![]() PART I

PART I![]()

1. Introduction

1 Introduction

We will answer the following questions in this chapter:

1.1 Why do we need venture capital?

1.2 How did venture capital evolve as an asset class? What are the key definitions associated with venture capital? What is the difference between a Private Equity Firm and a Venture Capital Firm?

1.3 What is a startup Ecosystem? How has the Start-up Ecosystem developed in India in recent years? What factors have influenced its development?

- Which are the key sectors and geographies that have contributed to the start-up story in India?

- How have unicorns evolved in India?

1.4 How has the venture capital industry in India developed in recent years? What factors have influenced its development?

- What are the investment patterns of venture capital investment, in terms of Stage, Sector and Geography of investments in India?

- What are the exit trends in venture capital in India?

1.1 Why Do We Need Venture Capital?

One of the fundamental questions that get asked is whether entrepreneurial ventures need a sophisticated set of investors such as venture capital funds. To answer this question, one must understand that entrepreneurial firms seek capital from different internal and external sources, including founder’s equity, retained earnings, banks, suppliers, customers, private individuals, shareholders, and venture capitalists, among other sources. Evidence also suggests that most of the financing needs of entrepreneurial companies are addressed by traditional sources of financing, such as internal finance and bank finance (Vanacker and Manigrat, 2013)1. So why then do venture capital firms exist as separate financial intermediaries?

Let us look at some anecdotal evidence from history to begin with. Legend has it that Walt Disney was turned down more than 300 times before finally getting financing from one of the bankers for his concept of the now iconic ‘Mickey Mouse’. Walter Isaacson, in his book, Steve Jobs: The Exclusive Biography, mentions that Jobs was turned down for a loan by a bank and a computer parts store declined equity stake in his new venture. Jobs finally got the computer parts on a 30-day credit period from another supplier. Today, the situation of both companies is in stark contrast to their early days. For the fiscal year ending 2019, Disney reported revenues of approximately $70 billion, while Apple is currently valued at more than $1 trillion. In hindsight, the bankers who refused them would have regretted their decision. But that may not be the case, actually.

Typically, entrepreneurial ventures at such an early stage have little or no financial track record and are characterized by high information asymmetry and high uncertainty. In the absence of cash flows, balance sheets, or any hard collateral, raising capital from traditional sources becomes extremely tough for these ventures. In their research, Raphael et al., highlight that the raison d’etre of venture capitalists is their superior ability to reduce the cost of this information asymmetry, compared to banks or public equity investors2. Their investment strategy allows them to cope with high uncertainty embedded in high-risk entrepreneurial firms. For instance, banks provide debt finance that involves fixed claims restricted to interest and principal payments. Venture capital investors typically provide equity (or equity-linked instruments) that entails a claim on the company’s residual wealth creation. Consequently, they have a more powerful incentive to monitor their portfolio, minimize overall risks through effective contracting, and create large value to earn high returns3 which are commensurate with the risks taken. Raphael et al., also indicate that venture capital funds have disproportionate representation in industries that have had high levels of informational asymmetry over the years, for instance, technology, biotechnology, software, and other such disruptive industries.

Indeed, this market has globally been a major source of funding and support for many success stories. As of 2019, five out of the top seven global companies by market capitalization have been venture capital funded.

Table 1.1: Success stories in the US4

These large outcomes have ensured that venture capitalists tend to dominate the headlines on startup funding. But the fact remains that the percentage of small businesses raising venture capital is still a small fraction of the overall number. A study done in the US suggests that only 0.91% of startups are funded by angel investors, while an even smaller percentage are funded by venture capital funds5. So, what is the importance of venture capital? Is its impact more than financing a small niche of companies? The evidence overwhelmingly indicates so!

Several companies backed by venture capitalists have become technology behemoths, contributing to research, development, employment generation, innovation, and economic growth. In the United States, public companies with venture capital backing employ four million people and account for one-fifth of the total market capitalization and 44% of the research and development spending of all public companies (Gornall and Strebulaev, 2015). Kaplan and Lerner (2009) also found in their research that roughly 50% of the ‘entrepreneurial’ IPOs in recent years in the US were venture-backed despite the fact that only 0.2%of all firms receive venture funding.

Venture capital firms have had significant impact on the global economy through their investments. While the direct investments may be minuscule compared to the GDP of any country, the end impact through the success of their investments is extremely significant. As an example, in the US, while venture investments form around 0.2% of the GDP, they deliver around 21% to the GDP through fructification of their investments6. Further, these investments revolutionize the way things work. Examples being Google (of Alphabet) which revolutionized search engines and went on to build an entire ecosystem around the Internet or Facebook which revolutionized social media.

Venture capital has helped entrepreneurs convert their innovative ideas and research into products or services across the globe. Let us now look at how venture capital has evolved as an asset class and some key definitions associated with it.

1.2 The Evolution of Venture Capital as an Asset Class and Definitions

1.2.1 The evolution of Venture Capital as an asset class

The venture capital industry is an important player in the modern-day financial system. It not only acts as a vehicle for fund deployment into early stage companies (companies which are in nascent stages of operation, or have just started operations, or completed the proof of concept of the business idea), it enables them to grow, generate employment, and add to the success story of any nation. This industry comes under the larger category of private equity investment. A private equity firm is a firm which provides equity capital to a private company over a medium-to long-term period to fuel its growth ambitions7. This industry has its origins in the United States where the American Research and Development Corporation (ARDC) was founded in 1946 in Boston to fund young enterprises8. The industry has since then grown manifold and become an extremely sophisticated participant in the financial systems.

Venture capital falls under the class of equity investments where firms provide money in exchange for a stake in the company and earn returns on the basis of its performance. It is a high-risk investment that does not offer a fixed return. Other equity investment sources for unlisted companies are generally the promoters, their friends and family, angel investors, large corporates, and large institutional investors like insurance companies, pension funds, and endowments, who allocate capital to a wide variety of alternate capital asset classes, including venture capital.

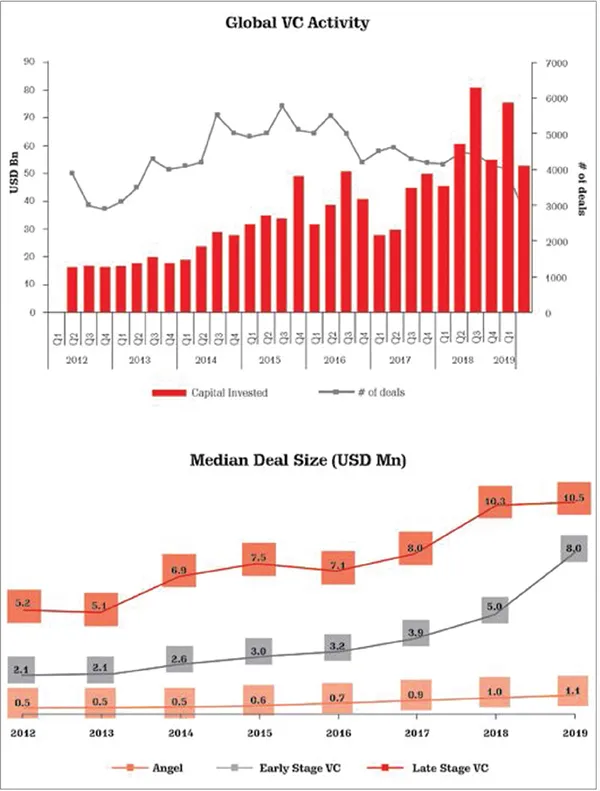

Venture capital typically involves investments in high-growth companies and are traditionally technology-centric or disruptive. They invest their money across a portfolio of companies, all of which are in early stages with high-growth potential. The returns from such investments typically follow the Pareto principle, where 80% of the returns come from 20% of the total investments a fund makes. These investments in investee companies happen across multiple stages on the basis of their capital requirements. The investments are made till a certain business volume is achieved and/or the company achieves certain milestones and starts demanding attractive valuations from the market. These funds sell their stake at this point to earn returns on their investment. Figure 1.1 and figure 1.2 provide highlights of the global venture capital industry.

Figure 1.1: Highlights of the global VC industry9

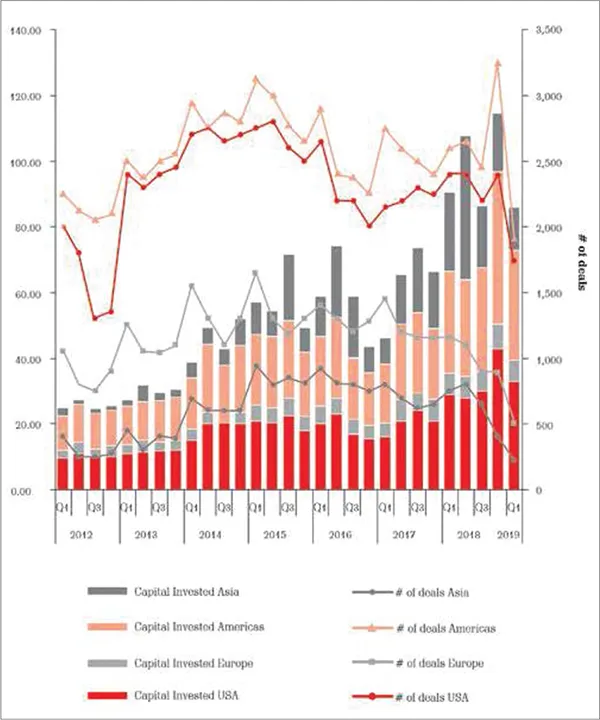

Figure 1.2: VC in key markets—amounts in USD Bn10

The global venture capital industry has been on an upward trend with both deal size and valuations increasing across all rounds of funding. However, this remains a debatable issue as large amounts of capital, which are chasing fewer deals, come at the expense of more companies being funded. Nonetheless, there is significant interest in technology and technology-oriented innovative solutions globally, while new areas such as Artificial Intelligence (AI), Machine Learning (ML), etc., have been gaining significant traction.

Investments through this route have a gestation period of more than seven years. During this period, companies use the parked money for their operations and the money remains locked until the time an exit is made. Given that the nature of this investment is illiquid (funds parked in an investment for long periods) and risky (in startups), the expected return on investment is also high.

Data shows that for the top quartile of absolute returns, venture capital returns in the long run have exceeded those of other asset classes, as shown in table 1.2.

Table 1.2: Top-quartile returns by asset class11

An example of a more recent success story is Sequoia’s cumulative $60M investment in WhatsApp. In 2011, Sequoia invested $8M in WhatsApp’s Series A (early-stage investment) round as a sole investor, without soliciting support from other potential early-stage investors. WhatsApp chose to cultivate its relationship with Sequoia as well, with the latter being the sole investor in their subsequent Series B (round of fund-raised post Series A—mostly classified as early-stage funding) round. In 2014, Facebook acquired WhatsApp at a valuation of $22 billion, turning Sequoia’s $60M investment (and 18% stake), into a return of $3 billion at a 50X return multiple. The acquisition is the largest ever acquisition of a venture capital-backed company.

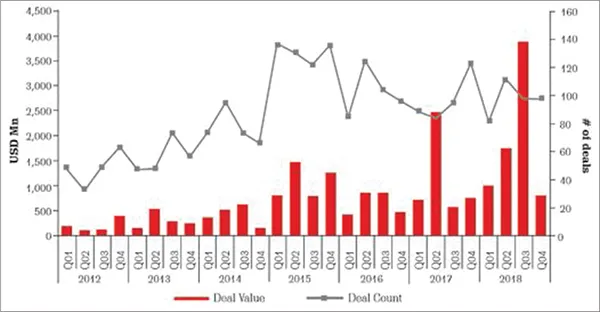

The venture capital market in India has also been extremely active. Venture capital funds started entering India in the late 1990s, with most large players entering by 2006. The industry has cumulatively raised over $31 billion in over 3,500 deals between 2006 and 2018. Several venture capital-backed startups have also gone on to attain unicorn status, including Flipkart, Swiggy, Ola, and Byju’s.

Figure 1.3: VC market in India12

A notable Indian success story would be the investment by Accel Partners in Flipkart. Accel Partners had set up a $65M seed fund (funds which typically invest at ideation stage or early-revenue stage) in 2008 and were looking at backing ‘unconventional and audacious businesses’. They invested $800,000 in early seed capital in Flipkart, early on in 2008, at a time when the company had no backers and when ecommerce was still in its nascent phase in India. Accel has stated on record that it took this investment decision partly because of ‘the founders’ penchant for constant innovation, experimentation, and ability to look at every obstacle as an opportunity. Accel’s cumulative investment of $100M yielded a return of around $1.1...