Development Index.

Source: Calculation based on ADB Asia SME Monitor 2020 database.

The sum of squared loadings in each Zi is λ (λ1, λ2,… λi). We calculated Θ as the proportion of respective λ (λ1, λ2,… λi) to the total λ (λ1 + λ2 + …+ λi). Then, “squared loadings to the unity sum (η)” (Huh and Park, 2017) were calculated as the proportion of the squared loading to the λ in each component (Zi). In the next step, we calculated weights of respective variables of the dimension as the sum of “η by Θ” of each component (Zi). Table 8 shows the weights (scores) of each dimension obtained through the first-stage PCA.

Table 8: Weights for Index, Regional SME-DI (First Stage)

Dimension | Weight |

Macro | |

PC1: num-MSMEs to total (%) | 0.2047 |

PC2: emp-MSME employees to total (%) | 0.2516 |

PC3: gdp-MSME contribution to GDP (%) | 0.2627 |

PC4: inf-Annual inflation rate (%) | 0.2809 |

Bank | |

PC1: bkc-MSME bank loans to total (%) | 0.2766 |

PC2: bkc_gdp-MSME bank loans to GDP (%) | 0.2211 |

PC3: bkc_npl-MSME nonperforming loans to total MSME bank loans | 0.2397 |

PC4: len_r-Annual commercial bank lending rate (%) | 0.2626 |

Nonbank | |

PC1: nbkc-NBFI financing to bank loans (%) | 0.3211 |

PC2: nbkc_gdp-NBFI financing to GDP (%) | 0.3210 |

PC3: nbkc_npl-NBFI nonperforming loans to total NBFI financing | 0.357... |

Table of contents

- Front Cover

- Title Page

- Copyright

- Contents

- Tables, Figures, and Boxes

- Foreword

- Acknowledgments

- Abbreviations

- Executive Summary

- Introduction

- MSME Landscape in Southeast Asia

- Exploration of Index

- Methodology

- Estimation Results

- Conclusion

- References

- Annex: Profile of Cambodian Enterprises

- Footnotes

- Back Cover