![]()

SECTION 1

FINANCIAL REPORTING AND THE ACCOUNTANCY PROFESSION

![]()

CHAPTER 1

CONTRASTING INSTITUTIONAL LOGICS: HISTORICAL DEVELOPMENT OF THE PUBLIC ACCOUNTANCY PROFESSIONS IN THE UNITED KINGDOM AND FRANCE

ABSTRACT

The development of the public accountancy profession in the last 200 years has increased the demand for the labor of professional accountants and enhanced the role and status of the professional public account. This increase in both the demand for the labor of professional accountants and for the professional services, which professional accountants provide, has resulted from the growth of capitalist enterprises, as well as institutional work on the part of members of the organized public accountancy profession. The objective of this chapter is to trace the historical development of the public accountancy professions in the United Kingdom and in France in response to contrasting institutional logics in these two countries. While legal requirements for external audits of company financial statements provided the basis for the development of the public accountancy profession as early as the end of the eighteenth century, differences in institutional logics, including differing conceptions of the relationship between individuals and the state, led to differences in the development of the public accountancy professions in the two countries. The primary argument of this chapter is that contrasting institutional logics have influenced the history of the public accountancy profession, which has evolved into one of the key regulatory structures of modern capitalism.

INTRODUCTION

An “institutional logic” is a core concept in sociological theory. An institutional logic involves the study of how broad belief systems shape the cognition and behavior of organizational actors (Friedland & Alford, 1991). Powell and DiMaggio (1991) defined an institution as

[…] a supraorganisational pattern of activity by which individuals and organizations produce and reproduce their material subsistence and organize time and space. Institutions are also symbolic systems, ways of ordering reality, thereby rendering experience of time and space meaningful.

Thornton and Ocasio (1999, p. 804) define an institutional logic as

[…] the socially constructed, historical patterns of material practices, assumptions, values, beliefs, and rules by which individuals produce and reproduce their material subsistence, organize time and space, and provide meaning to their social reality.

The unifying theme of this chapter is that contrasting institutional logics, based upon differing conceptions of the relationship between the individual and the state, has shaped the development of the public accountancy profession from the late eighteenth century onward. One important difference among institutional logics is the conception of the individual’s role in relation to the state. Individualism has been more highly regarded in the United Kingdom than in certain other countries. Consequently, the role of the state in the regulation of the public accountancy profession in the United Kingdom was relatively marginal until well into the twentieth century. The requirement for external audits of company financial statements was initially included in the United Kingdom Companies Acts in the mid-nineteenth century as a response to railroad company frauds, but these requirements were later removed. Thereafter, and up until the mid-twentieth century, the British state had very little involvement in the institutional logics which pertained to the regulation of public accountancy, leaving such matters to professional institutes of practicing accountants (Anderson, Edwards, & Chandler, 2005). This laissez-faire institutional logic, not surprisingly, led to the proliferation of professional bodies of professional accountants in competition with each other (Edwards, Anderson, & Matthews, 1997).

British individualistic traditions were not similarly embraced in France or other parts of Continental Europe during either the Ancien Régime or republican periods. In this chapter, France serves as a proxy for continental (i.e., Roman law) countries, in contrast to more common-law approaches such as those of Great Britain and its Commonwealth. The Roman civil law tradition led to an institutional logic in which the relationship between the individual and the state was more precisely defined. In France, the regulation of commercial accounting practices commenced as early as the seventeenth century under Louis XIV (Lodge, 1931).

Beginning in the mid-nineteenth century, the gradual removal of restrictions against the formation of limited liability companies, and other positive acts on the part of the state (Braudel, 1992, p. 24) in both Britain and France, provided linkages between political rationalities, which favored economic liberalism, and legal technologies, which facilitated capital formation (Miller, 1990, p. 315). The emergence of public accountancy as an important regulatory structure of capitalism can therefore be traced, at least in part, to the increased use of limited liability companies as a principal form of the capitalist enterprise (Micklethwait & Wooldridge, 2003, p. 50).

In this chapter, we argue that historical factors, which led to differences in financial reporting systems (e.g., Nobes, 1983, 1992; Persson & Napier, 2018), also led to different institutional logics related to the role and status of the public accountancy profession in different countries. Individual shareholders have been the traditional providers of capital in the United Kingdom. Even prior to any involvement by the British state in the regulation of public accountancy, shareholders in Britain demanded the issuance of audited financial statements (Edwards et al., 1997, p. 2); as a result, the public accountancy profession in the United Kingdom developed through individual professional partnerships and recognized professional bodies.

The experience in France was more mixed, with historical periods during which the French state encouraged capitalist development and periods in which the state nationalized major enterprises. Consequently, the regulation of the public accountancy profession in France developed primarily through legislation and government decrees, resulting in institutional logics in which public accountants functioned, at least in part, as agents of the French state in the regulation of capitalist activity.

The remainder of this chapter is organized as follows. Section 1 reviews the prior literature in the sociology of professions literature and the literature in comparative financial accounting systems with respect to the institutional logics that pertain to the development and regulation of the public accountancy profession. Sections 2 and 3 describe the development of the public accountancy profession in the United Kingdom and France, respectively. A discussion and summary conclude the chapter in the Section 4.

REVIEW OF PRIOR LITERATURE

The sociology of professions literature has defined the characteristics, nature, and functions of professional activity (e.g., Abbott, 1983, 1988; Carr-Saunders & Wilson, 1933; Etzioni, 1969; Larson, 1977; Vollmer & Mills, 1966). One of the arguments of this literature is that the role and status of professions differ among countries, and that, in particular, there are institutional logics in code law countries (such as France), which specify the role of the state in the regulation of professional activity. The institutional logic regarding a higher expectation in code law countries pertaining to the regulation of professional activity derives from the fact that the state has often been instrumental in creating professions in such countries. Pursuant to the sociology of professions literature, we expect to find differences between the United Kingdom and France with respect to the public accountancy profession, with the state having played a greater role in the regulation of the public accountancy profession in France.

Another strand of the sociology of professions literature has investigated distinctions between institutional logics pertaining to occupations and professions. Abbott (1988) has argued that the process of professionalization involves competition among occupational groups for the right to become recognized by the state as a profession and that professional recognition is typically achieved when the state grants recognition as a profession. Abbott (1988) indicates that no profession can remain completely free from external influences, particularly in the form of regulation by the state (p. 141). Following Abbott’s theory of the system of professions, it can be argued that it is the legal designation of a monopoly in the practice of public accountancy that has led to the establishment of the accountancy profession. However, this argument may not be supported in the case of the United Kingdom, in that the legal requirement for statutory audits did not come into existence until the mid-twentieth century, while the accountancy profession existed in the United Kingdom from at least the late eighteenth century.

In contrast to Abbott, Larson (1977) envisioned professionalization as a process through which an occupational group achieves professional status by obtaining cognitive expertise in an area of practice. Larson’s theory of professionalization concerns the ability of an occupational group to obtain a state-granted monopoly based on the recognition of its competence with respect to a body of knowledge that the profession controls through education and training programs (Edwards, Anderson, & Chandler, 2007). Larson’s notion of a monopoly of competence is relevant to the development of the public accountancy profession in the United Kingdom.

A third question that arises in a historical analysis of the development of the public accountancy profession relates to the origins of the profession, which in turn relates back to the distinction between an occupation and a profession. Prior to the nineteenth century, public accountancy was not considered to be a profession. In effect, various groups of accountancy practitioners sought to achieve recognition as a profession in the emerging industrial economies of the early nineteenth century (Edwards et al., 2007). In the United Kingdom, the public accountancy profession developed through private sector accountancy bodies, which were created before the legal requirement to have company audits (Lee & Parker, 1979). Whereas these accountancy bodies were able to achieve recognition from the British Crown through royal charters, they were not formally regulated by the British state.

In France, the regulation of the public accountancy profession emerged originally through the appointment by royal edict of inspecteurs and censeurs as early as the seventeenth century. After the French Revolution, there was a period of liberalism during the nineteenth century, during which the French State had little involvement with the regulation of the public accountancy profession (Lemarchand, 1995). This period of liberalization persisted for most of the nineteenth century, but it was eventually replaced by increasing intervention by the French state in the regulation of capitalist activity (Dattin, 2017).

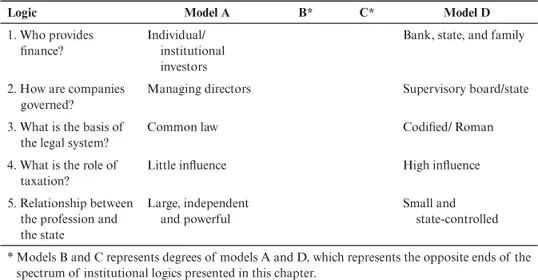

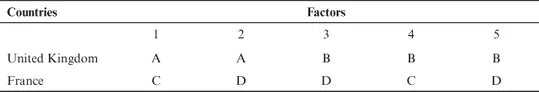

A fourth question that arises when discussing contrasting institutional logics in the historical development of the public accountancy profession concerns differences in financial accounting systems among countries. These differences are important because the primary subject matter of public accountancy pertains to the examination of company financial statements in relation to financial accounting norms and standards. A significant amount of prior literature has compared differences in financial accounting systems among countries (e.g., Bloom & Naciri, 1989; Nobes & Parker, 1995b). Nobes and Parker (1995b) maintain that two types of financial reporting systems have developed through time, the “micro/professional” system (Model A) and the “macro/uniform system” (Model D) (see Fig. 1). Nobes and Parker have used their classification scheme to categorize the financial reporting systems of the United Kingdom and France, among other countries (see Fig. 2).

Fig. 1. Institutional Logics in the Regulatory Environment.

Fig. 2. Classification of Countries Based on Institutional Logics.

Pursuant to the Nobes and Parker model, the United Kingdom stands at one end of the spectrum, with the classification of France in a more intermediate position. The differences between the financial accounting systems of countries can be traced to differences in institutional logics, including differences in legal systems; traditional sources of capital; roles played by banks; regulatory practices; corporate governance practices; and the impact on financial reporting of legislation regarding income taxation and dividend payments (e.g., Gray, 1988; Nobes, 1983; Perera, 1989). In summary, differences in the underlying historical factors, which have led to differences in institutional logics as these relate to the development of financial accounting systems, have also led to differences in the regulation of the public accountancy profession. In the United Kingdom, the regulation of the public accountancy profession has been conducted primarily through private sector professional bodies. In contrast, the regulation of the public accountancy profession in France has been conducted through law and regulation.

UNITED KINGDOM

There have been many historians who have examined the development of the public accountancy profession in the United Kingdom, including such authors as Kedslie (1990), Cornwell (1991, 1993), Walker (2004), Boys (1994, 2011), Maltby (1999), Edwards (2001, 2010), and Lee (2011), among others. Most of these authors have focused broadly on the development of the accountancy profession in the United Kingdom and not on the auditing profession as a distinct element of the accountancy profession. This is because, unlike France, there is no distinction in the United Kingdom between the accountancy and auditing professions. The remainder of this section reviews some of the findings of the prior literature.

Historical Background of Professional Accountancy in the United Kingdom

Micklethwait and Wooldridge (2003, p. 20) indicate that the practice of public accountancy in Great Britain may be traceable to the rise of the joint-stock company during the reign of Elizabeth I. Dobija (2018) points to the separation of ownership and control in the East India Company as providing an impetus for the rise of auditing practices. However, audits of joint-stock companies during the sixteenth through eighteenth centuries were what may be referred to as “amateur” audits...